Extending AS - PowerPoint PPT Presentation

1 / 64

Title:

Extending AS

Description:

is the same for both the SRAS curve. and the LRAS curve ... [Good News-Bad News] Price Level. Real GDP. Annual rate of inflation. Unemployment rate (percent) ... – PowerPoint PPT presentation

Number of Views:87

Avg rating:3.0/5.0

Title: Extending AS

1

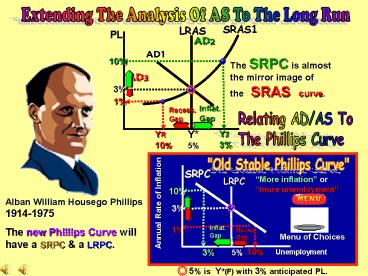

Extending The Analysis Of AS To The Long Run

SRAS1

LRAS

PL

AD2

AD1

The SRPC is almost the mirror image of the SRAS

curve.

10

AD3

3

1

Inflat. Gap

Recess. Gap

Relating AD/AS To The Phillips Curve

Y 5

YI 3

YR 10

"Old Stable Phillips Curve"

SRPC

PC

More inflation or more unemloyment

LRPC

10

Alban William Housego Phillips 1914-1975

3

Annual Rate of Inflation

1

Inflat. Gap

The new Phillips Curve will have a SRPC a LRPC.

Recess. Gap

Menu of Choices

3

10

Unemployment

5

5 is Y(F) with 3 anticipated PL.

2

Extending AS SRAS to the LR LRAS

When PL is anticipated, equilibrium is the

same for both the SRAS curve and the LRAS

curve at potential output.

LRAS

SRAS

AD

LRASwhat is available to us today SRAS where

AD crosses the SRAS shows how well we are

using what is available today

PL1 3

E1

Y

Real GDP

NAIRU Non Accelerating Inflation Rate of

Unemployment

3

.

Extending the Analysis of ASSRAS to the LRLRAS

when PL changes are unanticipated

SR output prices increase but input

prices wages remain fixed in the presence

of unanticipated inflation.

AS1

AS3

LRAS

AD2

AD1

There is an unanticipated increase in AD and PL.

6

E3

E2

Youre crazy if you think were going to accept

3 wage increases while prices are going up

6.

3

E1

LR - both output prices and input (wages)

prices increase.

With more profits, firms work their workers

overtime, and entice others like homemakers

retirees, and hire and train the structurally

unemployed.

5

3

4

Extending the Analysis of ASSRAS to the LRLRAS

when PL changes are not anticipated

LRAS

SR output prices decrease but input

prices wages remain fixed in the

presence of unanticipated disinflation.

AS1

AS2

AD1

AD3

There is an unanticipated decrease in AD and

PL.

3

E1

1

Thanks boss. You are giving me 3 raises

while prices are increasing only 1.

E2

E3

LR - both output prices and input (wages)

prices decrease.

5

9

5

.

Extending the SRAS to the LR LRAS

SR - output prices change but input

prices remain fixed in the presence of

unanticipated inflation or disinflation.

LRAS

AS1

AS3

AS2

AD2

AD1

6

E3

AD3

3

E1

1

E3

LR - both output prices and input (wages)

prices change.

9 5 3

6

.

LRAS

Higher PL results in higher nominal wages

shifts SRAS left.

LRAS

SRAS2

AD1

SRAS1

E3

PL26

E2

Price Level

AD2

E1

PL13

Y employment increased in the SR but not

the LR.

Inflationary Gap

o

Y1

Y2

Real domestic output

7

LRAS

Lower PL reduces nominal wages and shifts SRAS

right.

LRAS

SRAS1

AD1

SRAS3

AD2

Price Level

PL13

E1

E2

Y and employment decreased in the SR but not

the LR.

PL11

E3

The LRAS Shifters are the same things that shift

the PPC out more or better resources land,

labor, capital, or entrepreneurial

ability better technology

Recessionary Gap

o

9

5

Real domestic output

8

GROWTH IN THE AD-AS MODEL

Economic Growth

1. Increase in resources -

LRAS1

LRAS2

c

2. Better resource quality -

a

3. Technological advances -

Capital Goods

U

Price Level

Y1

Y2

d

b

Consumer Goods

Real GDP

9

.

Economic Growth in the Extended ADAS Model

LRAS1

LRAS2

The LRAS drags the SRAS curve along with it.

SRAS2

SRAS1

PL2

Price Level

PL1

AD2

AD1

o

Y1

Y2

Real GDP

10

.

EQUILIBRIUM IN EXTENDED AD-AS MODEL Equilibrium

for the SRAS LRAS are the same if the correct

rate of inflation is anticipated

LRAS

SRAS1

AD1

Price Level

E1

PL1 2

o

Y1

Real domestic output

11

.

DEMAND-PULL INFLATION Self-Correction

LRAS

AD2

SRAS1

AD1

PL25

E2

Price Level

E1

PL12

o

Y1

Y2

Real GDP

12

.

DEMAND-PULL INFLATION Self-Correction

LRAS

SRAS2

AD2

SRAS1

AD1

E3

Price Level

PL25

E2

PL12

E1

o

Y1

Real GDP

Y2

13

COST-PUSH INFLATION

LRAS

SRAS2

AD1

SRAS1

Occurs when SRAS shifts left

Due to a shortage of inputs like crude oil food

No job, yet prices are going up.

E2

PL210

PL12

E1

Price Level

Stagflation

o

Y2 10

Y1

Real GDP

14

COST-PUSH INFLATION

Government response with increased AD

LRAS

SRAS2

AD2

SRAS1

AD1

Even higher price levels

PL3 12

E3

Price Level

E2

PL2 10

PL12

E1

o

Y2

Y1

Real GDP

10

15

COST-PUSH INFLATION

If government allows a recession to occur

LRAS

SRAS2

AD1

SRAS1

E2

PL210

Price Level

E1

PL12

o

Y1

Y2

Real GDP

10

16

COST-PUSH INFLATION

If government allows a recession to occur

LRAS

SRAS2

SRAS1

Nominal wages fall and AS returns to its

original location

E2

PL210

Price Level

E1

PL12

AD1

o

Y2

Y1

Real GDP

10

17

Inflation-Unemployment Relationship

- Normally, there is a short-run trade-off between

the rate of inflation and the the rate of

unemployment. - AS shocks can cause both higher rates of

inflation and higher rates of unemployment. - There is no significant PL/Y trade-off over

long periods of time.

18

Effect of Changes in AD on Real Output and Price

Level

AD1

SRAS

Price Level

PL1

0

Y1

Real GDP

19

Effect of Changes in AD on Real Output and Price

Level

SRAS

AD2

AD1

PL2

Price Level

PL1

o

Y1

Y2

Real GDP

20

Effect OF Changes IN AD On Real Output and Price

Level

AD3

AD1

AD2

SRAS

PL3

PL2

Price Level

PL1

o

Y1

Y3

Real GDP

Y2

21

Effect of Changes in AD on Real Output and Price

Level Good News-Bad News

AD4

AD3

AD1

AD2

SRAS

PL4

PL3

Price Level

PL2

PL1

o

Y4

Y1

Y3

Y2

Real GDP

22

THE PHILLIPS CURVE CONCEPT

PC

7 6 5 4 3 2 1

AS inflation declines...

Annual rate of inflation

Unemploy. increases

1 2 3 4 5 6 7

Unemployment rate (percent)

23

The Phillips Curve Trade-Off

PL

Y/Empl.

A Phillips Curve trade-off between unemployment

and inflation.

Increases in AD causes . . .

Phillips curve

PC

AS

AD3

AD2

C

AD1

9 3 1

C

9 3 1

Price Level

Inflation

B

B

A

A

9 5 2

2 5 9

24

Shifting Phillips Curve

Stagflation Shifts in AS

Cause shifts in the PC

PC5

PL

PC4

AD

AS5

PC3

AS4

PC2

PC1

AS3

AS2

Inflation

AS1

Output Employment

Unemployment

The unemployment-inflation experience of the

1970s 1980s demolished the idea of an

always-stable Phillips Curve.

25

Anticipated or Unanticipated increase/decrease in

AD

Review before looking at the New Phillips

Curve

LRAS

If there is an unanticipated increase in AD,

then PL, Y, and employment increase in SR,

but only PL in the LR. Now this was a

surprise!

AD1

SRAS1

AD2

E2

PL26

Unanticipated

PL12

Price Level

E1

o

Y1

Y2

Real GDP

26

Anticipated or Unanticipated increase/decrease in

AD

Review before looking at the New Phillips

Curve

LRAS

SRAS2

If there is an unanticipated increase in AD,

then PL, Y, and employment increase in SR,

but only PL in the LR. Now this was a

surprise!

SRAS1

AD1

AD2

E3

E2

PL26

Price Level

PL12

E1

o

Y1

Y2

Real GDP

27

Anticipated or Unanticipated increase/decrease in

AD

LRAS

Review before looking at the New Phillips

Curve

AS2

AS1

If there is an unanticipated increase in AD,

then PL, Y, and employment increase in SR,

but only PL in the LR.

AD2

AD1

E3

E2

PL26

Anticipated

Price Level

PL12

E1

If the increase in AD is anticipated, only PL

increases.

o

Y1

Real GDP

28

Anticipated or Unanticipated increase/decrease in

AD

Review before looking at the New Phillips

Curve

LRAS

AS1

AD1

If there is an unanticipated, decrease in AD,

then PL, Y, and employment decrease in SR,

but only PL in the LR.

Price Level

PL16

Unanticipated

E1

E2

PL22

AD2

o

Y1

Y2

Real domestic output

29

Anticipated or Unanticipated increase/decrease in

AD

Review before looking at the New Phillips

Curve

LRAS

AS2

AS1

AD1

If there is an unanticipated, decrease in AD,

then PL, Y, and employment decrease in SR,

but only PL in the LR.

PL16

E1

Price Level

Unanticipated

E2

PL22

E3

AD2

o

Y1

Y2

Real domestic output

30

Anticipated or Unanticipated increase/decrease in

AD

Review before looking at the New Phillips

Curve

LRAS

AS2

AS1

AD1

If there is an unanticipated, decrease in AD,

then PL, Y, and employment decrease in SR,

but only PL in the LR.

Price Level

PL16

E1

Anticipated

PL22

E2

If the decrease in AD is anticipated, only PL

decreases.

AD2

o

Y1

Y2

Real GDP

31

Adaptive expectations view - SRPC LRPC

There is a SRPC output prices are changing and

a LRPC output input prices chg after

unanticipated inflation or disinflation LRPC -

when unemployment the natural rate and there

is no tendency for PL to be incr/decr. PL is

stable contracts reflect it.

LRPC

My salary just isnt keeping up.

Lets say that inflation has averaged 3 for

three years. 3 is anticipated.

15

12 9 6 3

SRPC3

Wow, my raise exceeds inflation.

b3

But my raise was only 6.

But when it comes time to sign a new contract,

his boss says

SRPC2

a3

It cant get any better. My raises exceed

inflation.

b2

SRPC1

c3

a2

Lets say that inflation has averaged 9

for the past few years. 9 is anticipated.

b1

But my salary went up by only 3.

a1

c2

Inflat. Gap

Recess. Gap

C1

0 2 4 6 8 10

32

SRPC LRPC Adaptive Expectations View

When labor contracts expired, workers desired

to restore their real purchasing power that had

been reduced by unanticipated inflation and

they adjusted their expectations about

future inflation at 6 instead of 3.

The Adaptive Expectations view holds that there

are two curves, a SR backward-looking

fooled curve with a trade-off and a LR curve

with no trade-off.

LRPC

Friedmans natural rate or fooling theory.

The economy moved away from the natural

unemployment rate because workers were fooled

in the SR into thinking that inflation was

either lower or higher than it really was. So,

there is a SRPC and a LRPC.

15

12 9 6 3

SRPC3

b3

SRPC2

While the RATEX view says that there is only one

LR forward-looking not-fooled curve with no

trade-offs.

a3

So, we have the Natural Rate Hypothesis with a

trade-off in the SR but no trade-off

in the LR. 1. Adaptive expectations theory or

backward-looking approach. 2. Rational

Expectations theory or forward-looking

approach.

b2

SRPC1

c3

a2

b1

a1

c2

Inflat. Gap

Recess. Gap

C1

0 2 4 6 8 10

33

The Phillips Curve Trade-Off

C to B like AD1 to AD2

C to A like AD1 to AD3

C to D like AD3 to AD2

Y/Empl.

PL

C to E like AD3 to AD1

A Phillips Curve trade-off between unemployment

and inflation.

Increases in AD causes . . .

PC

AS

Phillips curve

AD3

PL3 PL2 PL1

AD2

A

AD1

B

C

D

E

34

Phillips Curve in the 1960s

PC

PC

What is the conclusion of the Phillips curve?

The opportunity cost of more employment is more

inflation The opportunity cost of less

inflation is less employment.

35

Inverted Phillips Curve Swerve late

90s

The new economy was helped by a favorable

supply shock oil dropping from 26 to 11 and a

speedup in productivity.

97

98

2

4

The Crocodile Hunter the Fed Still Listens

To Alban William Housego Phillips was a

violinist, crocodile hunter, and electrician who

became a W.W.II hero. Many say the link between

unemployment and inflation has been weakened by

technology-driven productivity advances and

global competition. the so-called new

economy However, Alan Greenspan still believed

in the SRPC trade-off.

36

Phillips Curve Shifting in the 70s and 80s

37

Phillips Curl?

Unemployment got worse but so did inflation.

38

Wage-Price Controls To Control Inflation1971

1973 both failed

President Nixon came into office as a strong

opponent of wage-price controls to control

inflation. However as inflation edged over 5 in

summer of 1971, he did try it for 90 days.

Like pre-empting Desperate Housewives

In August of 71, Nixon announced to the nation on

a Sunday night (pre- empting Bonanza), the 90

day freeze on wages. Nixon hoped he would not be

perceived as a flip-flopper on this issue. The

next day, 90 of the next days news were devoted

to this issue.

The DOW liked the news and shot up 33 points, as

Nixon was perceived as acting boldly, and

coming to the defense of the consumers against

the price gougers. He also did it again in 73

but it didnt work any better. His head of the

OMB told him that they had convinced the

public of their original position that, wage

price controls dont work to control inflation.

So-do wage price controls work to control

inflation?

Protesters against the Nixon Wage freeze

39

Incomes Policies (1. Jawboning, 2. Wage/price

guidelines,

3. Wage/price controls)

Controlling incomes lessens price pressures.

Controlling prices lessens wage pressures.

Kublai Khan

Wage price controls were tried failed during

these periods. Diocletion-301 Kublai Khan-13th

century Antwerp-1584 Continental Congress-1775

Nixon-1971 S. American Countries-1980s. Inflati

on always won and wage and price controls

lost. 1. This produces shortages of products

workers cant send signals. 2. Price increases

show up off the books. 3. Firms convert illegal

wage increases (create new job classifications)

into legal promotions 4. Workers cant freely

bargain for wages so the public quickly tires of

this. 6. The Market cant equate QD and QS. 7.

Economists reject this approach to reducing

inflation.

40

THE LAFFER CURVE

100

Tax rate (percent)

l

0

Tax revenue (dollars)

41

THE LAFFER CURVE

100

n

m

m

Maximum Tax Revenue

Tax rate ()

l

0

Tax revenue (dollars)

42

Tax

Ben Steins part in this movie as a

boring econ prof was voted one of the 50 most

famous scenes in American film.

100

Tax Rate

0

Ben Stein from Ferris Buelers Day Off

graduated from Columbia University in 1966

with a degree in economics and from Yale Law

School in 1970 as valedictorian. He was a

speech writer for Nixon. He has written 16

books, including his latest humor book, How

To Ruin Your Life.

43

Here Is A Phillips Curve FRQ Asked In

2005

44

FR 2005

3. 4 total pts Assume that the table below

shows the unemployment and inflation data in

Country X as a result of a shift in AD.

Period Unemployment Rate Inflation

Rate Last Year 2 8 This

Year 5 4

(a)2 pts Draw a correctly labeled graph of a

short-run Phillips curve for Country X,

showing the actual unemployment and inflation

rates for both years. Label the Phillips curve

as SRPC.

(b) 2 pts Now assume that the SRAS curve

has shifted to the left. (i) Identify one

factor that could cause the AS curve to shift to

the left.

SRPC2

SRPC

1

8

Answer 3 (b) (i) An increase in input cost

could shift the AS curve left. Other answers

could be increase in bus. regs., increase in

business taxes, decrease in subsidies, or an

increase in expected inflation (increase in

wages)

Inflation

4

Unemployment

2

5

(ii) On the graph, show how this shift would

affect the short-run Phillips curve.

45

FR 2005

(c) 1 pt Assume that the natural rate of

unemployment in Country X is 5. Draw a

correctly labeled graph of the long-run Phillips

curve and label it as LRPC.

LRPC

SRPC

8

Inflation

4

Unemployment

2

5

(d) 1 pt What is the relationship between the

unemployment rate and the inflation rate

in the long run?

Answer 2. (d) There is no relationship between

the unemployment rate and inflation in the long

run. As can be seen in the graph above. If there

is unanticipated inflation or disinflation,

although PL increases or decreases, unemployment

ends up at the natural rate.

46

And Here Is A Phillips Curve FRQ Asked In

2006

47

NAIRU BackgroundNon Accelerating Inflation

Rate of Unemployment

- There exists a level of unemployment where

inflation is not generated. Having too little

unemployment 3 generates wage inflation,

too much unemployment 12 causes wages to fall.

This special level of unemployment IS NOT a

constant. It varies based on the conditions and

restrictions society places upon it. - Shifters of the NAIRU and therefore the LRPC

- Changes in the labor force characteristics. Age,

sex, of married both employed couples, of new

workers entering, structural changes in demand

for labor skills, educational level. - Changes of government policies. Minimum wages,

unemployment compensation, job training programs,

employment subsidies to workers or the employers. - Changes in Productivity. Increases in

productivity w/o wage increases makes workers

more desirable, and slowing of productivity

without a corresponding slowing of wage

increases makes workers less desirable. - Changes in Labor Market Institutions. Power of

labor unions to negotiate wages above equilibrium

level, temporary employment agencies, and the

internet for job searches.

48

FRQ 2006

3 (c) 4 pts Assume that the government

reduces the level of unemployment

compensation.

(i) Explain how this affects the natural

rate of unemployment. (ii) Using a

correctly labeled graph, show how this affects

the long-run Phillips curve.

PL

LRPC1

LRPC2

4 points given for saying the a.) natural rate

will fall, b.) People have more

incentive to look for work, c.) graph of

LRPC, and d.) leftward shift of the LRPC

Unemployment

Y1

Y2

Answer 3(c) (i) The natural rate of

unemployment would decrease to Y2 because

of more labor in the work force. (ii)

Lower payment for unemployment compensation will

mean that workers have more incentive to work

and go out and search for jobs more quickly. They

remain unemployed for shorter periods of time

and hence the natural rate of unemployment

tends to be lower. The LRPC would shift to the

left to Y2.

49

Phillips

Curve (74) 51. According to the short-run

Phillips curve, there is a trade-off between

a. interest rates and inflation b. the growth

of the MS and interest rates c. unemployment

and economic growth d. inflation and

unemployment e. economic growth and interest

rates (22) 52. According to the long-run

Phillips curve, which of the following is true?

a. Unemployment increases with an increase in

inflation. b. Unemployment decreases with an

increase in inflation. c. Increased automation

leads to lower levels of structural unemployment

in the long run. d. Changes in the composition

of the overall demand for labor tend to be

deflationary in the long run. e. The

natural rate of unemployment is independent of

monetary and fiscal policy changes that

affect AD.

Here Are Two Phillips Curve MC Questions Asked In

2005

LRPC

Inflation

Unemployment

Y

50

Reaganomics

I was on the Laffer curve.

Ave. 23 cut

The core of the supply-side theory was that

lower marginal tax rates would cause people to

supply more labor, working more and harder,

which would increase growth and the positive

effect on growth would be so large that G

tax revenue would actually increase rather than

decrease in response to the tax cut.

51

Reaganomics and Budget Deficits

In honor of President Reagans 1st 4 years the

democrats wanted this new 1 Trillion bill.

52

(No Transcript)

53

What happens to profits, output, and employment

when there is an increase or decrease in PL

in SR and LR?

1. An increase in price level from PL1 to PL2

results in a(an) (increase/decrease) in

profits, output, and employment. 2. A decrease

in price level from PL1 to PL3 results in a(an)

(increase/decrease) in profits, output,

and employment. 3. In the LR, output (Y) and

employment (increase/decrease/stay the same).

54

The Phillips Curve Trade-Off

C to B like AD1 to AD2

C to A like AD1 to AD3

C to D like AD3 to AD2

Y/Empl.

PL

C to E like AD3 to AD1

A Phillips Curve trade-off between unemployment

and inflation.

Increases in AD causes . . .

PC

AS

Phillips curve

AD3

PL3 PL2 PL1

AD2

A

AD1

B

C

D

E

55

- NATURAL RATE HYPOTHESIS

- A. Adaptive Expectations

- B. RATEX

- 1. B1 to B2 represents the (SR/LR) for adaptive

expectations. - 2. B1 toC1 represents the (SR/LR) for adaptive

expectations. - 3. RATEX LR view would be from B1 to ____.

- 4. Traditional PC movement would be from B1 to

(C1/B2). - 5. The whole graph explains the (Old/New)

Phillips curve.

B2

12 9 5

LRPC

SRPC3

c3

New Phillips Curve

SRPC2

B3

c2

SRPC1

B2

C1

Recess. Gap

Inflat. Gap

b1

2

0 2 4 6 8

56

Economy Starts At Equilibrium

C 1. Inflation unexpectedly falls from 5 to

3, unemployment will increase from 6 to

___. 2. RATEX view if anticipate decline from 5

to 3, unemployment will (increase to

8/stay at 6). 3. SR and LR if PL unexpectedly

falls from 5 to 3, unemployment moves from

6 to ___ to ___.

What a surprise!

I anticipated this.

8

6

8

LRPC

Wow, surprised again!!

SRPC3

5 3

SRPC2

C

d

SRPC1

b

a

Inflat. Gap

Recess. Gap

0 2 4 6 8

57

A

Hard to anticipate here.

Start from equilibrium A

1. Unanticipated decrease

of AD1 to AD2 with flexible prices and wages.

Equilibrium would go from A to ____ to ____. 2.

Anticipated decrease of AD would result in A to

____. 3. Decrease from AD1 to AD2 if prices are

flexible but wages are not. Equilibrium would

move from A to ____. 4. Decrease from AD1 to

AD2 if prices are not flexible. A to __.

C

D

C

D

E

58

Yes, I can anticipate things.

A

- Anticipated increase from AD1 to AD2Classical.

A to __. - Anticipated increase from AD1 to AD2RATEX. A

to ___. - Unanticipated increase in AD and

- self correction. A to ___ to ___.

- 4. Unanticipated increase in ADRATEX. A to

___ to ___.

Start from equilibrium A

C

C

Fooled again.

B

C

B

C

59

NS 1-6

1. The traditional Phillips Curve suggests a

tradeoff or conflict between unemployment

(GDP/inflation). 2. A simultaneous increase in

unemployment and inflation is known as

(deflation/stagflation). 3. In a given year the

nominal wage rate of a particular group of

employees rises by 10 their productivity

increases by 4, we conclude that the unit

labor costs will (rise/fall) by (3/4/5/6).

Old Phillips Curve

My 10 wages exceed my 4 productivity.

I can adapt my expectations later.

I always anticipate.

4. The two main variants of the natural rate

hypothesis are the backward looking

adaptive expectations theory and the

forward looking (Keynesian/RATEX) theory. 5. In

the natural rate theory when the actual rate of

inflation exceeds the expected

unanticipated rate firms will experience

(declining/rising) profits and (increase/decrease)

their employment. 6. In the natural rate theory,

when the rate of inflation is less than the

expected rate the firms will experience

(declining/rising) profits and

(increase/decrease) their employment.

60

NS 7

7. Assume the economy is at b1. A. According to

RATEX, the long-run relationship between

unemployment inflation is represented by

(line b1 to c1/line through b1, b2, b3, b4).

B. This diagram explains the (adaptive

expectations/ Keynesian) view of the

Phillips curve. C. Adaptive expectations

theorists argue that C1 represents future

nominal wage (increases/decreases).

D. A movement consistent with the traditional

(old) Phillips curve tradeoff is (c1 to

b2/b1 to b2/b1 to c1). E. If factor cost

factor of production have not adjusted to

inflation, the economy will move from (b1

to b2/b1 to c1). F. The full employment rate

for this economy is (4/6/8). G. If price

level is anticipated, when government uses

expansionary policies to lower

unemployment below 6, the economy will move

from (b1 to c1/b1, b2, b3, b4).

61

8. RATEX theory implies workers can correctly

forecast inflation, therefore the Phillips

curve is (horizontal/vertical).

(9)PL2

NS 8-11

(6)PL1

(3)PL3

YR Y YI

9. In terms of AS, the short-run is a period in

which nominal wages and other input prices

are (variable/constant) in the presence of

unanticipated inflation/disinflation. 10. The

LRAS is (up-sloping/vertical) because in time

resource prices catch up with product

prices. 11. The SRAS curve is (up-sloping/vertical

) because higher prices cause firms to

expand output when resources prices remain

constant.

62

NS 12-15

The natural rate of unemployment is 6.

The economy is operating at point C where

the expected and actual rates of inflation are

5. 12. If the actual rate of inflation

unexpectantly falls from 5 to 3, then the

unemployment rate will (temporarily fall from

6 to 8/ permanently increase from 6 to 8).

Now, that was a surprise.

5

6

13. According to RATEX theory, if firms and

workers fully anticipate the decline in the

actual rate of inflation from 5 to 3, the

economy will (move from c to a

eventually to b/remain at c/move directly

from c to b). 14. The diagram of the natural

rate hypothesis suggests that (disinflation

can occur/any rate of inflation is consistent

with the natural rate of unemployment/

unemployment rates which exceed the natural rate

are only temporary/all the above are true.

15. In the long run, the decline in the actual

rate of inflation from 5 to 3 will

(reduce/have no effect) on the unemployment rate.

63

NS 16-20

Movement, just movement.

SRAS

PL1

PL1

PL2

PL3

16. An increase in the PL will cause a

(shift/movement) (up/down) a SRAS curve. a

decrease in the PL will cause a (shift/movement)

(up/down) a SRAS curve.

17. If demand management AD changes policies

are initiated to restrain cost-push inflation,

we can expect unemployment to

(increase/decrease).

10

3

But I will get another job.

6

14 10

18. The historical record in America since W.W.

II indicates that incomes policies

restraining wages to control prices during

inflation have been largely

(effective/ineffective). 19. The Laffer Curve is

a central concept in (monetarism/supply-side

economics). 20. Reaganomics

advocated (cuts/increases) in taxes,

(increases/decreases) in government

regulation.

Laffer Curve

64

The End