LTCM - PowerPoint PPT Presentation

Title:

LTCM

Description:

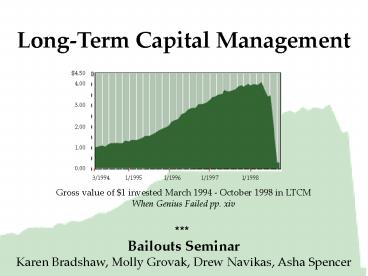

Long-Term Capital Management $4.50 4.00 3.00 2.00 1.00 0.00 Gross value of $1 invested March 1994 - October 1998 in LTCM When Genius Failed pp. xiv 3/1994 1/1995 ... – PowerPoint PPT presentation

Number of Views:138

Avg rating:3.0/5.0

Title: LTCM

1

Long-Term Capital Management

4.50

4.00

3.00

2.00

1.00

0.00

Gross value of 1 invested March 1994 - October

1998 in LTCMWhen Genius Failed pp. xiv

3/1994 1/1995 1/1996

1/1997 1/1998

Bailouts Seminar Karen Bradshaw, Molly Grovak,

Drew Navikas, Asha Spencer

2

Agenda

- Background

- Framework for analysis

- Was LTCM a bailout?

- Was LTCM successful (as a bailout)?

- Relevance to Current Crisis

- Conclusions

- Questions

3

Bond trading experience

Black

LOANS

BAILOUT 3.6B

PRESSURE

Up to 40 returns

Scholes

Meriwether

INVESTMENTS

Merton

Up to 1 trillion in derivatives

Mullins

LTCM

1.25 billion up to 7B down to 555M

PRESSURE

LOANS

4

Background

5

Background

6

Background

Russia defaults

80 loss over 5 weeks

4.50

4.00

3.00

2.00

1.00

0.00

3/1994 1/1995 1/1996

1/1997 1/1998

Gross value of 1 invested March 1994 - October

1998 in LTCMWhen Genius Failed pp. xiv

7

(No Transcript)

8

(No Transcript)

9

(No Transcript)

10

(No Transcript)

11

Background

12

Background

MISFIRE

Wall Streets Rocket Scientists thought they had

a surefire way to bear the markets. Boy, were

they wrong! -Business Week, Sept 21, 1998

13

Framework for Analysis

Was LTCM a bailout?

ASK

Was LTCM successful (as a bailout)?

- Use case studies from class to define the

criteria for determining a bailout/success - Consider whether LTCM qualifies as a

bailout/success against the criteria - Determine whether LTCM was a bailout/success and

how LTCM might impact the criteria

FRAMEWORK

14

Was LTCM a bailout?

15

Was LTCM a Bailout?

What makes something a bailout?

Input of private parties

Government intervention

More like a bailout

WHO

Principals of the firm

Existing creditors and stakeholders

Market Players

The Fed

Treasury

Congress

16

Was LTCM a Bailout?

What makes something a bailout?

Input of private parties

Government intervention

More like a bailout

WHO

Principals of the firm

Existing creditors and stakeholders

Market Players

The Fed

Treasury

Congress

Market facilitation

Government intervention

More like a bailout

WHAT/ WHY

Jumpstart private negotiations

Stopping a downward spiral

Propping up firms during economic turbulence

Emulating private market when dysfunctional

Govt intervention to pursue normative vision

17

Was LTCM a Bailout?

What makes something a bailout?

Input of private parties

Government intervention

More like a bailout

WHO

Principals of the firm

Existing creditors and stakeholders

Market Players

The Fed

Treasury

Congress

Discount window BOA Merrill

TARP HOLC Chrysler 1979

GE Immelt bonus Law firm partners

Chapter 11

Buffet GS

Detroit Today

Market facilitation

Government intervention

More like a bailout

WHAT/ WHY

Jumpstart private negotiations

Stopping a downward spiral

Propping up firms during economic turbulence

Emulating private market when dysfunctional

Govt intervention to pursue normative vision

SL Housing

Detroit Today American Dream FF

TARP

Chrysler 1979

Detroit Today Chrysler 1979

18

Was LTCM a Bailout?

Yes yes yes! NO

Input of private parties

Government intervention

More like a bailout

WHO

Principals of the firm

Existing creditors and stakeholders

Market Players

The Fed

Treasury

Congress

LTCM

LTCM

LTCM

Market facilitation

Government intervention

More like a bailout

WHAT/ WHY

Jumpstart private negotiations

Stopping a downward spiral

Propping up firms during economic turbulence

Emulating private market when dysfunctional

Govt intervention to pursue normative vision

LTCM

LTCM

19

Why does it matter?

- Distributes the perception of responsibility

- Bailout needed rescuing/failure by managers

- Not a Bailout this was a function of regulatory

choices and global markets - Sets criteria by which we measure success

20

Was LTCM successful (as a bailout)?

21

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Short-term impact on first parties

Long-term impact on first parties

first party

t

short-term

long-term

22

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Autos, SL, Banks

Saving Jobs Chrysler, Detroit

Keeping Homes HOLC, FF, SL

first party

t

short-term

long-term

23

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Home Ownership SL, FF

Public Policy

American Autos Chrysler, Detroit

Economic Growth

Panic/Confidence

Easy Credit TARP

TARP

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Autos, SL, Banks

Saving Jobs Chrysler, Detroit

Keeping Homes HOLC, FF, SL

first party

t

short-term

long-term

24

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Home Ownership SL, FF

Public Policy

American Autos Chrysler, Detroit

Economic Growth

Panic/Confidence

Easy Credit TARP

TARP

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Preserving Jobs

Autos, SL, Banks

Chrysler, Detroit

Saving Jobs Chrysler, Detroit

Keeping Homes HOLC, FF, SL

Moral Hazard

first party

Autos, SL, Banks

t

short-term

long-term

25

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Home Ownership SL, FF

Barrier to Entry, Alternative Investment TARP,

Chrysler, FF

Public Policy

Opportunity Cost

American Autos Chrysler, Detroit

Economic Growth

Panic/Confidence

Preserving Networks

Moral Hazard

Easy Credit TARP

Market Learning SL, Chrysler

TARP

Chrysler, Detroit

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Preserving Jobs

Autos, SL, Banks

Chrysler, Detroit

Saving Jobs Chrysler, Detroit

Keeping Homes HOLC, FF, SL

Moral Hazard

first party

Autos, SL, Banks

t

short-term

long-term

26

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Home Ownership SL, FF

Barrier to Entry, Alternative Investment TARP,

Chrysler, FF

Public Policy

Opportunity Cost

American Autos Chrysler, Detroit

Economic Growth

Panic/Confidence

Preserving Networks

Moral Hazard

Easy Credit TARP

Market Learning SL, Chrysler

TARP

Chrysler, Detroit

Stopping Downward Spiral

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Preserving Jobs

Autos, SL, Banks

Chrysler, Detroit

Saving Jobs Chrysler, Detroit

Keeping Homes HOLC, FF, SL

Moral Hazard

Muting Economic Turbulence

first party

Autos, SL, Banks

Chrysler, SL

t

short-term

long-term

27

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Public Policy

Opportunity Cost

Economic Growth

Panic/Confidence

Preserving Networks

Moral Hazard

Stopping Downward Spiral

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Preserving Jobs

Moral Hazard

Muting Economic Turbulence

first party

t

short-term

long-term

28

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

Public Policy

Opportunity Cost

Economic Growth

Panic/Confidence

Preserving Networks

Moral Hazard

prevented credit meltdown

/- precedent for Fed involvement /- avoided

regulation

Stopping Downward Spiral

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Preserving Jobs

no huge costs in human capital unwound at a

profit internalized losses investors who got

out early

Moral Hazard

Muting Economic Turbulence

first party

mitigated moral hazard

t

short-term

long-term

29

people impacted

Short-term impact on third parties

Long-term impact on third parties

third party

- benefit financial gaming

- made quantitative investment

- less risky

- how to rather than a

- ghost story

Public Policy

Opportunity Cost

Economic Growth

Panic/Confidence

Preserving Networks

Moral Hazard

prevented credit meltdown

/- precedent for Fed involvement /- avoided

regulation

Stopping Downward Spiral

Short-term impact on first parties

Long-term impact on first parties

Reputational Harm

Shielding Stakeholders

Preserving Jobs

no huge costs in human capital unwound at a

profit internalized losses investors who got

out early

Moral Hazard

Muting Economic Turbulence

first party

mitigated moral hazard

- didnt continue as a going concern

- reputational decline

t

short-term

long-term

30

Relevance to Current Crisis

- Investment strategies

- Market dynamics

- Moral hazards

31

Conclusions

- How do we put a stop to the learning gap without

knee-jerk regulation? - What should LTCM have led the Fed and Treasury to

ask about Bear and Lehman? - Why shotgun weddings without equity?

32

Questions?

33

Bond trading experience

Black

LOANS

BAILOUT 3.6B

PRESSURE

Up to 40 returns

Scholes

Meriwether

INVESTMENTS

Merton

Up to 1 trillion in derivatives

Mullins

LTCM

1.25 billion up to 7B down to 555M

PRESSURE

LOANS