SEATING CHART (Back) - PowerPoint PPT Presentation

1 / 27

Title:

SEATING CHART (Back)

Description:

... at one time. What is a Debit card? A debit card is a credit card that works like a check. The amount is electronically deducted (debited) ... – PowerPoint PPT presentation

Number of Views:163

Avg rating:3.0/5.0

Title: SEATING CHART (Back)

1

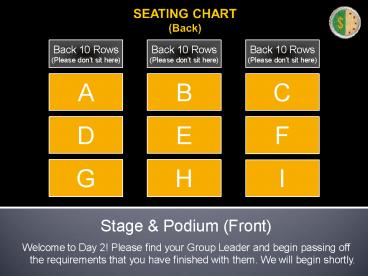

SEATING CHART(Back)

- Stage Podium (Front)

- Welcome to Day 2! Please find your Group Leader

and begin passing off the requirements that you

have finished with them. We will begin shortly.

2

Personal ManagementMerit Badge Day 2

- Objective of this presentation

- To help you pass of as many requirementsas you

can by the end of today!

BSA Advancement ID 11Source Boy Scout

Requirements, 33215 Revised Oct. 25,

2007 Instructor(s)

3

Review of your timeline

- Where are we? Where will we be after today?

- From last time (pass off everything but Req. 2)

- Req. 1 Shopping Strategy Pass off today!

- Req. 2 Budget Continue, pass off in 11

weeks! - Req. 5 5 Stocks Pass off today!

- Req. 8 To Do List Schedule Pass off today!

- Req. 9 Written Project Pass off today!

- Req. 10 Career Research Pass off today!

- New material for today, Day 2 (pass off

everything else) - Req. 3 Discuss Feelings on Begin pass

off today! - Req. 4 Discuss Investing Begin pass off

today! - Req. 6 Discuss 1,000 Begin pass off

today! - Req. 7 Discuss Debt Begin pass off today!

4

Requirement 3Discuss Topics

- 3. Discuss with your merit badge counselor FIVE

of the following concepts - a. The emotions you feel when you receive money.

- b. Your understanding of how the amount of money

you have with you affects your spending habits. - c. Your thoughts when you buy something new and

your thoughts about the same item three months

later. Explain the concept of buyer's remorse.

5

Requirement 3Discuss Topics Contd

- d. How hunger affects you when shopping for food

items (snacks, groceries). - e. Your experience of an item you have purchased

after seeing or hearing advertisements for it.

Did the item work as well as advertised? - f. Your understanding of what happens when you

put money into a savings account. - g. Charitable giving. Explain its purpose and

your thoughts about it. - h. What you can do to better manage your money.

6

Requirement 4Discuss Investing

- 4. Explain the following to your merit badge

counselor - A. The differences between saving and investing,

including reasons for using one over the other. - Saving to put money aside, usually in a bank

account for future use. - The return you earn is generally very low but

certain - Investing to invest money to make even more

money in the future. - The return is generally higher but uncertain

- Generally you save for short-term goals, and

invest for long-term goals.

7

Requirement 4Discuss Investing

- B. What is return on investment?

- Return on investment is the money received from

investing divided by the amount of money

invested. In other words, it is a increase in

the money you invest. - What is risk?

- Risk can be many things, but generally relates to

uncertainty. The less certain a return,

generally the higher the risk. - C. What is the difference between simple

interest and compound interest? How do these

affected the results of your investment exercise? - Simple interest is interest on principle only.

- Example 1,000 invested for 1 year at 10 simple

interest - 1,000 x 10 100 in interest

- So 1,000 in principle 100 in interest

1,100 total

8

Requirement 4Discuss Investing

- Compound Interest is interest on interest

- Example 1,000 invested for 5 years at 10

compounding - 1,000 x 10 100 in interest (same as simple

interest for year 1) - So, 1,000 100 1,100 total (same as simple

interest for year 1) - Then, for year 2 (the first year of compounding),

we do - 1,100 x 10 110 in interest

- So, 1,100 in principle 110 in interest

1,210 total

9

Simple vs. Compound InterestInterest can harm or

help you - EARN it, dont PAY it!

1000 at a 10 rate

10

Simple vs. Compound InterestInterest can harm or

help you - EARN it, dont PAY it!

1000 at a 10 rate

11

Requirement 6Discuss Invest 1,000

- 6. Pretend you have 1,000 to save, invest, and

help prepare yourself for the future. Explain to

your merit badge counselor the advantages or

disadvantages of saving or investing in each of

the following - a. Common stocks

- b. Mutual funds

- c. Life insurance

- d. A certificate of deposit (CD)

- e. A savings account or U.S. savings bond

12

Requirement 6Discuss Invest 1,000 contd

- What are common stocks?

- Stocks are pieces of ownership in a listed

company - Advantages

- Higher returns over the long-term

- Disadvantages

- Higher risk

13

Requirement 6Discuss Invest 1,000 contd

- What are mutual funds?

- Mutual funds are portfolios of securities

(stocks, bonds, or cash) managed by an investment

company - Advantages

- Professionally run

- Immediate diversification

- Disadvantages

- No control over taxes

- May not outperform benchmarks

14

Requirement 6Discuss Invest 1,000 contd

- What is life insurance?

- Life insurance is a contract that will pay money

to your beneficiaries should you die - Advantages

- Life insurance payments are tax-free

- Cash value life insurance grows tax-free

- Disadvantages

- Cash value life insurance is very expensive

- You have to die to get paid

15

Requirement 6Discuss Invest 1,000 contd

- What are Certificates of Deposit (CDs)?

- CDs are savings accounts held with a financial

institution for a specific time - Advantages

- Returns are higher than savings accounts

- Returns are guaranteed

- Disadvantages

- Returns are lower than other instruments

16

Requirement 6Discuss Invest 1,000 contd

- What are U.S. Savings bonds?

- U.S. Savings Bonds are bonds issued by the US

government - Advantages

- Returns are higher than general savings accounts

- Returns are tax-free if used for education

- Disadvantages

- Returns are lower than other instruments

17

Investing The Hourglass Bottom

Investment Strategy

Taxable Assets(Non-Retirement Investments)

Retirement Assets(Investments like IRAs, 401Ks,

etc)

4. OpportunisticIndividual Stocksand Sector

Funds

3. Diversify Broaden andDeepen your Asset

Classes(International emerging markets,

mid-cap, small-cap)

2. Core Broad Market Index or Mutual

Funds(Large Cap U.S. funds in core industries)

1. Basics Emergency Fund and Food

Storage(Liquid funds, US treasuries, savings

accounts, MMMFs, CDs)

18

Requirement 7Discuss Debt

- 7. Explain the following

- A1. What is a loan?

- A loan is an agreement to borrow money and to

repay a specific amount of money (principle and

interest) each period. It is also called credit. - A2. What is interest?

- Interest is money you pay to borrow money. The

Key to Interest is Earn it, Dont pay it!!

19

Requirement 7Discuss Debt Contd

- A3. How does the annual percentage rate (APR)

measure the true cost of a loan? - The APR reflects the true percentage rate of a

loan. It takes into account various fees and

other costs over a year. The APR is always higher

than the simple interest rate on a loan. - Before you borrow

- Ask what the total cost of the loan will be in

dollars and cents. - Find out the amount of all fees they add up

quickly. - Dont always choose the loan with the lowest

payment. A lower payment may mean a longer

repayment period and you will pay more in total

interest charges.

20

Requirement 7Discuss Debt Contd

- B. What are the different ways to borrow money?

- Money can be borrowed many different ways. From

cheapest to more expensive, it is - Loans from family and parents

- Loans from Credit Unions and SLs

- Loans from banks

- Credit cards

- In-store financing

- Payday lenders

- Generally, the worse your credit the more you

will pay to get a loan

21

Requirement 7Discuss Debt Contd

- C. Explain the differences between a charge card,

debit card, and credit card. - What is a Charge card?

- A charge card is a credit card but typically is

restricted to purchases from a particular

company, like a department store or a gasoline

company. - Most charge cards are like a credit card in that

you dont have to pay off all of your charges, or

your entire balance, at one time. - What is a Debit card?

- A debit card is a credit card that works like a

check. The amount is electronically deducted

(debited) from your checking account and paid

into the stores bank account. - What is a Credit card?

- A credit card is a card issued by a bank and can

be used to pay for any product as long as the

seller accepts the card.

22

Requirement 7Discuss Debt Contd

- What are the costs and pitfalls of using these

financial tools (cards)? - They are expensive and charge very high interest

rates (gt20) - They obligate future earnings to payments

- They encourage consumption, not saving

- Why it is unwise to make only the minimum payment

on your credit card? - Companies want you to pay only the minimum

balance as it will take you years to pay off the

card and they will charge thousands in interest

costs

23

Requirement 7Discuss Debt Contd

- D. What are credit reports and how does personal

responsibility affect your credit report? - Credit reports are reports of information

collected by credit bureaus from subscribers,

creditors, public court records, and the consumer - Why are credit reports important?

- Credit reports help financial institutions

determine if you will likely pay back a loan. If

your credit report is good, there is a much

higher likelihood that you will pay back a loan

and hence, more likely a financial institution

will lend you money

24

Requirement 7Discuss Debt Contd

- E. What are some ways to eliminate debt?

- The best is dont go into debt in the first place

- Pay off your highest cost debt first

- Pay more than the minimum amountas much as you

can - Consider plastic surgery (cutting up your credit

cards) if you cant stop using your cards

25

Requirement 4Discuss Investing

- Interest can help or harm you. Earn it, dont pay

it! - It is a rule of our financial and economic life

in all the world that interest is to be paid on

borrowed money. . . Interest never sleeps nor

sickens nor dies it never goes to the hospital

. . it never visits nor travels it is never laid

off work it never works on reduced hours it

never pays taxes it buys no food, it wears no

clothes. . . Once in debt, interest is your

constant companion every minute of the day and

night you cannot shun it or slip away from it

you cannot dismiss it. . .and whenever you get

in its way or cross its course or fail to meet

its demands it crushes you. So much for the

interest we pay. Whoever borrows should

understand what interest is, it is with them

every minute of the day and night. (J. Reuben

Clark, conference address, April 6, 1938)

26

Finish Line

- CONGRATULATIONS!!

- By now you should have successfully passed off

all the requirements except for your personal

budget. Finish your budget over the next 11 weeks

and pass it off to your local merit badge

counselor. - Have a fun Saturday!

27

Requirement 4Discuss Investing

- Compound Interest is interest on interest

- Example

- 1000 investment, 12 interest rate, compounded

monthly - So, monthly interest 12 / 12 months 1 per

month

Month Initial Balance Interest New Balance

Jan 1,000.00 10.00 1,010.00

Feb 1,010.00 10.10 1,020.10

Mar 1,020.10 10.20 1,030.30

Apr 1,030.30 10.30 1,040.60

May 1,040.60 10.41 1,051.01

Jun 1,051.01 10.51 1,061.52

Jul 1,061.52 10.62 1,072.14

Aug 1,072.14 10.72 1,082.86

Sep 1,082.86 10.83 1,093.69

Oct 1,093.69 10.94 1,104.62

Nov 1,104.62 11.05 1,115.67

Dec 1,115.67 11.16 1,126.83

Total Interest Earned Total Interest Earned 1,126.83