Forecasting For Operational Decisions - PowerPoint PPT Presentation

1 / 30

Title:

Forecasting For Operational Decisions

Description:

The trend-cycle can be estimated by smoothing the series to reduce random variation. ... No trend. Exponentially declining weight given to past observations. Model: ... – PowerPoint PPT presentation

Number of Views:45

Avg rating:3.0/5.0

Title: Forecasting For Operational Decisions

1

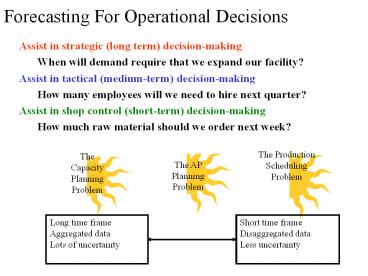

Forecasting For Operational Decisions

- Assist in strategic (long term) decision-making

- When will demand require that we expand our

facility? - Assist in tactical (medium-term) decision-making

- How many employees will we need to hire next

quarter? - Assist in shop control (short-term)

decision-making - How much raw material should we order next week?

Long time frame Aggregated data Lots of

uncertainty

Short time frame Disaggregated data Less

uncertainty

2

Forecasting Methods

Time frame of decision

short

long

much

Quantitative tools that can incorporate current

information. - Averaging - Exponential smoothing

Quantitative tools that can incorporate a great

deal of historical information. - Causal

methods - Time series

Experience with decision

Qualitative tools that use very rich sources of

data. - Judgement methods - Market research

none

3

(No Transcript)

4

- Goals

- Predict future from past

- Smooth out noise

- Standardize forecasting procedure

5

Patterns in Time-Series Data

TREND

Sale of fuel oil in gallons

CYCLE

SEASON

RANDOM

Time

6

Time Series Forecasting

Forecast

Historical Data

Time series model

A(i), i 1, ,t

f(tt), i 1, 2,

7

Moving Average

- Average most current values to predict future

outcomes. The trend-cycle can be estimated by

smoothing the series to reduce random variation. - Assumptions

- No trend

- Equal weight to last m observations

- Model

8

Averaging Techniques Example

What if we used a three period moving average but

weighted the historical data as follows nearest

periods weight .6, second periods weight .3

and most distant period .1? What are the

advantages and disadvantages of using a weighted

average?

9

(No Transcript)

10

(No Transcript)

11

(No Transcript)

12

(No Transcript)

13

Cum error cum ave abs error

Running MAD

-19.54 Cumulative Forecast Error 151.58 Mean

Squared Error 12.31 Standard Deviation

8.81 Mean Absolute Deviation -.0729 Mean

Percent Error 0.1742 Mean Abs. Percent Error

14

Exponential Smoothing

- Estimate next outcome with a weighted combination

of the forecast for previous period and the most

recent outcome - Assumptions

- No trend

- Exponentially declining weight given to past

observations - Model

F(t) Forecast in period t x(t) Actual demand

in period t smoothing constant is alpha

15

.1(20.2).9(10.5) 11.47

.65(27.60).35(41.48) 32.46

16

Exponential Smoothing with a Trend

- Assumptions

- Linear trend

- Exponentially declining weights to past

observations/trends - Model

F(t) Forecast in period t x(t) Actual demand

in period t ? ? smoothing constants (values

between 0 and 1) T(t) Trend component in period

t

17

Example Single Exponential Smoothing with

Trend Use last problems data to provide a SEST

forecast (?.55 ? .09)

Period 3 From period 2 x(2) 20.2, F(2)

10.5, T(2) 0

16.31

Period 4 From period 3 x(3) 23.9, F(3)

15.83, T(3) .48

21.34

Period 5 ?

18

Double Exponential Smoothing

- Special case of the Holts linear method - where

the two parameters (? ?) assumed to be equal. - Model

F(t) Forecast in period t x(t) Actual demand

in period t ? smoothing constant

19

Double Exponential Smoothing Use last problems

data to provide a DES forecast (?.79)

Period 3 From period 2 x(2) 20.2, F(2)

10.5

Period 4 From period 3 x(3) 23.9, F(3)

18.16, F(3)16.55

Period 5 ?

20

(No Transcript)

21

(No Transcript)

22

(No Transcript)

23

(No Transcript)

24

Regression of original and deseasonalized data

253.05 2.5615 291.4 (291.4).93 271.0

Reseasonalized (intercepttrend)season

25

Regression Equation for Deseasonalized data

253.05 2.56P

26

(No Transcript)

27

Forecasting example You must prepare a forecast

of product demand in order to plan for

appropriate production quantities. You receive

the following historical information from

marketing Month Sales

Advertising in thousands

in thousand s 1 264 2.5 2 116 1.3 3 165

1.4 4 101 1.0 5 209 2.0

28

(No Transcript)

29

(No Transcript)

30

Conclusions

- Sensitivity Lower values of m or higher values

of a will make moving average and exponential

smoothing models (without trend) more sensitive

to data changes (and hence less stable). - Trends Models without a trend will underestimate

observations in time series with an increasing

trend and overestimate observations in time

series with a decreasing trend. - Smoothing Constants Choosing smoothing constants

is an art the best we can do is choose constants

that fit past data reasonably well. - Seasonality Methods exist for fitting time

series with seasonal behavior (e.g., Winters

method), but require more past data to fit than

the simple models given here. - Judgement No time series model can anticipate

structural changes not signaled by past

observations these require judicious overriding

of the model by the user.