DebtEquity Trade Off - PowerPoint PPT Presentation

1 / 12

Title:

DebtEquity Trade Off

Description:

(a) Issue: Will 900k shareholder debt be treated as equity for tax purposes? ... principle payments taxed as dividends to extent of E & P. ... – PowerPoint PPT presentation

Number of Views:57

Avg rating:3.0/5.0

Title: DebtEquity Trade Off

1

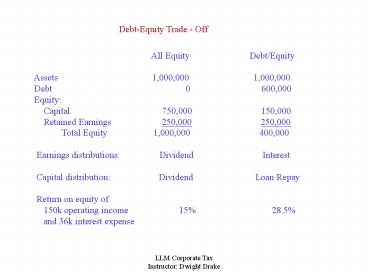

Debt-Equity Trade - Off

All Equity

Debt/Equity Assets

1,000,000

1,000,000 Debt

0

600,000 Equity Capital

750,000

150,000 Retained

Earnings 250,000

250,000 Total

Equity 1,000,000

400,000 Earnings

distributions Dividend

Interest Capital

distribution Dividend

Loan Repay Return on

equity of 150k operating income

15

28.5 and 36k interest expense

2

Debt-Equity Factors

1. Documentation Unconditional promise to

pay specified term

interest rate default remedies 2.

Debt/Equity Ratio Inside and Outside debt.

Book value v.

Market Value. If ratio over 5-to-1 based on

total debt and book value, must be able to show

consistent profitability and cash flow will

support debt. 3. Proportionality Same ratio

as stock ownership 4. Subordination Inside

debt inferior to outside debt 5.

Convertibility Debt convertible to stock

LLM Corporate Tax Instructor

Dwight Drake

3

Problem 153-1 (a)

Bank

900k loan

Chez Corp.

80k cash for 100 shares

40k cash business (40k) for 100 shares

Bldg 80k for 100 shares Basis 20k

A

C

B

300k five-year note Variable interest

300k five-year note Variable interest

300k five-year note Variable interest

(a) Issue Will 900k shareholder debt be

treated as equity for tax purposes?

Consequences Interest payments not deductible

all interest and principle payments taxed as

dividends to extent of E P. Factors

Form of debt (no problem) proportionality

(problem) Debt- Equity ratio (problem

12.851 (Cost) 7.51 (FMV)) Capacity to repay

(?) intent to repay (?) subordination (?).

Probably cooked here.

4

Problem 153-1

Chez

Balance Sheet Post Funding

Cost FMV

Assets Cash

1,920,000

1,920,000 Building

20,000

80,000 Goodwill

0

40,000 Total

1,940,000

2,040,000 Liabilities

Bank Loan 900,000

900,000

Shareholder Loan 900,000

900,000 Total

1,800,000

1,800,000 Equity

140,000

240,000 Total Liab.

Equity 1,940,000

2,040,000

LLM Corporate Tax Instructor

Dwight Drake

5

Problem 153-1 (b)

Bank

900k loan

Chez Corp.

80k cash for 100 shares

40k cash business (40k) for 100 shares

Bldg 80k for 100 shares Basis 20k

A

C

B

300k 20 year debenture Interest 0nly from

profits

300k 20 year debenture Interest 0nly from

profits

300k 20 year debenture Interest 0nly from

profits

(b) No hope. Too long bad form (Debenture?)

squirrelly interest (like dividend)

subordinated flakey intent to repay.

LLM Corporate Tax Instructor

Dwight Drake

6

Problem 153-1(c)

Bank

900k loan unsecured

Chez Corp.

80k cash for 100 shares

40k cash business (40k) for 100 shares

Personally Guaranteed

Bldg 80k for 100 shares Basis 20k

A

C

B

300k five-year note Variable interest

300k five-year note Variable interest

300k five-year note Variable interest

(c) Bank loan may also be equity if corp thinly

capitalized, unlikely corp can pay back debt, and

bank expects ultimate repayment from

shareholders. Guarantee itself wont kill given

prevalence of shareholder guarantees in private

businesses. Need more facts here.

LLM Corporate Tax Instructor

Dwight Drake

7

Problem 153-1(d)

Bank

900k loan

Chez Corp.

80k cash for 100 shares

40k cash business (40k) for 100 shares

Bldg 80k for 100 shares Basis 20k

A

C

B

900k five-year note Variable interest

(d) Much safer because no proportionality. But

385 Regs. would have subjected non-proportional

loan to proportional scrutiny if made by over 25

shareholder and had debt-to-equity ration over

101 (based on cost).

LLM Corporate Tax Instructor

Dwight Drake

8

Problem 153-1(e)

Bank

900k loan

Chez Corp.

80k cash for 100 shares

40k cash business (40k) for 100 shares

Bldg 80k for 100 shares Basis 20k

Chez default in year 3

A

C

B

900k five-year note Variable interest

(e) Failure to pay can trigger reclassification

as equity if there is no effort made to enforce

rights under default. 385 Regs. required second

look if debt not paid. What to do? Renegotiate

based on market standards and then properly

document.

LLM Corporate Tax Instructor

Dwight Drake

9

Problem 153-2

Given vagueness, how to advise

1. Carefully draft to avoid any hybrid stock

attributes. 2. Market interest rate,

term, maturity and payment terms. 3.

Avoid proportionality and subordination, if

possible (often not). 4. Manifest

intent to repay (terms, remedies, maybe even

security). 5. If possible, keep total

debt/equity ration under 101 and inside

under 31 (the 385 Reg safe harbors).

6. Make sure payments are made.

LLM Corporate Tax Instructor

Dwight Drake

10

Problem 157 (a)

Hi-Tech Corp.

400k cash for 50 shares

200k cash Secure, growth, tax smart

400k cash for 50 shares

A

J

T

a) 200k unregistered 5 yr note, market rate

interest. No upside potential. Since not

registered and no coupons, not security under

165(g). Hence, loss subject to 166, which

permits ordinary loss if it business bad debt

incurred in Jennifers trade or businesses. If

non-business, then short-term capital loss. Key

factor is that business, not investment, must be

dominate motive. Need info Was J employee of

Hi-Tech, in business of loaning money, or had

need to protect business relationship with

H-Tech? If no, then STCL treatment.

LLM Corporate Tax Instructor

Dwight Drake

11

Problem 157 (b),(c),(d)

Hi-Tech Corp.

400k cash for 50 shares

200k cash Secure, growth, tax smart

400k cash for 50 shares

A

J

T

b) 200k registered bond. Still no upside. Since

registered, is security under 165(g). If J

hold a yr. as capital asset, loss will be LTCL.

c) 190k registered bond with warrants to

purchase stock (warrant cost 10k). Both bonds

and warrants securities under 165 LTCL

treatment. d) 200k common stock. Per 1244, 50k

(100K if married) of worthless stock loss may be

ordinary then rest LTCL. For 1244, J must be

original issuee stock issued for cash aggregate

amount corp received for stock not over 1 mill

corp receives over 50 of receipts from

non-passive investment sources.

LLM Corporate Tax Instructor

Dwight Drake

12

Problem 157 (e) thru (h)

Hi-Tech Corp.

400k cash for 50 shares

200k cash Secure, growth, tax smart

400k cash for 50 shares

A

J

T

e) 200k convertible preferred stock. May

qualify for 1244 treatment as described in d), a

1984 change in the law. f) Common stock to

Jennifer, original shareholders capitalized for 1

mill. No 1244 treatment available to Jennifer.

Stock loss capital loss pursuant to 165(g) g)

Common stock to Jennifer, who gives stock to son.

Gift would kill 1244. Only original issuees. h)

Purchase common stock through partnership.

Partnership may qualify for 1244, passing through

to each partner.

LLM Corporate Tax Instructor

Dwight Drake