Other Liabilities - PowerPoint PPT Presentation

Title:

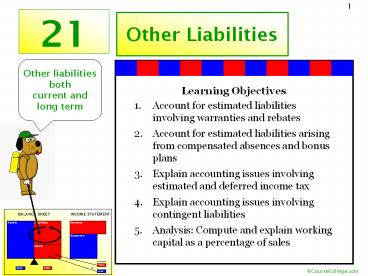

Other Liabilities

Description:

21 Other Liabilities Other liabilities both current and long term Learning Objectives Account for estimated liabilities involving warranties and rebates – PowerPoint PPT presentation

Number of Views:123

Avg rating:3.0/5.0

Title: Other Liabilities

1

Other Liabilities

21

Other liabilities both current and long term

2

Liabilities -definition

- The FASB definition of a liability includes these

3 essential elements - It is an obligation in effect that must be

settled by giving up cash, goods or services in

the future. - It is an obligation that cannot be avoided.

- The event that created the obligation has already

occurred.

- In this chapter we will study several liabilities

that could meet this definition but may - Require an estimate as to

- the size of the liability,

- the date it must be paid and

- the party to whom it will be paid

- Exhibit uncertainty as to whether the liability

will occur

3

Objective 21.1 Account for estimated liabilities

involving warranties and rebates

Estimated liabilities are known obligations of an

uncertain amount. They often also exhibit

uncertainty as to the date they must be paid and

the party to whom they will be paid.

O21.1

4

Account for estimated liabilities involving

warranties and rebates

Firms often guarantee their products and services

under a warranty agreement. Based on the expected

occurrence of claims, they must follow the

Matching Concept and expense the warranty repair

or replacement in the same fiscal period as the

sales that involved the warranty.

WARRANTY We guarantee. . .

O21.1

5

Account for estimated liabilities involving

warranties and rebates

Firms also offer inducements to generate sales

and develop customer loyalty through the use of

marketing innovations such as cash rebates. This

additional expense, must follow the Matching

Concept and be included in the same fiscal period

as the sales that these inducements helped

generate.

25 Rebate With the purchase of. . .

O21.1

6

Account for estimated liabilities involving

warranties and rebates

- Problem -When the warranty or rebate is expensed,

the firm doesnt know precisely - Who will be paid

- How much or how many will be paid

- When they will be paid

Solution -Estimate the warranty and rebate

expense expected

O21.1

7

Account for estimated liabilities involving

warranties and rebates

- Warranty liabilities

- After sale obligations arising from guaranty

agreements for products and services - Estimates must be used to predict expected

warranty claims - Warranty liability and expense must be recorded

in the same period as sales subject to the

warranty

WARRANTY We guarantee. . .

O21.1

8

Account for estimated liabilities involving

warranties and rebates

- Rebate liabilities

- Subject to a sale, cash, product or service

obligation to a customer - Estimates must be used to predict amounts that

must be paid based on expected redemption rates - Rebate liability and expense must be recorded in

the same period as the sales subject to the

incentive

25 Rebate With the purchase of. . .

O21.1

9

Example WARRANTYOn January 1, Greenline Engine

Rebuilders began to offer a 2 year 20,000 mile

parts and labor warranty on their rebuilt auto

and truck engines. Management estimates that

warranty expenses will average 3 of net sales.

As of December 31, net sales 2,350,000.

Estimated warranty claims are 2,350,000 x 3

70,500

Greenline will report 70,500 less net income as

a result of this adjustment.

O21.1

10

Example WARRANTYIn January following the first

year of the warranty agreement, a customer

submitted a claim for 500 for warranty repairs

made on a Greenline engine.

No change in net income as a result of this

transaction

Note that the debit does not go to an expense

account, it reduces the Warranty Liability. This

obligation has already been expensed in the prior

fiscal period.

O21.1

11

Example REBATE On January 1, YardMax Tools began

to offer a 25 mail-in rebate on the purchase of

their new garden tiller. Management estimates

that 40 of customers will submit the mail-in

rebate. The sales price for the new tiller is

425.

Sales totaled 850,000. Estimated rebate

expense 850,000/425 2000 tillers x 40

x 25 20,000

YardMax will report 20,000 less net income

O21.1

12

Objective 21.2 Account for estimated liabilities

arising from compensated absences and bonus plans

- Compensated absence plans include

- Vacations

- Sick pay

- Holidays

- Family leave

- earned by employees

O21.2

13

Account for estimated liabilities arising from

compensated absences and bonus plans

- FASB rules indicate these expenses should be

accrued if the following conditions are met - The obligation to compensate for absences arises

from services already rendered by the employee. - The obligation is related to rights for time off

that vest or accumulate - Payment is probable

- Amounts can be reasonably estimated

O21.2

14

Account for estimated liabilities arising from

compensated absences and bonus plans

Vested rights exist when the employee has a

right to the benefit even if terminated

Accumulated rights exists when benefits can be

carried forward into future periods if not used

in the current period

O21.2

15

Compensated absences -example

Consider start up firm Barrier Systems who began

operation on July 1 (FYE 6/30). Barrier has 10

employees who earn, on average, 625 per week.

During the year employees earned 20 weeks of paid

vacation and none was used. 625 x 10 employees

x 20 weeks 125,000

O21.2

16

Compensated absences -example

In the first month of the subsequent fiscal year,

employee Ralph Tonga takes his 2 week vacation.

His weekly wage, net of all payroll costs and

deductions, is 725.

Additional entries (i.e. debits to the Vacation

Wages Payable credits to various payroll

payable accounts) for employee deductions and the

employer payroll costs would be necessary to

complete the payroll recording. (See Chapter 8)

O21.2

17

Bonus agreements -example

Ridlow Corporations bonus plan pools 20 of net

profits (after the expense of the profit sharing

is deducted) for distribution to all employees

weighted by their total annual compensation.

Ridlows net income before any bonus plan

deductions is 1,500,000. Let B equal the

amount of the bonus, then B 20 x

(1,500,000B) B 300,000 - .20B 1.20B

300,000 B 250,000

O21.2

18

Objective 21.3 Explain accounting issues

involving estimated and deferred income tax

- The regular C-corporation is subject to federal

income taxes which must be accounted for on the

corporate financial statements - Estimates are recorded during the tax year based

on anticipated taxable income levels - Corporations are required to make estimated

quarterly income tax payments to the IRS to avoid

penalties

O21.3

19

Explain accounting issues involving estimated and

deferred income tax

At month end, Nappy Corp estimates the first

quarterly tax payments due April 15 to be

22,000.

Note that the estimate is expensed

O21.3

20

Explain accounting issues involving estimated and

deferred income tax

On April 15, the tax payment is made

The payable is satisfied with the cash payment

O21.3

21

Explain accounting issues involving estimated and

deferred income tax

- Deferred Income Tax Liabilities

- income under GAAP and income under IRS rules is

usually different - most differences are temporary due to timing

issues - over longer periods of time (years) different

income amounts between IRS and GAAP due to timing

are eliminated - except for some permanent differences

O21.3

22

Explain accounting issues involving estimated and

deferred income tax

Consider the different income for the same year

under GAAP and IRS for Vision Corporation

O21.3

23

Explain accounting issues involving estimated and

deferred income tax

Why is the income (GAAP vs IRS) different?

- Some examples of permanent reasons are

- Permanent GAAP IRS

- Is municipal bond interest revenue?

- Are fines for legal violations expenses?

For temporary and permanent reasons.

No

Yes

No

Yes

O21.3

24

Explain accounting issues involving estimated and

deferred income tax

Why is the income (GAAP vs IRS) different?

Due to temporary timing differences in the

recognition of revenues and expenses

- Some examples of temporary reasons are

(eventually results will be same for GAAP IRS) - Straight line depreciation could be used for GAAP

but an accelerated depreciation for IRS - Uncollectible account expense and warranty

expense is accrued under GAAP but IRS only allows

these to be expensed when cash is actually paid

O21.3

25

Explain accounting issues involving estimated and

deferred income tax

These differences often result in a deferred

income tax liability (or asset)

Keep in mind that we are preparing GAAP

statements here

GAAP statements

We are obliged to record the federal income tax

expense based on the 30,000 GAAP income NOT the

10,000 IRS taxable income.

O21.3

26

Explain accounting issues involving estimated and

deferred income tax

If the tax rate is 15 for Vision Corporation,

this would require 15 x 30,000 4,500 debit

to income tax expense

The amount currently due (must be paid this

period) to the IRS 15 x 10,000 1,500

The balancing entry of 3,000 is the deferred

amount (will be paid in future years)

O21.3

27

Explain accounting issues involving estimated and

deferred income tax

These differences can also result in a deferred

income tax asset

Consider Cascade Corporation net income of

20,000 under GAAP and 50,000 under IRS.

The deferred tax asset will be used up in future

periods.

O21.3

28

Objective 21.4 Explain accounting issues

involving contingent liabilities

Contingent liabilities are potential liabilities

arising from an existing set of circumstances

Example Consider a product defect lawsuit

pending against PNC Corporation. If the firm

loses the suit they may be required to pay

substantial amounts.

O21.4

29

Explain accounting issues involving contingent

liabilities

Depending on how future events unfold, PNC

Corporation could suffer a loss based on the

outcome of the lawsuit.

The loss is uncertain until the lawsuit is over

O21.4

30

Explain accounting issues involving contingent

liabilities

- FASB rules regarding the recording of contingent

liabilities are based on two questions - What are the chances the event will occur?

- Can the size of the potential loss be reasonably

estimated?

O21.4

31

Explain accounting issues involving contingent

liabilities

- FASB assigns three ranges of possibility to the

first question. - Probable The future event is likely to occur

- Reasonably possible The chance of the event

occurring is less than likely but more than

remote - Remote The chance of the future event occurring

is slight

O21.4

32

Explain accounting issues involving contingent

liabilities

Only one of these situations require the

liability to be recorded

O21.4

33

Explain accounting issues involving contingent

liabilities

Assuming that the PNC corporation product defect

lawsuit has been determined to be both probable

and can be reasonably estimated as a 500,000

potential loss. . .

The loss is still probable, not 100 certain

O21.4

34

Explain accounting issues involving contingent

liabilities

- Also

- A set of circumstances could possibly result in a

gain (i.e. the firm began a lawsuit against

another party for damages) - If the firm wins, a gain could result

- However, GAAP rules lean toward the Conservatism

Concept in the case of gains and they are not

recorded until they actually occur

O21.4

35

Objective 21.5 Analysis Compute and explain

average working capital as a percentage of sales

Working capital answers the following question

How many dollars of current assets would remain

if all current liabilities were paid using

current assets? The higher the number, the more

liquidity is displayed by the balance sheet.

Working Capital

Current Assets

Current Liabilities

O21.5

36

Analysis Compute and explain average working

capital as a percentage of sales

Average working capital Working capital

(beg.) Working capital (ending) 2

Average working capital as a percentage of sales

Average Working Capital

Sales

O21.5

37

Analysis Compute and explain average working

capital as a percentage of sales

Average working capital as a percentage of

sales answers the question What level of

working capital was necessary to achieve the

reported sales for the year?

Average Working Capital

Average working capital as a percentage of sales

Sales

O21.5

38

Example

O21.5

39

End Unit 21