Multivariate Regression Model - PowerPoint PPT Presentation

1 / 37

Title:

Multivariate Regression Model

Description:

Therefore, the test statistic is. t (b2- 2) / (standard error of b2) ... The estimator a is the test-statistic. Step 1: Step 2: The Model :: y = a bx e ... – PowerPoint PPT presentation

Number of Views:23

Avg rating:3.0/5.0

Title: Multivariate Regression Model

1

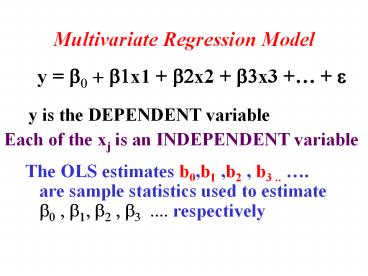

Multivariate Regression Model

y b0 b1x1 b2x2 b3x3 e

y is the DEPENDENT variable

Each of the xj is an INDEPENDENT variable

- The OLS estimates b0,b1 ,b2 , b3 .. . are sample

statistics used to estimate b0 , b1, b2 , b3

.... respectively

2

- Conditions

Each explanatory variable Xj is assumed

(1A) to be deterministic or non-random

(1B) to come from a fixed population

(1C) to have a variance V(xj) which is not

too large

The above assumptions are best suited to a

situation of a controlled experiment

3

Assumptions concerning the random term ei

(IIA) E(ei ) 0 for all i

(IIB) Var(ei) s2 constant for all i

(IIC) Covariance (ei , ek) 0 for any i and k

(IID) Each of the ei has a normal distribution

4

- Properties of b0 , b1 , b2 , b3

1. Each of these statistics is a linear functions

of the Y values.

2. Therefore, they all have normal distributions

3. Each is an unbiased estimator. That is,

E(bk) bk

5

4. Each bk is the most efficient estimator of

all unbiased estimators.

6

Thus, each of b0 , b1 , b2 .is

Best Linear Unbiased Estimator of the respective

parameter

7

Conclusion

Each estimator bi has a normal distribution with

mean bi and variance ?bi2 where ?bi2 is

unknown.

8

Income ( per week) of an individual is

regressed on a constant, education (in years),

age (in years) and wealth inheritance (in ),

using EViews.

Number of observations is 20 and the regression

output is given below

9

Variable Coefficient Std.Error t-Stats Prob.

C -1001.87 520.71 -1.92

0.0654 AGE 8.85 5.45

1.62 0.1168 EDUCATION 95.17 38.54

2.46 0.0252 WEALTH 1.51

0.46 3.26 0.0031

10

The Maximum Type 1 Error Significance Level

Significance Level (a)

11

p-value

The smaller the p-value the more significant is

the test

12

- The proposed regression model is

- Income ß0 ß1(Age) ß2(Education)

- ß3(Wealth Inheritance)

-

. . (A)

We are proposing that Income is the variable

dependent on three independent variables Age,

Education and Wealth.

13

- b0 is a constant.

It measures the effect of other deterministic

factors on Income not included in the model.

b1 , b2, b3 measure the effect of a marginal

change in Age, Education and Wealth,

respectively.

14

- However, we recognise that there may be other

random factors affecting the dependent variable

Income. - So we add a random variable ? to the model which

now becomes - Income ß0 ß1(Age) ß2(Education)

- ß3(Wealth Inherited) ?

-

. . (B)

15

We use the least squares technique to estimate

the model B.

Therefore, our estimation of the proposed model

B is Ye -1001.87 8.85AGE

95.17EDUCATION 1.51WEALTH INHERITANCE

Here Ye is the estimated value of income

16

-1001.87 is the estimate of ß0, 8.85 is the

estimate of ß1, 95.17 is the estimate of ß2 and

1.51 is the estimate of ß3

The least-squares estimates of the ß-values are

denoted by b-values. Thus, b1 is the estimate of

ß1 and b2 is the estimate of ß2 . In our case,

b1 8.85 and b2 95.17.

17

We next make the following assumptions on the

specification of model B so that the

least-squares method produces good estimators.

18

- i. ? is normally distributed with mean 0 and

an unknown variance ?2? .

In the context of the model B, ? can be thought

of as a luck factor which can be good (positive

values) or bad (negative values),

If the positive and negative values cancel out on

average, we can say that mean value is 0.

19

- The ? values are uncorrelated across the

population

(Whether or not you are lucky does not influence

my being lucky/unlucky)

i. The ? values have the same variance (?2?)

across it. (Every individual is exposed to the

same extent/chance of good or bad luck)

20

- The ? values are uncorrelated with the

independent variables Age, Education and Wealth

Inheritance.

(For example, an old person is as likely to be

lucky as a young one

or a university graduate is as likely to be

unlucky as someone with no A-levels).

21

- We now test (at 10 significance) the following

hypothesis

Education has a positive effect on income

Step 1 Set up the hypotheses

H0 ß2 0 (Education has no effect) H1

ß2 gt 0(Education has a positive effect)

one-tailed test

22

Step 2 Select statistic

The estimator b2 is the test-statistic

Step3 Identify the distribution of b2

23

Assumptions i-iii above imply that b2 is

- Best

- Linear in the dependent variable income

- Unbiased

- Estimator of ?2

24

Since b2 is unbiased, E(b2) ?2

b2 has a normal distribution because it is

linear in Income

- Thus, b2 N(?2, ?22) where ?22 is unknown.

25

Step 4 Construct test statistic We use the

standard error of b2 because we do not know what

?22 is

Therefore, the test statistic is t ? (b2- ?2) /

(standard error of b2) has a Students

t-distribution with 20-4 16 d.o.f.

26

As ?2 0 under the null hypothesis (H0) t b2 /

(standard error of b2)

- EViews therefore gives us a t-statistic regarding

education of 2.46907

The corresponding probability value is 0.0252.

27

Select fx /TDIST. For X, enter 2.469607, the

t-Statistic value. The degree of freedom is 16.

EViews calculates two-tail probability So number

of tails is 2. You now get the 2-tail

probability of 0.025165 from Excel.

Since we are performing a one-tail test, take

half the probability value, or 0.0126 .

28

Step 5 Compare with critical value tC

tC 1.336757 for a one-tailed test with

significance level (a) 0.1 and d.o.f. 16

tC 1.336757 lt 2.469607

29

Step 6 Draw conclusion

The test is significant. Reject H0 at 10 and at

5 (1.745884 lt 2.469607) but not at 1 (2.583492

gt 2.469607)

Step 7 Interpret result

The data supports (with at least 98 accuracy)

the hypothesis that EDUCATION is an important

explanatory variable affecting income.

30

In rejecting H0, we are prone to make a Type 1

Error.

The probability of a type 1 error is nothing but

the area to the right of t-statistic, or 0.0126.

31

- Example 2 Use output 2 to test the hypothesis

(at 5 significance) that weightgain is

proportional to foodvalue.

The Model y a bx e and add the

assumptions (Lec17)

Step 1

H0 a 0 (proportionality) H1 a ? 0

(non-proportionality)

Step 2

The estimator a is the test-statistic

32

- Conditions

The explanatory variable X is assumed

(1A) to be deterministic or non-random

(1B) to come from a fixed population

(1C) to have a variance V(x) which is not too

large

The above assumptions are best suited to a

situation of a controlled experiment

33

Assumptions concerning the random term ei

(IIA) E(ei ) 0 for all i

(IIB) Var(ei) s2 constant for all i

(IIC) Covariance (ei , ej) 0 for any i and j

(IID) Each of the ei has a normal distribution

34

Step 3

Thus, a N(a, ?2 ) where ?2 is unknown.

Step 4

Therefore, the test statistic t ? (a- a) /

(standard error of a) has a Students

t-distribution with 10-2 8 d.o.f.

35

Step 5 Compare with critical value tC

tC -2.31 for a two-tailed test with

significance level (a) 0.05 and d.o.f. 8

Step 6 Draw conclusion

The test is significant. Reject H0 at 5

tC -2.31 gt -3.005262

- The p-value is 0.0169 lt 0.05

Step 7 Interpret

Foodvalue is not the only variable that affects

weightgain

36

Example 3

Use output 3 to test (at 5 significance) the

following hypothesis

Exercise has a negative effect on weight gain

The proposed regression model is Weightgain

ß0 ß1(Foodvalue) ß2(Exercise) e

37

Step 1 Set up the hypotheses

H0 ß2 0 (Exercise has no effect) H1 ß2

lt 0(Exercise has a negative effect)