Diapositiva 1

Title: Diapositiva 1

1

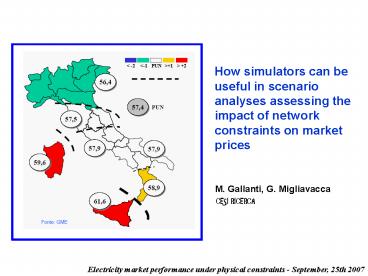

How simulators can be useful in scenario analyses

assessing the impact of network constraints on

market prices

M. Gallanti, G. Migliavacca

CESI RICERCA

Electricity market performance under physical

constraints - September, 25th 2007

2

Index

- Introduction of the Italian market (IPEX) the

PUN and its effects - Impact of congestion on market efficiency and

market power - Effects of increasing transmission capacity

between zones - Aims and methodologies of market simulation

- SREMS a tool to investigate strategic competition

3

The Italian day-ahead electricity market

- The Italian Power EXchange (IPEX) is operative

since April 1st, 2004 and features three physical

markets (day-ahead, adjustment, ancillary

services). - The day-ahead is zonal, structured in 22 zones (7

geographical, 6 limited production poles and 9

border virtual zones). Market splitting is used

for congestion management. - It is a non-compulsory (mixed) market both spot

market and bilateral physical contracts are

allowed.

4

The Italian day-ahead electricity market

- Zonal sell prices in the IPEX in the last year

Source GME monthly report - July 2007

5

The Uniform Purchase Price (PUN)

- Unique feature generated power paid at the zonal

price, while purchase price is uniform on the

national territory (PUN Prezzo Unico

Nazionale). The PUN is obtained as an average of

all zonal sale prices weighed with the purchase

volumes.

Yes

Inter-zonal transmission constraints respected?

No

Calculation of energy exchanges between zones

Separation of the market in zones

Injection and withdrawal programs compatible with

the constraints

- zonal sale prices

- uniform purchase price

Sale and purchase bids

6

Some important side-effects of the PUN

- The PUN destroys any locational signals given to

the load (while they remain on generation). - With the PUN the concept of congestion rent

becomes opaque and difficult to understand by

market operators. - The grid structure and power plants distribution

among generating companies in the different areas

may determine market concentration in some areas. - Local Market concentration may turn out in local

market power - In Italy the incumbent generation share is very

significant in the South - The PUN introduces further incentives to exercise

local market power - Suppose a zonal system with one exporting zone

(A) and one importing zone (B). Demand elasticity

and competition would act discouraging GenCos

from raising prices in B, even if pivotal a

GenCo that is not monopolist in B by raising

prices would give up part of its production in

favor of its competitors, with a possible loss of

profits. - The PUN weakens this effect loads in B pay the

PUN, that is lower than the relevant zonal price.

- The greater the demand in A wrt B, the weaker the

influence of zonal price in B onto the PUN.

7

Effects of network congestion on prices

- Since the opening of the Italian market, CESI

RICERCA has studied the effects of network

congestion on the electricity prices - The economic impact of the unavailability of the

Matera S. Sofia line was assessed through a

market simulator (fall 2004) .

Price duration curve (simulated) in the South

zone without the Matera - S. Sofia line

8

Effects of network congestion on prices

- Price reduction duration curve (simulated) in the

South zone due to the presence of the Matera - S.

Sofia line. - The availability of the Matera S. Sofia line

made it possible to increase the the transits

capacity among the zones

The return for the consumers would have been an

annual cost reduction of 40 M. The total cost of

the Matera - S. Sofia line was estimated around

100M.

9

Congestion and social welfare in zonal markets

Load offer prices are indicative of the value of

the goods produced

Generators bid prices should be indicative of

the costs for producing energy

- The merchandise surplus corresponds

- to the congestion rent extracted by the

- TSO.

- The dead-weight loss is an indicator of

- efficiency loss in the market due to

- congestion.

Congestion means lower market efficiency

10

Effects of an increase of interzonal capacity

- Increasing the capacity of

- congested tie-lines decreases the

- dead-weight loss and increases the

- social welfare. The market solution

- is more efficient.

- However, the increase of social welfare (AgtB) is

not necessarily matched with a reduction of loads

payments. In this example - if pure zonal market loads in the export zone

pay price p2 gtp1, those in import zone pay the

same - if PUN is introduced all the loads pay more

(the weighed average grows).

p

p

B

A

p3

p2

p1

q

Export zone

Import zone

q

11

Congestions and market power

- Market power can be exercised both at global

(market) level and locally. - Textbook definition of local market power

consists in a producer actuating bidding

behaviors such as to artificially cause

congestion between market zones. In this way, he

prevents the import of cheaper energy from other

zones and creates pivotality conditions for its

own local generators in the importer zone. The

action of creating congestion may be not

profitable in itself, but the sum with the

exercise of market power by local generators

turns up to be very profitable.

- This kind of local market power may only be

exercised in meshed networks, not in tree-like

ones (as the Italian market)

A

B

1. Create a saturation between A and B

C

A

By saturating A-B, B receives more power. Either

it uses it locally or exports it to C. In both

cases, C imports the same power or more and this

reduces (or doesnt increase) the pivotality of

local generators.

B

C

2. C cant import any longer (parallel flows)

local generators are pivotal

12

Congestions and market power

- However, this does not mean that a producer with

market power on the whole national territory

cannot find it profitable to congest one or

several connections. By comparing the results of

perfect and strategic competition in simulations

carried out with SREMS, we see there are several

hours in which the leader could strategically

congests the tie line between Sicily and

continent. - One example

DL-186 MW DF229 MW

DQ43

Perfect competition P 48.61 /MWh Strategic

competition P 50.34 /MWh P(Sicily)59.31

/MWh The leader increases his surplus by 60.8

k

43

DL0 DF0

DL0 DF0

43 (saturated)

DL-43 DF0

13

What are market simulators

- Electricity market simulators are used to

forecast market results under given scenario

hypotheses, like - fuel prices

- characteristics of generators, distribution on

the territory and among the generation firms - characteristics of the transmission network

(transit limits) - legislation (e.g. emissions of pollutants)

- Simulators are classified by their reference

time horizon

14

Who uses market simulators

15

Market analysis tools

Data analysis to examine past market behavior by

means of indices and different data aggregations

Optimization tools least cost generation

decisions, once provided supply and demand

schedules, keeping into account operational

constraints

Price forecasting tools extrapolating market

results to the future (ARMAX, etc)

Suppliers strategy models simulation using games

theory (Cournot, Bertrand, Stackelberg, Supply

Function Equilibrium, conjectural variations)

16

Main features of SREMS

- SREMS is a short-medium run electricity market

simulator based on game theory. - SREMS calculates price makers hourly strategic

bids, supposing they actuate both a bid-up and a

capacity withholding strategy. Additionally, it

allows to define a certain number of price

takers. - Demand is inelastic, defined hour by hour and

zone by zone. - The network is supposed non-meshed (tree-like).

Nodes represent market zones separated by

interconnectors with min/max transit limits. - The electricity market is modeled with hourly

detail, but the scheduling of reservoir hydro and

pumping power plants is carried out monthly. - Characteristics of thermal power plants are

taken into account with a high level of realism

(quadratic cost curves, maintenance periods,

accidental outages). - Each producer can appoint a percentage of his

power to physical bilateral contracts, function

of total load, market share and attitude towards

the risk.

17

- Input XLS file

- load, limits of transit

- generators characteristics

- calendar of maintenances

- monthly production and

- pumping of hydro power plants

- overall bilaterals percentage

M 1

COMPETITIVE LOAD

H 1

Month end

18

Preferential transactions and hydro plants

19

Unit Commitment of thermal power plants

- Setting up a UC strategy for a producer is very

complex. Many aspects have to be considered - If the sum of minima of all committed generators

is higher than the load, price is zero (even

variable costs are not recovered) and the

generators must bid in the adjustment market. - In general, too much committed power generates

low prices. However, generators are also

interested to have many plants committed to

maximize produced power. - Load changes along the day during the night few

plants should be on (sum of technical minima must

stay below the load), while during the day power

should be available to catch peaking prices.

However, flexibility to switch on and off is

limited and depends from the plant technology.

20

Strategic competition the algorithm Vampiro

- Lets suppose a leader knows the bids of all his

competitors and, on the basis of them he wants to

calculate the most favorable market solution

(highest producer surplus), in terms of produced

quantity and zonal prices. - Vampiro solves this problem resorting to the

following logical steps - write market clearing problem,

- translate it into a set of equilibrium

conditions, - write producers problem,

- solve the latter adding the equilibrium

conditions of the market clearing problem as a

set of additional constraints.

The resulting optimization problem is not convex

local minima do exist!

21

Strategic competition calculating bids

- Then, it is necessary to translate the

information on leaders optimal quantities into

an optimal bidding strategy (price-quantity)

capable to induce the optimal market clearing.

22

Typical trend of one week of zonal hourly prices

23

A simulation of the Italian market

- Aim of the simulation is to assess the economical

benefits that an enlargement by 300MW of the

maximum allowed transit on the connector between

Sicily and continent. - Benefits are measured in terms of total saving of

the customers against value of the investment in

new infrastructures (1.8 M/km x 40 km 72 M

additional expenditures 80 M). - The simulations have been built upon a scenario

2005 of the Italian market - 19 GenCos, 170 thermal units, 53 hydro units

- 4 macro-zones (Nord, Centro-Sud, Sicilia,

Sardegna) - fuel prices 26.14 /Gcal (oil), 31.55 /Gcal

(methane) - real hourly load assigned to each macrozone

- max bid price tuned on real market price peaks

- monthly CIP6 and import provided as input data.

- Preliminary simulation results show that

investment costs could be recovered in less than

two years. However, the non-convexity of the

problem solved by Vampiro invites to some

precaution in reading the results of comparative

simulations (like this one).

24

Conclusions

- SREMS is a reliable tool allowing to perform

scenario analyses on real electricity markets

over a short-medium run time horizon and to

assess the capability of the market leaders to

exercise market power, both market-wide and at

local level. The true challenge would be to

incorporate real strategies instead of sheer

profit maximization, to make the market

equilibrium model acquire a true predictive role.

No literature paper has tackled the problem yet. - On the basis of simulations, building

inter-zonal tie lines to decongest the most

critical connectors would probably create an

amount of benefit sufficient to recover

investment costs in few years. Increasing TTC

between zones would also make the market more

efficient and the exercise of market power more

difficult.

25

Thank you for your attention...

Massimo GallantiGianluigi Migliavacca CESI

RICERCA via Rubattino,54 20134 Milano

(Italy) E-mail massimo.gallanti_at_cesiricerca.it

gianluigi.migliavacca_at_cesiricerca.it