Three manufacturing costs - PowerPoint PPT Presentation

1 / 30

Title:

Three manufacturing costs

Description:

Three manufacturing costs Direct material cost: Consist of all those material that can be identified with a specific product. Example: wood used in manufacturing of a ... – PowerPoint PPT presentation

Number of Views:185

Avg rating:3.0/5.0

Title: Three manufacturing costs

1

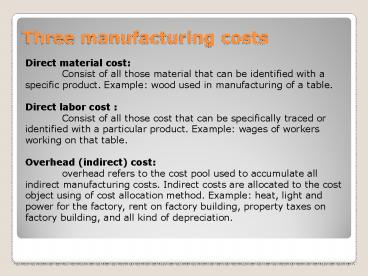

Three manufacturing costs

Direct material cost Consist of all those

material that can be identified with a specific

product. Example wood used in manufacturing of a

table. Direct labor cost Consist of all those

cost that can be specifically traced or

identified with a particular product. Example

wages of workers working on that table. Overhead

(indirect) cost overhead refers to the cost

pool used to accumulate all indirect

manufacturing costs. Indirect costs are allocated

to the cost object using of cost allocation

method. Example heat, light and power for the

factory, rent on factory building, property taxes

on factory building, and all kind of depreciation.

2

Factory Overhead

Overhead consists of many individual cost items.

These are costs that cant be measured or traced

for a specific product. Factory overhead costs

are both fixed and variable. The factory overhead

controlling account is debited when costs are

incurred and credited when factory overhead is

applied to various job orders. i.e indirect

material and labor, utility costs, depreciation

of equipment and salaries of factory

administrative personnel.

3

Plant-wide (blanket) overhead rates

The most simplistic traditional costing system

assigns indirect costs to cost objects using a

single overhead rate for the organization as a

whole. The terms blanket overhead rate or

plant-wide rate are used to describe a single

overhead rate that is established for the

organization as a whole.

4

Job Order Costing

A job is a production run for a specific product.

A relatively small number of units generally

comprise a job. Job order costing system record

actual and estimated production costs in the

formal accounting system leading to manufacturing

statements. Construction firms use a variation of

job order costing. Some overhead is applied to

each job so that the contractor can recoup its

general production costs which apply to all jobs

but which are not traceable to any specific job.

5

Benefits of job costing

- You will know on an ongoing basis which projects

are profitable and which ones arent. - You will be able to get paid on a timely basis as

you complete the job. - You can avoid committing resources to projects.

- If you manufacture products

- You will know what it cost to make each item

- You will be able to set selling prices that cover

your costs and earn a fair profit - You will know what product lines to expand

because theyre profitable, and what product line

to drop because theyre unprofitable.

6

General approach to job costing

- Identify the job that is chosen cost object

- The cost object can be chosen through the job

cost record. Companies keep a job cost record for

every specific job. A job cost record, also

called a job cost sheet records and accumulates

all the costs assigned to a specific job,

starting when work begins.

7

- Identify the Direct costs of the job

- Robinson identified two direct manufacturing

cost categories, - direct material and direct manufacturing

labour. Example can be seen for the direct costs

for the specific job. - Select the cost allocation bases to use for

allocating indirect cost to the job. - Indirect costs cant be allocated to a

specific product. It will be impossible to

complete a job without incurring indirect cost

such as supervision, manufacturing engineering,

utilities and repairs. Multiple cost allocation

bases are used to allocate a indirect cost

because different indirect cost have different

cost drivers. Example depreciation or repair of

machines is closely related to machine hours so

machine hours can be used as a cost driver.

8

- Identify the indirect cost associated with each

cost allocation base. - Now that the allocation bases has been

identified, all indirect cost are now identified

for that allocation base. In our example from the

Robinson company they use indirect manufacturing

costs to machinery hours used.

- Compute the rate per unit of each cost allocation

base used to allocate indirect costs to the job.

Actual manufacturing overhead costs

Actual manufacturing overhead rate

Actual total quantity of cost allocation base

1215000

Actual manufacturing overhead rate

27000 direct manufacturing labor hours

45 per direct manufacturing labor hour

9

- Compute the indirect costs allocated to the job.

Indirect cost allocated to a job actual quantity

of each different allocation base x indirect cost

rate of each allocation base

- Compute the total cost of the job by adding all

direct and indirect costs assigned to the job.

Total cost Direct cost Indirect cost

10

JOB-COST RECORD

JOB NO

CUSTOMER

WPP 298

Western Pulp and Paper

Date Started

Date Completed

Feb. 3, 2006

Feb. 28, 2006

DIRECT MATERIALS

Materials Requisition No.

Unit Cost

Date Received

Quantity Used

Total Costs

Part No.

Feb. 3, 2006

2006 198

MB 468-A

8

14

112

Feb. 3, 2006

2006 199

TB 267-F

12

63

756

4,606

Total

DIRECT MANUFACTURING LABOR

Period Covered

Labor-Time Record No.

Employee No.

Hours Used

Hourly Rate

Total Costs

Feb. 3-9, 2006

LT 232

551-87-3076

25

18

450

Feb. 3-9, 2006

LT 247

287-31-4671

5

19

95

1,579

Total

MANUFACTURING OVERHEAD

Allocation-Base Units Used

Cost pool Category

Allocation- Base Rate

Total Costs

Date

Allocation-Base

Dec. 31, 2006

Manufacturing

Direct Manufacturing

88 hours

45

3,960

Labor-Hours

3,960

Total

10,145

TOTAL MANUFACTURING COST OF JOB

11

MATERIALS-REQUISITION RECORD

Materials-Requisition Record No

2006 198 Feb. 3, 2006 Unit Total Cost

Cost

Date Quantity 8

Job No. Part No. MB 468-A

WPP 298 Part Description Metal Brackets

14 112

Issued ByB. Clyde Received By L. Daley

Date Date

Feb. 3, 2006 Feb. 3, 2006

12

Panel 1Job Number J4369 Date

July 6, 2000Customer Michigan MotorsProduct

Automobile engine valves (Valve

L181)Engineering Design Number JDR-103Number

of Units 1,500

Panel 2Material Requisition Number

Description Quantity Rate Amount

47624 Bar steel 720 lbs

11.50 8,280.00 Stock

3 A35161 Subassemblies 290 units

38.00 11,020.00 Total direct materials cost

19,300.00

13

Panel 3Dates Number Hours

Rate Amount 8/2, 8/3, 8/4, 8/5

M16 24

28.00 672.00 8/2, 8/3, 8/4, 8/5

M18, M19, M20 64

26.00 1,664.00 8/6, 8/7, 8/8, 8/9, 8/10

A25, A26, A27 120 18.00

2,160.00 8/6, 8/7, 8/8, 8/9, 8/10

A32, A34, A35 60 17.00

1,020.00 Total direct labor cost

268

5,516.00

Panel 4 Support Cost

Amount 117 Machine hours _at_ 40

per hour 4,680.00 268 Direct

labor hours _at_ 36 per hour

9,648.00 Total overhead cost

14,328.00

14

Concept of Costing System

Cost Assignment

Direct costs

Cost Object

Cost Tracing

Indirect costs

Cost Allocation

15

Assigning direct and indirect costs

A cost allocation is the process of assigning

costs when a direct measure does not exist for

the quantity of resources consumed by a

particular cost object. Example consider an

activity such as receiving incoming materials.

Assuming that the depreciation of the machine is

strongly related to the number of hours machine

was used. The basis that is used to allocate

costs to cost objects is called an allocation

base or cost driver. Two types of systems can be

used to assign indirect costs to cost objects.

They are traditional costing system and

activity-based-costing(ABC) systems.

16

Cost Allocations and Cost Tracing

Direct costs

Cost tracing

Traditional costing systems

Cost objects

Indirect costs

Cost allocations

ABC systems

17

Traditional Costing Systems

Overhead cost accounts (for each individual

category of expenses)

First stage allocations

Cost center 1 (Normally departments)

Cost center 2 (Normally departments)

Cost center N (Normally departments)

Second stage allocations (Direct labour

or machine hour)

Cost objects (Products, services and customers)

Direct cost

18

An illustration of the three-stage process for a

traditional costing system

- Applying the three-stage allocation process

requires the following four steps - Assigning all manufacturing overheads to

production and service cost centres - Reallocating the cost assigned to service cost

centres to production cost centres - Computing separate overhead rates for each

production cost centre - Assigning cost centre overheads to products or

other chosen cost objects.

19

Traditional Costing System Levels of

Sophistication

Simplistic systems

- Inexpensive to operate

- Extensive use of arbitrary cost allocations

- Low levels of accuracy

- High cost of errors

20

Service dept

S1

S4

S2

S3

Conceptual view of the separate department

overhead rates

Producing dept

DM DL FO

DM DL FO

DM DL FO

Cost objects

Cost objects

Cost objects

Cost objects

Cost objects

Cost objects

21

Stage 1 Assigning all manufacturing overhead to

production and service departments.

Common cost are allocated to all the departments.

Some cost can be directly related such as salary

of the engineer working in the service quality

department, however other need to be allocated

using an allocation base.

Basis of allocation

Cost

Area Number of employees Value of items of plant

and machinery

Property taxes, lighting and heating

Employee-related expenditure works

management, works canteen, payroll

office Depreciation and insurance of plant and

machinery

22

Stage 2 Reallocating the cost assigned to

service cost centers to production cost centers.

- the next step is to reallocate the costs that

have been assigned to service cost centres to

production cost centres. Service departments or

support department are those departments that

exist to provide services of various kinds of

other units within the organization. For example,

the costs of the cafeteria can be reallocated to

the production cost center by using number of

workers in the factory as the allocation base. - There are three methods in reallocating the cost

from service to production departments. - DIRECT METHOD

- STEP METHOD

- ALGEBRIC METHOD

23

Producing department

Service department

Diagram of 3 diff, allocation methods

X

A

Part 1 Direct method

B

Y

X

A

Part 2 Step method

B

Y

X

A

Part 3 Algebraic method

B

Y

24

Stage 3 Assigning cost center overheads to

products or other chosen cost objects.

In the final step is to allocated the overheads

to products passing through the production

centers. Volume base allocation is used to assign

the overhead costs to the products. Example,

number of units produced, number of machine hours

used.

25

The annual costs for the Enterprise Company which

has three production centres (two machine centres

and one assembly centre) and two service centres

(materials procurement and general factory

support) are as follows

()

()

Indirect wages and supervision Machine cenres

X Y Assembly

Materials procurement General factory

support Indirect materials Machine centres X

Y Assembly

Materials procurement General factory

support Lighting and heating Property

taxes Insurance of machinery Depreciation of

machinery Insurance of buildings Salaries of

works management

1 000 000 1 000 000 1 500 000 1 100 000 1 480 000

6 080 000

500 000 805 000 105 000 0 10 000

1 420 000

500 000 1 000 000 150 000 1 500 000 250

000 800 000

4 200 000

11 700 000

26

The following information is also available

Area Occupied (sq. metres)

Number Of employees

Direct Labour hours

Book Value of Machinery ()

Machine hours

Machine shop X

Y Assembly Stores Maintenance

8 000 000 5 000 000 1 000 000 500 000 500

000

10 000 5 000 15 000 15 000 5 000

300 200 300 100 100

1 000 000 1 000 000 2 000 000

2 000 000 1 000 000

1000

15 000 000

50 000

Details of total material issues to the

production centres are as follows

()

4 000 000 3 000 000 1 000 000

Machine shop X Machine shop Y Assembly

8 000 000

27

OVERHEAD ANALYSIS SHEET

Production centres

Service centres

Machine centre Y ()

Materials procurement ()

General factory support ()

Machine centre X ()

Item of expenditure

Total ()

Basis of allocation

Assembly ()

Indirect wage and supervision Indirect

materials Lighting and heating Property

taxes Insurance of machinery Depreciation of

machinery Insurance of buildings Salaries

of works management Reallocation of

service centre costs Materials

procurement General factory

support Machine hours and direct labour

hours Machine hour overhead rate Direct labour

hour overhead rate

Direct Direct Area Area Book value of

machinery Book value of machinery Area Numbe

r of employees (1) Value of materials

issued Direct labour hours (2)

6 080 000 1 420 000 500 000 1 000 000

150 000 1 500 000 250 000 800 000

1 000 000 500 000 100 000 200 000

80 000 800 000 50 000 240 000

1 000 000 805 000 50 000 100 000

50 000 500 000 25 000 160 000

1 500 000 105 000 150 000 300 000

10 000 100 000 75 000 240 000

1 100 000 150 000 300 000 5

000 50 000 75 000 80 000

1 480 000 10 000 50 000 100 000

5 000 50 000 25 000 80

000

11 700 000

2 970 000

2 690 000

2 480 000

1 760 000

1 800 000

880 000 450 000

660 000 450 000

220 000 900 000

1 760 000

1 800 000

11 700 000

4 300 000

3 800 000

3 600 000

2 000 000

1 000 000

2 000 000

2.15

3.80

1.80

28

Reallocation of Service centre costs

Materials procurement General

factory support Machine hours and

direct labour hours Machine hour overhead

rate Direct labour hour overhead rate

Value of materials issued Direct labour

hours (2)

880 000 450 000

660 000 450 000

220 000 900 000

1 760 000

1 800 000

11 700 000

4 300 000

3 800 000

3 600 000

2 000 000

1 000 000

2 000 000

2.15

3.80

1.80

29

cost centre overheads

cost centre direct labour hours or machine hours

4 300 000

Machine centre X

2.15 per machine hour

2 000 000 machine hours

3 800 000

Machine centre Y

3.80 per machine hour

1 000 000 machine hours

3 600 000

Assembly department

1.80 per direct labour hour

2 000 000 direct labour hours

30

Product A

Direct costs (100 units x 100) Overhead

allocations Machine center A (100 units x 5

machine hours x 2.15) Machine center B (100

units x 10 machine hours x 3.80) Assembly (100

units x 10 direct labour hours x 1.80) Total

cost Cost per unit (16 675/100 units) 166.75

10 000 1 075 3 800 1 800

16 675

Product B

Direct costs (200 units x 200) Overhead

allocations Machine center A (200 units x 10

machine hours x 2.15) Machine center B (200

units x 20 machine hours x 3.80) Assembly (200

units x 20 direct labour hours x 1.80) Total

cost Cost per unit (66 700/200 units) 333.50

40 000 4 300 15 200 7 200

66 700