Decision Trees - PowerPoint PPT Presentation

1 / 20

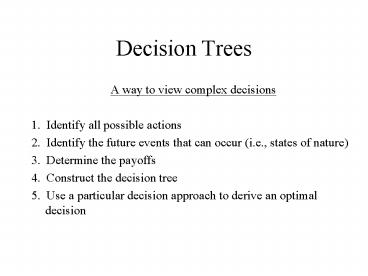

Title: Decision Trees

1

Decision Trees

- A way to view complex decisions

- 1. Identify all possible actions

- 2. Identify the future events that can occur

(i.e., states of nature) - 3. Determine the payoffs

- 4. Construct the decision tree

- 5. Use a particular decision approach to derive

an optimal decision

2

Decision Trees General Form

v(a1, s1)

s1

s2

v(a1, s2)

.

.

sm

.

v(a1, sm)

a1

s1

v(a2, s1)

s2

a2

v(a2, s2)

.

sm

.

.

.

.

.

v(a2, sm)

an

s1

v(an, s1)

s2

Decision node

v(an, s2)

.

sm

.

.

Event node

v(an, sm)

Terminal node

3

Solving Decision Trees

- 1. Work backwards

- 2. At each event (circular) node, calculate the

return according to your preferred decision

approach from the branches leaving that node - 3. At each decision (square) node, the payoff

corresponds to the branch with the largest return

4

Decision Trees with Multiple Decisions

5

Example 1 Houston Oil

- Houston Oil owns some land for which it must make

a decision - a1 Drill for oil

- Cost to drill 100,000 for an oil-producing

well and 75,000 for a dry well - Revenue 1.50 per barrel

- a2 Unconditional land lease

- Receive 45,000

- a3 Conditional land lease

- Receive 0.50 per barrel, provided the land

yields at least 200,000 barrels Otherwise,

receive nothing

6

Example 1 Houston Oil

- Geology Report

- The land can be classified in four ways with

corresponding probabilities - Classification Probability

- s1 500,000-barrel well 0.10

- s2 200,000-barrel well 0.15

- s3 50,000-barrel well 0.25

- s4 Dry well 0.50

- Which decision should Houston Oil make to

maximize its profits? - First draw a decision tree what are the possible

payoffs? - Its Quickie time ?

7

In-class Quickie

- a1 Drill for oil

- Cost to drill 100,000 for an oil-producing

well and 75,000 for a dry well - Revenue 1.50 per barrel

- a2 Unconditional land lease

- Receive 45,000

- a3 Conditional land lease

- Receive 0.50 per barrel, provided the land

yields at least 200,000 barrels Otherwise,

receive nothing - State of nature Probability

- s1 500,000-barrel well 0.10

- s2 200,000-barrel well 0.15

- s3 50,000-barrel well

0.25 - s4 Dry well

0.50 - Draw a decision tree include the payoffs that

occur at each terminal node

8

Houston Oil Decision Tree

s1 750K 100K 650,000

0.10

s2 300K 100K 200,000

0.15

s3 75K 100K 25,000

0.25

s4 0 75K 75,000

0.50

a1

0.10

s1 45,000

a2

0.15

s2 45,000

0.25

s3 45,000

0.50

s4 45,000

a3

0.10

s1 500,000 x 0.50 250,000

0.15

s2 200,000 x 0.50 100,000

0.25

a1 Drill a2 Unconditional land lease a3

Conditional land lease

s3 0

0.50

s4 0

9

Houston Oil Decision Tree

s1 650,000

0.10

- Maximum Likelihood

s2 200,000

0.15

75,000

0.25

s3 25,000

s4 75,000

0.50

a1

0.10

s1 45,000

45,000

a2

0.15

s2 45,000

0.25

45,000

s3 45,000

0.50

s4 45,000

a3

0.10

s1 250,000

0

0.15

s2 100,000

0.25

a1 Drill a2 Unconditional land lease a3

Conditional land lease

s3 0

0.50

Optimal Decision a2 Uncond. lease

s4 0

10

Houston Oil Decision Tree

s1 650,000

0.10

- MaxiMin

s2 200,000

0.15

75,000

0.25

s3 25,000

s4 75,000

0.50

a1

0.10

s1 45,000

45,000

a2

0.15

s2 45,000

0.25

45,000

s3 45,000

0.50

s4 45,000

a3

0.10

s1 250,000

0

0.15

s2 100,000

0.25

a1 Drill a2 Unconditional land lease a3

Conditional land lease

s3 0

0.50

Optimal Decision a2 Uncond. lease

s4 0

11

Houston Oil Decision Tree

s1 650,000

0.10

- Bayes Decision Rule

s2 200,000

0.15

51,250

0.25

s3 25,000

s4 75,000

0.50

a1

0.10

s1 45,000

45,000

a2

0.15

s2 45,000

0.25

51,250

s3 45,000

0.50

s4 45,000

a3

0.10

s1 250,000

40,000

0.15

s2 100,000

0.25

a1 Drill a2 Unconditional land lease a3

Conditional land lease

s3 0

0.50

Optimal Decision a1 Drill

s4 0

12

Example 2 Contractor Bidding

- Two competing contractors (us vs. them) bid on a

single project. Lowest bid gets it. - Our possible bids (in 100,000s) 10, 13, 16

- Two uncertainties Competitors bid and actual

cost of project. - Competitors Bid 8 11 14 17

- Probability 0.1 0.4

0.4 0.1 - Actual Cost of Project 6 9 12 15 18

- Probability 0.2 0.2

0.3 0.2 0.1

13

Example 2 Contractor Bidding

- Competitors Bid 8 11 14 17

- Probability 0.1 0.4

0.4 0.1 - Actual Cost of Project 6 9 12 15 18

- Probability 0.2 0.2

0.3 0.2 0.1 - To simplify the analysis, convert competitors

bids into probabilities of us winning or losing,

based on our bids - Our Bid Prob(We Win)

Prob(We Lose) - 10 0.9 0.1

- 13 0.5 0.5

- 16 0.1 0.9

- What should be our optimal bidding policy?

14

Contractor Bidding Decision Tree

AC 6, Prob 0.2, Payoff 4

AC 9, Prob 0.2, Payoff 1

0.9(W)

AC 12, Prob 0.3, Payoff 2

AC 15, Prob 0.2, Payoff 5

0.1(L)

0

AC 18, Prob 0.1, Payoff 8

10

AC 6, Prob 0.2, Payoff 7

0.5(W)

AC 9, Prob 0.2, Payoff 4

13

AC 12, Prob 0.3, Payoff 1

0.5(L)

AC 15, Prob 0.2, Payoff 2

16

0

AC 18, Prob 0.1, Payoff 5

0.1(W)

AC 6, Prob 0.2, Payoff 10

AC 9, Prob 0.2, Payoff 7

AC 12, Prob 0.3, Payoff 4

0.9(L)

AC 15, Prob 0.2, Payoff 1

0

AC 18, Prob 0.1, Payoff 2

15

Contractor Bidding Decision Tree

AC 6, Prob 0.2, Payoff 4

Bayes Decision Rule

1.4

AC 9, Prob 0.2, Payoff 1

0.9(W)

AC 12, Prob 0.3, Payoff 2

1.26

AC 15, Prob 0.2, Payoff 5

0.1(L)

0

AC 18, Prob 0.1, Payoff 8

10

AC 6, Prob 0.2, Payoff 7

1.6

0.5(W)

0.8

AC 9, Prob 0.2, Payoff 4

0.8

13

AC 12, Prob 0.3, Payoff 1

0.5(L)

AC 15, Prob 0.2, Payoff 2

16

0

AC 18, Prob 0.1, Payoff 5

0.46

0.1(W)

AC 6, Prob 0.2, Payoff 10

4.6

AC 9, Prob 0.2, Payoff 7

AC 12, Prob 0.3, Payoff 4

0.9(L)

AC 15, Prob 0.2, Payoff 1

Expected payoff 80,000

0

AC 18, Prob 0.1, Payoff 2

16

Contractor Bidding A Complication

- Oh no! A 2nd project is coming up!

- Our possible bids (in 100,000s) 13, 16

- Two uncertainties Competitors bid and actual

cost of project. - Competitors Bid 14 18

- Probability 0.5 0.5

- Actual Cost of Project 8 11 15

- Probability 0.4 0.5

0.1 - Bidding for the 2nd project begins after the 1st

project is awarded. - Our firm is too small to handle both projects.

- What should be our optimal bidding policy?

17

Contractor Bidding A Complication

- Competitors Bid 14 18

- Probability 0.5 0.5

- Actual Cost of Project 8 11 15

- Probability 0.4 0.5

0.1 - To simplify the analysis, convert competitors

bids into probabilities of us winning or losing,

based on our bids - Our Bid Prob(We Win) Prob(We Lose)

- 13 1.0 0.0

- 16 0.5 0.5

18

Contractor Bidding Decision Tree 2

- 2nd Project

- Bayes Decision Rule

AC 8, Prob 0.4, Payoff 5

2.8

AC 11, Prob 0.5, Payoff 2

1.0(W)

2.8

AC 15, Prob 0.1, Payoff 2

0.0(L)

13

0

AC 8, Prob 0.4, Payoff 8

5.8

2.9

0.5(W)

2.9

16

AC 11, Prob 0.5, Payoff 5

0.5(L)

AC 15, Prob 0.1, Payoff 1

0

Expected payoff 290,000

19

Contractor Bidding Decision Tree 3

- Must now include possibilities that we will NOT

bid on 1st or 2nd project - Bayes Decision Rule

1.4

0.9(W)

0.97

0.1(L)

10

2.9 (Tree 2)

3.07

0.5(W)

1.6

2.25

13

Bid on 1st proj.

0.5(L)

16

3.07

2.9 (Tree 2)

3.07

0.1(W)

2.9

No bid on 1st proj.

No bid on 2nd proj.

4.6

0

0.9(L)

Bid on 2nd proj.

2.9 (Tree 2)

2.9 (Tree 2)

20

Contractor Bidding Solution

- Optimal Bidding Policy

- We will bid 16 (i.e. 1,600,000) on the 1st

project. - If we lose, we will bid 16 (i.e. 1,600,000) on

the 2nd project. - Expected Payoff 307,000

- (divided among 26 of us 11,807.69 per person

?)