The Relationships between the Financial Statements - PowerPoint PPT Presentation

1 / 18

Title:

The Relationships between the Financial Statements

Description:

Statement of Cash Flows 1/1/04 12/31/04. Net cash flow from operating ... Conservatism. When in doubt about the objective value of an item: - Understate assets ... – PowerPoint PPT presentation

Number of Views:26

Avg rating:3.0/5.0

Title: The Relationships between the Financial Statements

1

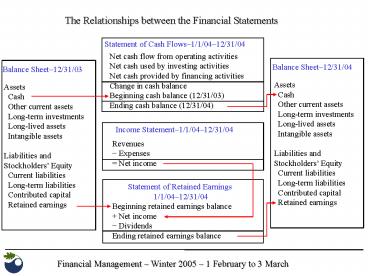

The Relationships between the Financial Statements

Statement of Cash Flows1/1/0412/31/04

Net cash flow from operating activities Net cash

used by investing activities Net cash provided by

financing activities Change in cash

balance Beginning cash balance (12/31/03) Ending

cash balance (12/31/04)

Balance Sheet12/31/04

Balance Sheet12/31/03

Assets Cash Other current assets Long-term

investments Long-lived assets Intangible

assets Liabilities and Stockholders Equity

Current liabilities Long-term liabilities

Contributed capital Retained earnings

Assets Cash Other current assets Long-term

investments Long-lived assets Intangible

assets Liabilities and Stockholders Equity

Current liabilities Long-term liabilities

Contributed capital Retained earnings

Income Statement1/1/0412/31/04

Revenues - Expenses Net income

Statement of Retained Earnings 1/1/0412/31/04

Beginning retained earnings balance Net

income - Dividends Ending retained earnings

balance

2

Todays topics

- The 4 basic assumptions of financial accounting

- The 4 valuation bases of financial accountings

- The 4 basic principles of financial accounting

- Capitalizing versus expensing cost

- Environmental information in financial statements

3

Investing

Liability Accounts

Asset Accounts

Operating Revenues

Operating Expenses

Credit

Interest Principal

Equity

Dividends

Financing

Accounting is about measurements of stocks within

well-defined boundariesand flows across these

boundaries, using a well-defined measure.

4

Four basic assumptions of financial accounting

The first 2 basic accounting assumptions

establish the boundaries of the accounting

object (economic entity)

- Economic entity assumption (financial boundary)

Profit-seeking entities, which are separate and

distinct from their owners and other entities,

can be identified and measured. (holding

company, subsidiary, consolidated statements) - Fiscal period assumption (temporal boundaries)

The life of the economic entity can be divided

into fiscal periods, and the performance and

financial position of the entity can be measured

during those periods. (10-Q, 10-K, calendar

versus fiscal year, e.g. retailers often use

January 31)

Financial flows and stock changes are temporal

phenomena

Question What is the difference between the

financial performance and position of a company?

5

Four basic assumptions of financial accounting,

cont.

- Going concern The life of the economic entity

will extend beyond the current fiscal period.

(related to the definition of an asset something

creating future economic benefits) - Stable dollar The performance and financial

position of the entity can be measured in terms

of a monetary unit that maintains constant

purchasing power across fiscal periods.

The fourth basic accounting assumption assures

that the accounting measure,i.e. the dollar, is

a well-defined unit of measurement. What does

it not account for?

6

Financial boundaries

- Measurement of flows (e.g. market transactions)

are based on transaction value

- Measurement of stocks is more difficult, since

no market transaction takes place ? Need for

valuation methods

7

Four valuations on the Balance Sheet

- Present value (PV)

- Fair market value (FMV)

- Original cost (OC)

- Replacement cost (RC)

- Present value Method Calculate sum of all

discounted future cash flows Problem

Subjectivity associated with cash flow

predictions Used for Contractual agreements

like notes receivable or payable, mortgages,

bonds, leases, pensions - Fair market value (or sales price) Method

Current value of the item in the output market

Problem Calculating market value can be

difficult and too subjective for

financial accounting Used for Short-term

investments Special case of FMV Face value (or

current cash flows) Used for Cash and all

current liabilities Special case of FMV Net

realizable value (expected cash

collection from outstanding accounts) Used for

Accounts receivable

8

Four valuations on the Balance Sheet, cont.

- Original cost

- Method Use the historical cost paid in the

input market - Advantage Supported by documented evidence,

thus objectively verifiable Used for

Prepaid expenses, land, securities, property,

plant, equipment,

intangible assets - Is typically reduced by accumulated

amortization or depreciation (net book value) - Replacement cost Method Current cost that

would have to be paid in input market Used in

The conservative lower-of-cost-or-market rule for

inventory Reason To avoid overstatement of

the actual dollar value of this account

Now we have valuation bases for all asset and

liability accounts. Stockholders equity is not

is not valued but calculated as the difference

betweenthe value of total assets and the value

of total liabilities. This is also called the

book value of the company.

9

Four basic principles of financial accounting

Managerial accounting The economic value of an

entity, an asset or a liability is its present

value, i.e. the sum of all discounted future

cash flows. Problem How to predict future

interest rate and future cash flows? Result

PV in many cases not suitable for financial

accounting.

The appropriate valuation basis for each account

is determined by the principle of objectivity.

The Principle of Objectivity (of flow and stock

measurements) Financial accounting information

must be verifiable and reliable. The values of

transaction and the assets and liabilities

created by them must beobjectively determined

and backed by documented evidence. Plus

Disclosed dollar amounts are reasonably

reliable. Minus Much relevant and useful

information will not appear on the financial

statements. (Example Potential environmental

liability)

10

Four basic principles of financial accounting,

cont.

- The Principle of Matching (Coordination of in-

and outflows) - In order to correctly measure operating

performance, the companys efforts - of a given period should be matched against the

benefits that result from them. - This principle matches the timing of the cost

item (e.g. wages, equipment purchases, security

investment) against the benefits it generates,

i.e. usually revenues. - If revenues are generated immediately - Treat

cost item as expense - Cost appears on the

income statement of the current period. - If revenues are realized in future periods -

Treat cost item as asset, i.e. capitalize it. -

Cost appears on the balance sheet. - Convert the

asset into an expense in the periods when the

related revenues are realized, i.e. amortize

/ depreciate it.

Definitions Amortization Systematic allocation

of a capitalized (deferred) cost item over its

life. Depreciation Amortization of fixed assets,

i.e. property, plant and equipment

11

Cost is expensed when related revenue occurs in

same period.

Revenues

ExpensedCost

Period 1

12

Cost is capitalized in period 1

Initial value of asset (cost)

Period 1

13

and amortized in the periods

Initial value minus accumulated depreciation

Revenues

DepreciationExpense 1

Period 2

14

in which related revenues are generated.

Initial value minus accumulated depreciation

Revenues

DepreciationExpense 2

Period 3

15

Four basic principles of financial accounting,

cont.

- The Principle of Revenue Recognition (Timing of

the flows) - Four criteria must be met before revenue can be

included in the income statement - The company has completed a significant portion

of the production and sales effort - The amount of revenue can be objectively

measured - The major portion of the costs has been

occurred, and the remaining costs can be

reasonably estimated - The eventual collection of the cash is

reasonably assured

To understand the principle of revenue

recognition consider a complete production /

sales cycle

1. Order

2. Production

3. Transfer

4. Payment

The most common point of revenue recognition is

Step 3, when the good or service is transferred

to the buyer.

16

Relationship between matching and revenue

recognition

Income Statement Future Period

Income Statement Current Period

Principles of Revenue recognition

Revenue

Revenue

Expense cost onincome statement

3a.

1.

2.

Expense

Incur cost in current period forthepurpose

of generatingrevenue

Decidein what periodthe revenueis to

begenerated

Capitalize cost onbalance sheet

Expense

3b.

Net Income

Net Income

17

Four basic principles of financial accounting,

cont.

- The Principle of Consistency (between all stock

and flow measurements) - Companies should choose a set of methods und use

them from one period to - Another. However, companies do change accounting

methods occasionally. - Why is consistency an issue?

- GAAP allow a number of different, acceptable

methods to measure assets, - liabilities, revenues, expenses and dividends.

- There are two reasons for this

- No method is general enough to apply to all

companies in all situations - GAAP are the result of a political process with

many interested parties facing widely different

situations, not a natural science

- Summary of the Four Basic Accounting Principles

- Objectivity

- Matching

- Revenue recognition

- Consistency

18

Two exceptions to the four basic principles

- 2 Exceptions to the 4 Basic Principles

- Materiality The principles of financial

accounting measurement can be violated if the

transactions involve dollar amounts that are too

small to affect the decisions of the users of

financial statements. Example No need to

capitalize the purchase of a wastepaper basket.

Q Why should it be capitalized

in theory? Q Why is it not

necessary in practice? - Conservatism When in doubt about the

objective value of an item - Understate

assets - Overstate liabilities - Accelerate

the recognition of losses - Delay the

recognition of gains Main reason Liability

associated with overstating incorrectly the

financial condition and performance of a

company. Example Lower-of-cost-or-market

rule However, does not mean to intentionally

understate financial statements