Farm Financial Statements - PowerPoint PPT Presentation

1 / 27

Title:

Farm Financial Statements

Description:

Title: Cash Flow and Net Farm Income Author: edwards Last modified by: William Edwards Created Date: 9/5/2000 1:57:39 PM Document presentation format – PowerPoint PPT presentation

Number of Views:84

Avg rating:3.0/5.0

Title: Farm Financial Statements

1

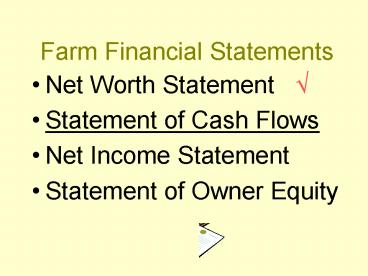

Farm Financial Statements

- Net Worth Statement v

- Statement of Cash Flows

- Net Income Statement

- Statement of Owner Equity

2

Recording Transactions in the Cash Journal

- Date

- Description

- Value

- Amount (bu., lb., etc)

- To (from) whom

- Enterprise (optional)

- Production period (optional)

3

Transactions can be

- Receipts (cash inflows)

- Expenditures

- (cash outflows)

4

Transactions are Posted to 4 Types of Accounts

- Production

- Investment

- Financing

- Nonfarm

5

Statement of Cash Flows

6

Chart of Accounts Detail

- 101 Corn sales

- 102 Hog sales

- 110 USDA payments

- 201 Machinery sales

- 301 Operating loan received

- 410 Nonfarm interest earned

7

Chart of Accounts Detail

- 112 Soybean seed

- 131 Cash rent paid

- 210 Hog equipment purchase

- 333 Cow loan payment (principal only)

- 42 Family medical insurance

8

Cash Flow Summary for Year 3 Farm Number

Operating Income Borrowing Corn

Sales 25,200 Emergency

1,101 Soybean sales 23,917 Operating

10,000 Feeder cattle 90,000 Crop

insurance payment 0 Machinery 0 Cattle

sales 266,929 Combine 0 Hog sales

101,041 Hog facilities 0 Sow and boar

sales 4,386 Land 0 Capital Asset Sales

Machinery and comb. sales 0 Carryover

operating 0 Total cash inflow

522,574

9

Cash Outflows Operating Expense Capital

Assets Seed, fertilizer, chem. 21,540 Machiner

y purchase 0 Crop insurance premium 0 Combine

purchase 0 Fuel and oil 3,832 Hog facilities

purchase 0 Custom machine hire 9,525 land

purchase 0 Machinery repairs 1,158 Cash

rent 0 Principal paid Feeder cattle

purchased 92,400 operating 10,000 Grain

purchased 45,886 cattle 162,000 Hay and

supplement 31,126 machinery 24,600 Veterinary

and health 10,250 combine 0 Hauling,

commission 7,200 swine facilities 0 Boars,

gilts purchased 1,600 emergency

loan 1,101 Property tax 5,506 land 10,000 I

nsurance on bldg., mach. 1,148 Building

repairs 675 Nonfarm Utilities 5,900 Family

living expenses 30,000 Hired labor 3,000 Incom

e tax paid 0 Grain storage 0 Interest

paid 28,809 Total cash outflow 507,257

10

Summary Cash on hand, Jan. 1 16,261 Total

cash inflow 522,574 - Total cash outflow

507,257 Cash remaining, Dec. 31 31,578

11

Net Farm Income Statement(Profit and Loss

Statement)

- Total Income

- - Total Expenses

- Net Farm Income

12

Step 1. Record Cash Income and Cash Expenses from

the Statement of Cash Flows Cash Net Farm

Income (do not include loans, capital assets,

or nonfarm transactions)

13

Step 2 Make Accrual Adjustments at end of the

Year

- Include income in the year it is produced (rather

than in year sold) - Include expenses in the year the products or

services are used (rather than in year paid).

14

Accrual Adjustments to Income

- Add change in the value of

- Crops in inventory

- Growing crops

- Market livestock in inventory

- Accounts receivable

- Ending NW value

- Beginning NW value

- Use values from Current Assets.

15

Profit and Loss Statement for End of Year

3 Income Total Crops Hogs Cattle

Sales 421,473 49,117 105,427

266,929 Ins payments 0 0 Inventory chg

-46,297 21,650 1,653 -69,600 Gross income

375,176 70,767 107,080 197,329 Feed

purchased -77,013 0 -42,323 -34,690

raised crops fed 30,642 -10,843 -19,800

Livestock purch -94,000 -1,600 -92,400

Value farm Prod 204,162 101,409 52,314

50,439

16

Accrual Adjustments to Expenses

- Change in accounts payable

- Ending value Beginning value

- (from Current Liabilities)

- Change in expenses paid in advance

- prepaid expenses

- supplies on hand

- Beginning value Ending value

- (from Current Assets)

17

Capital Assets

- Accrual adjustment to intermediate and long-term

assets is made through - Depreciation expense

18

Capital Gain or Loss

- Difference between the selling price of a capital

asset and its cost (depreciated) value. - Can be positive (capital gain) or negative

(capital loss)

19

Cash Income /- adjustmentsminusCash Expenses

/- adjustments equalsNet Farm Income from

Operations/-Capital gains (or

losses)equalsNet Farm Income

20

Net Worth and Net Farm Income

Ending Net Worth

Beginning Net Worth

Net Farm Income

21

Net Worth is also affected by

- Contributions of nonfarm capital ()

- Withdrawals for nonfarm expenses(-)

- Changes in the market values of capital assets

(affect market value net worth, only)

22

Statement of Owner Equity

- Beginning Net Worth

- Net Farm Income (accrual)

- - Nonfarm withdrawals or contributions

- Ending Net Worth (cost value)

- /- adjustments to capital asset values

- Ending Net Worth (market value)

23

Statement of Owner Equity for Year 3 Farm Number

150

24

Single and Double-Entry Accounting

- Single Entry record only income and expenses

- Double Entry record changes to assets and

liabilities as you go (credits and debits)

25

Advantages to Double Entry

- Net Worth Statement is always up to date.

- Can check accuracy by comparing account values to

actual balances and inventories. - Accrual adjustments are made automatically

26

Double-Entry Example

- Harvest grain and sell it

- Increase Grain Sales account (income)

- Increase Cash on Hand account (asset)

- Buy skid loader for cash

- Increase Machinery account (asset)

- Decrease Cash on Hand account (asset)

27

Double-entry Examples

- 3. Pay back cattle loan--principal

- Reduce Cash on Hand account (asset)

- Reduce Bank Loan account (liability)

- 4.Pay electric bill

- Reduce Cash on Hand account (asset)

- Increase Utilities Expense account (expense)