Accounting Principles 8th Edition - PowerPoint PPT Presentation

1 / 46

Title: Accounting Principles 8th Edition

1

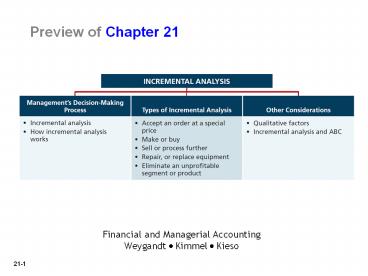

Preview of Chapter 21

Financial and Managerial Accounting Weygandt

Kimmel Kieso

2

Management Functions

3

Management Hierarchy

4

Decisions are broadly taken at 3 levels

- Strategic decisions big choices of identity /

direction. - WHO / WHAT / WHERE Who are we? Where are

we heading? - Complex and multi-dimensional. Often large

dollars, a long-term impact - made by senior management.

- Tactical decisions manage resources to achieve

strategy. - HOW What is needed? Time-frame?

Distinctive, within clearer - boundaries. May involve significant

resources, made by senior or middle - managers.

- Operational decisions routine and follow known

rules. - DO IT How many? To what specification?

These decisions involve - more limited resources, shorter-term

application, made by middle or first - line managers.

5

Types of Decision Making

- Programmed Decisions routine, automatic

process. - There are rules or guidelines to follow.

- Ex Deciding to reorder office supplies.

- Non-programmed Decisions unusual situations

that - have not been often addressed.

- No rules to follow since the decision is new.

- These decisions are made based on data, info, and

- mangers intuition, and judgment.

- Ex Should the firm invest in a new technology?

6

The Proces of Making (rational) Decisions

7

Incremental Analysis Approach

- Decisions involve a choice among alternative

actions. - Process used to identify the financial data that

change under alternative courses of action. - Both costs and revenues may vary or

- Only revenues may vary or

- Only costs may vary

8

Important concepts - incremental analysis

- Relevant cost

- Revenues or Costs that DIFFER between options

- Option 1 Buy a Honda Civic with a GPS

20,500 - Option 2 Buy Honda Civic without GPS

21,000 - Relevant cost is the 500 for a GPS

9

Important concepts - incremental analysis

- Opportunity cost.

- Potential benefit lost when you choose one thing

over another the next best choice. - Opportunity costs of going away to college

full-time - include - wages that could have been earned,

the value of any

activities missed to study,

value of items that you could have

bought with tuition money.

10

Important concepts - incremental analysis

- Sunk Costs.

- Cost that cannot be changed or avoided by any

present or future choice. - Money spent on a non-refundable deposit.

- Concert tickets already bought for this weekend.

11

(No Transcript)

12

Types of Incremental Analysis

- Accept an order at a special price.

13

Accept an Order at a Special Price

- Obtain additional business by making a major

price concession to a specific customer. - Assumes that sales of products in other markets

are not affected by special order. - Assumes company is not operating at full capacity.

14

Accept an Order at a Special Price

- Ex Company makes 100,000 a blenders per month

(80 cap.) - Variable manufacturing costs 8 per unit.

- Fixed mfg costs are 400,000, 4 per unit.

- Blenders normally sell to retailers 20 each.

- New customer wants an additional 2,000 blenders

at 11 each. (Acceptance will not affect other

sales of product). - What should you do? What data is relevant?

15

Accept an Order at a Special Price

- Fixed costs do not change since within existing

capacity thus fixed costs are not relevant. - Variable manufacturing costs and expected

revenues change thus both are relevant to the

decision.

16

- You make a product that sells for 42.

- Your costs are 28 per unit (18 variable

10 fixed) - Foreign company offers to buy 5,000 units at 25

ea. - You will incur additional shipping costs of 1

per unit. - Assuming you have excess operating capacity.

Should you accept or reject this special order?

Accept or Reject?

Accept or Reject?

17

Types of Incremental Analysis

- Accept an order at a special price.

- Make or buy parts or finished products.

18

Make or Buy (Outsource or not)

- Ex Your annual costs to make 25,000 switches

are

Should you outsource (buy) the switches at 8

ea. What should you do?

19

Make or Buy

- Total cost to make switch is 1 higher per unit

than buy price. - Must absorb at least 50,000 of fixed costs under

either option.

20

Make or Buy Opportunity Cost

Ex If you buy the switches, you can use the

released capacity to generate additional income

of 38,000 by making a different product. So

what ? This lost income is an additional

cost of making switches.

21

Review Question

- In a make-or-buy decision, relevant costs are

a. Manufacturing costs that will be saved. b.

The purchase price of the units. c.

Opportunity costs. d. All of the above.

22

- Should you make or buy plug-in cords for

appliances you make. - Your costs of making 166,000 the cords are as

follows. - Direct materials 90,000 Variable overhead

32,000 - Direct labor 20,000 Fixed overhead .

24,000 - Make cords cost per unit 1.00 ea.

(166,000 166,000) - Buy cords cost per unit 0.90 ea.

- Buying cords, eliminates all variable costs and

1/4 of the fixed costs. - Prepare an analysis of whether company should

make or buy the cords. - What if the released capacity will generate

additional income of 5,000?

23

(a) Prepare an incremental analysis showing

whether the company should make or buy the

electrical cords.

You will incur 1,400 of added costs buying vs

making cords.

24

(b) Is your answer be different if the released

capacity will generate additional income of

5,000?

Yes, net income is increased by 3,600 buying vs

making cords.

25

Types of Incremental Analysis

- Accept an order at a special price.

- Make or buy component parts or finished products.

- Sell or process further.

26

Sell or Process Further

- You have option to sell product at a given point

in production or to process further and sell at a

higher price. - Decision Rule

Process further as long as

the incremental revenue from processing exceeds

the incremental processing costs.

27

Sell or Process Further Single Product

- Ex You make tables. Your cost to make an

unfinished table is 35. The selling price

per unfinished unit is 50. - You have unused capacity that can be used to

finish the tables and sell them at 60 per unit.

Process further - Direct materials will increase 2

- Direct labor costs will increase 4.

- Variable overhead will increase ?? 2.40

(60 of direct labor). - No increase is anticipated in fixed overhead.

28

Sell or Process Further Single Product

The incremental analysis on a per unit basis is

as follows.

Should Woodmasters sell or process further.

Should you sell or process further?

29

Sell or Process Further Multiple Products

Joint product situation for DairyCo. Cream and

skim milk result from the processing of raw milk.

Joint product costs are sunk costs and thus not

relevant to the sell-or-process further decision.

30

Sell or Process Further Multiple Products

Cost and revenue data per day for cream.

Determine whether DairyCo should just sell the

cream or process it further into cottage cheese.

31

Sell or Process Further - Multiple Products

Analysis of whether to sell cream or process into

cottage cheese.

Marais should or should not process the cream

further?

DairyCo should or should not process the

cream further?

32

Sell or Process Further Multiple Products

Cost and revenue data per day for skim milk.

Determine whether DairyCo should sell the skim

milk or process it further into condensed milk.

33

Sell or Process Further Multiple Products

Analysis of whether to sell skim milk or process

into condensed milk.

Marais should or should not process the milk

further?

Marais should or should not process the milk

further?

34

Review Question

- The decision rule is a sell-or-process-further

decision - Process further as long as the incremental

revenue from processing exceeds

a. Incremental processing costs. b. Variable

processing costs. c. Fixed processing costs. d.

No correct answer is given.

35

Types of Incremental Analysis

- Accept an order at a special price.

- Make or buy component parts or finished products.

- Sell or process further them further

- Repair, retain, or replace equipment.

36

Repair, Retain, or Replace Equipment

- Decision Replace old machine with new. Old

machine originally cost 110,000. Book value is

40,000. It has a remaining useful life of four

years (_at_ depreciation rate of 70,000 per year). - New machine costs 120,000.

- Expected salvage value after 4-year useful life

is zero. - New machine will decrease variable mfg costs from

640,000 to 500,000 - The old machine can be sold for 5,000.

37

Repair, Retain, or Replace Equipment

- Additional Considerations

- Book value of old machine does not affect

decision. (Book Value calculation Asset Cost

- Accumulated Depreciation) - Book value is a sunk cost.

- Costs which cannot be changed by future decisions

(sunk cost) are not relevant in incremental

analysis. - However, any trade-in allowance or cash disposal

value of the existing asset is relevant.

38

Repair, Retain, or Replace Equipment

Prepare the incremental analysis for the

four-year period.

REPLACE Machine

KEEP Machine

Retain or Replace?

Retain or Replace?

39

Types of Incremental Analysis

- Accept an order at a special price.

- Make or buy component parts or finished products.

- Sell or process further them further

- Repair, retain, or replace equipment.

- Eliminate unprofitable business segment or

product(s).

40

Eliminate an Unprofitable Segment

- Key Focus on Relevant Costs.

- Consider effect on related product lines.

- Fixed costs allocated to the unprofitable segment

must be absorbed by the other segments. - Net income may decrease when an unprofitable

segment is eliminated. - Decision Rule Retain the segment unless fixed

costs eliminated exceed contribution margin lost.

41

Eliminate an Unprofitable Segment

- Illustration Company makes 3 models of tennis

rackets - Profitable lines Pro and Master

- Unprofitable line Champ

Should Champ be eliminated?

42

Eliminate an Unprofitable Segment

- Prepare income data after eliminating Champ

product line. Assume fixed costs are allocated

2/3 to Pro and 1/3 to Master.

Total income is changed by 10,000.

43

Eliminate an Unprofitable Segment

- Incremental analysis of Champ provided the same

results - Do Not Eliminate Champ

44

Review Question

- If an unprofitable segment is eliminated

a. Net income will always increase. b. Variable

expenses of the eliminated segment will have to

be absorbed by other segments. c. Fixed

expenses allocated to the eliminated segment will

have to be absorbed by other segments. d. Net

income will always decrease.

45

Company makes accessories including hats and

scarves. Sales of hats scarves

400,000,

Variable expenses 310,000,

Fixed expenses 120,000,

for a net loss 30,000. If company

eliminates hats and scarves, 20,000 of fixed

costs will remain. Should company eliminate

hats and scarves.

46

Other Considerations in Decision-Making

Qualitative (vs Quantitative) Factors

- Potential effects of decision on existing

employees and the community. - Cost of lost morale that might result.

- Cost of (potentially) lost sales.

![[PDF] Foundations of Mental Health Care 8th Edition Android PowerPoint PPT Presentation](https://s3.amazonaws.com/images.powershow.com/10077869.th0.jpg?_=20240712087)