Advance forecasting - PowerPoint PPT Presentation

1 / 25

Title:

Advance forecasting

Description:

Title: Ch. 7: Forecasting Author: W. E. Youngdahl Last modified by: Jaflah Al Ammari Created Date: 9/30/1995 2:07:08 PM Document presentation format – PowerPoint PPT presentation

Number of Views:68

Avg rating:3.0/5.0

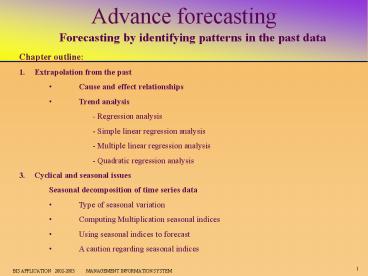

Title: Advance forecasting

1

Advance forecasting

Forecasting by identifying patterns in the past

data

- Chapter outline

- Extrapolation from the past

- Cause and effect relationships

- Trend analysis

- - Regression analysis

- - Simple linear regression analysis

- - Multiple linear regression analysis

- - Quadratic regression analysis

- 3. Cyclical and seasonal issues

- Seasonal decomposition of time series data

- Type of seasonal variation

- Computing Multiplication seasonal indices

- Using seasonal indices to forecast

- A caution regarding seasonal indices

2

Extrapolation from the pastCause-and-effect

Relationships

- Causal forecasting seeks to identify specific

cause-effect relationships that will influence

the pattern of future data. Causes appear as

independent variables, and effects as dependent ,

response variables in forecasting models. - Independent variable Dependent, response

variable - Price demand

- Decrease in population decrease in demand

- Number of teenager demand for jeans

- Causal relationships exist even when there is no

specific time series aspect involved. - The most common technique used in causal modeling

is least squares regression.

3

Extrapolation from the past Linear Trend

analysis

Its noticed from this figure that there is a

growth trend influencing the demand, which should

be extrapolated into the future.

4

Extrapolation from the pastLinear Trend

analysis

The linear trend model or sloping line rather

than horizontal line. The forecasting equation

for the linear trend model is Y ??X

or Y a bX Where X is the

time index (independent variable). The parameters

alpha and beta ( a and b) (the intercept and

slope of the trend line) are usually estimated

via a simple regression in which Y is the

dependent variable and the time index X is the

independent variable.

5

Extrapolation from the past Linear Trend

analysis

Although linear trend models have their uses,

they are often inappropriate for business and

economic data. Most naturally occurring business

time series do not behave as though there are

straight lines fixed in space that they are

trying to follow real trends change their slopes

and/or their intercepts over time. The linear

trend model tries to find the slope and intercept

that give the best average fit to all the past

data, and unfortunately its deviation from the

data is often greatest near the end of the time

series, where the forecasting action is.

6

Extrapolation from the pastLinear Trend analysis

Using a data table (what if analysis ) to

determine the best-fitting straight line with the

lowest MSE

7

Extrapolation from the past Linear Trend analysis

Simple linear Regression Analysis

Regression analysis is a statistical method of

taking one or more variable called independent or

predictor variable- and developing a mathematical

equation that show how they relate to the value

of a single variable- called the dependent

variable. Regression analysis applies

least-squares analysis to find the best-fitting

line, where best is defined as minimizing the

mean square error (MSE) between the historical

sample and the calculated forecast. Regression

analysis is one of the tools provided by Excel.

8

Simple linear Regression Analysis

9

(No Transcript)

10

Extrapolation from the past Linear Trend analysis

Multiple linear Regression Analysis

Simple linear regression analysis use one

variable (quarter number) as the independent

variable in order to predict the future value. In

many situations, it is advantageous to use more

than one independent variable in a forecast.

11

Multiple linear Regression Analysis

Two factors that control the frequency of

breakdown. So they are the independent

variables. Y a bX1 cX2

Intercept

Slope 1 Slope2

12

Multiple linear Regression Analysis

13

(No Transcript)

14

Extrapolation from the past Linear Trend analysis

Quadratic Regression Analysis

Quadratic regression analysis fits a second-order

curve of the form Y a bX

cX2 Quadratic regression is prepared by adding

the squared value of the time periods. The

coefficients in the quadratic formula are

calculated again using regression, where time

periods and the squared time periods are the

independent variables and the demand remains the

dependent variable.

15

Quadratic Regression Analysis

16

Quadratic Regression Analysis

17

Extrapolation from the past Cyclical and Seasonal

Issues

- The fundamental approach to including cyclical or

seasonal factors is to break the forecast into

two components - The underlying growth component

- The seasonal variations

- To prepare a forecast model

- Use a method to fit a growth curve to the

historical record - Determine the pattern of the seasonal variability

- In general, two sets of parameters to be

estimated - ( the coefficients in the trend line, and the

percents in the seasonal patterns )

18

Extrapolation from the past Cyclical and Seasonal

Issues

Basically two things must be done 1- determine

the trend line 2- take the trend line out (

calculate deviations from the trend) 3- create a

pie, radar, or polar chart of the average period

value

19

Cyclical and Seasonal Issues Seasonal

Decomposition of Time Series Data

- Time series data are usually considered to

consist of six component - Average demand is simply the long-term mean

demand - Trend component is how rapidly demand is

growing or shrinking - Autocorrelation is simply a statement that

demand next period is related to demand this

period - Seasonal component is that portion of demand

that follows a short-term pattern - Cyclical component is much like the seasonal

component, only its period is much longer. - Random component is the unpredictable component

of demand

20

Cyclical and Seasonal Issues Type of Seasonal

Variation

There are two types of seasonal

variation Additive seasonal variation Occurs

when the seasonal effects are the same regardless

of the trend. Multiplication seasonal variation

Occurs when the seasonal effects vary with the

trend effects. Its the most common type of

seasonal variation

21

Cyclical and Seasonal Issues Computing

Multiplicative Seasonal Indices

- Steps of Multiplicative Time Series Model

- Decide that the data is seasonal in nature.

- Then realized that the seasonal variation is

quarterly - If the variation of the data is larger to the

right, then that seasonal variation is

multiplicative. - Seasonal indices is needed to produce the

seasonal forecast model.

22

Cyclical and Seasonal Issues Computing

Multiplicative Seasonal Indices

- Computing seasonal indices requires data that

match the seasonal period. If the seasonal period

is monthly, then monthly data are required. A

quarterly seasonal period requires quarterly

data. - Calculate the centered moving averages (CMAs)

whose length matches the seasonal cycle. The

seasonal cycle is the time required for one cycle

to be completed. Quarterly seasonality requires a

4-period moving average, monthly seasonality

requires a 12-period moving average and so on. - Determine the Seasonal-Irregular Factors or

components. This can be done by dividing the raw

data by the corresponding depersonalized value. - Determine the average seasonal factors. In this

step the random and cyclical components will be

eliminated by averaging them.

23

Cyclical and Seasonal Issues Computing

Multiplicative Seasonal Indices

Step 1

Step 4

Step 2 AVERAGE(B2B5)

Step 3 B3/C3

24

Cyclical and Seasonal Issues Using Seasonal

Indices to Forecast

To forecast using seasonal indices 1- Compute the

forecast using an annual values. Any forecasting

techniques can be used. 2- Use the seasonal

indices to share out the annual forecast by

periods

25

(No Transcript)