Best Taxation Lawyers Jaipur | GST Consultant Jaipur - PowerPoint PPT Presentation

Title:

Best Taxation Lawyers Jaipur | GST Consultant Jaipur

Description:

Need a GST Bail Lawyer or ITAT Advocate in Jaipur? Experienced Saxena Law Chambers lawyers can assist you with GST legal matters and Income Tax appeals. – PowerPoint PPT presentation

Number of Views:0

Title: Best Taxation Lawyers Jaipur | GST Consultant Jaipur

1

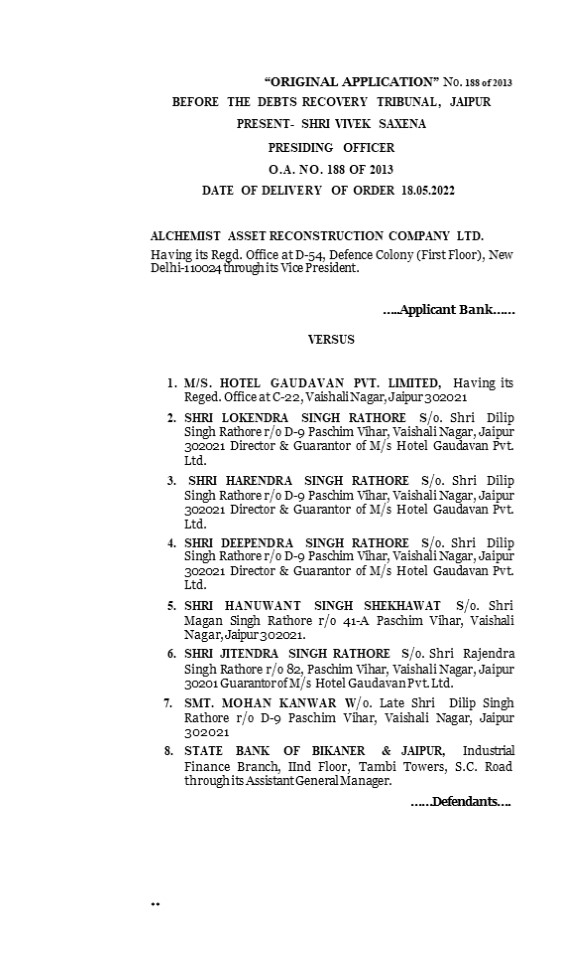

- ORIGINAL APPLICATION No. 188 of 2013

- BEFORE THE DEBTS RECOVERY TRIBUNAL, JAIPUR

PRESENT- SHRI VIVEK SAXENA - PRESIDING OFFICER

- O.A. NO. 188 OF 2013

- DATE OF DELIVERY OF ORDER 18.05.2022

- ALCHEMIST ASSET RECONSTRUCTION COMPANY LTD.

- Having its Regd. Office at D-54, Defence Colony

(First Floor), New Delhi-110024 through its Vice

President. - ..Applicant Bank

- VERSUS

- M/S. HOTEL GAUDAVAN PVT. LIMITED, Having its

- Reged. Office at C-22, Vaishali Nagar, Jaipur

302021 - SHRI LOKENDRA SINGH RATHORE S/o. Shri Dilip

- Singh Rathore r/o D-9 Paschim Vihar, Vaishali

Nagar, Jaipur 302021 Director Guarantor of M/s

Hotel Gaudavan Pvt. Ltd.

2

OA No. 188/2013

2

Present Shri Akarsh Mathur along with Ms.

Jayshree Das Gupta Sh. Abhishek Saxena, Counsel

for the applicant Sh. Saurabh Jain, Ld. Counsel

for the Defendant No. 1, M/s Hotel Gaudawan Pvt.

Ltd. Sh. Sudeep Singh Hora alongwith Sh. Manish,

Counsel for Defendant No. 2, Sh. Lokendra Singh

Rathore Sh. Sarash Saini along with Sh. Puneet

Gupta, Ld. Counsel for Defendant No. 3 Sh. R.K.

Salecha, Ld. Counsel for Defendant No. 6,

Jitendra Singh Rathore, Smt. Arti Sharma, Counsel

for Defendant No. 8. None for Defendant No. 4, 5,

7 JUDGMENT This Original Application was filed

by the applicant bank on 21.07.2013 for recovery

of an amount of Rs. 396910137/- along with

pendent lite interest and future interest at the

contractual rate of 14.70 2 Penal Interest

P.A. with monthly rest against the defendants.

Defendant no. 1 is the principle borrower

and Defendant no. 2 to 7 are personal

guarantors. During the course of pendency of the

present Original Application the debts was

assigned by the applicant bank in favour of the

Alchemist Assets Reconstruction, on account of

an assigning deed executed between them on

20.03.2014 and so an I.A. no. 30.05.2014 was

filed for substitution of respondents, which was

allowed by my Ld. Predecessor vide order dated

09.04.2015.

3

OA No. 188/2013

3

- As per facts of the case, a term loan facility

was sanctioned by State Bank of India, Jodhpur

Branch for an amount of Rs. 25.00 Crore in favour

of the Respondent no.1, out of this amount an

amount of Rs. - 1.00 Crore was sanctioned as credit limit and

remaining amount sanctioned as medium term and

the term loan was required to be paid in 27

quarterly installments of the sectioned

facilities, so issued vide letter at Exhibit A-3,

original loan agreement is at Annexure A-4,

agreement of hypothecation of goods and assets is

at Annexure A-5, Agreement of pledge of goods and

assets is at Annexure A-6, letter regarding grant

of individual limit within overall limit at

Exhibit A-7, letter of pledge in respect of

machine accepted as security for advances is at

Annexure A-8. - Against the one credit facilities, following

securities were also secured in order to secure

the credit facilities. - Equitable mortgaged was created by immovable

property owned by defendant no. 1, situated at

Kuri Road, Jaisalmer , bearing Khasra no. 72

(Sale dated 21.03.2007 in favour of defendant

no. 1) is at Exhibit -17 and sale deed in favour

of previous owner of the subject property dated

19.01.2005 is at Annexure A-18 and

confirmation letter issued by the competent

authority i.e. Collector, Jamabandi is at

Annexure A-19 to A-29. - Second charge over the companys properties i.e.

land - building situated at Hotel Complex Link Road,

Jaisalmer (Hotel Fort Rajwada), State Bank of

Bikaner and Jaipur having first charge over

the property vide letter dated 21.03.2008,

second charge was created in favour of applicant

bank i.e. State Bank of India , which was

recorded in ROC and the relevant documents are at

Annexure A-31 to A-34. - The guarantee deed was executed by Dilip Singh,

Jitendra Singh Rathore Respondent no. 6,

Harendra Rathore

4

OA No. 188/2013

4

Respondent no. 3 and Hanuvant Singh

Sakhawat, the documents are at Exhibit -14. On

account of death of Sh. Dilip Singh, Guarantee

Deed was executed by Defendant no. 2 to 7 on

27.12.2010 at Exhibit A-53, this guarantee Deed

was executed by the defendants for

repayment of full loan amount together with

interest cost, charges, expenses or any other

amount may be due in future. As per contentions

raised in the O.A. the guarantee is continue is

irrecoverable and guarantors confirms that

in balance conformation by borrower shall have

to be deemed to have been made on behalf of the

guarantors and shall be binding on them. As per

guarantee agreement, it was also agreed between

the parties that in case of litigation and

binding up and taken over the management of the

company, the repayment of any part of dues shall

be exhort the guarantor and guarantor will be

liable for recovery of the full amount due. As

the principle borrower failed to repay the loan

amount as per repayment schedule and default was

committed by the end of 2008 and so, the

erstwhile applicant i.e. State Bank of India

rescheduled the loan while its letter dated

16.01.2009 and as per rescheduled plan first

installment was to be paid on 31.03.2010.

However, the interest was required to be paid on

monthly basis but again the principal borrower

company defaulted in payment of the first

installment as per restructured plan. As the

principle borrower company defaulted in repayment

so, State Bank of India issued a legal notice on

11.11.2010 at Exhibit A-15 so remaining amount of

Rs. 254753588/-, due as on 31.01.2010 executed

interest due from 01.11.2010 onwards and response

to this legal notice defendant no. 1, requested

for six months time for repay the loan through

letter executed at Exhibit A-14, which was signed

by Sh. Jitendra Singh Rathore,

5

OA No. 188/2013

5

- Defendant no. 2, Lokendra Singh Rathore through

Exhibit A-35 made similar request through letter

dated 27.11.2010. - Defendant issued various plans confirmation

letters and sought time for payment which

includes the communication at Exhibit A-47, A-46

A-50 and Exhibit A- 49, A-83, A-86 A-87 - these are the letters which were written by the

Defendants - during the period 31.03.2022 to 11.10.2012, as

the amount was not paid so, through letter dated

28.07.2012 (Exhibit A-84), the applicant bank was

issued notice of repayment of outstanding amount

and then on 06.11.2012 issued a legal notice. - Along with this Original Application statement of

account under Bankers Book Evidence Act, at

Exhibit A-91 is filed. Affidavit of Authorized

officer who was authorized to file this O.A. is

also field. - Due to continuous defaults, SBI again issued

letter dated 28.07.2012 requesting the Defendants

to repay the outstanding (Exhibit A-84) and

thereafter, issued legal notice dated

06.11.2012(Exhibit A-66). - So, on the above said developments, this OA was

filed on 22.07.2013 by SBI demanding

recovery of Rs. 39,69,10,137.88/- as on

21.07.2013 alongwith pendente-lite and future

interest at contractual rate i.e., 14.70 2

penal interest per annum with monthly rest,

against Defendant No. 1 as the principle borrower

and Defendant No. 2 to 7 as personal guarantor.

SBI also filed statement of account

alongwith certificate under Section 2A of the

Bankers Book of Evidence Act, 1891 (Exhibit

A-91). The statement of Account reflects

outstanding as prayed for in the OA.

6

OA No. 188/2013

6

- OA is supported with all documents as discussed

above and are supported evidence by way of

Affidavit of VK Saxena, Assistant General

Manager SBI and Vivek Kumar Meena, Branch

Manager, which were filed alongwith the OA. - As already stated above, during the pendency of

OA the debt was assigned by SBI to AARC on

20.03.2014 and accordingly AARC was substituted

in place of SBI. - During the pendency of instant proceedings AARC

preferred Section 7 Insolvency and Bankruptcy

Code, 2016 (IB) petition before Honble National

Company Law Tribunal, New Delhi (NCLT) which was

registered as (IB), 23 (TB)/2017. The Section 7

petition was admitted vide order dated

31.03.2017. The Resolution Professional as

appointed by the NCLT, admitted an amount of

Rs. 69.12 Crores as on 31.03.2017 as the

outstanding due to AARC. Subsequently, Resolution

Plan was approved by the NCLT vide its order

dated 13.12.2017 (A-18 to reply of IA 843 /18).

Under the Resolution Plan an amount of Rs. 42.50

Crores was provided to be paid to AARC and the

Resolution Plan clearly provides that the

remaining amount is to be recovered from the

Personal Guarantors i.e Defendants 2 to 7. - Under the Resolution Plan, entire debt of SBBJ

has been admitted and provided to be paid in

full. - As the Resolution Plan of the Principal Borrower

Company i.e Defendant No. 1 has been

approved and the amount so provided in the

Resolution Plan is paid,Claimant i.e AARC is now

pressing for issuance of final recovery

certificate against Defendant Nos. 2 to 7 for

the balance amount and no relief has been

claimed against Defendant No. 1 and its assets,

which is now represented by the new management.

7

OA No. 188/2013

7

- The Defendants have filed written statement.

Written Statement has been filed by Defendant

No. 6, Jitendra Singh Rathore and Defendant Nos.

1 to 5 and 7, jointly. - No evidence by way of Affidavit has been filed by

any of the Defendants. - Heard arguments and perused the record.

- Counsel for Defendant No. 1, now represented

through the Resolution Applicant, supported the

resolution plan and based on the terms of the

resolution plan pressed that nothing can be

recovered from Defendant No. 1 and the liability

is now limited qua Defendant Nos. 2 to 7. - Counsel for Defendant No. 3 and 6 separately

addressed arguments, which were adopted by

counsels for other remaining defendants, except

Defendant No 4, 5 and 7, who pleaded no

instructions at the last stage. However,

Defendants have raised the following two issues,

which are common. - The main objections by the Defendant Nos. 2 to

7were raised in IA no. 843 of 2018 in which after

hearing arguments this Honble Tribunal vide

order dated 21.02.2020 observed that these issues

can be raised at the final hearing stage. - First, the contention is that NPA

classification by SBI (assignor of AARC) has

been declared as null and void by this Tribunal

and by Honble DRAT, New Delhi in SA

Proceedings and therefore the assignment deed is

void and thus the OA is not maintainable. - Second, the contention is that in view of the

Resolution Plan approved by the Honble NCLT,

Delhi whereby Principal Debtor is discharged from

its liability, no liability allegedly

8

OA No. 188/2013

8

- subsists qua the other Defendants and the

guarantees allegedly stands discharged. - In support of challenge classification of the

account as NPA Ld. counsel for Defendant No. 3,

Shri. Hrendra Singh Rathore argued that, in SA

proceedings SARFAESI actions of AARC, has been

decided by this Tribunal and NPA classification

was found in violation of RBI guidelines(A-7 to

IA no. 843 of 2018). The said order dated

06.05.2015 passed in SA proceedings has been

upheld by the Honble DRAT, Delhi vide its order

dated 07.12.2015 (A-8 to IA no. 843 of 2018). It

is further argued that Writ Petition preferred by

the AARC was dismissed by the Honble Delhi High

Court as infructuous vide order dated 05.07.2018

(A-10 to IA no. 843 of 2018). It is therefore the

claim of the Defendants that finding rendered by

this Honble Tribunal has attained finality. It

is further the contention that as the NPA

classification is contrary to the RBI guidelines,

the assignment in favour of AARC by SBI is also

bad in law and therefore the instant OA is not

maintainable and deserves to be rejected. - In support of the above arguments that no claim

exists against the Defendant Nos. 2 to 7 as

Resolution Plan has been approved by NCLT, the

contention is that it is settled law that if the

principal borrowers is absolved from its

liability, the other borrowers/ guarantors also

stand absolved. In support of the said contention

Ld. counsel has relied upon Section 133 134 of

the Contract Act. The Defendants also relied upon

a number of judgements in support of the said

contention of discharged of surety under Section

133 134 of the Contract Act. The Defendants

have also relied upon Section 141 of the Indian

Contract Act to contend that their right of

subrogation

9

OA No. 188/2013

9

- has also extinguished and the same necessarily

extinguishes their obligations. - Ld. Counsel for Defendant No. 3 further

submitted that without a valid classification of

accounts as NPA which order has not been

interfered with by the High Court, and so the

alleged assignee has no legal right and even the

assignment is bad. It was further submitted that

in terms of the order passed in SA proceeding,

which was upheld in DRAT proceedings possession

of the mortgaged assets was to be handed back to

the original borrower, and the said order AARC

has not complied with, till date. So, it was

argued that O.A. is not maintainable. - Ld. Counsel for Defendant No. 3 further argued

that under Contract Act once the Principal

Borrower is absolved, so the guarantors

automatically stands discharged and the same

principle will apply in the given facts also as

AARC is admittedly not claiming any amount

from the principal borrower relying upon the

Resolution Plan. It was further submitted that

conduct of AARChas deprived the Defendants of

their right to reclaim the recovered amount

from the principal borrower and therefore, the

same is also inviolation of Section 141 of the

Contract Act.Based on these arguments it is

prayed that no claim can continue against the

remaining Defendants also and therefore, the OA

is bad in law. - These arguments have been supported and

reiterated counsel for the Defendant No. 6 Mr.

Salecha. - It was further the submission of the Defendants

that the Resolution Plan also specifically

provides for withdrawal of all suit/proceeding

against the principal borrower. Based on this

10

OA No. 188/2013

10

- clause of the Resolution Plan it is further the

contention that once Resolution Plan was

implemented, AARC was bound to withdraw the

instant OA and if, any cause of action subsisted,

it could have filed a fresh OA against

the remaining Defendants. It is further

contended that neither OA has been withdrawn nor

the same has been amended to place on record

subsequent development including deletion of

Defendants No. 1 and therefore, the OA in its

existing form is defective and no final order can

be passed on the basis of the same. - Thereafter, Ld. counsel of Defendant No. 3

informed that Defendant Nos. 2, 4 and 7 are

relying on same arguments. - Based on these arguments and submissions the

Defendants have prayed for dismissal of the OA. - Ld. counsel for AARC on the other hand contends

that the issue of NPA classification of account

as NPA is not relevant for adjudication of OA

under Section 19 (1) and OA has been filed based

on recall ofloan facility. It is further the

contention that remedy under RDB Act and

SARFAESI Act are independentof each other and

operates in different spheres and distinct and

precondition of one cannot be imposed on another.

In support of the said arguments AARC has relied

upon following judgments-

- Keshavlal Khemchand v. Union of India (2015) 4

SCC 770 _at_Paragraphs, 31, 32 and 54, - M/s Transcore vs Union of India, (2008) 1 SCC

125, _at_ Paragraphs 68 - United Bank of India v. The Debts Recovery

Tribunal, (1999) 4 SCC 69 _at_ paragraphs 15 - IV. State Bank of India v Charter Awadh

Education Trust 2020 SCC Online DRAT 122 _at_

paragraphs 6

III.

11

OA No. 188/2013

11

- Bank of India v Ajay Finsec Manu/DR/0037/2003 _at_

Paragraphs 6 - O.P. Raphe Vs. IDBI Bank 2018 SCC Online DRT 7,

DRT Ernakulam _at_ Paragraphs 4.3, 4.4 - It was further argued that since the

classification of account as NPA on 28.06.2010

till the assignment of debt i.e 20.03.2014,

admittedly the borrower had only made a payment

of Rs.2 Lacs. On the date of assignment of debt,

the account of the Borrower was any ways remained

as NPA as the borrower failed to make any

payments thereafter. Furthermore even, on

initiation of CIRP proceedings on 31.03.2017

before Honble NCLT, Borrowers failed to clear

the liability. It has been further stressed that

is it is not the case of Defendant Nos. 2 to 7

that the debt was repaid during the this period,

and therefore, the claim is not maintainable. - The Counsel for AARC has also relied up

the NPA Classification Guidelines(A-6 to reply

to IA no. 843 of 2018), Clause 11.2.4 to

contend that despite restructuring on

16.01.2009(A-2 to reply to IA no. 843 of 2018)

there was no satisfactory performance on

completion of specified period. - The Counsel for AARC further submitted that

after restructuring, the first instalment of

interest became due on 30.01.2009 and the account

continued to remain irregular since June, 2009.

Interest due on 28.02.2010 remained unpaid for 90

days and on completion of said period on

29.05.2010 an amount of Rs.4,74,104/- remained

unpaid. The principal instalment after

re-schedulement was due on 31.03.2010, i.e. one

year from the date of restructuring however, the

same remained unpaid. Thus, on expiry of

specified period on

12

OA No. 188/2013

12

- 31.01.2010, there was clear default in payment of

principal and interest due as per original loan

terms and thus there is no merit in the challenge

to NPA classification.Further, as per RBI

Circular if there is a default in the payment of

the restructured account, then the NPA would be

considered that as from the original date of

default which in the instant case would be from

2008. In this regard AARC has relied upon the

statement of SBI filed alongwith the OA and the

statement reflecting default of more than 90 days

(A-4 and A-5 to reply to IA no. 843 of 2018). It

is further the contention that the debt and

default is admitted in the documents / letters

filed in the OA and also in the written

statement. - It was further argued that that the orders passed

by the Honble DRT and Honble DRAT were

challenged by AARC before the Honble Delhi High

Court by way of Writ Petition (WP(C) No. 11814 of

2015). Further it is submitted that the

Defendants had during the pendency of the

aforesaid petition, forcefully taken back the

possession of the secured assets. When the said

fact was brought to the notice of the Honble

Delhi High Court, vide order dated 05.01.2016

directed the Defendants that the possession of

the said property be restored. Thereafter when

the possession was restored the Honble High

Court vide order dated 19.01.2016 directed that

the status quo shall be maintained and vide order

dated 14.12.2016permitted AARC to issue a fresh

notice under Section 13(2) of the SARFAESI

Act(A-9 to reply to IA no. 843 of 2018). - It is further argued that in terms of the order,

dated 14.12.2016 AARC issued fresh notice

under Section 13(2) of the SARFAESI Act on

01.02.2017(A-10 to reply to IA no. 843 of 2018)

and without prejudice to the classification of

NPA by SBI on 28.06.2010 AARC declared the

account as NPA on

13

OA No. 188/2013

13

- 30.06.2015 w.e.f. 29.06.2010. The contention

is that this establishes that the Honble High

Court, on the basis of the documents and

pleadings prima facie accepted the contentions of

AARC. - In view of the Resolution Plan sanctioned by

Honble NCLT the Honble High Court disposed off

the writ vide order dated 05.07.2018 recording

that now the said issue has become academic but

also with liberty to the AARC to approach again

if so required. As such, the contentions of the

Defendants that the issue of NPA declaration

has become final is misconceived, self serving

and incorrect. - It has also been argued that similar objections

with respect to NPA, assignment of debt were

raised by the Defendants before the Honble NCLT

in Section 7 IBC Petition preferred by AARC and

the same were rejected by the Honble NCLT vide

order dated 31.03.2017 (A-12 to reply to IA no.

843 of 2018). The Defendants had also filed a

Writ Petition challenging the vires of various

provisions of IBC and in consequence thereof the

order dated 31.03.2017 before the Honble High

Court Judicature, Jaipur,and the Honble Jaipur

High Court vide order dated 06.07.2017 admitted

the Writ Petition only on the issue of challenge

to vires of IBC which was finally dismissed on

15.07.2019 but refused to grant any stay of the

order dated 31.03.2017 (A-13 to reply to IA no.

843 of 2018). The said order of the High Court

was challenged by the Defendants before the

Honble Supreme Court and vide order dated

26.04.2017 the said SLP was dismissed by

the Honble Supreme Court. (A-14 to reply to IA

no. 843 of 2018). It is also brought to the

notice that the Defendants thereafter

challenged the order dated 31.03.2017 before the

Honble NCLAT in an Appeal and the Appeal was

dismissed as

14

OA No. 188/2013

14

- withdrawn with no liberty to challenge the

order dated 31.03.2017 vide order dated

17.07.2017 (A-17 to reply to IA no. 843 of 2018).

Thus it was contented that the order dated

31.03.2017 had attain finality. - It is further the argued that the Resolution Plan

as approved by the NCLT has attained finality as

the challenge to the same before Honble NCLAT

and Honble Supreme Court was dismissed vide

orders dated 29.10.2018 (A-21 to reply to IA no.

843 of 2018) and 05.03.2019 (A-23 to reply to IA

no. 843 - of 2018).

- The counsel has also placed on record judgement

passed by the Honble Supreme Court of India in

the matter of Committee of Creditors ofEssar

Steel India Ltd, through Authorized Signatory

Vs. Satish Kumar Gupta and Ors., (2020) 8 SCC

531, wherein it was clearly held that Resolution

Plan once sanctioned is binding on all, including

the guarantors. The Honble Supreme Court also

relied upon its judgment in the matter of State

Bank of India Vs. Ramakrishnan 2018(9) SCALE 597

to hold that the plan may exclude provision as to

payments to be made by such guarantor and Section

133 of the Contract Act will not apply. AARC has

also relied upon Lalit Kumar Jain vs. Union of

India Ors. (2021) SCC Online SC 396,which held

that approval of Resolution Plan, will not

discharge the guarantors. - The Applicant has specifically relied upon

the following judgments in support of the

contentions that discharge of principal borrower

under Insolvency Law of Company Law would not

absolve the Personal Guarantors - IN STATE BANK OF INDIA VS V RAMAKRISHNAN ORS.

(2018) 17 SCC

15

OA No. 188/2013

15

394, THE HONBLE SUPREME COURT HELD THAT

PARAGRAPH 24-25 22. Section 31 of the Act was

also strongly relied upon by the Respondents.

This Section only states that once a Resolution

Plan, as approved by the Committee of Creditors,

takes effect, it shall be binding on the

corporate debtor as well as the guarantor. This

is for the reason that otherwise, under Section

133 of the Indian Contract Act, 1872, any change

made to the debt owed by the corporate debtor,

without the suretys consent, would relieve the

guarantor from payment. Section 31(1), in fact,

makes it clear that the guarantor cannot escape

payment as the Resolution Plan, which has been

approved, may well include provisions as to

payments to be made by such guarantor. This is

perhaps the reason that Annexure VI(e) to Form 6

contained in the Rules and Regulation 36(2)

referred to above, require information as to

personal guarantees that have been given in

relation to the debts of the corporate 23

debtor. Far from supporting the stand of the

Respondents, it is clear that in point of fact,

Section 31 is one more factor in favour of a

personal guarantor having to pay for debts due

without any moratorium applying to save him. IN

LALIT KUMAR JAIN VS UNION OF INDIA ORS (2021

SCC ONLINE SC 396, THE HONBLE SUPREME COURT HELD

THAT PARAGRAPH 133, 136 It is therefore, clear

that the sanction of a resolution plan and

finality imparted to it by Section 31 does not

per se operate as a discharge of the

guarantor's liability. As to the nature and

extent of the liability, much would depend on the

terms of the guarantee itself. However, this

court has indicated, time and again, that an

involuntary act of the principal

16

OA No. 188/2013

16

- debtor leading to loss of security, would not

absolve a guarantor of its liability. In

Maharashtra State Electricity Board (supra) the

liability of the guarantor (in a case where

liability of the principal debtor was discharged

under the insolvency law or the Company law), was

considered. It was held that in view of the

unequivocal guarantee, such liability of the

guarantor continues and the creditor can realize

the same from the guarantor in view of the

language of Section 128 of the Contract Act as

there is no discharge under Section 134 of that

Act. - In view of the above discussion, it is held that

approval of a resolution plan does not ipso facto

discharge a personal guarantor (of a corporate

debtor) of her or his liabilities under the

contract of guarantee. As held by this court, the

release or discharge of a principal borrower

from the debt owed by it to its creditor,

by an involuntary process, i.e. by operation of

law, or due to liquidation or insolvency

proceeding, does not absolve the surety/guarantor

of his or her liability, which arises out of an

independent contract. - It was further argued by AARC, that since the

admission order passed by NCLT on 31.03.2017 and

the order approving the resolution plan

13.12.2017 have attain finality in light of the

orders passed by the Honble Supreme Court,

wherein the issues regarding NPA and

assignment of debt had been challenged by

the Defendants, thus the same cannot be

questioned again in the instant proceedings. - It was further argued that the claim filed by the

AARC and admitted by the Resolution Professional

as on 31.03.2017 was Rs. 69.12 Crore which has

also attain finality in view of the submissions

made hereinabove. Thus this Tribunal is now to

17

OA No. 188/2013

17

- consider the instant OA by taking into

account amount admitted under the CIRP of the

Principal Borrower as the amount claimed as on

31.03.2017 and provide interest on contractual

rates, thereafter. It is further submitted that

the amount received under the Resolution Plan of

Rs. 42.50 Crores by the AARC may be adjusted with

the interest and portion the balance amount, left

thereafter with the principal amount. - It was further the argued that borrowers also

challenged the Deed of Assignment executed

between AARC and SBI and sought a declaration

that the same be declared as null and void by way

of Civil Suit. The suit filed before Senior Civil

Judge, Jodhpur was registered as Suit No. 194 of

2015. The same was subsequently dismissed as

withdrawn vide order dated 05.02.2019(A-22 to

reply to IA no. 843 of 2018). The said argument

is already decided by the Honble Supreme Court

in the matter of APS Star wherein it was held

that borrower cannot challenge the Assignment

Deed. - On the issue of the grounds of the Defendants

that Personal Guarantor stand discharged in view

of approval of Resolution Plan which absolves the

principal borrower, it is the contention for the

counsel of AARC that Resolution Plan provides for

payment plan to cover part debt of AARC, to the

extent of 61.49 as on 31.03.2017 which is

Rs.42.50 Crores. Clause (f) at internal Pg. 7 of

the Resolution Plan clearly provides that AARC

to recover the balance dues by enforcement

of personal guarantee / corporate guarantee and

other third party collaterals as it is entitled

to as per law. It is the contention that the

Resolution Plan is binding on all concerned

including the guarantors, in terms of Section

31(1) and 238 of IBC and as such the Defendants

cannot take a contentions that they are absolved

of their obligations on approval of the

18

OA No. 188/2013

18

- Resolution Plan but on the contrary in view of

binding nature of the Resolution Plan, the

Defendants are obliged and duty bound to repay

the debt to the AARC. - The Resolution Plan records that the outstanding

of AARC as on 31.03.2017 is Rs. 69.12 Crores and

the Resolution Plan provides for the payment of

Rs. 42.50 Crores out of the outstanding as on

31.03.2017. It is submitted that the said amount

is already received by the AARC.(A-8 to reply to

IA 843 of 2018) - Ld. Counsel for the AARC has also stressed upon

the conduct of the Defendants and argued that the

defendants are not only chronic defaulters but

are also hindering the due process of law and in

support thereof various observations made in

orders passed by Honble NCLT, Honble NCLAT and

Honble Supreme Court have been relied upon and

placed on record along-with the reply to the IA.

The reliance is placed on the orders passed by

the Honble NCLT, NCLAT and Honble Supreme

Court, wherein costs were imposed on the

Defendants for not following the orders. The

Honble Supreme Court had also in the order dated

23.10.2017 had observed the conduct of the

Ex-Management of the Principal Borrower i.e

Defendants which reads as The facts of the

present case disclose a very sorry state of

affairs - Heard arguments in details and perused the record

carefully and findings are as under-. - On the issue of classification of account as NPA

- It is important to note at the outset that it

is not the case of the Defendants that in or

around 28.06.2010 (NPA classification date),

payments were made and there was no

irregularity on the date of proceeding under

19

OA No. 188/2013

19

- SARFEASI Act. Statement of account has been

produced, which established that no payments were

made. In fact, until the stage of initiation of

CIRP on 31.03.2017 no payments were made, thus

for 7 years from the date of NPA classification,

defaults continued till the admission of the

Petition u/s 7 of IBC and even thereafter. - 40. Furthermore, as per NPA classification

guidelines in case of restructuring are clear and

the reading of clause 11.2.4 clearly stablished

that in view of continued defaults, the

NPA classification cannot be questioned. In this

regard, the relevant clauses of RBI guidelines

are reproduced- - 11.2 Asset Classification

- The accounts classified as

- standard asset" should be immediately re-

classified as sub-standard assets" upon

restructuring. - The non-performing assets, upon

- restructuring, would continue to have the

same asset classification as prior to

restructuring and slip into further lower asset

classification categories as per extant asset

classification norms with reference to the pre-

restructuring repayment schedule. - ..

- In case, however, satisfactory performance

after the specified period is not - evidenced, the asset classification of the

restructured account would be governed as per

the applicable prudential norms with

20

OA No. 188/2013

20

- reference to the pre-restructuring payment

schedule. - Specified Period

- Specified Period means a period of one year from

the date when the first payment of interest

or installment of principal falls due - under the terms of restructuring package.

- Satisfactory Performance

- Non-Agricultural Term Loan Accounts

- In the case of non-agricultural term loan

accounts, no payment should remain overdue for a

period of more than 90 days. In addition there

should not be any overdues at the end of the

specified period. - In para above the details of default and

calculation of 90 day as submitted by the counsel

for AARC is reproduced which remained

un-rebutted as Defendants have failed to prove

making of payments during this period.

Furthermore, the Honble Delhi High Court vide

order dated 05.07.2018 granted liberty to AARC to

issue fresh Section 13(2) SARFEASI Act notice,

which was issued on 01.02.2017 declaring the

account as NPA on 30.06.2015 w.e.f. 29.06.2010.

Admittedly, this also remained un-rebutted. In

view of this there is no iota doubt that the

account was irregular and NPA much before the

filing of the OA and assignment of debt by SBI to

AARC. - It is also relevant to note here that Defendants

have been unsuccessfully raising similar

issues before various Courts/Tribunals. Similar

issue of NPA classification and assignment of

debt were raised before Honble NCLT Delhi,

21

OA No. 188/2013

21

- opposing the Section 7 IBC petition. After

consideration of the same, the objection was

rejected and Section 7 petition was admitted vide

order dated 31.03.2017. Appeal challenging the

said order before the Honble NCLAT, New

Delhi was withdrawn without liberty as recorded

in the order dated 17.07.2017. Subsequently,

resolution plan was approved by the Honble NCLT,

New Delhi vide order dated 13.12.2017, which was

upheld by the Honble NCLAT, New Delhi vide order

dated 29.10.2018 and by the Honble Supreme Court

vide order dated 05.03.2019. Therefore, on this

ground also the issue raised is meritless and

therefore, rejected. - I also find force in the submission of the

counsel for the Applicant that classification of

NPA is not a pre-condition for filing of OA under

Section 19 (1) of the RDB Act. - In view of the above, I find no merit in the

contentions qua maintainability of this O.A,

merely on the ground of classification of

account as NPA. - The second contention of the Defendants is also

devoid of merits. In view of the law reiterated

by the Honble Supreme Court in the matter of

Lalit Kumar Jain (supra) and Essar Steel

(supra)sanction of Resolution Plan does not

result in absolving the personal and corporate

guarantors from their liability. In view of the

judgements of the Honble Supreme Court, it is

settled law that process of absolving of

Principal Borrower by Operation of law under

Insolvency Law or Company Law will not

automatically result in absolving of personal

guarantors, which ratio is directly applicable

to the given facts and therefore, no further

discussion is required on the said issue. - The objection is further meritless as admittedly,

the Resolution Plan does not provide for full and

final clearance of entire dues

22

OA No. 188/2013

22

and only covers part of the debt of AARC. Further

AARCs right to recover the balance amount

from the Personal Guarantors is clearly

provided for under the Resolution Plan. The said

Resolution Plan which was approved by the Honble

NCLT, was also upheld by the Honble NCLAT and

Honble Supreme Court of India. Admittedly,

defendants in the instant OA had approached

Honble NCLAT and Honble Supreme Court of India

challenging the Resolution Plan. As the plan has

already attained finality and clause (f) at Page

No.7 of the Resolution Plan is an integral part

of the plan, even on merits the said contention

deserves to be dismissed. On this issue the

judgment relied upon by Ld. Counsel for applicant

are required to be discussed as under-

III.

Resolution Plan under Insolvency Bankruptcy

Code is binding upon the Corporate Debtor and

Secured Creditor can still continue recovery

proceedings against the Guarantor

1. In State Bank of India Vs V RamakrishnanOrs

(2018) 17 SCC 394, the Honble Supreme Court held

that Paragraph 24- 25 The scheme of Section

60(2) and (3) is thus clear the moment there is

a proceeding against the corporate debtor pending

under the 2016 Code, any bankruptcy proceeding

against the individual personal guarantor will,

if already initiated before the proceeding

against the corporate debtor, be transferred to

the National Company Law Tribunal or, if

initiated after such proceedings had been

commenced against the corporate debtor, be filed

only in the National Company Law Tribunal.

However, the Tribunal is to decide such

proceedings only in accordance with the

Presidency-Towns Insolvency Act, 1909 or the

Provincial Insolvency Act, 1920, as the case may

be. It is clear that sub-section (4), which

states that the Tribunal shall be vested with all

the powers of the Debt Recovery Tribunal, as

contemplated under Part III of this Code, for the

purposes of sub-section (2), would not take

effect, as the Debt Recovery Tribunal has not

yet been empowered to hear bankruptcy

proceedings against individuals under Section

179 of the Code, as the said Section has not yet

been brought into force. Also, we have seen that

Section 249, dealing with the consequential

amendment of the Recovery of Debts Act to empower

Debt Recovery Tribunals to

23

OA No. 188/2013

23

- try such 22 proceedings, has also not been

brought into force. It is thus clear that Section

2(e), which was brought into force on 23.11.2017

would, when it refers to the application of the

Code to a personal guarantor of a corporate

debtor, apply only for the limited purpose

contained in Section 60(2) and (3), as stated

hereinabove. This is what is meant by

strengthening the Corporate Insolvency Resolution

Process in the Statement of Objects of the

Amendment Act, 2018. 22. Section 31 of the Act

was also strongly relied upon by the Respondents.

This Section only states that once a Resolution

Plan, as approved by the Committee of Creditors,

takes effect, it shall be binding on the

corporate debtor as well as the guarantor. This

is for the reason that otherwise, under Section

133 of the Indian Contract Act, 1872, any change

made to the debt owed by the corporate debtor,

without the surety"s consent, would relieve the

guarantor from payment. - Section 31(1), in fact, makes it clear that the

guarantor cannot escape payment as the Resolution

Plan, which has been approved, may well include

provisions as to payments to be made by such

guarantor. This is perhaps the reason that

Annexure VI(e) to Form 6 contained in the

Rules and Regulation 36(2) referred to above,

require information as to personal guarantees

that have been given in relation to the debts of

the corporate 23 debtor. Far from supporting the

stand of the Respondents, it is clear that in

point of fact, Section 31 is one more factor

in favour of a personal guarantor having to

pay for debts due without any moratorium applying

to save him. - In Lalit Kumar Jain Vs Union of India Ors (2021

SCC Online SC 396, the Honble Supreme Court held

that Paragraph 133, 136 - It is therefore, clear that the sanction of a

resolution plan and finality imparted to it by

Section 31 does not per se operate as a discharge

of the guarantor's liability. As to the nature

and extent of the liability, much would depend on

the terms of the guarantee itself. - In view of the above discussion, it is held that

approval of a resolution plan does not ipso facto

discharge a personal guarantor (of a corporate

debtor) of her or his liabilities under the

contract of guarantee. As held by this court, the

release or discharge of a principal borrower from

the debt owed by it to its creditor, by an

involuntary process, i.e. by operation of law,

or due to liquidation or insolvency

proceeding, does not absolve the surety/guarantor

of his or her liability, which arises out of an

independent contract. - In Committee of Creditors of Essar Steel India

Ltd through Authorized Signatory Vs Satish Kunar

Gupta Ors (2020) 8 SCC 531, the Honble Supreme

Court of India held that Paragraph 105, 106

24

OA No. 188/2013

24

Section 31(1) of the Code makes it clear

that once a resolution plan is approved by the

Committee of Creditors it shall be binding on all

stakeholders, including guarantors. This is for

the reason that this provision ensures that the

successful resolution applicant starts running

the business of the corporate debtor on a fresh

slate as it were. In State Bank of India v. V.

Ramakrishnan, 2018 (9) SCALE 597, this Court

relying upon Section 31 of the Code has

held 22. Section 31 of the Act was also

strongly relied upon by the Respondents. This

Section only states that once a Resolution Plan,

as approved by the Committee of Creditors, takes

effect, it shall be binding on the corporate

debtor as well as the guarantor. This is for

the reason that otherwise, Under Section 133

of the Indian Contract Act, 1872, any change made

to the debt owed by the corporate debtor, without

the surety's consent, would relieve the guarantor

from payment. Section 31(1), in fact, makes

it clear that the guarantor cannot escape

payment as the Resolution Plan, which has been

approved, may well include provisions as to

payments to be made by such guarantor. This is

perhaps the reason that Annexure VI(e) to Form 6

contained in the Rules and Regulation

36(2) ...referred to above, require information

as to personal guarantees that have been given in

relation to the debts of the corporate debtor.

Far from supporting the stand of the

Respondents, it is clear that in point of fact,

Section 31 is one more factor in favour of a

personal guarantor having to pay for debts due

without any moratorium applying to save

him. Following this judgment, it is

difficult to accept Shri Rohatgi"s argument

that that part of the resolution plan which

states that the claims of the guarantor on

account of subrogation shall be extinguished,

cannot be applied to the guarantees furnished

by the erstwhile directors of the corporate

debtor. So far as the present case is concerned,

we hasten to add that we are saying nothing which

may affect the pending litigation on account

of invocation of these guarantees. However,

the NCLAT judgment being contrary to Section

31(1) of the Code and this Court"s judgment in

State Bank of India (supra), is set aside. 47.

No arguments have been advanced by the Defendants

on the merits of the OA claim and there is no

challenge to execution of guarantee deeds. The

witnesses of the Applicant have fully

corroborated the averments in the OA. Even

otherwise the whole case is based on documents

and the witnesses have fully proven all the

documents. On careful perusal of the documents

filed and exhibited with the OA and duly

supported with the

25

OA No. 188/2013

25

documents, AARC has been successful in

establishing its claim as prayed for in para 6 of

the OA and the same is accordingly allowed. IV.

Ld. Counsel for the AARC alongwith the Written

Submission has placed on record updated

statement of account after adjustment of amount

received under the resolution plan, which is

reproduced hereinbelow

Period Amount

Upto 21.07.2013 (date of filing of the OA) Rs. 39,69,10,137.88/-

Upto 31.03.2017 (alongwith contractual rate of interest, forming part of the resolution plan approved by NCLT) Rs. 69,12,00,000.00/-

Minus amount received under the resolution plan on 13.12.2017 Rs. 42,50,00,000.00/-

Outstanding as on 13.12.2017 after the adjustment of the amount received Rs. 26.62 Crores Outstanding as on 13.12.2017 after the adjustment of the amount received Rs. 26.62 Crores

V. On the basis of documents, so filed this

Tribunal is inclined to grant contractual rate of

interest as in case of a commercial transaction

rate of interest is agreed upon between the

parties and therefore there is no reason to alter

the agreed contractual terms. It has been

repeatedly held that defaulters should not be

given a premium by reducing the rate of interest

as against Debtor who is diligent and is

regular in payment of instalments. In fact

against defaulters the lenders have to take legal

steps for recovery and therefore, defaulting

party cannot have benefit of lesser rate of

interest. In this regard reliance is placed on

Indian Bank vs. Blue Jaggers States Ltd. (2010) 8

SCC 129 and Punjab Financial Corporation vs Surya

Auto Industries (2010) 1 SCC 297.

26

OA No. 188/2013

26

VI. Another reason for awarding contractual

rate of interest is arising of the record placed

by the parties in IA No. 843 of 2018 by way of

Application, Reply and Written Submission. The

same establish that the Defendants conduct has

been misleading and malicious. Defendants at no

stage made any attempts to clear the outstanding

and initiated various legal proceedings, raising

similar issues, which have been rejected by the

Honble Supreme Court, NCLAT and NCLT.

As such the amount of Rs. 39,69,01,137.88/- as

claimed is payable by Defendant Nos. 2 to 7

jointly and severally alongwith pendente-lite

and future interest. This Tribunal is inclined to

grant the same at contractual rate of interest

i.e. 14.70 per annum w.e.f. 21.07.2013till the

date of actual realization subject to adjustment

of an amount of Rs. 42.50 crores which is

already received by AARC under

the Resolution Plan as on 13.12.2017.

VII.

VIII. The table below shows the amount to

be recovered by applicant AARC from Defendants

No. 2 to 7.

Suit Filed Amount as on 21.07.2013 Rs. 39,69,01,137.88

Interest _at_ 14.70 p.a from 21.07.2013 to 13.12.2017 Rs. 25,67,21,477.00

TOTAL Rs. 65,36,31,614.88

(Less amount received under the Resolution Plan) (-) Rs. 42,50,00,000.00

Balance amount to be recovered as on 13.12.2017 Rs. 22,86,31,614.88

IX. In the light of the above discussion the

Original Application deserves to be allowed

against Defendant Nos. 2 to 7.

The OA is allow and Defendant Nos. 2 to 7 are

held liable to pay to the Applicant/AARC

jointly and severally a sum of Rs.

22,86,31,614.88 as on

I.

27

OA No. 188/2013

27

13.12.2017 alongwith pendente-lite and future

interest

at contractual rate i.e. 14.70 per annum from

13.12.2017 till the date of actual realization,

within a period 30 days failing which the

same shall be recovered through sale of

already identified and attached and other

assets of Defendant Nos. 2 to 7. The cost of

litigation of Rs. 1.50 Lakhs shall also be paid

by the Defendant Nos. 2 to 7 to the

Applicant/AARC. Recovery Certificate be issued

forthwith and be send to the Recovery

Officer. IV. The attachment order dated

21.02.2020 qua the properties of Defendants

mentioned in IA Nos. 176 of 2017 and 134 of 2017

will continue and the Recovery Officer shall

proceed with taking steps for the sale of the

said properties for the recovery of the

outstanding dues. Parties are directed to appear

before the Recovery Officer on 04.07.2022. VI.

Copy of judgment and recovery certificate be send

to all parties free of cost. File be consigned to

record room.

II.

III.

V.

VII.

(Vivek Saxena) Presiding Officer, Debts Recovery

Tribunal, Jaipur Order pronounced in the open

court today i.e. 18.05.2022.

(Vivek Saxena) Presiding Officer, Debts Recovery

Tribunal, Jaipur

Place-Jaipur Dated-18.05.2022

28

OA No. 188/2013

28

- BEFORE THE DEBTS RECOVERY TRIBUNAL, JAIPUR

PRESENT- SHRI VIVEK SAXENA - PRESIDING OFFICER

- O.A. NO. 188 OF 2013

- DATE OF DELIVERY OF ORDER 18.05.2022

- RECOVERY CERTIFICATE

- (UNDER SUB Section 22 of the Recovery of Debts

due to Banks and Financial Institutions Act, 1993

(Act 51 of 1993) - ALCHEMIST ASSET RECONSTRUCTION COMPANY LTD.

- Having its Regd. Office at D-54, Defence Colony

(First Floor), New Delhi-110024 through its Vice

President. - ..Applicant Bank

- VERSUS

- M/S. HOTEL GAUDAVAN PVT. LIMITED, Having its

- Reged. Office at C-22, Vaishali Nagar, Jaipur

302021

29

OA No. 188/2013

29

- STATE BANK OF BIKANER JAIPUR, Industrial

- Finance Branch, IInd Floor, Tambi Towers,

S.C. Road through its Assistant General Manager. - Defendants.

- Recovery Certificate for Rs. 22,86,31,614.88/-

- In terms of final order dated 18.05.2022 passed

by this Tribunal in the above mentioned case, it

is ordered that the- - The OA is allow and Defendant Nos. 2 to 7 are

held liable to pay to the Applicant/AARC

jointly and - severally a sum of Rs. 22,86,31,614.88 as on

13.12.2017 alongwith pendente-lite and future

interest

at contractual rate i.e. 14.70 per annum from

13.12.2017 till the date of actual realization,

within a period 30 days failing which the

same shall be recovered through sale of

already identified and attached and other

assets of Defendant Nos. 2 to 7. The cost of

litigation of Rs. 1.50 Lakhs shall also be

II.

paid by the Defendant Nos. 2 to 7 to the

Applicant/AARC. Recovery Certificate be issued

forthwith and be send to the Recovery

Officer. IV. The attachment order dated

21.02.2020 qua the properties of Defendants

mentioned in IA Nos. 176 of 2017 and 134 of 2017

will continue and the Recovery Officer shall

proceed with taking steps for the sale of the

said properties for the recovery of the

outstanding dues. Parties are directed to appear

before the Recovery Officer on 04.07.2022.

III.

V.

The Recovery Officer shall realize the amount as

per this Certificate in the manner and mode

prescribed under Section 25 and 28 of the

Recovery of Debts Due

30

OA No. 188/2013

30

to Banks and Financial Institutions Act, 1993 (as

amended from time to time) from the above named

Certificate Debtor. This Certificate has been

issued under my signatures and seal of the

Tribunal on this 18.05.2022. (Vivek

Saxena) Presiding Officer, Debts Recovery

Tribunal, Jaipur Place-Jaipur Dated-18.05.2022

31

OA No. 188/2013

31

- FORM NO. 10

- See Regulation-24(1)

- DEBTS RECOVERY TRIBUNAL

- First Floor, Sudharma-II, Opp.Kisan Bhawan, Lal

Kothi Shopping Centre, Tonk Road, JAIPUR- 302015 - SCHEDULED TO RECOVERY CERTIFICATE MEMO OF COST

- O.A No. 188 of 2013

- ALCHEMIST ASSET RECONSTRUCTION COMPANY LTD.

- Having its Regd. Office at D-54, Defence Colony

(First Floor), New Delhi-110024 through its Vice

President. - ..Applicant Bank

- VERSUS

- M/S. HOTEL GAUDAVAN PVT. LIMITED, Having its

- Reged. Office at C-22, Vaishali Nagar, Jaipur

302021 - SHRI LOKENDRA SINGH RATHORE S/o. Shri Dilip

- Singh Rathore r/o D-9 Paschim Vihar, Vaishali

Nagar, Jaipur 302021 Director Guarantor of M/s

Hotel Gaudavan Pvt. Ltd. - SHRI HARENDRA SINGH RATHORE S/o. Shri Dilip

- Singh Rathore r/o D-9 Paschim Vihar, Vaishali

Nagar, Jaipur 302021 Director Guarantor of M/s

Hotel Gaudavan Pvt. Ltd.

32

OA No. 188/2013

32

S. No. Item of Costs Amount in Rupees

1. Fee on the application 1,50,000

2. Process Fees (inc. Publication) 821

3. Advocate Fees 1,250

4. Commissioner/Receivers/Valuation/ Security Fee NIL

5. Miscellaneous Charges NIL

Total Costs 1,52,071

(Vivek Saxena) Presiding Officer, Debts Recovery

Tribunal, Jaipur

Place-Jaipur Dated-18.05.2022

33

OA No. 188/2013

33

18.05.2022 Counsel Shri Akarsh Mathur along with

Ms. Jayshree Das Gupta Sh. Abhishek Saxena,

Counsel for the applicant Sh. Saurabh Jain, Ld.

Counsel for the Defendant No. 1, M/s Hotel

Gaudawan Pvt. Ltd. Sh. Sudeep Singh Hora alongwith

Sh. Manish, Counsel for Defendant No. 2, Sh.

Lokendra Singh Rathore Sh. Sarash Saini along

with Sh. Puneet Gupta, Ld. Counsel for Defendant

No. 3 Sh. R.K. Salecha, Ld. Counsel for Defendant

No. 6, Jitendra Singh Rathore, Smt. Arti Sharma,

Counsel for Defendant No. 8. None for Defendant

No. 4, 5, 7 Judgment dictated separately and

pronounced in the open court. As per order the

O.A. is allowed. Recovery Certificate be prepared

accordingly and the Registry is directed to

verify the Recovery Certificate as per Regulation

24(1) and (2) of Debts Recovery Tribunal Jaipur

Regulation 2015 and after verification place the

same before the Tribunal.

(Vivek Saxena) Presiding Officer, Debts Recovery

Tribunal, Jaipur

34

OA No. 188/2013

34

18.05.2022 Counsel Shri Akarsh Mathur along with

Ms. Jayshree Das Gupta Sh. Abhishek Saxena,

Counsel for the applicant Sh. Saurabh Jain, Ld.

Counsel for the Defendant No. 1, M/s Hotel

Gaudawan Pvt. Ltd. Sh. Sudeep Singh Hora alongwith

Sh. Manish, Counsel for Defendant No. 2, Sh.

Lokendra Singh Rathore Sh. Sarash Saini along

with Sh. Puneet Gupta, Ld. Counsel for Defendant

No. 3 Sh. R.K. Salecha, Ld. Counsel for Defendant

No. 6, Jitendra Singh Rathore, Smt. Arti Sharma,

Counsel for Defendant No. 8. None for Defendant

No. 4, 5, 7 The Tribunal vide order dated

18.05.2022, directed the Registrar to verify

the Recovery Certificate as per Regulation 24(1)

and (2) of Debts Recovery Tribunal Jaipur

Regulation 2015.

The Registrar vide order dated Recovery

Certificate as per Regulation

18.05.2022 verified the 24(1) and (2) of Debts

Recovery Tribunal Jaipur Regulation 2015.

Recovery Certificate is prepared accordingly.

Copy of the Judgment and Recovery

Certificate be given free to the concerned

parties as well as be sent to the Recovery

Officer for further proceedings. File be put up

before the Registrar for compliance. After

compliance file be consigned to record.

(Vivek Saxena) Presiding Officer, Debts Recovery

Tribunal, Jaipur

35

OA No. 188/2013

35

DEBTS RECOVERY TRIBUNAL, JAIPUR

ORIGINAL APPLICATION NO. 188 of 2013 The Recovery

Certificate prepared in compliance of order dated

18.05.2022 passed by Honble Presiding Officer,

DRT, Jaipur in Original Application No. 188

of 2013 Title- ALCHEMIST ASSET RECONSTRUCTION

COMPANY LTD.Vs. M/S. HOTEL GAUDAVAN

PVT. LIMITED and Ors has been checked and may be

verified.

Section Officer

Assistant Registrar On the basis of the report

of Section Officer the Recovery Certificate is

verified. The Recovery Certificate is placed

below for the signature of Honble Presiding

Officer please.

Assistant Registrar

Honble Presiding Officer