Society of Human Resource Management - PowerPoint PPT Presentation

Title:

Society of Human Resource Management

Description:

Insurance Market Reform As of ... Qualifications for Participating Health Plans require qualified health plans participating in the Exchange to meet marketing ... – PowerPoint PPT presentation

Number of Views:180

Avg rating:3.0/5.0

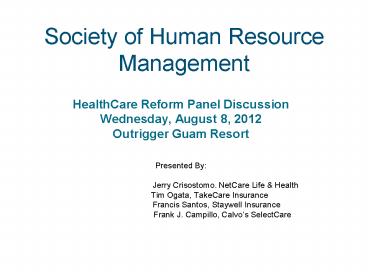

Title: Society of Human Resource Management

1

Society of Human Resource Management

- HealthCare Reform Panel Discussion

- Wednesday, August 8, 2012

- Outrigger Guam Resort

- Presented By

- Jerry Crisostomo. NetCare Life

Health - Tim Ogata, TakeCare Insurance

- Francis Santos,

Staywell Insurance - Frank J.

Campillo, Calvos SelectCare

2

Objective

- Provide a synopsis of and the impact on Health

Plans by the recently upheld Patient Protection

and Affordable Care Act and the Reconciliation

Act (collectively PPACA)

3

AGENDA

- Background on Healthcare Cost

- Overview - Timeline of Reforms

- Insurance Market Reforms

- Expansion of Medicaid

- Premium and Cost-sharing Subsidies

- Tax Changes related to Health Reform

- Employer Requirements

- Individual Mandate

- State Role

- Health Insurance Exchanges

- Medical Loss Ratio Update

- Summary of Impact

4

Health Expenditures for Selected Services

20002015

Projected Projected

TOTAL 2000 2000 2005 2010 2015

Billions 1,353.3 1,353.3 1,987.7 2,879.4 4,031.7

Percent GDP 13.8 13.8 16.0 18.0 20.0

BY TYPE OF SERVICE BY TYPE OF SERVICE BY TYPE OF SERVICE BY TYPE OF SERVICE BY TYPE OF SERVICE BY TYPE OF SERVICE

Hospital care Hospital care 417.0 611.6 882.4 1,230.9

Physician clinical services Physician clinical services 288.6 421.2 610.7 849.8

Other professional services (dental, etc.) Other professional services (dental, etc.) 138.2 200.5 292.6 411.5

Nursing home care Nursing home care 95.3 121.9 160.5 216.8

Home health care Home health care 30.5 47.5 72.3 103.7

Prescription drugs Prescription drugs 120.8 200.7 299.2 446.2

Other medical products Other medical products 49.5 58.1 69.1 83.1

Program admin. net cost of private health insurance Program admin. net cost of private health insurance 81.2 143.0 210.6 289.8

Investment Investment 88.8 126.8 191.3 268.9

Source The Commonwealth Fund Data from A.

Catlin et al., National Health Spending in 2005

The Slowdown Continues, Health Affairs,

Jan./Feb. 2007 26(1)14253 C. Borger et al.,

Health Spending Projections Through 2015

Changes on the Horizon, Health Affairs Web

Exclusive (Feb. 22, 2006)w61w73.

5

U.S. National Healthcare Expenditures

6

(No Transcript)

7

Global Payments

HEALTH SPENDING AS GDP AND PER CAPITA

8

Comparative Cost of ProceduresUSA vs. other

Countries

http//www.washingtonpost.com/wp-srv/special/busin

ess/high-cost-of-medical-procedures-in-the-us/

9

Average Annual Premiums for Single and Family

Coverage, 1999-2011

Estimate is statistically different from

estimate for the previous year shown

(plt.05). Source Kaiser/HRET Survey of

Employer-Sponsored Health Benefits, 1999-2011.

10

PPACA Has Three Basic Goals

- Expands Health Insurance Coverage. 94 of all

Americans covered by 2019 - Strong regulations and oversight of the insurance

industry - Control cost, particularly for Medicare

- __________________________________

- But what is the intended consequence?

- A Single Payer System

11

(No Transcript)

12

12

13

2010 Consumer Focused Provisions

- Grandfathered Plans

- Early Retiree Reinsurance Program

- Online Resources

- Appeals and External Review

- Cancellation of Coverage (Recissions)

- Dependent Coverage up to age 26

- Doctor Choice

- Restriction on Annual Limits and a Ban Lifetime

Limits - Emergency Care

- Prohibition in favor of highly paid individuals

- No pre-existing conditions for members under age

19 - Preventive Care Services without cost share

- Temporary High Risk Pool

- No Unreasonable premium increases

- Small Business Tax Credit

14

2011 Preparing for Future Provisions

- Health Savings Account Distribution Tax Penalty

- Medical Loss Ratio

- -80 for Individual and Small Group

- -85 for Large Group

- Eliminating Medicare Part D Donut Hole

- Over The Counter Drug

- Rate Review Begins

15

2012 Creating Administrative Standards

- Insurers are required to standardize documents

and implement new reporting requirements - Encouraging Integrated Health Systems

- Summary of Benefit and Coverage

- Quality of Care Reporting

- Reducing paperwork and administrative costs

- Patient-Centered Outcome Research Fee

16

2013 Final Preparations

- Focus on the final preparations for the new state

health insurance exchanges. - Flexible Spending Account Limits

- Expanded Authority to Bundle Payments

- Increase Medicare Part A tax on wages by 0.9

- Higher Medicare payroll tax of 2.35 for

individuals making 200K/250K

17

2014 Key Health Reform Provisions Take Effect

- PPACA comes to a cresendo in 2014. Many key

changes will be implemented - Health Benefit Exchanges

- Mandates (Individual, Employer)

- No Pre-existing Conditions for ALL adults

- Clinical Trials

- Guaranteed Availability, Renewability Rating

Variations - Limit on Waiting Periods

- Auto Enrollment Implemented

- Health Care Excise Tax

- Increases access to Medicaid

- No Annual Limits on Coverage

18

2015 Continuing Innovation and Lower Health

Costs

- Establishes an Independent Payment Advisory Board

aimed at extending the solvency of Medicare - Paying Physicians based on Value and not Volume.

A new provision will tie physician payments to

the quality of care they provide.

19

2016 Electronic Standards

- Health Claims Attachments standards for

electronic transmission of health related

documents - Encounter, enrollment, disenrollment, premium

payment and referral certification standards

20

2018 New Tax on Rich Benefits

- PPACA imposes a Cadillac Excise Tax on plans with

rich benefits

21

2020 Medicare Donut Hole

- Donut Hole coverage gap in Medicare prescription

drug benefit is fully phased out. Seniors will

continue to pay the standard 25 of their drug

costs until they reach the threshold for Medicare

Catastrophic coverage

22

2010 - 2011 PPACA REQUIREMENTS

(NetCare's Experience)

Unlimited Lifetime

Max - 1.44

Non-Participating Emergency

Preventive

Services -3.48

Care

3.83

OB/GYN

Services -1.19

Essential Benefits

No Annual Limits - 2.45

Dependent Coverage Up to age 26 - 1.82

Annual Dollar Plan Max

Pre-Existing Coverage

Increase - 3.62

For Dep age lt19

2.31

Preventive Care Coverage

Essential Benefit Coverage - No Annual Limits

Increase in Annual Dollar Plan Max

Pre-Existing Condition Waiver for Dep age lt19

Extended Coverage for Dep age gt26

No Referrals for OB/GYN Services

Emergency Coverage at Non-Participating

Facilities

Unlimited Lifetime Maximum

23

(No Transcript)

24

PPACA Supreme Court Decision

25

Insurance Market Reform Effective Date of

Enactment 03/23/10

- Annual Rate Review (individual group markets)

- Secretary states to establish process for

annual review of unreasonable increases in

premiums for health insurance coverage in the

individual and small group markets. - Insurer must submit prior justification for

unreasonable premium increases and post on

website. - State to provide Secretary with trends on premium

increases and whether particular insurer should

be excluded from Exchange based on pattern or

practice of excessive or unjustified premium

increases.

26

Insurance Market Reform 90 Days of Enactment

06/23/10

- z? State High Risk Pool- Not applicable

territories - z ? Secretary to establish high risk pool for

individuals with pre-existing conditions who

do not have creditable coverage. - z ? Will run through 1/1/14 (when Exchange is up

and running) - z ? If Secretary finds insurer or employer has

encouraged individuals to disenroll in order

to join high risk pool, insurer/employer must

reimburse expenses. - z? Early Retiree Reinsurance- Not applicable to

territories - z ? Secretary to establish temporary retiree

reinsurance program to reimburse claims of

retirees age 55 and older who are not

Medicare-eligible. Program would pay 80 of

eligible claims. - Z ? Plan only may use reimbursement to reduce

costs (premiums, copayments, out-of-pockets

costs, etc.).

27

- Insurance Market Reform

- Six Months from Enactment - 9/23/10

- Annual Lifetime Limits (insured self-funded)

- No annual or lifetime limits on essential

benefits (ok for nonessential benefits). - May have annual limits on certain restricted

benefits set by Secretary, prior to 1/1/14. - No rescissions except for fraud

- Dependent Coverage to age 26 (insured

self-funded) - Not required to cover child of adult child

dependent.

28

- Insurance Market Reform

- Six Months from Enactment 9/23/10

- Prior to 1/1/14, group not required to cover if

dependent is eligible to enroll in

employer-sponsored coverage. - Secretary to issue regulations to define

dependent. - No Pre-existing Condition Exclusion for enrollees

under age 19 (insured self-funded) - Applies to all enrollees as of 1/1/14.

29

- Insurance Market Reform

- Six Months from Enactment 9/23/10

- Preventive Health (insured self-funded)

- Must cover preventive health without cost sharing

- Nondiscrimination Based on Income (insured)

- May not discriminate in favor of highly paid

individuals under IRC105(h) (for insured

coverage already applies to self-funded) - Choice of Providers (insured self-funded)

- Must allow child to designate pediatrician as

primary care provider. - May not require authorization or referral for

participating OB-GYN.

30

Insurance Market Reform Six Months from Enactment

9/23/10

- Emergency (insured self-funded)

- Must cover emergency services without prior

authorization and treat as in-network. - Appeals External Review (insured self-funded)

- Must have internal review process.

- ? Must have external review that either meets

NAIC Uniform External Review Model Act or

standards set by Secretary. Secretary may deem

external review process in operation on date of

enactment as compliant. - Must provide continued coverage pending outcome

of appeals.

31

Insurance Market ReformSix Months from

Enactment 9/23/10

- ANNUAL LIMITS

- Restricted annual limits permitted with respect

to essential health benefits until plan years

beginning on or after January 1, 2010. - Restricted annual limits are applied on a per

person basis - Restricted annual limits are

- For plan or policy years beginning on or after

September 23, 2011 but before September 23, 2012

1.25M - For plan or policy years beginning on or after

September 23, 2012 but before January 1, 2014

2M - For plan or policy years beginning on or after

January 1, 2014 Unlimited

32

Insurance Market ReformSix Months from

Enactment 9/23/10

- ESSENTIAL HEALTH BENEFITS

- The rules defining essential health benefits

have yet to be finalized by each state and

territory based on a benchmark plan. - Until the rules defining essential health

benefits are finalized and benchmark plans are

selected, HHS will take into account good faith

efforts to comply with a reasonable

interpretation of the term essential health

benefits. - For this purpose, a plan or issuer must apply the

definition of essential health benefits

consistently.

33

Insurance Market Reform Two Years from Enactment

- 2012

- Summary Documents (insured self-funded)

- Within 24 months of enactment, insurers must

provide summary of benefits and coverage using a

format issued by HHS (including uniform

definitions). - Limited to 4 pages and must state whether

provides minimumessential coverage and whether

meets 60 actuarial value. - In addition to ERISA SPD requirements.

- Must provide 60-day prospective notice of plan

changes.

34

- Insurance Market Reform

- As of 1/1/14

- No Pre-Existing Condition Exclusions (insured

self-funded) - Applies earlier for enrollees under age 19.

- Limit on Waiting Periods (insured self-funded)

- Waiting period cannot exceed 90 days.

- HIPAA Wellness Reward increased from 20 to 30

(and - Secretary has discretion to increase to 50)

35

- Insurance Market Reform

- As of 1/1/14

- May not discriminate based on health status

(insured self- - funded).

- Cost-sharing limits tied to HSA amounts (5,000

individual / - 10,000 family) (insured self-funded).

- For small group market, deductible limit is

2,000 individual / - 4,000 family (insured).

- Expanded coverage of clinical trials (may not

impose - additional conditions) (insured self-funded).

- Must cover essential benefits (insured /

individual small - group markets only).

36

Insurance Market Reform As of 1/1/14 Insured Only

? Guaranteed Access Renewability ? Rating Restrictions (individual small group markets large group if offered through Exchange) ? May not vary rate except for ? Individual versus family ? Rating Area ? Age (limit of 3 to 1) ? Tobacco Use (limit of 1.5 to 1) ? Guaranteed Access Renewability ? Rating Restrictions (individual small group markets large group if offered through Exchange) ? May not vary rate except for ? Individual versus family ? Rating Area ? Age (limit of 3 to 1) ? Tobacco Use (limit of 1.5 to 1)

37

Expansion of Medicaid

- Expand Medicaid to all non-Medicaid eligible

individuals under age 65 with incomes up to 133

FPL based on modified adjusted gross income - All newly eligible adults will be guaranteed a

benchmark benefit package that meets the

essential health benefits available through the

Exchanges - To finance the coverage for the newly eligible,

states will receive - 100 federal funding for 2014 2016

- 95 federal financing in 2017

- 94 federal financing in 2018

- 93 federal financing in 2019

- 90 federal financing in 2020 and subsequent

years - Increase Medicaid payments in fee-for-service and

managed care for primary care services provided

by primary care doctors to 100 of the Medicare

payment rates for 2013 and 2014

38

Premium and Cost-Sharing Subsidies to Individuals

- Eligibility

- Availability of premium credits and cost-sharing

subsidies through the Exchanges to U.S citizens

and legal immigrants who meet income limits - Premium Credits

- To eligible individuals and families with

incomes between 133-400 FPL to purchase

insurance through the Exchanges - Tied to the second lowest cost silver plan in the

area - Contributions limited to the following

percentages of income for specified income

levels - Up to 133 FPL 2 of income

- 133-155 FPL 3 4 of income

- 150-200 FPL 4 6.3 of income

- 200-250 FPL 6.3 8.05 of income

- 250-300 FPL 8.05 9.5 of income

- 300-400 FPL 9.5 of income

- Increase the premium contributions for those

receiving subsidies annually - Provisions related to the premium and

cost-sharing subsidies are effective January 1,

2014

39

Premium and Cost-Sharing Subsidies to Individuals

- Cost-sharing subsidies

- To eligible individuals and families

- Reduce cost-sharing amounts and annual

cost-sharing limits - Have the effect of increasing the actuarial value

of the basic benefit plan to the following

percentages of the full value of the plan for the

specified income level - 100-150 FPL 94

- 150-200 FPL 87 of income

- 200-250 FPL 73 of income

- 250-300 FPL 70 of income

- Verification

- Required for both income and citizenship status

in determining eligibility for the federal

premium credits - Subsidies and abortion coverage

- Ensure that federal premium or cost-sharing

subsidies are not used to purchase coverage for

abortion if coverage extends beyond saving the

life of the woman or cases of rape or incest.

40

Premium and Cost-Sharing Subsidies to Employers

- Small business tax credits

- Phase I (2010 2013),

- Provide a tax credit of up to 35 of employers

contribution toward employees health insurance

premium if employer contributes at least 50 of

the total premium cost or 50 of a benchmark

premium - Full credit will be available to employers with

10 or fewer employees and average annual wages of

less than 25,000. - Phase II (2014 and later)

- For eligible small business that purchase

coverage through the state Exchange, provide a

tax credit of up to 50 of the employers

contribution toward employees health insurance

premium if the employer contributes at least 50

of the total premium cost. - Credit will be available for two years

- Full credit will be available to employers with

10 or fewer employees and average annual wages of

less than 25,000. - Reinsurance program

- Created temporarily for employers providing

health insurance coverage to retirees over age 55

who are not eligible for Medicare - Will reimburse employers or insures for 80 of

retire claims between 15,000 and 90,000 - Payments from the reinsurance program will be

used to lower the costs for enrollees in the

employer plan - Effective 90 days following the enactment through

January 1, 2014

41

TAX CHANGES

- W-2 reporting of value of employer-sponsored

health - benefits, effective in 2011

- ? Employee salary reduction contributions to

FSAs limited - to 2,500, indexed to CPI-U, effective 2013

- Restrictions on the reimbursement of

over-the-counter - (OTC) drugs from FSA, HSA, or HRA, effective

in 2011 - Exemption for prescribed OTC drugs difficult to

- administer

- Increase additional tax on distributions from

HSAs that are not used for qualifying

medical expenses from 10 - to 20 of the distribution, effective in 2011

42

TAX CHANGES - Individuals

- Additional Taxes on High Income Individuals

- Additional HI payroll tax of 0.9 for wages

- in excess of 250,000 (joint filers) and

- 200,000 (all others)

- Effective for remuneration received after

- December 31, 2012

- Also 3.8 tax on same filers on investment income

43

TAX CHANGES - Individuals

- Itemized deduction for medical expenses

- Floor for claiming goes from 7.5 to 10 of AGI

- Effective tax years beginning after December 31,

2012 - o ? Delayed effective date to 2017 for those age

65 or - over

- Tax on indoor tanning services

- 10 of amount paid

- Effective for services performed after July 1,

2010

44

TAX CHANGES Others

- New fees on health care companies beginning in

2011 - Pharmaceutical manufacturing companies

- 2014 -- 8 billion 2015, 2016 -- 11.3 billion

2017 -- 13.7 billion 2018 -- 14.3 billion - Medical device manufacturers

- ? 2.9 tax on sale of medical device after

12/31/12 - Health insurance companies (certain nonprofits

exempted) - ? 2014 -- 8 billion 2015 -- 11.3 billion

2016 -- 11.3 - billion 2017 -- 13.9 billion 2018 -

14.3 billion - Thereafter indexed to medical cost

growth - Fee is allocated based on market share

- Fee expected to be passed on to consumers as

higher health care costs

45

- TAX CHANGES

- Others

- Health Insurance Company Compensation

- Denial of deduction for compensation in excess of

- 500,000 for health insurance providers

- Applies to deferred compensation also

- No performance-based compensation exception

- Applies to more than top-5 executives

- Officer, director or employee

- Anyone who provides services to insurer

- What does this mean for doctors?

46

Employer Requirements Currently unknown if

applicable to territories

- ? Applies to employers who employed an average

of at least 50 full- time employees on business

days during the preceding calendar year

(full-time employee average of 30 hours per

week). - Must pay a fee if coverage IS NOT offered to

full-time employees AND any full-time employee

receives premium assistance from federal

government. - 2,000 annual fee for each full-time employee

employed (minus the first 30 employees) - Must pay a fee if coverage IS offered to full

time employees BUT any full-time employee still

receives premium assistance from federal

government. - the lesser of 3,000 annual fee for each employee

receiving premium assistance OR 2,000 annual fee

per employee for each full-time employee employed

(minus the first 30 employees) - Generally effective beginning in 2014.

47

Employer Requirements Other Provisions Currently

unknown if applicable to territories

- Automatic Enrollment

- Employers with more than 200 employees that offer

coverage - must automatically enroll new full-time employees

in - coverage with the opportunity to opt-out.

- Notification To Employees Regarding Exchange

(effective 3/1/13) - Cafeteria Plan

- Exchange coverage is considered qualified under

a cafeteria plan only for qualified employers

that are permitted to offer a choice of Exchange

plans to their employees. - W-2 Reporting

- Employers must report, for information purposes,

the - aggregate cost of employer-sponsored coverage on

an - employee's W-2.

48

Employer Requirements Other Provisions Currently

not known if applicable to territories

- Automatic Enrollment

- Employers with more than 200 employees that offer

coverage - must automatically enroll new full-time employees

in - coverage with the opportunity to opt-out.

- Notification To Employees Regarding Exchange

(effective 3/1/13) - Cafeteria Plan

- Exchange coverage is considered qualified under

a cafeteria - plan only for qualified employers that are

permitted to offer a - choice of Exchange plans to their employees.

- W-2 Reporting

- Employers must report, for information purposes,

the - aggregate cost of employer-sponsored coverage on

an - employee's W-2.

49

Employer Requirements Vouchers Currently not

known if applicable to territories

- ? Free Choice Voucher Used by "Qualified

Employees" to purchase qualified health plan

coverage through the Exchange. - Qualified employees those whose required

contribution for minimum essential coverage

through the employers plan exceeds 8 but is

less than 9.5 of the employees taxable income

for the year, whose household income is less than

400 FPL and who do not participate in a health

plan offered by the employer. - Amount The most generous amount the employer

would have contributed for self-only (or family,

if applicable) coverage under the employers

plan. - Employers may deduct the amount paid in vouchers

as an amount paid for personal services. - Employees that receive free choice vouchers do

not trigger the fee on employers who have

employees receive coverage through an Exchange.

50

Individual Mandate Penalty Currently not known

if applicable to territories

- ? Individuals are required to maintain "minimum

essential coverage" for each month beginning in

2014. Failure to maintain coverage for the entire

year will result in a penalty. The monthly

penalty is 1/12thof the greater of - For 2014, 95 per uninsured adult in the

household or 1 of household income over the

filing threshold, - For 2015, 325 per uninsured adult in the

household or 2 of household income over the

filing threshold, and - For 2016 and beyond, 695 per uninsured adult in

the household or 2.5 of household income over

the filing threshold. - ? The penalty will be one-half of the amounts

listed above for individuals under 18. - ? The total household penalty may not exceed

(i) 300 percent of the per adult penalty or (ii)

the national average annual premium for bronze

level health coverage offered through the

Exchange.

51

Individual Mandate - Exceptions

- Exceptions to the individual responsibility

requirement - religious exemptions,

- individuals not lawfully present in the United

States, - incarcerated individuals,

- those who cannot afford coverage (required

contributions - toward coverage exceed 8 of household income),

- taxpayers with income under 100 percent of the

poverty - level,

- those who have received a hardship waiver, and

- those who were not covered for a period of less

than three - months during the year.

52

- STATE ROLE

- Create an American Health Benefit Exchange and a

Small Business Health Options Program (SHOP)

Exchange for individuals and small businesses and

provide oversight of health plans with regard to

the new insurance market regulations, consumer

protections, rate reviews, solvency, reserve fund

requirements, premium taxes, and to define rating

areas. - Enroll newly eligible Medicaid beneficiaries

into the Medicaid program no later than January

2014. - Establish an office of health insurance consumer

assistance or an ombudsman program to serve as an

advocate for people with private coverage in the

individual and small group markets. - Permit states to create a Basic Health Plan for

uninsured individuals with incomes between 133

and 200 FPL in lieu of these individuals

receiving premium subsidies to purchase coverage

in the Exchanges.

53

- HEALTH INSURANCE EXCHANGES

- Create state-based American Health Benefit

Exchanges and Small Business Health Options

Program (SHOP) Exchanges - Administered by a governmental agency or

non-profit organization - Individuals and small businesses with up to 100

employees can purchase qualified coverage. Permit

states to allow businesses with more than 100

employees to purchase coverage in the SHOP

Exchange beginning in 2017. - (Funding available to states to establish

Exchanges until 2015). - Public Plan Option Require the Office of

Personnel Management (OPM) to contract with

insurers to offer at least two multi-state plans

in each Exchange. At least one plan must be

offered by a non-profit entity and at least one

plan must not provide coverage for abortions

beyond those permitted by federal law.

54

- HEALTH INSURANCE EXCHANGES

- Four benefit categories of plans plus a separate

catastrophic plan to be offered through the

Exchange in the individual and small group

markets - Bronze Plan represents minimum creditable

coverage and provides the essential health

benefits (EHB), cover 60 of the benefit costs of

the plan with an out of pocket limit equal to the

Health Savings Account current law limit - Silver Plan provides the EHBs, covers 70 of the

benefits costs of the plan, with the HSA out of

pocket limits - Gold Plan provides the EHBs, covers 80 of the

benefits costs of the plan with the HSA out of

pocket limits - Platinum Plan provides the EHBs, covers 90 of

the benefits costs of the plan with HSA out of

pocket limits - Catastrophic Plan available to those up to age 30

or to those who are exempt from the mandate to

purchase coverage

55

- HEALTH INSURANCE EXCHANGES

- Insurance Market and Rating rules

- require guarantee issue and renewability and

allow rating variation based only on age, premium

rating area, family composition, and tobacco use

in the individual and small group market - require risk adjustment in the individual and

small group markets and in the Exchange

(effective January 1, 2014) - Qualifications for Participating Health Plans

- require qualified health plans participating in

the Exchange to meet marketing requirements, have

adequate provider networks, contract with

essential community providers, be accredited with

respect to performance on quality measures, use a

uniform enrollment form and standard format to

present plan information - require qualified health plans to report

information on claims payment policies,

enrollment, disenrollment, number of claims

denied, cost-sharing requirements, out of network

policies and enrollee rights in plain language

56

Medical Loss Ratio Update 2012

57

Calculations Based on Aggregation Set

- How are rebates determined?

- MLR calculation will be performed for each

Aggregation Set - Aggregation sets are based on policyholder

groupings as determined by a legal entity, by

state of issue and segment (Individual, Small

Group or Large Group) - Group policies placed into the appropriate state

based on - contract issuance state situs where policy is

issued - Rebates are calculated based on the MLR of the

Aggregation Set as a whole - NOT solely on the experience of the individual

group policy - NOT solely on the claim experience of individual

members - Rebates are based on the experience of the

Aggregation Set, not on the claim experience of a

specific employer or individual.

58

Rebate Calculation

Incurred claims plus expenses for activities that

improve health care quality and credibility

adjustments Premium revenue less Federal State

taxes, premium taxes, licensing regulatory fees

and adjustments for state and federal high risk

pools, I any.

Medical (numerator) Premium (denominator)

Quality Improvement Activities (examples)

- Included

- Case Disease Management, Discharge Planning

- Nurse line

- Fraud Abuse (lesser of expenses and recoveries)

- Certain Wellness Expenses

- Prospective Utilization Review

- HIT Expense for Quality

- Some ICD-10 Implementation Costs

- Excluded

- HIPAA Implementation Costs

- Concurrent Retrospective Utilization Review

- Provider Credentialing

- Provider Contracting / Network Management

- Claims Adjustment Expensesexcluded from medical

59

Distribution of Rebates

- Are there restrictions on how a group

policyholder can use the - rebate payment received from the health

insurer? - Yes, restrictions depend on whether the plan is a

federal government plan, a non-federal government

plan, a plan governed by ERISA or a plan that is

neither a government plan nor governed by ERISA.

The requirements are outlined below.

Group Policyholder PlanCategories Requirements on Group Policyholders for Use and Distribution of Rebates

ERISA plans Most businesses are ERISA including employee welfare benefit plans. These are plans sponsored by private sector employers, unions or associations. Most private sector plans are governed by ERISA. ERISA plans are subject to the jurisdiction of the Department of Labor (DOL), which has provided guidance to assist plan sponsors in determining how MLR rebates may be used. There are very specific rules for ERISA plans around return of premium. DOL Technical Release 2011-04 (December 2, 2011).

Federal Governmental plans (like FEHBP) The use of the rebate dollars would be governed by the legal requirements under federal law applicable to the government agency.

60

Distribution of Rebates

Group Policyholder PlanCategories Requirements on Group Policyholders for Use and Distribution of Rebates

Non-Federal Governmental Plans (states, counties, municipalities, public schools) Group policyholder must use the amount of the rebate that is proportionate to the total amount of premium paid by all subscribers under the group health plan option for which the rebate applies, in one of the following ways Used to reduce the premium for the subsequent policy year (2013), for all subscribers (2012), who are covered at the time the rebate is received by the policyholder. Used to reduce the premium for the subsequent policy year (2013), for all subscribers under the group health plan option for which the rebate is issued, who are covered at the time the rebate is received by the policyholder. A cash refund to subscribers enrolled in the group health plan option. With respect to the three (3) options above, the reduction in future premium or the cash refund provided may at the option of the group policyholder be Divided evenly among such subscribers, Divided based on each subscribers actual contribution to premium, or Apportioned in a manner that reasonably reflects each subscribers contribution to premium.

Non-ERISA, non- governmental plans (churches, tribes) Group policyholder will only receive rebate dollars if they execute a written assurance that outlines how the rebate dollars are to be used. If the group policyholder in this situation does not execute the written assurance, then the entire rebate will be distributed to subscribers.

Reduction would be based on subscriber portion of

premium Note Group policyholders should consult

their company attorney and tax advisor

61

Impact to Guam

- Insurance Market Reforms will benefit consumers

including unreasonable rate increases - Access and Affordability through Health Exchange

- Increased Funding for Medicaid up to 58 Million

in 2019 - Medical Loss ratio Rebates

- 21 New Taxes will be implemented

62

Impact to Guam

- The bottom line is the Federal Government is

about to assume MASSIVE new powers - These powers include designing insurance plans,

telling people where they can go for coverage and

how much insurers are allowed to charge - How then are doctors and hospitals suppose to

practice medicine?

63

Health Care Reform

Questions?