Easy, intuitive importing of external databases - PowerPoint PPT Presentation

1 / 27

Title:

Easy, intuitive importing of external databases

Description:

Stratification capability down to the loan level ... Filter out data such as Auto Loans ... and custom reports detail new loans added, sold, written-off, and ... – PowerPoint PPT presentation

Number of Views:32

Avg rating:3.0/5.0

Title: Easy, intuitive importing of external databases

1

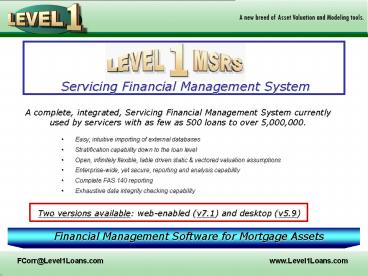

Servicing Financial Management System

A complete, integrated, Servicing Financial

Management System currently used by servicers

with as few as 500 loans to over 5,000,000.

- Easy, intuitive importing of external databases

- Stratification capability down to the loan level

- Open, infinitely flexible, table driven static

vectored valuation assumptions - Enterprise-wide, yet secure, reporting and

analysis capability - Complete FAS 140 reporting

- Exhaustive data integrity checking capability

Two versions available web-enabled (v7.1) and

desktop (v5.9)

2

The 5.9 Transformer converts EBCDIC, ASCII or

binary data to a Level 1 compatible database.

See raw data as it appears on the tape

Map only fields required for the analysis

Handles compressed data also

3

The 7.1 Transformer converts EBCDIC, ASCII or

binary data to a Level 1 compatible database

through a point click GUI.

1) To map a field click on the Source field that

matches the Asset Onsite Target field

2) Click on Add and the fields are Mapped

4

Source fields are mapped to common Asset OnSite

fields

Data can be manipulated and convert source data

through simple VB Script wizards

5

Develop and save often used scripts such as Avg

of 3 credit scores

Filter out data such as Auto Loans

6

Level 1 MSRs 7.1 System is available through the

Internet Explorer icon on your desktop. This

SQL based system can reside either on your server

or ours. Additionally, it will soon be available

on an ASP basis, where all of the work of data

conversion and table maintenance is done by the

Servicing Source, but the valuation itself is

performed by you.

Level 1 MSRs 5.9 resides on your desktop and can

access data that is either local on a server to

be shared. This system produces and uses tables

formatted as DBFs

Both systems allow for ease in digging in to

the underlying data and assumptions.

7

Busch - Overview

7.1

Level 1 MSRs provides independent modules to help

manage loan and servicing portfolios

5.9

Stratifier parses portfolio into user defined

homogenous subsets down to the LOAN LEVEL

Translator manages and creates almost limitless

assumptions tables to reflect the idiosyncrasies

of a portfolio - applies them to the stratified

portfolio

Evaluator calculates the portfolios cash flows

and valuation metrics

Bridge creates permanent FAS 140/156

sub-ledger entries

8

Busch - Overview

Level 1 MSRs provides independent modules to help

manage loan and servicing portfolios

Stratifier parses portfolio into user defined

homogenous subsets down to the LOAN LEVEL

Translator manages and creates almost limitless

assumptions tables to reflect the idiosyncrasies

of a portfolio - applies them to the stratified

portfolio

Evaluator calculates the portfolios cash flows

and valuation metrics

Bridge creates permanent FAS 140/156

sub-ledger entries

9

The Stratifier is a powerful tool that allows

tremendous flexibility in defining how your

portfolio is to be aggregated for a variety of

disparate purposes.

Stratify at the loan or super-loan level for

valuation and analytical purposes

This assures consistency in MSA valuation

assumptions used in valuation, bidding, pricing,

and hedging activities as well as, where

relevant, in mortgage-related activities in other

aspects of an institutions business as required

by the FDIC.

Bring MSR basis in at the mini-portfolio level

(e.g. acquisition)

Perform FAS 140 Impairment Testing at Impairment

Tranche Level

Insure the proper accounting treatment of each

Tranche

10

Additionally, if desired

Value at the loan level

Perform GAAP and Tax analyses break out excess

servicing using mini keys

Handle a wide variety of exception reporting

Update tables investor remittance, state, etc.

and much more

Each stratification run can be saved for future

use!

11

Busch - Overview

Level 1 MSRs provides independent modules to help

manage loan and servicing portfolios

Stratifier parses portfolio into user defined

homogenous subsets down to the LOAN LEVEL

Translator manages and creates almost limitless

assumptions tables to reflect the idiosyncrasies

of a portfolio - applies them to the stratified

portfolio

Evaluator calculates the portfolios cash flows

and valuation metrics

Bridge creates permanent FAS 140/156

sub-ledger entries

12

7.1 assumptions are driven by loan attributes

5.9 assumptions are driven by Aggregation Code

In the Translator

Any combination of Assumption Variables can be

applied to any combination of Loan Attributes to

tailor the valuation to the idiosyncrasies of

your portfolio

Level 1 MSR automatically calculates all

combinations of the Loan Attributes chosen to

afford the ultimate flexibility in assigning

Assumption Variables

Additionally .

13

The 7.1 Translator maintains a complete history

of translation runs and affords the user the

option to lock runs for future reference

when they are complete

14

Busch - Overview

Level 1 MSRs provides independent modules to help

manage loan and servicing portfolios

Stratifier parses portfolio into user defined

homogenous subsets down to the LOAN LEVEL

Translator manages and creates almost limitless

assumptions tables to reflect the idiosyncrasies

of a portfolio - applies them to the stratified

portfolio

Evaluator calculates the portfolios cash flows

and valuation metrics

Bridge creates permanent FAS 140/156

sub-ledger entries

15

The Evaluator takes the translated data and

calculates cash flows and values. A wide variety

of valuation reports are generated for review.

Each run can be saved for future reference .

16

7.1 Evaluator Screen

5.9 Evaluator Screen

Parameters and values on individual tranches can

be reviewed for reasonableness and accuracy.

Modification to tranche level assumptions can

then be made ...

17

All valuation assumptions can be reviewed on an

individual tranche level, changed and

rerun.

additionally many assumptions can be

vectored over time through the use of tables

or Calculated based on functions such as PI

times 5

18

Busch - Overview

Level 1 MSRs provides independent modules to help

manage loan and servicing portfolios

Stratifier parses portfolio into user defined

homogenous subsets down to the LOAN LEVEL

Translator manages and creates almost limitless

assumptions tables to reflect the idiosyncrasies

of a portfolio - applies them to the stratified

portfolio

Evaluator calculates the portfolios cash flows

and valuation metrics

Bridge creates permanent FAS 140/156

sub-ledger entries

19

The Bridge utilizes sequential processing to

minimize chance of accounting errors no step can

be performed until the prior one is complete and

correct

Tremendous flexibility in the Bridge setup to

insure the model follows the clients approved

accounting methodologies.

PRIOR PERIODS can be adjusted for unusual

occurrences. However, all adjustments are noted

in the Bridge reports

20

New period

Import book basis on an impairment tranche level

Re-evaluate portfolio value based on updated bases

Update current months portfolio for both updated

book and market values

Set accounting masks based on MSR type and

origination date

21

Import book basis on an impairment tranche level

Re-evaluate portfolio value based on updated bases

Update current months portfolio for both updated

book and market values

Set accounting masks based on MSR type and

origination date

Produce impairment trial balances

and amortization schedules in a wide variety of

formats

22

Import book basis on an impairment tranche level

Re-evaluate portfolio value based on updated bases

Update current months portfolio for both updated

book and market values

Set accounting masks based on MSR type and

origination date

Produce impairment trial balances

and amortization schedules in a wide variety of

formats

Canned and custom reports detail new loans added,

sold, written-off, and all the other categories

needed for monthly reconciliation

23

Import book basis on an impairment tranche level

Re-evaluate portfolio value based on updated bases

Update current months portfolio for both updated

book and market values

Set accounting masks based on MSR type and

origination date

Produce impairment trial balances

and amortization schedules in a wide variety of

formats

Canned and custom reports detail new loans added,

sold, written-off, and all the other categories

needed for monthly reconciliation

Upon completion of the reconciliation, lock

sub-ledgers for the period.

24

Large array of pre-formatted reports

Reporting in 5.9

User defined ranges of many variables

User friendly multitude of standard reports

Because underlying database is in a DBF format,

customized reporting is easy and accurate

25

Reporting in 7.1

Asset OnSite provides 7.1 Level 1 users

unparalleled and totally secure, enterprise-wide

reporting and analysis.

Review summary statistics on any portfolio

maintained in Asset OnSite

Review canned reports, such as Interest Rate

stratification, at the touch of a blue button

26

Change column headings to any field on the

valuation tape including values and assumptions

weighted average, average or sum

Build custom reports that reflect single, double,

or more sorts. All reports can be viewed online,

exported, or printed in PDF

Create and save filters to show only the pieces

of the portfolio you are interested in. Convert

them to pools for distribution to others.

Drill down to loan level on any stratification.

Explore the underlying data fields to explore any

perceived anomalies.

Because underlying database is in SQL format,

customized reporting is easy and accurate

27

Servicing Financial Management System

A complete, integrated, Servicing Financial

Management System currently used by servicers

with as few as 500 loans to over 5,000,000.

- Easy, intuitive importing of external databases

- Stratification capability down to the loan level

- Open, infinitely flexible, table driven static

vectored valuation assumptions - Enterprise-wide, yet secure, reporting and

analysis capability - Complete FAS 140 reporting

- Exhaustive data integrity checking capability

Please click here to return to Level1Loans.com

Two versions available web-enabled (v7.1) and

desktop (v5.9)