Complete Guide to Real Estate - PowerPoint PPT Presentation

Title:

Complete Guide to Real Estate

Description:

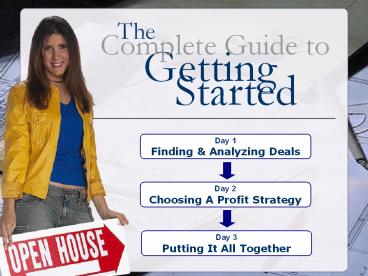

The Complete Guide to Getting Started Day 1 Finding & Analyzing Deals Day 2 Choosing A Profit Strategy Day 3 Putting It All Together Day 1 Finding & Analyzing Deals ... – PowerPoint PPT presentation

Number of Views:267

Avg rating:3.0/5.0

Title: Complete Guide to Real Estate

1

The

Complete Guide to

Getting

Started

Day 1 Finding Analyzing Deals

Day 2 Choosing A Profit Strategy

Day 3 Putting It All Together

2

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

3

Day 1Finding Analyzing Deals

What will it take for you to be wealthy?

4

Day 1Finding Analyzing Deals

- Learn The Wealth Formula

- Learn Types of Income

- Develop Millionaire Mindset

- Implement Wealth Formula

- GET STARTED

5

The Wealth Formula

Day 1Finding Analyzing Deals

- Constant Investment

- Time For Growth

- What Yield Will You Learn To Get

- Wealth Result

6

Stage One Investing

Day 1Finding Analyzing Deals

- Amount Invested 165 Per Month

- Time Period 25 Years

- Rate of Return ???????

- Financial Goal 1,000,000

7

Day 1Finding Analyzing Deals

25

20

Money plus Knowledge

15

10

Amount Invested 165 a month

6

3

0

8

Day 1Finding Analyzing Deals

3,800,000!!

25

1,400 K

20

Or Residual Rates?

535,000

15

218,000

10

114,000

6

73,000

3

49,500

0

Twenty-Five Years

9

Types of Income

Day 1Finding Analyzing Deals

Linear

Residual

- Time For Money

- Results For Money

- Assets For Money

10

Wealth Characteristics

Day 1Finding Analyzing Deals

- Burning Desire

- Goal Oriented

- Decisive In Nature

- Surrounded By Master Mind Team

- Specialized Knowledge

11

Real Estate Flip

Day 1Finding Analyzing Deals

- Buy For 150,000

- Sell For 180,000

- Profit 30,000

12

Yield

Day 1Finding Analyzing Deals

Profit

Rate of Return

Investment

30,000

20

150,000

13

Leverage

Day 1Finding Analyzing Deals

120,000 from Bank

150,000 Price

30,000 from You

30,000

100

30,000

14

Balance

Day 1Finding Analyzing Deals

Business

Linear Income

Assets

Residual Income

15

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

16

Day 1 - Finding Analyzing Deals

Day 1Finding Deals/Motivated Sellers

GOALS

- At the end of this session, you will be able to

- Recognize a motivated seller

- Summarize why sellers become motivated

- Explain how to target motivated sellers

17

Day 1 - Finding Analyzing Deals

Finding Deals/Motivated Sellers

- Types of Motivated Sellers

- Price (wholesale) willing to discount the

price to get a quick sale - Terms willing to discount the terms to get a

quick sale

18

Day 1 - Finding Analyzing Deals

Finding Deals/Motivated Sellers

Reasons Sellers Become Motivated

- Personal affect only the seller

- Property attach to the property

- Economic relate to general

location or the local economy

19

Day 1 - Finding Analyzing Deals

Finding Deals/Motivated Sellers

Reasons Sellers Become Motivated

Personal

- Owners location

- Health

- Retirement

- Divorce

- Financial

- Job Transfer

- Tired Landlord

- Death in the family

- Poor Management

- Bad Partnership

20

Day 1 - Finding Analyzing Deals

Finding Deals/Motivated Sellers

Reasons Sellers Become Motivated

Property

- Poor Management

- Poor Financing

- Property Condition

- Obsolescence

21

Day 1 - Finding Analyzing Deals

Finding Deals/Motivated Sellers

Reasons Sellers Become Motivated

Economic

- Local Economic Changes

- Local Neighborhood Changes

- Law Changes

- Zoning, Rent Control, etc.

22

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Realtors/MLS

- Types of sellers

- Pros

- Cons

- Tips

23

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Newspapers

- Types of sellers

- Pros

- Cons

- Tips

24

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Legal Newspapers

- Types of sellers

- Pros

- Cons

- Tips

25

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Driving for Dollars

- Types of sellers

- Pros

- Cons

- Tips

26

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Foreclosures

- Types of Sellers/Foreclosure Process

- Pros

- Cons

- Tips

27

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Bird Dogs

- Types of sellers

- Pros

- Cons

- Tips

28

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Courts

- Types of sellers

- Pros

- Cons

- Tips

29

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Bird Dogs/Networking

- Types of sellers

- Pros

- Cons

- Tips

30

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Advertising

- Flyers

- Business Cards

- Newspaper Ads

- Direct Mail

- Car Signs

- Radio TV

- Website

- REIA Groups

- Expired MLS

- Yard Signs

31

Day 1 - Finding Analyzing Deals

Finding the Deals/Where to Locate

Advertising

- Types of sellers

- Pros

- Cons

- Tips

32

Day 1 - Finding Analyzing Deals

Finding the Deals/How to Target

Contacting Sellers

- Advertising

- Direct Mail

- Telemarketing

- Drive bys/Door knocking

33

Day 1 - Finding Analyzing Deals

Evaluating Income Property

SESSION REVIEW

- What we covered this session

- How to recognize a motivated seller

- Why sellers become motivated

- How to target motivated sellers

34

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

35

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

GOALS

- At the end of this session, you will be able to

- Summarize key focal points of valuing and

analyzing discount property - Explain how to use a CMA

- Perform a discount analysis

36

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

7 Steps of Evaluation

- Find the Property

- Find the comps

- Estimate Repairs

- Estimate Costs

- Evaluate Exit Strategies

- Estimate Profit Potential

- Complete Acquisition Sheet

37

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Focal Points

- Location

- Property Condition

- Price

- Financing

- Sellers Motivation/Flexibility

38

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Comparables (Comps)

- Address

- Sq footage

- Age

- Bedrooms

- Baths

- Gar/Carport

- Lot Size

- Construction

- Price

- Days on Mkt

- Extras

- Distance

- Subdivision

- Appraisals

39

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Finding Comps

- Tax Rolls

- Web Sites

- MLS/Realtors

- Driving for Dollars

- Listing Services

40

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Estimating Repairs

- Initial Self Inspection

- Measuring Tape

- Ground Tester

- Marble

- Screw Driver

- Software

- Licensed Inspector

41

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Estimating Costs

- Buying Costs

- Holding Costs

- Closing Costs

42

Day 1 - Finding Analyzing Deals

Evaluating Income Property

SESSION REVIEW

- What we covered this session

- Key focal points of valuing and analyzing

discount property - How to use a CMA/Find Comps

- How to perform a discount analysis

43

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

44

Day 1 - Finding Analyzing Deals

Evaluating Income Property

GOALS

- At the end of this session, you will be able to

- Define key terms of cash flow analysis

- Explain how to perform a cash flow analysis

- Recognize pitfalls of cash flow analysis

45

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Cash Flow Analysis

__________ Projected Gross

Income __________ - Vacancy Loss __________ -

Collection Loss __________ Effective Gross

Income __________ - Fixed Expenses __________

- Variable Expenses __________ Net

Operating Income __________ - Debt

Service __________ Pre-tax Cash Flow

46

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Cash Flow Analysis

Projected Gross Income Monthly rent ?12 Vacancy

Loss Accounts for time when property is not

rented Effective Gross Income Amount that

remains to pay expenses Fixed Expenses Any cost

not related to occupancy

47

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Cash Flow Analysis

Variable Expenses Any additional costs Net

Operating Income Income before any mortgage

payments Debt Service Mortgage payments Pre-Tax

Cash Flow Cash flow before paying taxes

48

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Pitfalls of Cash Flow Analysis

- Overestimation of income

- Lease price vs. actual rent

- Undervaluation of vacancies

49

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Pitfalls of Expenses

- Underestimation of fixed and variable

expenses - Omission of expenses

- Omission of maintenance expenses

50

Day 1 - Finding Analyzing Deals

Evaluating Discount Property

Estimating Expenses

- 20 of effective gross income

- Three years of tax returns

- Audited financials

- Management company reports

51

Day 1 - Finding Analyzing Deals

Evaluating Income Property

SESSION REVIEW

- What we covered this session

- Key terms of cash flow analysis

- How to perform a cash flow analysis

- How to recognize pitfalls of cash flow

analysis

52

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

53

Day 1 - Finding Analyzing Deals

Financing With No Money Down

GOALS

- At the end of this session, you will be able to

- Explain factors affecting creative finance

- 2. Explain the following strategies

- a. Seller finance

- b. Second mortgage

- c. Wrap around mortgage

- d. Lease Option

- e. Subject To

- 3. Name 15 creative strategies

54

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Factors Affecting Creative Finance

Creative Finance a financing arrangement in

which maximum share of invested resources comes

from other people rather than from yourself

55

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Key Terms

- Balloon Mortgage

- Short-term, fixed-rate loans with fixed monthly

payments - Set number of years, followed by one large, final

balloon payment (the balloon) for the balance of

the principal - Usually due at the end of five, seven, or 10 years

56

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Key Terms

- Note Promissory Note

- A written promise to pay a specific amount of

money with interest at a specific rate for a

specific period of time - Owner Financing

- Seller accepts a promissory note as part of the

purchase price - Also called seller financing

57

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Key Terms

- Deed

- A written instrument that, when executed and

delivered, conveys title to or an interest in

real estate. - Mortgage

- Instrument between lender and borrower. A

conditional transfer or pledge of real estate as

security for the payment of a debt. Also, the

document creating a mortgage lien.

58

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Factors Affecting Creative Finance

- At what price

- Using whose financial resources?

- How soft/hard are the other people?

- What size of down payment?

- When is the down payment due?

- In what form of consideration?

- What rate of interest?

- What repayment term?

59

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Factors Affecting Creative Finance

1 2 3 4 5 6 7 8 9 10 Total

Price

Whose

How soft/Hard is ?

How big is down pmt?

When is down pmt due?

Consideration?

Interest rate?

Repayment Term?

60

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Creative Offers 101

Ultimate Paper Out - Who - Why -

Considerations

61

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Creative Offers 101

Second Mortgage - Who - Why -

Considerations

62

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Creative Offers 101

Wrap Around Mortgage - Who - Why -

Considerations

63

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Creative Offers 101

Lease Option - Who - Why -

Considerations

64

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Creative Offers 101

Buying Subject To - Who - Why -

Considerations

65

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Creative Offers 101

Buying with Hard or Private Money -

Who - Why - Considerations

66

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Thinking Outside of the Box

- Joint ventures/partners

- Buy low/refinance high

- HELOC

- Borrow the brokers commission

- Satisfy sellers needs

- Deposits, rent credits, tax credits

- Government Programs

67

Day 1 - Finding Analyzing Deals

Financing With No Money Down

Thinking Outside of the Box

- Credit Cards

- Borrow from friend/relative

- Refinance

- Car loan/boat loan

- Unsecured bank loan

- Signature loan

- Credit partners

68

Day 1 - Finding Analyzing Deals

Evaluating Income Property

SESSION REVIEW

- What we covered this session

- Factors affecting creative finance

- 2. Cookie Cutter financing strategies

- a. Seller finance

- b. Second mortgage

- c. Wrap around mortgage

- d. Lease Option

- e. Subject To

- f. Hard money vs. Private money

- 3. Alternative ways to finance deals

69

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

70

Day 1 - Finding Analyzing Deals

Conventional Financing

GOALS

- At the end of this session, you will be able to

- Explain the difference between hard money

lenders and conventional finance - 2. Understand basic loan programs

- 3. Understand property qualifications

- 4. Understand borrower qualifications

71

Day 1 - Finding Analyzing Deals

Conventional Financing

Hard Money vs. Conventional

- LTV (Loan to Value)

- Interest

- Points

- Payment Schedule

- Repair Money

- Closing Costs

72

Day 1 - Finding Analyzing Deals

Conventional Financing

Conventional Non - Conforming Loans

- Fixed Rate

- Adjustable Rate

- Balloon/Reset

- Second Mortgage

- Equity line of credit

73

Day 1 - Finding Analyzing Deals

Conventional Financing

Fixed Rate Mortgage

Description Constant, fixed payments during the

term of the loan

Advantages

Disadvantages

- Monthly payments are fixed over the life of

the loan - Interest rate does not change

- Protected if rates go up

- Can refinance if rates go down

- Higher interest rate

- Higher mortgage payments

- Rate does not drop if interest rates improve

74

Day 1 - Finding Analyzing Deals

Conventional Financing

Adjustable Rate Mortgage

Description Lower initial interest rate,

interest is adjusted periodically, have defined

adjustment periods

Advantages

Disadvantages

- Lower initial monthly payment

- Lower payment over a shorter period of time

- Rates and payments may go down if rates

improve - May qualify for higher loan amounts

- Payments may change over time

- Potential for high payments if rates go up

75

Day 1 - Finding Analyzing Deals

Conventional Financing

Balloon/Reset Mortgage

Description 30 year amortization and fixed rate

loan. Entire balance due at end of specified term

Advantages

Disadvantages

- Lower initial monthly payment

- Lower payment over a shorter period of time

- Many balloon mortgages offer the option to

convert to a new loan after the initial term.

- Risk of rates being higher at the end of the

initial fixed period - Risk of foreclosure if you cannot make

balloon payment or if you cannot refinance or

if you cannot exercise the conversion option

76

Day 1 - Finding Analyzing Deals

Conventional Financing

Second Mortgage

Description A second loan on the equity of the

home, carry higher interest rates, shorter terms

Advantages

Disadvantages

- Fixed payments

- Interest may be tax deductible

- Higher interest rates than on 1st mortgages

- Harder to refinance your first mortgage

77

Day 1 - Finding Analyzing Deals

Conventional Financing

Equity Line - HELOC

Description Revolving lines of credit that use

real estate as collateral

Advantages

Disadvantages

- Only borrow what you need

- Pay interest only on what you borrow

- Flexible access to funds

- Interest may be tax deductible

- Rates can change. The maximum interest rate

is normally high. - Payments can change

- Harder to refinance your first mortgage

78

Day 1 - Finding Analyzing Deals

Conventional Financing

Conventional-Conforming Loans

- Sub-Prime

- Interest Only

- Stated Income

- Power Option

79

Day 1 - Finding Analyzing Deals

Conventional Financing

Sub-Prime Loans

Description Offered to borrowers with poor

credit history, may require more down, higher

interest

Advantages

Disadvantages

- Potential for reestablishing credit if you

pay your mortgage on time. - When used for debt consolidation, you may be

able to reduce your monthly debt payment

- Higher rates

- Terms may not be as favorable

- Harder to get long term fixed loans

- Loans may have prepayment penalties

80

Day 1 - Finding Analyzing Deals

Conventional Financing

Interest Only Loans

Description Pay interest only for specified

period of time, based on 30 year loan

Advantages

Disadvantages

- Gives you greater control largest monthly

expense - Help manage cash flow and tax liability.

- For set time, can pay only interest

- Equity in your home still builds

- Usually no prepayment penalty

- Payments may change over time

81

Day 1 - Finding Analyzing Deals

Conventional Financing

Stated Income Loans

Description Do not need to prove income or

assets. (Stated/verified, stated/no verification)

Advantages

Disadvantages

- Dont need to verify income

- Faster approval

- Higher rates

- Higher down payment

82

Day 1 - Finding Analyzing Deals

Conventional Financing

Property Qualification

- Loan Parameters

- Property Type

- Transaction Type

- Loan Type

- Sale Price

- Desired Loan Amount

- Appraisal Amount

- Loan to Value

83

Day 1 - Finding Analyzing Deals

Conventional Financing

Borrower Qualification

- Loan Parameters

- Source of Down Payment

- Credit History

- Residence History

- Employment History

- Income/Debt Ratio

84

Day 1 - Finding Analyzing Deals

Conventional Financing

SESSION REVIEW

- What we covered this session

- Difference between hard money and conventional

financing - 2. Basic loan programs

- 3. Property qualifications

- 4. Borrower qualifications

85

Day 1Finding Analyzing Deals

Creating Wealth with Real Estate

Finding Deals

- Motivated Sellers

- Where to Find Deals

- Targeting Sellers

Evaluating Discount Property

Evaluating Income Property Cash Flow

Financing With No Money Down

Conventional Financing

86

The

Complete Guide to

Getting

Started

Day 1 Finding Analyzing Deals

Day 2 Choosing A Profit Strategy

Day 3 Putting It All Together