Adding Value as a PE COO - PowerPoint PPT Presentation

1 / 6

Title:

Adding Value as a PE COO

Description:

Adding Value as a PE COO Calling on COO colleagues in Boston and New York, I mapped the typical COO duties, the areas where some COO s are adding value to the ... – PowerPoint PPT presentation

Number of Views:36

Avg rating:3.0/5.0

Title: Adding Value as a PE COO

1

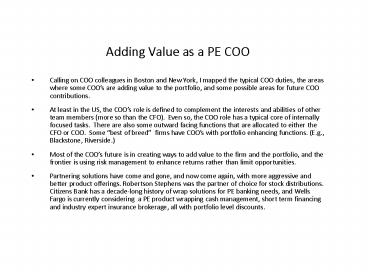

- Adding Value as a PE COO

- Calling on COO colleagues in Boston and New York,

I mapped the typical COO duties, the areas where

some COOs are adding value to the portfolio, and

some possible areas for future COO contributions. - At least in the US, the COOs role is defined to

complement the interests and abilities of other

team members (more so than the CFO). Even so,

the COO role has a typical core of internally

focused tasks. There are also some outward

facing functions that are allocated to either the

CFO or COO. Some best of breed firms have

COOs with portfolio enhancing functions. (E.g.,

Blackstone, Riverside.) - Most of the COOs future is in creating ways to

add value to the firm and the portfolio, and the

frontier is using risk management to enhance

returns rather than limit opportunities. - Partnering solutions have come and gone, and now

come again, with more aggressive and better

product offerings. Robertson Stephens was the

partner of choice for stock distributions.

Citizens Bank has a decade-long history of wrap

solutions for PE banking needs, and Wells Fargo

is currently considering a PE product wrapping

cash management, short term financing and

industry expert insurance brokerage, all with

portfolio level discounts.

2

- Inward facing, administrative duties

- In firms that have a COO, the core duties relate

to the administration of the business. Some of

the duties address facilities and IT, some cross

between COO and CFO. A third set emerges only if

the firm pushes for excellence in its internal

operations.

3

- Adding Value to the Portfolio

- Increasingly, VC and PE firms are actively

managing portfolio companies. The process seems

to ramp through four areas metrics and

monitoring, purchasing programs, cash management,

and then active consulting as an extension of

management. The COO can participate as a

diagnostician, helping with staffing logistics,

as part of a consulting team, et al.. The COOs

role becomes a reflection of abilities and

bandwidth more than job title.

4

- New Areas and Leading Edge

- Creative COOs are moving fund administration

into the best practices established for other

services companies.

5

- A swirl of other issues

- Several large scale issues are affecting the

operations of private investment firms, and will

continue to challenge industry COOs. Some are

listed below.

- New analyst and associate hiring is down sharply,

and the changing staffing profile is forcing

process changes at all funds. In general, deal

teams are more tightly focused on making

investments and exits, and non-deal professionals

are working other aspects of portfolio

development. - When you cant exit and valuation multiples dont

increase, you have to get gains from better

operations. The pressure for improved margins

has many effects, and one is faster development

of internal consulting teams. - Increasingly sophisticated outsourcing

alternatives can change the COO into to a

coordinator of third party providers. The

re-configured role emphasizes negotiation and

confrontation over analysis, and limits the COOs

use in portfolio company work. - Fund CFOs and COOs are willing to share

information, but not rewarded for doing so. The

previous slides are based on conversations with a

handful of well-connected COOs, but not

supported by a statistically valid sample.

6

- Appendix

- Duties commonly delegated by the General

Partners. The COO job starts by facing inward

A long list, but quickly becomes

routine Operations side of investor

communications Review, grammar and fact check all

investor information Create and maintain investor

information center (Sharepoint, other) Review and

assemble financial statements into investor

communication Production and distribution of

online and hard copy Treasury and banking Review

and verify controls over cash and securities (one

in finance, one deal partner) 3rd party custody

of physical securities (lock box with auditable

log) Credit line for funding between capital

calls Drive account structures and payment

systems to the lowest total net cost for

payments, funding, FX, wires, other Cash flow

optimization mechanics of cash collection and

disbursements Compliance function Training

(welcome to confidentiality and capital market

regulations) Monitoring (brokerage account

copies, et al.) Reporting (quarterly internal

and/or external) Fund raising process Administrati

ve systems / prospect tracking Document the track

record and establish the documents

room Structuring to market terms and tax

optimization Know Your Customer

process Coordinate with counsel to orchestrate

rolling? closes Subscription review and

documentation Kick off meeting? First call and

surrounding investor communications Investment

process New deal and follow on processes - define

it, document it, write it into the DNA of the

organization. Checklists for commitments,

checklists for funding. Guidelines to pre-empt

conflict issues between funds Guidelines to

pre-empt conflict issues between parallel equity

and debt funds, and shared services

operations Role of advisory committee in emerging

issues and handling exceptions Operating policies

and procedures Facilities manager functions HR

Legal IT