ECONOMICS - PowerPoint PPT Presentation

1 / 56

Title:

ECONOMICS

Description:

ECONOMICS MICROECONOMICS MACROECONOMICS What Macroeconomist Study? Why have some countries experienced rapid growth in incomes over the past century while others stay ... – PowerPoint PPT presentation

Number of Views:182

Avg rating:3.0/5.0

Title: ECONOMICS

1

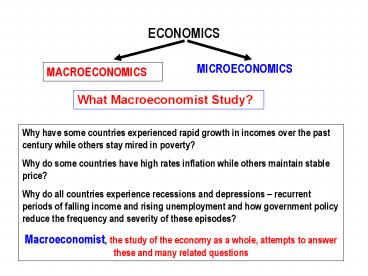

ECONOMICS

MICROECONOMICS

MACROECONOMICS

What Macroeconomist Study?

Why have some countries experienced rapid growth

in incomes over the past century while others

stay mired in poverty? Why do some countries have

high rates inflation while others maintain stable

price? Why do all countries experience recessions

and depressions recurrent periods of falling

income and rising unemployment and how government

policy reduce the frequency and severity of these

episodes? Macroeconomist, the study of the

economy as a whole, attempts to answer these and

many related questions

2

Theory as Model Building

Models are simplified theories that show the key

relationships among economic variables

Exogenous variables

Endogenous variables

Economic model

Figure 1. The Working of an Economic Model

TUJUANMODEL MENUNJUKKAN BAGAIMANA VARIABEL

EKSOGEN MEMPENGARUHI VARIABEL ENDOGEN

3

Qd f ( P, Y)

Qs f ( P, Pm)

Qs Qd

P

Supply

Market Equilibrium

Demand

Q

Figure 1.2 The Model Supply and Demand

4

(a). A Shift in Demand

P

S

P2

P1

D2

D1

Q

Q1

Q2

(b) A Shift in Supply

P

S2

S1

P2

P1

D1

Q

Q2

Q1

5

Using Function to Express Relationships Among

Variables

A function is a mathematical concept that show

one variable depends on a set of other variables

QD F (P, Y)

QD 60 10P 2Y

6

Macroeconomics is the study of the economy as a

whole - including growth in income, changes in

prices and rate of unemployment. Macroeconomist

attempt both to explain economic events and to

devise policies to improve economic performance

To understand the economy, economist use model

theories that simplify reality in order to reveal

show how exogenous variable influence endogenous

variables. The art in the science of economics is

in judging whether a model captures the important

economic relationships for the matter at hand.

Because no single model can answer all questions,

macroeconomist use different model to look at

different issues

7

NATIONAL-INCOME ACCOUNTING GROSS DOMESTIC

PRODUCT AND THE PRICE LEVEL

Chapter 2 (Macroeconomics A Modern Approach)

- Flows and Stocks Variables

- Some Frequently Used Terms

- (i). Output (Product), Income Expenditure

- (ii). Domestic and National

- (iii). Gross and Net

- (iv). Markets Price and Factor Cost

- (v). Nominal and Real

8

C. Aggregate Income, Output (Product)

Expenditure

(i). The Simplest Economy Households Firms

Factors of Production

Income (Y)

Firms

Households

Consumers Expenditure

Goods Services

Figure 4. Real and Money Flows in the Simplest

Economy

Money flow Continuous lines

Real flow Dash lines

9

(ii). Saving by Households

Incomes

Factors of Production

Incomes

Capital Goods

Factors of Production

HOUSEHOLDS

FIRMS C

FIRMS K

Investment Expenditure

Consumers Goods

Saving

Consumers Expenditure

Figure 5. Real Money Flows in Economy with

Saving Investment

10

Incomes (Y)

Factors of Production

H

F

Goods Services

Investment

Saving

Consumers Expenditures (C)

Figure 6. Real Money Flow in an Economy with

Saving Investment Simplified

Y C I

Y C S

S I

11

Y

H

F

S

I

C

Figure 7. The Money Flows in an Economy with

Saving and Investment A More Abstract

Representation

12

(iii). Government Expenditure and Taxes

H

F

GOV

T

G

S

I

(iv). The Rest of the World

EX

H

R

F

GOV

T

G

S

IM

I

13

Y C I G

Y C S T

Y C I G EX - IM

I G EX S T IM

(I-S) (G T) (EX IM) O

D. Measuring Aggregate Income

(i). The Expenditure Approach (ii). The Factor

Income Approach (iii). The Output Approach

14

MEASURING GROSS DOMESTIC PRODUCT (GDP)

GDP A MEASURE OF THE VALUE OF ALL GOODS

SERVICES NEWLY PRODUCED IN AN ECONOMY DURING A

SPECIFIED PERIOD OF TIME

WHAT? WHRE? WHEN?

GDP VS GNP

15

THREE WAYS OF MEASURING GDP

- THE PRODUCTION APPROACH TO MEASURING GDP

- THE SPENDING APPROACH TO MEASURING GDP

- THE INCOME APPROACH TO MEASURING GDP

- MANFAAT DIKETAHUINYA GDP

- MENGUKUR PERTUMBUHAN EKONOMI

- MENGETAHUI STRUKTUR EKONOMI

- MEMBANDINGKAN PEREKONOMIAN ANTAR NEGARA

16

What Determines the Demand for Goods Services?

- The four component of GDP

- Consumption (C)

- Investment (I)

- Government purchases (G)

- Net Export (NX)

Y C I G (X - M)

17

Consumption

C C(Y-T)

MPC

C

0,70

Consumption function

MPC

Y- T

The Consumption Function

18

TEORI-TEORI KONSUMSI

- John Maynard Keynes and the Consumption Function

- Irving Fisher and Inter temporal Choice

- Franco Modigliani and the Life-Cycle Hypothesis

- Milton Friedman and the Permanent-Income

Hypothesis - Robert Hall and the Random-Walk Hypothesis

19

Investment

I I (r)

The nominal interest rate The real interest rate

r

I I (r)

I

The investment Function

20

Government Purchases

20 of GDP

a balance budget

G T

G G

T T

21

Equilibrium in the Market for Goods and

Services The Supply and Demand for the Economy

Output

Y F(K, L)

Y C I G

Y

C C(Y- T)

Y C(Y-T) I(r) G

I I(r)

Y C(Y-T) I(r) G

G G

T T

22

Equilibrium in the Financial Markets The Supply

and Demand for Loanable Funds

Y C G I

S (Y-T-C) (T- G) I

Y- C(Y-T) - G I(r)

Y- C(Y-T) - G I(r)

S I(r)

23

Real interest rate

Saving (S)

Equilibrium r

Desired investment, I(r)

S

Investment, Saving

Saving, Investment and the Interest Rate

24

Changes in Saving The effects of Fiscal Policy

25

MONETARY THEORY AND POLICY

APAKAH TEORI MONETER?

TEORI MONETER TEORI MENGENAI PASAR UANG

TEORI MENGENAI PERMINTAAN (MD) PENAWARAN UANG (MS)

INTI TEORI MONETER ANALISIS TENTANG FAKTOR2 APA

YG MEMPENGARUHI PERMINTAAN AKAN UANG (DEMAND FOR

MONEY) DAN FAKTOR2 APA YG MEMPENGARUHI PENAWARAN

UANG (SUPPLY OF MONEY)

26

PERMINTAAN DAN PENAWARAN DI PASAR UANG

- AKAN MENENTUKAN HARGA

- TINGKAT SUKU BUNGA

- TINGKAT HARGA UMUM

KEYNES KEYNESIANS

CLASSIC MONETARIST

IMPLIKASI TEROTIS KEBIJAKAN YG BERBEDA

27

MENGAPA PERUBAHAN KONDISI PASAR UANG YANG

DICERMINKAN OLEH PERUBAHAN TINGKAT SUKU BUNGA

ATAU TINGKAT HARGA PENTING ????

- DEFINING MONEY BY ITS FUNCTIONS

- MEANS OF EXCHANGE (PAYMENT)

- MEASURE OF VALUE

- THE UNIT OF ACCOUNT

- THE STORE OF VALUE OR STORE OF WEALTH

28

TEORI KUANTITAS KEYNESIANS SEPAKAT MENGENAI

THE STORE OF VALUE OR STORE OF WEALTH

KEPUTUSAN MENGENAI BERAPA BESAR UANG TUNAI YG

KITA PEGANG ATAU BERAPA BESAR SALDO POS KAS YG

KITA INGINKAN DLM NERACA KITA. MERUPAKAN

KEPUTUSAN EKONOMIS YG KITA DASARKAN ATAS

UNTUNG-RUGI. KEPUTUSAN TENTANG SALDO KAS VS

MEMBELI SURAT BERHARGA (BONDS OR STOCKS)

29

DEFINISI UANG MENURUT PENCIPTANYA (1). MONEY

BASE (RESERVE MONEY OR HIGH-POWER MONEY), (2).

M1 KARTAL GIRAL) (3). M2 M1 QUASI MONEY

KESEIMBANGAN PASAR UANG TERJADI JIKA MS MD

MS MONEY SUPPLY

MS f (Y, rKRDT, rDEPO,A).B

MS f (Y, rKRDT, rDEPO,A).B (X1, X2,.Xn)

30

UANG PRIMER MONETARY BASE (B)

(ALN-PLN) (TP-DP) (TB) (AL-PL) C R B

MO

FAKTOR2 YG MEMPENGARUHI UANG PRIMER

TABEL 1.1 NERACA KONSOLIDASI OTORITAS MONETER

AKTIVA PASIVA

AKTIVA LUAR NEGERI (ALN) TAGIHAN PADA PEMERINTAH (TP) TAGIHAN PADA BANK-BANK UMUM (TB) AKTIVA LAIN (AL) UANG KARTAL YG ADA DIMASYARAKAT (C) CADANGAN BANK UMUM (R) DEPOSITO PEMERINTAH (DP) PASIVA LUAR NEGERI (PLN) PASIVA LAIN (PL)

31

ANGKA PENGGANDA UANG MONEY MULTIPLIER (m)

MS mB

m B/ MS

CP mc B

DD md B

M1 m1 B

QM mq B

M2 m2 B

32

PENCIPTAAN KOMPONEN UANG BEREDAR OLEH SISTEM

PERBANKAN

SC TPSb TPPb mb.B

KETERANGAN

mb ANGKA PENGGANDA AKTIVA BPUG

TPSb TAGIHAN PADA SEKTOR PEMERINTAH

TPPb TAGIHAN PADA PERUSAHAAN PERORANGAN

33

THE DEMAND FOR MONEY

THE QUANTITY THEORY 0F MONEY AND CAMRIDGE APROACH

MV PT

IRVING FISHER

MV PY

CAMBRIDGE APROACH

Y GDP REAL

Md 1/V.PY

V 1/k

Md k PY

PENDAPATAN NASIONAL RIIL (Y) k ADALAH KOSTAN

34

THE INTEREST RATE AS A DETERMINANT OF MONEY DEMAND

KEYNES (1936) INTRODUCE S THREE MOTIVESS FOR

HOLDING MONEY

- A TRANSSACTION MOTIVE (BUSSINES MOTIVE) Mt

- A PRECAUTIONARY MOTIVE (Mp)

- A SPECULATIVE MOTIVE (Ms)

Mt Mp f (Y)

Ms f (r)

K r P

P K/r

35

HOW THE QUANTITY OF MONEY IS CONTROLLED?

THE QUANTITY OF MONEY A VAILABLE IN AN ECONOMY IS

CALLED THE MONEY SUPPLY (MS)

THE CONTROL OVER THE MONEY SUPPLY IS CALLED

MONETARY POLICY

IN INDONESIA MANY OTHER COUNTRIES, MONETARY

POLICY IS DELEGATED TO INDEPENDENT INSTITUTION

CALLED THE CENTRAL BANK (BI)

UU NO.23 TAHUN 1999 UU NO.3 TAHUN 2004

36

INFLATION MONEY GROWTH

SEIGNIORAGE THE REVENUE FROM PRINTING MONEY

INFLATION INTEREST RATES

INTEREST RATES NOMINAL REAL

r i - p

Fisher equation

i r p

The nominal interest rate can change for two

reasons because the real interest rate changes

or because the inflation rate changes

37

The Quantity Theory of Money the rate of money

growth determines the rate of inflation

The Fisher equation the real interest rate the

inflation rate together to determine the nominal

interest rate

The Quantity Theory of Money The Fisher

Equation together tell us how money growth

affects the nominal interest rate

According the Quantity theory an increase in the

rate of money growth of 1 percent cause a 1

percent increase in the rate of inflation.

According to the Fisher Equation a 1 percent

increase in the rate of inflation in turn causes

a 1 percent increase in the nominal interest rate

The One-for-One relation between the inflation

rate and the nominal interest rate is called the

Fisher Effect

38

Two Real Interest Rates Ex Ante Ex Post

The ex ante real interest rate Tingkat bunga

riil yg diharapkan pemberi pinjaman peminjam

ketika kesepakatan dibuat

The ex post real interest rate Tingkat bunga

riil yg terealisasi secara nyata

39

Transmissions Mechanism Monetary Policy

Operational Target

Instruments

Intermediate Target

Final Target

JANGKAR NOMINAL

Inflation Targeting

SKEMA 1. KERANGKA OPERASI KEBIJAKAN MONETER

40

SISTEM OPERASI KEBIJAKAN MONETER

Quantity Approach TEORI KUANTITAS MV PT

Interest Rate or Price Approach TEORI Keynesians

INSTRUMEN-INSTRUMEN LANGSUNG TIDAK LANGSUNG

- INSTRUMEN TDK LANGSUNG

- OPERASI PASAR TERBUKA (OPT)

- GIRO WAJIB MINIMUM

- TINGKAT BUNGA DISKONTO

- INSTRUMEN PERSUASIF

41

SECARA UMUM MEKANISME TRANSMISI KEB. MONETER

MENGGAMBARKAN BAGAIMANA KEBIJAKAN MONETER OLEH

BANK SENTRAL DPT MEMPENGARUHI AKTIVITAS EK

KEUANGAN HINGGA TERWUJUDNYA FINAL TARGET

(INFLASI)

SECARA SPESIFIK Taylor (1995) The process

through which monetary policy decision are

transmitted into changes in real GDP and inflation

42

KEBIJAKAN MONETER

TUJUAN AKHIR INFLASI

?

SKEMA 2. MEKANISME TRANSMISI KEB. MONETER Black

Box

43

JALUR-JALUR MEKANISME TRANSMISI KEB. MONETER

- JALUR UANG (Money Channel)

- JALUR SUKU BUNGA ( Interest rate Channel)

- JALUR NILAI TUKAR ( Exchange Rate Channel)

- JALUR HARGA ASET ( Asset Price Channel)

- JALUR KREDIT (Credit Channel)

- JALUR EKSPEKTASI ( Expectation Channel)

44

Inflation Targeting Framework

KARATERISTIK UTAMA MODEL ITF DIJADIKANNYA TARGET

INFLASI SEBAGAI TUJUAN POKOK KEB. MONETER.

SASARAN YG HARUS DICAPAI ADALAH INFLASI YG RENDAH

STABIL (MASSON ET AL,1998)

45

OPEN ECONOMY

DLM PEREKONOMIAN TERBUKA PENGELUARAN U PERIODE

TERTENTU TIDK PERLU SAMA DGN HASIL PRODUKSI

BARANG JASA

PERAN EKSPOR NETO 60 THDP PDB

DLM PEREKONOMIAN TERTUTUP, SELURUH OUTPUT DIJUAL

DI PASAR DOMESTIK PENGELUARAN DIBAGI MENJADI 3

KOMPONEN C, I G. DLM PEREKONOMIAN TERBUKA

SEBAGIAN OUTPUT DI EKSPOR DI JUAL DI PASAR

DOMESTIK, PENGELUARAN DIBAGI MENJADI 4 BAGIAN C,

I, G EX

Y C I G EX

46

Y C I G EX - IM

Y C I G NX

NX Y - (C I G )

Y C G I NX

Y C G TABUNGAN NASIONAL (S)

Y T C TABUNGAN PERSEORANGAN

T G TABUNGAN PEMERINTAH

S I NX

S - I NX

47

PENGARUH KEBIJAKAN MONETER

r

LM1

A

r1

LM2

B

r2

IS

Y2

Y

Y1

GAMBAR PENINGKATAN MONEY SUPPLY (MS)

48

INTERAKSI KEB. FISKAL VS MONETER

r

LM1

r1

r2

IS1

IS2

Y1

Y

Y2

DAMPAK KENAIKAN PAJAK MS KONSTAN

49

INTERAKSI KEB. FISKAL VS MONETER

r

LM1

r1

r2

IS1

IS2

Y1

Y

Y2

DAMPAK KENAIKAN PAJAK MS KONSTAN

50

INTERAKSI KEB. FISKAL VS MONETER

r

LM2

LM1

r

IS1

IS2

Y1

Y

Y2

DAMPAK KENAIKAN PAJAK r KONSTAN

51

INTERAKSI KEB. FISKAL VS MONETER

r

LM1

LM2

r1

r2

IS1

IS2

Y

Y

DAMPAK KENAIKAN PAJAK Y KONSTAN

52

PENGARUH NILAI TUKAR TERHADAP INFLASI

PASAL 7 AYAT (1) UU N0.3/2004 TENTANG BI TUJUAN

BI ADALAH MENCAPAI MEMELIHARA KESTABILAN NILAI

RUPIAH.

KESTABILAN NILAI RUPIAH BISA DILIHAT DARI SISI

INTERNAL YAITU INFLASI SISI EKSTERNAL YAITU

STABLITAS NILAI TUKAR

INFLATION TARGETING

FREE FLOATING EXCHANGE RATE

53

EXCHANGE RATE PASS TRHOUGH PENJUMLAHAN DIRECT

INDIRECT PASS-THROUGH EFFECT

JALUR TRANSMISI INFLASI YG BERASAL DARI FAKTOR

EKSTERNAL ADA 2, YAITU Direct Pass-Through

Effect Indirect Pass-Through Effect

Direct Pass-Through Effect JALUR TRANSMIS

DAMPAK LANGSUNG NILAI TUKAR TERHADAP INFLASI

MELALUI BARANG-BARANG IMPOR (IMPORTED INFLATION)

DAMPAK MELALUI IMPOR BARANG KONSUMSI DINAMAKAN

First Direct Pass-Through Effect, SEDANGKAN

DAMPAK MELALUI IMPOR BAHAN BAKU BARANG MODAL

DINAMAKAN Second Direct Pass-Through Effect

54

Indirect Pass-Through Effect TRANSMISI TIDAK

LANGSUNG PENGARUH NILAI TUKAR TERHADAP INFLASI

ADALAH MELALUI DEMAN FULL, DIMANA KENAIKAN HARGA

LUAR NEGERI ATAU KENAIKAN MATA UANG ASING

TERHADAP RUPIAH MENGAKIBATKAN PENINGKATAN

PENGHASILAN PRODUSEN EKSPORTIR DOMESTIK SEHINGGA

PERMINTAAN MEREKA AKAN BARANG JASA DI DLM

NEGERI IKUT MENINGKAT YANG PADA AKHIRNYA

MENDORONG KENAIKAN HARGA2 DI DLM NEGERI.

DI NEGARA MAJU/INDUSTRI, DAMPAK DEPRESIASI NILAI

TUKAR TERHADAP PERMINTAAN DLM NEGERI ADALAH

POSITIF, UNTUK KASUS NEGARA BERKEMBANG TERMASUK

INDONESIA HAL INI TDK TERJADI ????

55

EKSPEKTASI INFLASI DAN NILAI TUKAR

EKSPEKTASI BERKAITAN DGN POLA PERILAKU PASAR DLM

MENERIMA SUATU INFORMASI. JENIS INFORMASI YG

MEREKA TERIMA AKAN BERVARIASI (ASYMETRIC

INFORMATION) POLA PERILAKU MEREKAPUN

BERBEDA-BEDA DLM MERESPON SUATU JENIS INFORMASI

YANG SAMA, BAHKAN TERKADANG AKAN TERDAPAT

PERILAKU IRASIONAL DLM MERESPON SUATU INFORMASI.

EKSPEKTASI INI TERDAPAT DI PASAR BARANG, PASAR

UANG PASAR TENAGA KERJA, DIMANA MASING-MASING

MEMPUNYAI SALING KETERKAITAN MEMPUNYAI DAMPAK

TERHADAP PERKEMBANGAN HARGA-HARGA (INFLASI).

56

EKSPEKTASI MASYARAKAT TERHADAP PERKEMBANGAN

HARGA-HARGA (INFLASI) DIYAKINI TERBENTUK DARI

backward looking expectation forward looking

expectation

Backward Looking Expectation MENGASUMSIKAN BAHWA

INFLASI YG TERJADI PD PERIODE SEBELUMNYA AKAN

TERJADI PD SAAT INI MASA MENDATANG

Forward Looking Expectation MENGGUNAKAN INFORMASI

MENGENAI KEJADIAN YG AKAN TERJADI PD PERIODE

MENDATANG SEBAGAI VARIABEL YG BERPENGARUH PD SAAT

INI.