Tax Evasion and Tax Avoidance - PowerPoint PPT Presentation

1 / 17

Title:

Tax Evasion and Tax Avoidance

Description:

1. Tax Evasion and Tax Avoidance. Tax ... Held legal documents could not be overturned merely because the motive was to save tax ... Nightingale chapter 6 ... – PowerPoint PPT presentation

Number of Views:6186

Avg rating:3.0/5.0

Title: Tax Evasion and Tax Avoidance

1

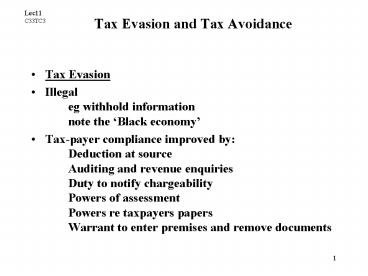

Tax Evasion and Tax Avoidance

Lec11 C33TC3

- Tax Evasion

- Illegal eg withhold information note the Black

economy - Tax-payer compliance improved by Deduction at

source Auditing and revenue enquiries Duty to

notify chargeability Powers of

assessment Powers re taxpayers papers Warrant

to enter premises and remove documents

2

Tax Evasion and Tax Avoidance

- Tax Avoidance

- Arranging affairs to minimise tax legal and

encouraged Artificial schemes

3

Tax Avoidance

- Tax avoidance and the law

- 1 Case law

- 2 Legislation

4

Tax Avoidance

- 1 Case law

- IRC v Duke of Westminster 1936 19 TC

490 Servants paid by deed of covenant in place

of wages - Held legal documents could not be overturned

merely because the motive was to save tax - Every man is entitled to order his affairs so

that the tax attaching under the Act is less than

it otherwise would be. - Importance of the letter of the law not the

substance - Tax avoiders charter

5

Tax Avoidance

- WT Ramsay Ltd v IRC 1981 STC 174

- Tax avoidance scheme

- Series of transactions that left the taxpayer in

the same position at the end as at the beginning

(circular transactions) - In course of transactions a CGT loss (allowable)

and a CGT gain (not chargeable) had arise. Idea

to use the CGT loss against other gains. - Held Pre-ordained events so court could look at

cycle of transactions as a whole. This resulted

in no gain, no loss. So CGT loss not available. - H of L said not overturning Duke of W. but

limiting it.

6

Tax Avoidance

- Tax avoidance split

- Legitimate tax planning mitigation of tax

- Not allowed Artificial tax avoidance schemes

7

Tax Avoidance

- Furniss v Dawson 1984 STC 153

- Ramsay principle extended to a non circular

transaction - Sale of shares with artificial step to avoid tax

- Held extra step ignored and gain taxed

8

Tax Avoidance

- Restrictions to Ramsay principle

- Craven v White 1988 STC 476

- Similar to F v D sale of shares through IOM

company But sale to third party not planned in

advance - Not pre-ordained at time of share exchange

9

Tax Avoidance

- For Furniss v Dawson to apply 1 Series of

transactions must be pre-ordained 2 Transaction

must have no other purpose than tax

mitigation 3 Intermediate transactions not

contemplated as having independent life 4

Pre-ordained events must in fact take place - Lord Oliver

10

Tax Avoidance

- Restrictions to Ramsay principle cont

- Piggot v Staines Investments 1995 STC 1418

- Note Rex v Charlton Others 1996 STC

1418 Bungled tax avoidance scheme regarded as

evasion and prosecuted as a crime

11

Tax Avoidance

- Further development of Ramsay principle

- IRC v McGuckian 1997 STC 908

- Lords Steyn and Cooke indicated that Ramsay

principle is not just to determine what a real

transaction is but to interpret the purpose of

the statute

12

Tax Avoidance

- 2 Legislation

- Anti avoidance legislation significant feature of

UK tax code - Works in different ways

- 1 Deny a relief which might be used to manipulate

a situationExampleSchedule B/Schedule D

forestry regimeCost of planting new forest

offset against Sch D income to encourage growth

of timber in UKUnforeseen effects and perceived

as a means of avoiding tax by the wealthy

13

Tax Avoidance

- 1 Deny a relief which might be used to manipulate

a situation (cont)Solution Not to adjust

relief to prevent (eg) a coniferous

monocultureBut to abolish the tax regime to

close a tax loophole exploited by the wealthy

14

Tax Avoidance

- 2 Introduce a special tax regime for the type of

transaction and taxpayer concernedExampleS.42

CAA 1994 a) Special 10 capital allowance

rate b) denial of relief altogetherTo prevent

advantage being taken of generous UK allowances

for non UK leasing equipment

15

Tax Avoidance

- 3 Inland Revenue power to challenge transactions

where they feel there is a tax avoidance motive

presentExampleS 775 ICTA 1988 Where

individuals earning capacity is exploited in

return for a capital sum..Pop star sells

services to company for fixed (relatively low)

salary and shares. Shares (capital) sold for

large amount Under S 775 capital sum treated as

income

16

Tax Avoidance

- 4 General Anti-avoidance Rule (GAAR) Favoured by

Labour government 1997 Institute Fiscal Studies

Report 1997 IR reported Confine to corporate

affairs Law Review Committee opposed

GAAR Burden of proof would fall on

taxpayer Clearance procedures of IR

inadequate 1999 Budget GAAR not to be

introduced for time being 2004 Budget Schemes

and arrangements to be submitted

for prior approval

17

Tax Evasion and Tax Avoidance

- Bibliography Nightingale chapter 6

- Taxation Policy and Practice Lymer and Oats

2006-07 Chapter 1 pp 31-34 and Chapter 11 - Tolleys Tax cases

![get [PDF] Download TAXTOPIA: How I Discovered the Injustices, Scams and Guilty Secrets of the Tax [PDF] PowerPoint PPT Presentation](https://s3.amazonaws.com/images.powershow.com/10109965.th0.jpg?_=20240826015)