Best Home Loan in India - Citi Bank

Title:

Best Home Loan in India - Citi Bank

Description:

Citibank Offers home loans with low EMIs & attractive interest rates. Get loans online up to 10 Crore and leverage Home Credit to decide what interest you pay on your dream home. – PowerPoint PPT presentation

Number of Views:73

Title: Best Home Loan in India - Citi Bank

1

PROPERTY

INSIGHTS

India Quarter 2, 2015

UPTICK IN ECONOMY, BETTER GROWTH PROSPECTS INDIA

MARKET OVERVIEW

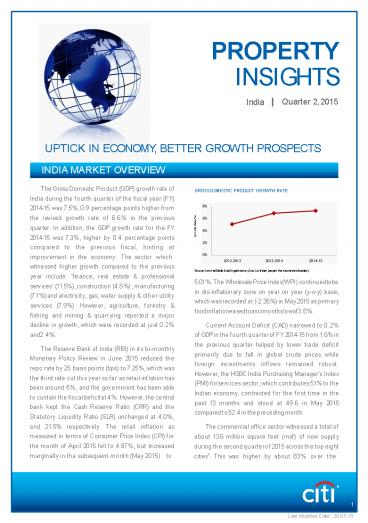

The Gross Domestic Product (GDP) growth rate of

India during the fourth quarter of the fiscal

year (FY) 2014-15 was 7.5, 0.9 percentage

points higher from the revised growth rate of

6.6 in the previous quarter. In addition, the

GDP growth rate for the FY 2014-15 was 7.3,

higher by 0.4 percentage points compared to the

previous fiscal, hinting at improvement in the

economy. The sector which

GROSS DOMESTIC PRODUCT GROWTH RATE

Growth Rate ()

witnessed higher growth compared to the previous

year include finance, real estate

professional services (11.5), construction

(4.8), manufacturing (7.1) and electricity,

gas, water supply other utility services

(7.9). However, agriculture, forestry fishing

and mining quarrying reported a major decline

in growth, which were recorded at just 0.2 and

2.4.

Source Central Statistical Organisation, Govt.

of India (as per the revised estimates)

5.01. The Wholesale Price Index(WPI)

continuedtobe in dis-inflationary zone on year

on year (y-o-y) basis, which was recorded at

(-2.36) in May 2015 as primary

foodinflationeasedtoasixmonthslowof3.8.

Current Account Deficit (CAD) narrowed to 0.2

of GDP in the fourth quarterof FY 2014-15 from

1.6 in the previous quarter helped by lower

trade deficit primarily due to fall in global

crude prices while foreign investments inflows

remained robust. However, the HSBC India

Purchasing Managers Index (PMI) forservices

sector, which contributes 51 to the Indian

economy, contracted for the first time in the

past 13 months and stood at 49.6 in May 2015

compared to 52.4 in the preceding month.

The Reserve Bank of India (RBI) in its bi-monthly

Monetary Policy Review in June 2015 reduced the

repo rate by 25 basis points (bps) to 7.25,

which was the third rate cut this year so far as

retail inflation has been around 5, and the

government has been able to contain the

fiscaldeficitat 4. However, the central bank

kept the Cash Reserve Ratio (CRR) and the

Statutory Liquidity Ratio (SLR) unchanged at

4.0, and 21.5 respectively. The retail

inflation as measured in terms of Consumer Price

Index (CPI) for the month of April 2015 fell to

4.87, but increased marginally in the

subsequent month (May 2015) to

The commercial office sector witnessed a total of

about 13.6 million square feet (msf) of new

supply during the second quarterof 2015 across

the top eight cities1. This was higher by

about 83 over the

1

2

preceding quarter as Chennai (17 times) and Pune

(5 times) saw a very substantial increase in the

supply. Similarly, total net absorption too

noted an increase by 25 from the previous

quarter to 9.9 msf, led by Bengaluru with 37

share in total net absorption followed by Pune

with 23 share. Overall vacancy level inched up

marginally by 0.13 percentage point over the

previous quarter and was recorded at 20.1 on

the back ofhuge supplyinflux.

(FC Road, Koregaon Park and Aundh) and Bengaluru

(Brigade Road) witnessed rentals declined by 2-5

owing to limited demand. Lower Parel and

Goregaon in Mumbai and Kamanahalli in Bengaluru

were the only main-streets where rentals

appreciated (q-o-q) by 13-15 and 7

respectively owing to limited availability

ofqualityspaceamidst increased enquiries.

In the residential sector, about 28,100 units

were launched in the top eight cities during the

second quarter of 2015, an increase of 14 over

the previous quarter. Within the total unit

launched this quarter, Delhi-NCR had the highest

share at 25, followed by Bengaluru with a 16

share. Capital values during the quarter

remained stable across most cities in comparison

to the previous quarter owing to slow pace of

sales velocity. However, few submarkets in

Kolkata and Pune witnessed appreciation in

capital values in 1-4 range for mid segment

units on the back of steady demand. Also,

high-end and luxury segments of a few submarkets

in Kolkata and Delhi- NCR respectively witnessed

about 3 appreciation in capital values on a

q-o-q basis. Residential sales are likely to

improve as banks have started reducing lending

rates on home loans.

In the retail sector, no new mall supply was

added during the second quarter of 2015. As a

result, overall mall vacancy levels of the top

eight cities declined by 1.1 percentage points to

13.6. In addition, three malls with high

vacancy levels, were closed this quarter in

Mumbai, contributing to a decline in overall

vacancy levels. Mall rentals remained stable

across most cities. However, certain submarkets

in western region of Mumbai (Kandivali, Kurla,

Thane, Bhandup-Mulund) and Pune (Hadapsar)

reported quarter-on-quarter (q-o-q) rental

decline of 7-9 decline owing to high

availabilities, low demand and competitive

pressure. Additionally, mall rentals in

Somajiguda and NTR Gardens in Hyderabad

witnessed double-digit decline (14-20) due to

decline in footfalls and lack of demand.

Rentals in certain main streets in Pune

Trends Updates

Economic Trends The Consumer Price Index (CPI)

increased marginally from (a three month low of)

4.87 recorded in April 2015 to 5.01 in May

2015. However, the CPI remained well within the

central bank's targetted comfort zone,

suppressing insecurities arising out of

forecasted rainfall deficit this year. Though

the Wholesale Price Index (WPI) remained in

dis-inflationary zone, it recorded narrower dis-

inflation in May 2015 at (-2.4) compared to

(-2.7) in the previous month. The inflation for

the minerals remained in sub-zero zone (-28.4)

for the tenth conseutive month, owing to about

36 fall in average price for the Indian crude

oil basket. Primary food inflation further eased

to a six month low of 3.8 in May 2015. The core

inflation (non-food manufactured products)

further fell to (-0.65) in May as against

(-0.41) in the previous month. 1Ahmedabad,

Bengaluru, Chennai, Delhi-NCR, Hyderabad,

Kolkata, Mumbai and Pune.

EXCHANGE RATE MOVEMENT (INR/USD)

INR/USD

Source RBI

FDI INFLOW IN HOUSING AND REAL ESTATE SECTOR

INR Crore

Source Dept. of Industrial Policy Promotion,

Govt, of India

2

3

In light of controlled CPI and WPI, the RBI

reduced repo rate by 25 bps to 7.25 in its

Bi-Monthly Monetary Policy Review held in June

2015. However, the centralbank has keptthe CRR

and SLR unchanged at 4.0 and 21.5

respectively. Further easing in key policy rates

are expected from the central bank owing to

positive macro-economic data such as controlled

twin deficit (current and fiscal deficits) and

inflation within comfort zone. The Indian

economy is projected to grow at 7.5 in the FY

2015-16.

BSE REALTY INDEX

Source BSE

previous year. Of this about 2.4 was attracted

by the construction development sector

(comprising townships, housing, built-up

infrastructure) totalling around INR 4,582

crores. On the back of robust foreign capital

inflows, the central bank added a whopping USD

61.4 billion to the foreign exchange reserves in

FY 2014-15, significantly higher from USD 15.5

billion in the previous fiscal.

The central governmenthas been able to achieve

better than targetted numbers on fiscal deficit

and revenue deficit front, which have been

confined to 4.0 and 2.8 for the FY 2014-15, as

against the targets of 4.1 and 2.9

respectively. The Current Account Deficit (CAD)

narrowed to 0.2 of GDP in the fourth quarter of

FY 2014-15 from 1.6 in the previous quarter.

CAD for the FY 2014-15 was also lower at 1.3 of

GDP compared to 1.7 in the previous fiscal,

primarily on account of lower crude oil prices

and robust foreign capital inflows.

The BSE Realty Index dropped by 251.25 points to

close at 1,413.26 points at the end of June 2015

due to capital outflows from FIIs especially in

the month of May amidst tax notices sent by the

Finance Ministry to the FIIs for the Minimum

Alternative Tax (MAT) payments forprevious years.

For the FY 2014-15, the FII investments in equity

and debt markets together stood at around INR

250,670 crores (USD 41 billion). However, the

Indian Rupee came under pressure as it fell

against the US dollar during the second quarter

of 2015 to INR 64.08 in June from INR 62.56 in

March as FIIs pulled out money from Indian

equities in the month of May amidst concerns

over Minimum Alternative Tax (MAT) notices and

subdued corporate earnings during the Jan-March

quarter.

The Cabinet Cabinet Committee on Economic

Affairs (CCEA) approved the low cost housing

scheme for promoting affordable housing for the

urban poor under the Housing for All by 2022

initiative in June 2015. Accordingly, the

interest subsidy has been hiked to 6.5 on

housing loans to beneficiaries belonging to

economically weakersections (EWS) including slum

dwellers and low-income groups (LIG).

The total Foreign Direct Investment (FDI) inflows

in India during FY 2014-15 were recorded at INR

189,107 crores (USD 31 billion), an increase of

28 over the

Residential Trends Capital values across most

cities remained stable on q-o-q basis owing to

slow pace of sales velocity amidst subdued

demand. However, select submarkets in

mid-segment in Kolkata witnessed about 2-4

q-o-q appreciation in capital values owing to

steady demand and improved infrastructure.

Additionally, luxury segment in Gurgaon

submarket in Delhi-NCR witnessed about 3

appreciation in capital values over the previous

RESIDENTIAL CAPITAL VALUES GROWTH INDEX

Source Cushman Wakefield Research

4

quarter, on the back of increased demand from

investors. In the near term, the capital values

are likely to remain stable until the demand

improves.

NEW RESIDENTIAL UNIT LAUNCHES ACROSS LOCATIONS IN

2Q 2015

During the second quarter of 2015, around 28,100

new unit launches were witnessed in the top

eight cities, higher by about 14 over the

preceding quarter. This was primarily due to

substantial increase in new launches in

Delhi-NCR, wherein new unit launches more than

doubled (144) over the previous quarter. In

addition, with about 6,900 unit launches,

Delhi-NCR accounted for 25 of the total unit

launches during Q2 2015, followed by Bengaluru

with a 16 share. Kolkata and Pune also witnessed

a q-o-q increase in unit launches by 15 and 13

respectively. New unit launches in Mumbai,

Chennai and Hyderabad declined from the previous

quarter and their respective shares in total

unit launches

Source Cushman Wakefield Research

during the quarter stood at 12, 8 and 4. Mid

segment accounted for nearly 63 in total unit

launches across top eight cities, followed by

affordable segment with a, 25 share. The

remainder of the unit launches were in high-end

(11) and luxury (1) segments.

5

Index

Ahmedabad. 6

Bengaluru.........................................

.............................................

9

Chandigarh........................................

............................................

13

Chennai. 16 Delhi - National Capital Region (NCR)

20 Hyderabad. 24 Jaipur 28 Kolkata. 31

Mumbai. 36 Pune 40

6

Ahmedabad

Market Overview

Nearly 2,300 units were launched during the

second quarter of 2015, marking an improvement of

33 from the previous quarter. Due to the launch

of two projects with more than 400 units each,

the Western submarket led the launch activity

with 54 contribution to total unit launches.

Mid segment dominated the quarterly unit

launches with a 56 share, whilst high-end

segment contributed the rest. Both capital and

rental values remained nearly stable across

submarkets during the quarter. Office sector

witnessed around 145,200 square feet (sf) of net

absorption in the second quarter of 2015,

registering a decline of 6 as compared to the

previous quarter. 96 of the quarterly net

absorption was contributed by Grade A

developments. Absence of new completions during

the second quarter amidst decent transaction

activity led to a 0.7 percentage points decline

in all Grades vacancy level to 18.5.

READY RESIDENTIAL PROPERTY VALUES IN JUNE '15

Source Cushman Wakefield Research

Represents Mid and High End segments

Ahmedabad mall vacancies declined by 0.1

percentage point over the quarter to 33.2 in the

second quarter of 2015. This marginal decline in

vacancy level was due to limited transaction

activity witnessed in malls amidst subdued

demand from retailers. The leasing activity in

main streets also declined due to limited

availability of quality spaces.

Trends Updates Ready Residential Property

Update

Capital values of ready residential projects

remained stable as compared to the previous

quarter. Select under-construction

residential projects by

reputed developers in key locations like

Satellite, Prahladnagar, S.G. Highway and

Vastrapur witnessed slightimprovementofup to 6

in quoted values.

7

Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf)

Location 2010 2011 2012 2013 2014 1Q 2015 2Q 2015

Satellite 4.0 - 4.8 4.3 - 6.0 4.3 - 6.0 4.3 - 6.0 4.3 - 6.0 4.3 - 6.0 4.3 - 6.5

Vastrapur 3.7 - 4.0 3.7 - 5.0 3.7 - 5.0 3.7 - 5.0 3.7 - 5.0 3.7 - 5.0 3.7 - 5.5

S.G.Highway 3.7 - 4.3 3.7 - 4.5 3.7 - 4.5 3.7 - 4.5 3.7 - 5.0 3.7 - 5.0 3.7 - 5.2

Prahlad Nagar 4.2 - 5.3 4.2 - 6.0 4.2 - 6.0 4.2 - 6.2 4.2 - 6.2 4.2 - 6.2 4.2 - 6.5

Source Cushman and Wakefield Research Note The

above values for high-end segment typically

include units of 2,000-4,000 sf

Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf)

Location 2010 2011 2012 2013 2014 1Q 2015 2Q 2015

Satellite 2.8 - 3.8 2.8 - 4.3 2.8 - 4.3 2.8 - 4.3 2.8 - 4.3 2.8 - 4.3 3.0 - 4.3

Vastrapur 2.6 - 3.5 2.6 - 3.8 2.6 - 3.8 2.6 - 3.9 2.6 - 3.9 2.6 - 3.9 2.8 - 4.0

S.G.Highway 3.0 - 3.8 3.3 - 4.3 3.3 - 4.3 3.0 - 4.3 3.0 - 4.3 3.0 - 4.3 3.2 - 4.3

Prahlad Nagar 2.8 - 3.6 3.2 - 4.2 3.2 - 4.2 3.2 - 4.3 3.2 - 4.3 3.2 - 4.3 3.5 - 4.3

Source Cushman and Wakefield Research Note The

above values for mid segment typically include

units of 1,200-1,800 sf Limited availability at

quoted values

New Residential Launches Nearly 32 of the total

2,300 launches in second quarter of 2015 were 2

Bedroom-Hall-Kitchen (BHK) configuration, while

30 were 3 BHK configuration. The 2 and 3 BHK

units launched this quarter had an average size

of 1,550 and 2,400 sf respectively. Due to the

continued preference of locations in the

Western submarket amongst end-users, all the

high- end segment launches this quarter were

located in this submarket. Nearly 80 of the

launches were witnessed in locations like

Thaltej, Vejalpur and Nehrunagar in the high-end

segment.

Project Name Developer Location Number of Units Type Area of Units (sf)

Maple Tree Ganesh Housing Thaltej 512 Apartments 3 BHK 2,295 4 BHK 4,412

Cloud 9 JV - Addor Realty Vivan Infrastructure Nehrunagar 448 Apartments 2 BHK 2,295 3 BHK 2,943 4 BHK 2,943 to 3,573

Swami Narayan Park 2 Dharmadev Vasna 400 Apartments 2 BHK 1,125 to 1,215

Unique Ashiyana Unique Infraspace Gota 384 Apartments 1 BHK 774 to 801 2 BHK 1,179

Orchid Heights HN Safal Sardar Patel Ring Road 272 Apartments 3 BHK 1,960 4 BHK 2,460

Sun Simpolo Sun Builders Bodakdev 246 Apartments 1 BHK 585 1.5 BHK 720

Parijat B Safal Constructions Vejalpur 44 Apartments 4 BHK 3,857

Estimated and as per market information

8

Under Construction Residential Property Update

The western submarkets continued to dominate the

under-construction scenario with locations such

as Prahladnagar, Vasna, Bopal, etc. leading the

activity. Northern locations like Motera and

Ranip also witnessed sizeable construction

activity due to

availability of large tracts of land and

comparatively affordable rates at these

locations. Capital values in under-construction

projects remained mostly stable to stay relevant

in competitive market.

Commercial Office Sector

Ahmedabad witnessed 153,200 sf of leasing

activity in the second quarter of 2015. The

IT-ITeS sector dominated the leasing activity

followed by consulting sector with 69 and 18

contribution respectively. Gandhinagar (65) and

S.G. Highway (25) witnessed maximum leasing

during this period accounting for 90 of the

total activity. This

quarter witnessed the first pre-commitment of the

year, with a telecom company committing to

30,000 sf of space in an upcoming Grade A

development. Grade A vacancy also dipped by 1.6

percentage points to 31.8 due to no new supply

and sizeable transaction activity during the

quarter.

Retail Sector Mall rentals continued to remain

stable due to limited enquiries and high vacancy

levels. Majority of the enquiries across malls

and main streets were from Food Beverage (FB)

retailers and lifestyle brands.

Main street rentals also remained stable amidst

limited transaction activity as landlords quoted

similarrents to attractretailers.

Outlook Residential launches are likely to

decline marginally in the coming quarter amidst

sizeable unsold inventory, limited projects in

pre-launch phase and wait-and-watch approach

being adopted by buyers. Some developers may

postpone their project launches to the fourth

quarter expecting improvement in sales during

the festive season.

contribute to an increase in vacancy levels

across submarkets.

Retail leasing activity is likely to be moderate

due to no new mall supply and limited

availability of quality space in existing malls.

Mall rentals are likely to remain stable except

S.G. Highway which might register slight

correction due to high vacancy levels. Main

streets are expected to witness improvement in

demand with major enquiries from FB and

jewellery retailers. Key main street locations

like C.G. Road, Prahladnagar and S.G. Highway

might record marginal improvement in rentals

with pick-up in demand.

Nearly 1.97 msf of Grade A new office supply is

likely to be delivered by the end of the year in

Ahmedabad. While transaction activity is expected

to improve, it is unlikely to keep pace with the

expected increase in supply during the coming

quarters. This demand-supply imbalance might

9

Bengaluru

Market Overview

In the second quarter of 2015, nearly 4,500 units

were launched a 10 increase from the previous

quarter. Mid segment unit launches were dominant,

with a total share of about 90. The Eastern and

Northern submarkets comprised of maximum unit

launches of 28 and 27 respectively. The office

supply doubled from the previous quarter and was

recorded at nearly 4.0 million square feet

(msf). More than half (57) of the Grade A

supply was witnessed in Outer Ring Road, followed

by 26 in the Peripheral South Market. Strong

leasing in Grade A spaces was noted at 3.8 msf,

which was similar to the leasing recorded in the

previous quarter. A combination of steady leasing

activities and no new mall supply led to a

dip in the overall mall

READY RESIDENTIAL PROPERTY VALUES IN JUNE'15

Source Cushman Wakefield Research

Represents Mid and High End segments

vacancy by 0.3 percentage point to 8.46 in

Bengaluru. In the second quarter of 2015, the

rentals across all malls and main streets

remained largely steady, with a few exceptions.

Trends Updates

Ready Residential Property Update Capital Values

across all submarkets in Bengaluru maintained

status quo, especially due to slow-moving

inventory. The rental values in mid segment of

South- Eastern and Eastern submarkets comprising

of the IT hub along Outer Ring Road (ORR) and

Whitefield locations witnessed a

quarter-on-quarter rental appreciation of 5.

The proximity to these IT

destinations and the presence of quality social

and physical infrastructure act as a strong

demand driver leading to a subsequent increase

in demand for rental housing in the

South-Eastern and Eastern submarkets. However,

the high-end segment of the Eastern submarket

witnessed softening of demand, resulting in a 5

dipinrentalsfromthepreviousquarter.

10

Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf) Average Capital Values High-end Segment (INR000/sf)

Location 2008 2009 2010 2011 2012 2013 2014 1Q 2015 2Q 2015

Central 14.0 - 18.0 12.0 - 14.5 13.5 - 17.5 14.0 - 18.0 18.0 - 28.0 18.0 - 30.0 18.0 - 30.0 18.0 - 30.0 18.0 - 30.0

South 7.0 - 9.0 6.0 - 8.5 6.0 - 9.5 6.5 - 10.0 6.5 - 10.0 6.8 - 10.3 7.0 - 10.3 7.0 - 10.5 7.0 - 10.5

Off-Central 6.5 - 7.5 5.0 - 6.8 5.0 - 7.0 6.0 - 8.5 7.0 - 9.0 8.0 - 11.0 8.0 - 11.0 8.0 - 11.0 8.0 - 11.0

East 6.5 - 9.0 5.6 - 7.0 6.5 - 7.5 6.8 - 8.0 6.5 - 9.0 6.5 - 10.0 6.5 - 10.0 6.5 - 10.0 6.5 - 10.0

North 6.0 - 8.0 5.5 - 7.0 5.5 - 7.0 6.5 - 8.0 6.5 - 8.2 7.0 - 9.5 7.0 - 9.8 7.0 - 11.0 7.0 - 11.0

Source Cushman and Wakefield Research Note The

above values for high-end segment typically

include units of 2,000-4,000 sf.

Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf) Average Capital Values Mid Segment (INR000/sf)

Location 2008 2009 2010 2011 2012 2013 2014 1Q 2015 2Q 2015

Central 5.8 - 7.0 5.0 - 6.0 5.5 - 7.0 6.0 - 7.5 6.0 - 8.0 9.0 - 12.0 9.0 - 12.0 9.5 - 13.0 9.5 - 13.0

East 2.7 - 3.1 2.4 - 2.7 2.7 - 3.1 3.2 - 3.8 3.8 - 4.8 4.0 - 5.5 4.0 - 5.5 4.3 - 5.7 4.3 - 5.7

South-East 2.9 - 4.0 2.5 - 3.2 2.8 - 4.0 3.4 - 5.0 4.0 - 5.5 4.5 - 5.9 4.5 - 6.0 4.5 - 6.3 4.5 - 6.3

North 5.0 - 6.5 2.8 - 4.0 2.8 - 4.4 3.0 - 4.8 6.0 - 9.0 6.0 - 9.0 6.0 - 9.0 7.0 - 10.0 7.0 - 10.0

South 3.0 - 4.0 4.6 - 5.7 4.8 - 6.0 5.0 - 6.5 3.5 - 5.5 3.5 - 5.5 4.0 - 5.5 4.0 - 6.5 4.0 - 6.5

South-West 2.8 - 4.2 2.7 - 3.9 3.2 - 4.5 3.6 - 5.0 4.0 - 5.5 4.5 - 6.5 4.5 - 6.5 4.5 - 6.5 4.5 - 6.5

Off-Central 3.5 - 6.0 3.3 - 5.7 4.0 - 6.2 4.5 - 6.7 5.0 - 7.5 7.0 - 10.0 7.0 - 10.0 7.0 - 10.0 7.0 - 10.0

Off-Central 4.0 - 6.0 3.7 - 5.7 3.8 - 6.2 4.3 - 6.7 5.0 - 7.0 6.0 - 8.0 6.5 - 8.5 6.5 - 8.5 6.5 - 8.5

North-West 4.2 - 5.8 3.5 - 5.2 3.8 - 5.6 4.3 - 6.2 4.5 - 6.5 5.5 - 6.5 6.0 - 6.8 6.0 - 6.8 6.0 - 6.8

Source Cushman and Wakefield Research Note The

above values for mid segment typically include

units of 1,600-2,000 sf.

Key to locations

High-end segment

East Marathalli, Whitefield, Old Airport Road

Central Lavelle Road, Off Palace Road, Off

Cunnigham Road, Ulsoor Road, Richmond Road

South-East Sarjapur Road, Outer Ring Road, HSR

Layout

South Koramangala, Outer Ring Road, Bannerghatta

Road, JP Nagar

South Kormangala, Jakkasandra

South-West Jayanagar, J P Nagar, Kanakpura Road,

Bannerghatta Road, BTM Layout

Off-Central Frazer Town, Benson Town, Richards

Town, Dollars Colony

North Hebbal, Bellary Road, Yelahanka,

Dodballapur Road, Jalahalli

East Whitefield (villas)

Off-Central Vasanth Nagar, Richmond Town and

Indiranagar

North Hebbal, Yelahanka, Jakkur, Devanahalli

Off-Central Cox Town, Frazer Town, HRBR,

Benson Town, etc.

Mid segment

Central Brunton Road, Artillery Road, Ali Askar

Road, Cunningham Road

North-West Malleshwaram, Rajajinagar

10

11

New Residential Launches The second quarter of

2015 witnessed new unit launches of

approximately 4,500 units. Similar to the last

quarter, 69 of these total launches were

pre-launched in the previous quarters. Overall,

there was a 10 quarter-on-quarter increase in

the total units launched, with over 90 share

belonging to

the mid segment projects. The Eastern submarket

witnessed 28 of unit launches especially in the

Old Madras Road and Whitefield locations. This

was followed by 27 share of the total launches

in Northern sub-market, especially in Horamavu

and Off Hennur Road locations.

Project Name Developer Location Number of Units Type Area of Units (in sf)

Vaishnavi Gardenia Vaishnavi Group Jalahalli 600 Apartments 2 BHK 1,100 to 1,175 3 BHK 1,440 to 1,550

Bollineni Silas Bollineni Whitefield 499 Apartments 2 BHK 1,060 to 1,405 3 BHK 1,590 to 1,600

Salarpuria Sattva Cadenza Salarpuria Sattva Group Hosur Road 493 Apartments 1 BHK 703 2BHK 1,183 2.5 BHK 1,564 3 BHK 1,850

Purva Waves Puravankara Developers Hennu Road 468 Apartments 2 BHK 1,232 to 1,348 3 BHK 1,630 to 1,846

Vaswani Equisite Vaswani Group Whitefield 450 Apartments 2 BHK 1,890 to 2,330 3 BHK 2,820

Gopalan Olympia -Phase I Gopalan Enterprises Kumbalgodu 449 Apartments 2 BHK 1,000 3 BHK 1,360

Prestige Gulmohar Prestige Group Horamavu 400 Apartments 2 BHK 1,169 2.5 BHK 1,370 3 BHK 1,623 to 1,752

DSR Waterscape DSR Properties Horamavu Road 334 Apartments 2 BHK 1,179 to 1,255 3 BHK 1,435 to 1,752

Vaswani Claremont Vaswani Group Whitefield 300 Apartments 2 BHK 1,150 to 1,200 3 BHK 1,590 to 2,100

Emmanuel Heights Emmanuel Constructions Sarjapur Road 293 Apartments 2 BHK 1,115 to 1,197 3 BHK 1,445 to 3,366

TG Epitome TG Developers Doddanekundi 93 Apartments 2 BHK 1,200 3 BHK 1,400

Garuda Green Field Garudachala Estates Mahadevapura, Outer Ring Road 90 Apartments 2 BHK 1,200 3 BHK 1,450

The Big Tree Ceear Realty Jayanagar 9 Apartments 4 BHK 4,300

Estimated and as per market information Under

Construction Residential Property Update

Around 174,600 residential units are under

construction across various submarkets. Mid

segment comprises at least 56 of the total

under- construction units, followed by 23 of

units in the affordable segment. Most of the new

under construction units noted in this quarter

were mid segment apartments offering 2BHK and

3BHK configuration. Affordable segment launches

appeared to be subdued in this quarter as

compared to 6 of the total unit launches

launched in the last

quarter. Far South, North and Eastern locations

comprise of a predominant (75) share of the

total affordable projects under construction in

the city.

Over the last few quarters, developers have

offered schemes like paying pre-EMI or giving a

buy- back option to the end user post procession

to incentivize the latter and increase the

sales. Given the slow movement of existing

inventory, different subvention schemes are on

the rise across the city.

12

Commercial Office Sector Grade A net absorption

of about 3.2 msf was recorded during the second

quarter of 2015. While the transactions in Grade

A spaces were healthy this quarter, relocation

activities resulted in a comparatively lower net

absorption of 3 from the previous quarter.

However, Grade A leasing was at 3.8 msf and at

par with the previous quarter. Major leasing

activities were noted in the Outer Ring Road

(41) and Peripheral East (22) submarkets. Also,

the IT-ITeS continued to be a dominant demand

driver with nearly 76 of the total leasing,

followed by BFSI sector that constituted 8 of

total leasing. The second quarter of 2015,

recorded total pre-

commitments of 1.2 msf, nearly 41 increase from

the previous quarter.

Bengaluru witnessed a rental decline in select

submarkets in Grade A office spaces. Peripheral

South and Suburban East witnessed a 6 and 13

decline in their weighted average rentals

respectively, owing to limited absorption and

available spaces quoting lower rentals. Given

high new supply and healthy absorption, the

overall Grade A vacancy increased by 0.5

percentage point and stood at 8.5.

Retail Sector Mall and main street rentals were

stable across most submarkets during the second

quarter of 2015. While there was no new mall

supply, steady leasing activities were noted in

malls across Whitefield, Magrath Road and

Malleswaram, especially by apparel, electronic

and Food Beverage (FB) retailers. Among main

streets, Kamanahalli Main Road rentals

appreciated by 7.7 owing to increased

enquiries and limited availability of quality

space. On the other hand, Brigade Road witnessed

a 5 rental decline, owing to dwindling demand

over the last few quarters. Automobile, fitness,

apparel and jewellery brands were some of the

prominent retailers that leased space in

Koramangala, Indiranagar and Commercial Street

in this quarter.

Outlook The residentiallaunches are likely tobe

restrained in the followingquarters due

tosurplus existing inventory, amidst stable

demand across most submarkets. Rental and

capital values are likely to remain stable across

most submarkets, with the exception of the

South- Eastern and Eastern submarkets which may

witness a capital value appreciation in the mid

segment due to growingdemand.

be in Grade A development. Outer Ring Road and

Peripheral East submarkets are likely to witness

marginal rental appreciation due to continued

demand, while the other submarkets may maintain

status quo in their rental values.

Rentalsmayholdsteadyacrossmostmallsandmain

streets. Anewmallmeasuring 320,000 sfis

expectedto be operational in Binnypet next

quarter. New BEL Road and Kamanahalli Main Road

are likely to witness an upwardrentalrevisionduet

osteadydemand.

In the third quarter of 2015, new office supply

of nearly 3.5 msf is expected, most of which is

likely to

13

Chandigarh

Market Overview

In the second quarter of 2015, approximately

1,100 units were launched in the Tri-City region.

The new launches were primarily in the outskirts

in submarkets of Zirakpur and Mohali. The

high-end segment witnessed healthy transaction

activity during the quarter. However, capital

values continued to maintain status quo due to

sustained selling pressure. Capital values in

the mid segment too remained stable across

submarkets. Submarkets in Peer Mushalla,

Zirakpur and Mohali witnessed increased number

of inquiries as construction work on the ring

road recommenced during the quarter. No new

office space was added to the Tri-City during

the quarter. Demand for office space during the

quarter was primarily from companies belonging

to Banking, Financial and Insurance Services

(BFSI), consulting and telecommunication

sectors. Grade A office rentals remained stable

during the quarter, due to the high prevailing

vacancies and subdued demand. Approximately

350,000 sf of retail area was added to the

Tri-City region in the second quarter of 2015.

READY RESIDENTIAL PROPERTY VALUES IN JUNE'15

Source Cushman Wakefield Research

Represents Mid and High End segments

Vacancy levels in the submarket of Mohali

increased due to the addition of new supply.

Demand for mall space remained tepid during the

quarter. In the main street locations, demand

was primarily from footwear and apparel brands.

Rentals remained stable for both malls and main

street locations across Chandigarh.

Trends Updates Ready Residential Property

Update Capital values remained stable across all

locations from the previous quarter. Transaction

activity in the high-end segment improved during

the quarter with availability of good deals

at

competitive prices. Despite improved buyers

interest, capital values in the markets of

Zirakpur and Mohali remained stable due to

high-unsold inventory in the market.

14

Average Capital Values High-end Segment (INR) Average Capital Values High-end Segment (INR) Average Capital Values High-end Segment (INR) Average Capital Values High-end Segment (INR) Average Capital Values High-end Segment (INR) Average Capital Values High-end Segment (INR) Average Capital Values High-end Segment (INR)

Location 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015

Chandigarh Sector 2-11 155,000 - 170,000/sqyd 155,000 - 170,000/sqyd 155,000 - 170,000/sqyd 155,000 - 170,000/sqyd 155,000 - 170,000/sqyd 155,000 - 170,000/sqyd

Chandigarh Sector 28 140,000 - 160,000/sqyd 140,000 - 160,000/sqyd 140,000 - 160,000/sqyd 140,000 - 160,000/sqyd 140,000 - 160,000/sqyd 140,000 - 160,000/sqyd

Panchkula 110,000 - 145,000/sqyd 110,000 - 145,000/sqyd 110,000 - 145,000/sqyd 110,000 - 145,000/sqyd 110,000 - 145,000/sqyd 110,000 - 145,000/sqyd

Manimajra 14,000/sf 14,000/sf 14,000/sf 14,000/sf 14,000/sf 14,000/sf

Source Cushman and Wakefield Research Note The

above values for high-end segment typically

include units of 2,000-4,000 sf, both apartments

and villa sqyd Square Yard

Average Capital Values Mid Segment (INR/sf ) Average Capital Values Mid Segment (INR/sf ) Average Capital Values Mid Segment (INR/sf ) Average Capital Values Mid Segment (INR/sf ) Average Capital Values Mid Segment (INR/sf ) Average Capital Values Mid Segment (INR/sf ) Average Capital Values Mid Segment (INR/sf )

Location 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015

Zirakpur 2,800 - 3,400 2,800 - 3,400 2,800 - 3,500 2,800 - 3,600 2,800 - 3,600 2,800 - 3,600

Mohali 3,000 - 3,800 3,200 - 3,800 3,200 - 4,000 3,200 - 4,200 3,200 - 4,200 3,200 - 4,200

Dera Bassi 2,800 - 3,200 2,800 - 3,400 2,800 - 3,500 2,700 - 3,500 2,700 - 3,500 2,700 - 3,500

Panchkula 2,800 - 3,400 2,800 - 3,400 2,900 - 3,500 2,900 - 3,500 2,900 - 3,500 2,900 - 3,500

Source Cushman and Wakefield Research Note The

above values for mid segment apartments typically

include units of 1,600-2,000 sf

Key to Locations High-end Segment Panchkula

Sectors - 2, 4, 6, 7, 8, 9, 15

Mid Segment Mohali Sectors - 114, 115,

127 Panchkula Sector - 20

New Residential Launches The Tri-City region

witnessed launch of approximately 1,100 units in

the second quarterof 2015. With basic prices in

the range of INR 3,200-3,800/sf,

new launches were primarily in the western and

southern regions namely, Zirakpurand Mohali.

Project Name Developer Location Number of Units Type Area of Units (sf)

Gillco Park Hills Gillco Sector 126, Mohali 700 Apartments 2 BHK 1,075 3 BHK 1,420 to 1,655 4 BHK 2,350

The Eminence Alliance Buildtech Zirakpur 192 Apartments 3 BHK 1,460

Tulip and Carnation Tower Ansal API Sector 115, Mohali 192 Apartments 3 BHK 1,695 to 1,806

15

Under Construction Residential Property Update

In Q2 2015, capital values of under construction

remained stable across submarkets. The

submarkets of Peer Mushalla, Zirakpur and Mohali

witnessed increased traction as the new airport

is

expected to begin operation shortly. Few projects

in Zirakpur and Panchkula are expected to be

ready for possession in the next quarter.

Commercial Office Sector In the second quarter of

2015, BFSI, consulting and telecommunication

sector companies had a major share in office

space take-up. Quoted rentals of IT Parks

and SEZs were around INR 50-60 per square feet

per month (psf pm) and commercial spaces were at

INR 70- 95 psfpm.

Retail Sector The second quarter of 2015

witnessed approximately 350,000 sf of new retail

space. Demand in mall space was primarily from

Food and Beverage (FB), jewellery and home

furnishing brands. Some of the retailers

include, Coffee Day,

Carat lane and Nilkamal. In main street

locations, footwear and apparel, retailers such

as Hush Puppies and Blackberry took up space in

Sector 17 market. Rentals across malls and main

street locations remained stable during the

second quarterof 2015.

Outlook Capital values are likely to remain

stable in the high-end segment despite

improvement in transaction activity, especially

due to significant existing unsold inventory.

New launch activity is likely to pick up in the

southern submarket of Zirakpur and on the 200ft

road as the new airport begins operation.

rentals are expected to remain stable over the

next quarter, considering the prevailing high

vacancies.

No new mall space is scheduled for completion in

the third quarter of 2015, which is expected to

lead to decline in vacancy levels. Rental values

in malls are expected to remain stable in

Chandigarh city due to stable demand whilst they

may soften marginally in the peripheral

submarkets, during the next quarter due to high

vacancies and tepid demand.

No new office supply is likely to be added in the

next quarter. Demand may remain moderate and

16

Chennai

Market Overview

During the second quarter of 2015, new

residential unit launches declined sharply by 33

over the previous quarter to nearly 2,100 units.

However, mid segment constituted the highest

proportion of launches during this quarter and

comprised nearly 92 of total units launched.

Southern and South-west quadrants of the city,

primarily Grand Southern Trunk (GST) Road and

Suburban (South) together comprised 59 of total

new launches as upcoming IT-ITeS office

developments and proximity to suburban business

hubs rendered these locations attractive for home

buyers. Launches in high-end segment rose by 26

over the previous quarter, mainly due to

increasing number of new unit offerings in this

segment in Nungambakkam. On an overall basis,

high-end segment comprised 8 of new unit

launches. Chennai witnessed sizeable new office

supply of nearly 1.3 msf during the second

quarter of 2015, comprising of IT parks (74)

and commercial office spaces (24). However, in

line with the first quarter of 2015, no new

supply of IT-Special Economic Zone (IT-SEZ)

became operational. The share of Grade A

developments as a proportion of total supply

increased from 27 in the first quarter to 74 at

the end of this quarter. This is primarily

because a new block of a prominent IT Park

became operational in Perungudi. Occupier

demand, mainly from the IT- ITeS sector,

remained strong leading to a 7

READY RESIDENTIAL PROPERTY VALUES IN JUNE'15

Represents Mid and High End segments

Source Cushman Wakefield Research

quarterly uptick in net absorption for Grade A

spaces which was noted at 529,700 sf. However,

dearth of new developments, mainly IT-SEZs slowed

down the expansion plans of few occupiers and

overall net absorption levels dipped by 11 over

the previous quarter. Mall stock in Chennai

remained static as supply infusion remained

absent for the sixth consecutive quarter.

Limited leasing coupled with the exit of a few

big retailers, including anchor tenants from

some malls in Chennai-CBD led to a 2.3 percentage

point rise in mall vacancy to 7.9 on a q-o-q

basis. Owing to limited churn and modest demand,

mall rentals remained maintained status-quo

across submarkets.

Trends Updates

Ready Residential Property Update Nearly 1,600

new residential units spread across 22 projects

completed construction during this period, a

stark decline of 37 over the previous quarter.

Many developers delayed possession of under

construction projects to second half of the year

due to several factors such as slow pace of

construction and high costs of building

materials.

GST Road (26) and Rajiv Gandhi Salai-II (16)

accounted for the highest number of unit

completions with builders such as Khivraj

Olympia, South India Shelters Pvt. Ltd and

Vishram Builders being prominent amongst others

who handed over completed units to buyers.

Rental and capital values largely remained

stable for all submarkets.

17

Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf) Average Capital Values High-end Segment (INR 000/sf)

Location 2009 2010 2011 2012 2013 2014 1Q 2015 2Q 2015

Boat Club 18.0-20.0 18.0-23.0 20.0-25.0 23.0-27.0 23.0-33.0 23.0-35.0 23.0-35.0 23.0-35.0

R.A Puram 13.0-15.0 13.0-16.5 14.0-17.0 15.0-19.0 17.0-23.0 17.0-23.0 17.0-25.0 17.0-25.0

Besant Nagar NA NA 12.5-13.5 13.0-14.5 13.5-15.0 13.5-15.0 13.5-15.0 13.5-15.0

Kotturpuram NA NA 12.0-14.0 14.0-16.0 14.0-20.0 14.0-20.0 14.0-20.0 14.0-20.0

Adyar 5.5-9.5 8.0-12.0 11.5 - 13.5 13.0-14.5 14.0-17.5 14.0-17.5 16.0-17.5 16.0-17.5

Poes Garden 14.5-18.0 14.5-20.0 17.5-24.5 18.5-25.0 20.5-28.0 20.5-33.0 23.0-33.0 23.0-33.0

Nungambakkam 13.0-16.0 13.0-16.5 13.0-17.0 17.0-20.0 14.0-25.0 14.0-25.0 14.0-25.0 14.0-25.0

Anna Nagar 6.0-9.0 7.5-10.5 8.0-11.5 12.0-14.0 12.0-17.0 12.0-17.0 12.0-17.0 12.0-17.0

Kilpauk 4.0-8.0 8.0-12.0 9.0-15.0 12.0-15.0 12.0-16.0 12.0-16.0 12.0-16.0 12.0-16.0

Source Cushman Wakefield Research Note The

above values for high-end segment typically

include units of 1,800-4,000 sf The time series

have been adjusted to reflect the updated

values RA Puram also includes Alwarpet and

Abhiramapuram Poes Garden also includes Venus

Colony and Kasturi Rangan Road

Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf) Average Capital Values Mid Segment (INR 000/sf)

Location 2009 2010 2011 2012 2013 2014 1Q 2015 2Q 2015

Adyar 4.5 - 6.5 6.0 - 8.5 8.0 - 11.0 9.0 - 13.0 10.0 - 14.0 10.0 - 14.0 12.0 - 15.0 12.0 - 15.0

RajivGandhi Salai(Perungudi) 2.5 - 2.8 3.5 - 4.5 4.0 - 5.5 5.0 - 6.3 5.0 - 6.3 5.0 - 6.3 5.0 - 7.0 5.0 - 7.0

Velachery 3.5 - 4.0 3.5 - 5.0 3.5 - 5.5 4.5 - 6.5 6.0 - 8.0 6.0 - 8.0 6.0 - 8.0 6.0 - 8.0

T. Nagar 4.0 - 6.5 7.5 - 10.5 8.5 - 11.5 8.5 - 14.0 10.0 - 16.0 10.0 - 17.0 10.0 - 17.0 10.0 - 17.0

Mylapore NA NA 8.0 - 12.5 10.0 - 15.0 12.0 - 17.0 12.0 - 17.0 12.0 - 17.0 12.0 - 17.0

Mogappair NA NA 5.0 - 5.5 5.0 - 6.5 5.0 - 7.5 5.0 - 7.5 5.0 - 7.5 5.0 - 7.5

Kilpauk 4.5 - 6.0 6.0 - 8.0 7.5 - 9.5 9.0 - 12.0 9.0 - 12.0 No availability No availability No availability

Source Cushman Wakefield Research Note The

above values for mid segment typically include

units of 1,000-2,000 sf The time series have

been adjusted to reflect the updated values

New Residential Launches New launches plummeted

from 3,200 units over the previous quarter to

nearly 2,100 units by the end of June 2015.

Whilst mid-segment continued to dominate the

maximum share of new unit launches, it also

acted as a catalyst behind the sizeable dip in

overall launches as mid-segment units declined

quarterly by 36. On an overall basis, 20 new

projects were launched out of which apartments

constituted 89 of total new units, remaining

constituting villa projects.

18

Project Name Developer Location Number of Units Type Area of Units (in sf)

Emerald Hallmark Infrastructure Chettipunniyam 860 Apartments 1 BHK 710 2 BHK 942 to 1,100

Bollineni Hillside Phase II BSCPL Infrastructure Ltd. Perumbakkam 383 Apartments 1 BHK 920 to 1,035 2 BHK 1,060 to 1,330 2.5 BHK 1,380 to 1,515 3 BHK 1,520 to 1,580

Optima Upgrade Optima Homes Pvt. Ltd. Avadi 180 Apartments 1.5 BHK 595 2 BHK 765 to 1,010 2.5 BHK 1,040 3 BHK 1,140 to 1,470

Creations Genesis Creations Promoters Navalur 156 Apartments 1 BHK 594 to 680 2 BHK 750 to 1,100 3 BHK 1,150 to 1,500

Frontier ETA Star Neikuppi 84 Villas 4 BHK 5,000

Adria Royal Splendour Developers Kovur 76 Apartments 1 BHK 497 to 595 2 BHK 750 to 1,167 3 BHK 1,297 to 1,485

R.S. Orchid R S Promoters Developers Manimangalam 73 Villas 2 BHK 1,450 to 1,578 3 BHK 1,722 to 1,795

VGN Presidency VGN Developers Nungambakkam High Road 72 Apartments 3 BHK 3,278 to 3,467

Akshaya Level Up Akshaya Homes Sterling Road 50 Apartments 3 BHK 2,037 to 3,387

ETA Lilac Heights ETA Star Greenways Road 48 Apartments 3 BHK 2,498 to 4,273

Nest Njoy Nest Builders Promoters East Coast Road 45 Villas 1 BHK 530 2 BHK 970 3 BHK 1,545

Poomalai Varishtaa Poomalai Housing Medavakkam 37 Villas 3 BHK 1,505 to 1,984 4 BHK 2,075 to 2,420

Violet ECO Bay Builders Developers Thiruvallur 32 Apartments 2 BHK 950 to 1,100 3 BHK 1,250

Lemongrass Green Leaves Estates Hotels Porur 16 Apartments 1 BHK 614 to 652 2 BHK 934 to 993 3 BHK 1,063 to 1,389

Queen's Court Selvi Constructions Kottivakkam 12 Apartments 2 BHK 973 to 1,054 3 BHK 1,564 to 1,604

Malles Vijayadhwajam Malles Constructions T. Nagar 8 Apartments 3 BHK 1,481 to 1,810

Peacock Enclave Dev Apartments Neelankarai 8 Villas 4 BHK 3,050

MM Seaview MS Charan Builders Kottivakkam 6 Apartments 3 BHK 1,331 to 2,674

Casamia Selvi Constructions Kottivakkam 6 Apartments 3 BHK 1,562 to 2,247

Oyester Rojavanam Oyester Homes Ayanavaram 5 Apartments 1 BHK 600 2 BHK 780

Estimated and as per market information Under

Construction Residential Property Update

Nearly 25,000 units are currently under

construction across various segments that may be

available for possession by the end of this year.

More than 81 of such units are in the mid

segment, followed by the affordable segment

(13). Nearly

50 of such units are spread across suburban and

peripheral submarkets of GST Road, Rajiv Gandhi

Salai (I) and II) and suburban areas near OMR and

Velachery.

19

Commercial Office Sector As new supply influx

remained sparse in prominent suburban

submarkets, existing availabilities in

Peripheral South-west (42) and North-west (17)

witnessed maximum share in Grade A net

absorption as demand remained healthy, despite

slow execution of expansion plans by some large

occupiers. Huge supply influx led to a

0.7 percentage point uptick in overall vacancy

that rose to 14.4 at the end of this quarter.

Weighted average rentals increased by 4 over

the previous quarter largely due to an 8 rental

uptick in Suburban South as premium spaces

started quoting higher rentals in the wake of

limited vacancy.

Retail Sector Strong demand for both established

main streets and standalone formats from

existing retailers as well as new entrants to

the city culminated in some large transactions.

Primarily jewellery and hypermarket

retailer categories fuelled demand for main

street locations rentals remained stable as

demand was fulfilled atrates similarto the

previous quarter.

Outlook Nearly 3,800 residential units are

currently under soft launch and maybe launched

during the latter half of the year. Improvements

in physical infrastructure, such as inauguration

of parts of Phase I of Metro Rail and road

widening of the East Coast Road (ECR) may act as

a catalyst and help improve new launches during

the next quarter, especially in locations such as

Alandur, Koyambedu, Guindy, Kodambakkam and

parts of East Coast Road (ECR).

cause an upward bias in overall vacancy in the

city. Modest availability of IT-SEZ developments

coupled with continual demand from occupiers may

lead to rental uptick in select submarkets such

as Suburban South and South-west.

Whilst no new mall influx is expected during the

next quarter, mall vacancy may revise downwards

as demand from apparels and food and beverages

(FB) categories may improve going forward.

However, rentals may hold steady. In the wake of

healthy demand, select main streets such as Anna

Nagar 2nd Avenue and Pondy Bazar may witness an

upward rental bias due to retailers preference

for these locations.

During the next quarter, supply infusion in

office sector may remain high as new

developments admeasuring nearly 1. 3 msf may

become operational. Approximately 87 of the

anticipated new supply belongs to Peripheral

South that may

20

Delhi - National Capital Region (NCR)

Market Overview

READY RESIDENTIAL PROPERTY VALUES IN JUNE'15

Delhi-NCR witnessed launch of approximately

6,900 units in the second quarter of 2015,

registering a 1.5 times increase over the

previous quarter. The surge in new unit launches

is due to large-scale projects that were

launched in Sohna, Gurgaon during the quarter.

Capital values maintained status quo during the

quarter across most submarkets in Delhi- NCR.

With stable demand, rental values also remained

stable across all submarkets. In the second

quarter of 2015, Grade A office supply in

Delhi-NCR was recorded at 2.5 msf, a 20.8

increase from the previous quarter. As compared

to the first quarter of 2015, net absorption

increased by 111 this quarter and was noted

close to 1.3 msf. No pre-commitments were noted

during the second quarter of 2015. Rental values

firmed up significantly in the submarkets of

Gurgaon CBD and Noida. No new mall supply was

added during the second quarter of 2015.

However, overall mall vacancy

Represents Mid and High End segments

Source Cushman Wakefield Research

increased marginally by 0.1 percentage points to

14.5 during the quarter. Rental values in malls

as well as main street locations remained stable

from the previous quarter. Main street locations

across Khan Market, Greater Kailash and South

Extension witnessed healthy take up of space.

Trends Updates Ready Residential Property

Update Due to subdued transaction activity,

capital values across all segments in various

submarkets remained stable from the previous

quarter. Capital values in the luxury segment in

Gurgaon increased by 3 from the

previous quarter amidst strong demand from

investors. The notification of Land Pooling

Policy by Delhi Development Authority is

expected to augment new supplyin submarkets of

Delhi.

21

Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf) Average Capital Values High-end Segment (INR '000/sf)

Location 2012 2013 2014 1Q 2015 2Q 2015

South-West 50.0 - 60.0 45.0 - 60.0 42.5 - 56.0 42.5 - 57.5 42.5 - 57.5

South-East 25.0 - 45.0 25.0 - 40.0 25.0 - 38.0 25.0 - 40.0 25.0 - 40.0

South Central 27.0 - 50.0 27.0 - 50.0 27.0 - 46.0 27.0 - 48.0 27.0 - 48.0

Central 60.0 - 80.0 60.0 - 90.0 60.0 - 90.0 60.0 - 90.0 60.0 - 90.0

Gurgaon 10.5 - 32.0 11.0 - 27.5 11.0 - 25.0 11.0 - 25.0 11.0 - 26.0

Noida 6.2 - 8.1 7.0 - 8.5 7.5 - 9.0 7.0 - 8.5 7.0 - 8.5

Source Cushman and Wakefield Research Note The

above values for high-end segment typically

include units of 2,000-4,000 sf

Average Capital Values Mid Segment (INR '000/sf) Average Capital Values Mid Segment (INR '000/sf) Average Capital Values Mid Segment (INR '000/sf) Average Capital Values Mid Segment (INR '000/sf) Average Capital Values Mid Segment (INR '000/sf) Average Capital Values Mid Segment (INR '000/sf)

Location 2012 2013 2014 1Q 2015 2Q 2015

South-East 25.0 - 30.0 25.0 - 30.0 22.0 - 27.0 22.5 - 27.5 22.5 - 27.5

South Central 25.0 - 35.0 25.0 - 35.0 25.0 - 35.0 25.0 - 35.0 25.0 - 35.0

Gurgaon 6.8 - 10.5 7.5 - 11.5 8.0 - 10.0 7.5 - 9.5 7.5 - 9.5

Noida 4.3 - 6.2 5.0 - 6.0 5.0 - 6.5 5.0 - 6.0 5.0 - 6.0

Source Cushman and Wakefield Research Note The

above values for mid segment typically include

units of 1,600-2,000 sf

Key to Locations High-end Segment South-west

Shanti Niketan, Westend, Anand Niketan, Vasant

Vihar, etc. South-east Friends Colony East,

Friends Colony West, Maharani Bagh, Greater

Kailash I, Greater Kailash II,

etc. South-central Defence Colony, Anand Lok,

Niti Bagh, Gulmohar Park, Hauz Khas Enclave,

Safdarjung Development Area, Mayfair Gardens,

Panchsheel Park, Soami Nagar, Sarvaodaya

Enclave, etc. Central Jorbagh, Golf Links,

Amrita Shergil Marg, Aurangzeb Road, Prithviraj

Road, Sikandara Road, Tilak Marg, Ferozshah

Road, Mann Singh Road, Sunder Nagar, Nizamuddin,

Tees January Marg, Chanakyapuri,

etc. Gurgaon-Luxury Golf Course Road (Sectors

26, 26A, 27, 28, 42, 43, 53-56) Gurgaon-High

end Golf Course Road (Sectors 24-26, 26A, 27,

28, 42, 43, 53-56), Mehrauli-Gurgaon Road

(Sectors 24-26) Golf Course Extension Road

(Sectors 58- 63, 63A, 65-67 and 67A), Sohna Road

(Sectors 38, 47- 49), Central Gurgaon (Sectors

40, 41, 44-46, 50-52 and 57) and Dwarka

Expressway (Sectors 99, 99A, 102, 102A, 103-110,

110A, 111-114) Noida Sectors 34-37, 39-41, 44,

50, 51, 92, 93, 96-98, 128 and 133

Mid Segment South-east New Friends Colony,

Kalindi Colony, Ishwar Nagar, Sukhdev Vihar,

Kailash Colony, Pamposh Enclave,

etc. South-central Uday Park, Green Park, Saket,

Asiad Village, Geetanjali Enclave, Safdarjung

Enclave, Sarvapriya Vihar, Panchsheel Enclave,

Navjeevan Vihar, etc. Gurgaon Sohna Road

(Sectors 38, 47-49), Southern Peripheral Road

(Sectors 68-70, 70A, 71-73), New Gurgaon

(Sectors 76-81, 81A, 82, 82A, 83-86, 88, 88A,

88B, 89, 89A, 90-93, 95, 95A and 95B) Dwarka

Expressway (Sectors 99, 99A, 102, 102A, 103-110,

110A, 111-114) and Sohna Noida Sectors 50,

74-79, 82, 83, 110, 112, 115-121, 134,

135, 137, 143, 150, 151 and 168), Greater Noida

and Yamuna Expressway

22

New Residential Launches With approximately 6,900

unit launches, the second quarter of 2015

witnessed a 1.5 times increase in launches over

the previous quarter. Nearly 62 of units

launched during the quarter were in the

affordable segment and the remaining in the mid

segment. Gurgaon accounted for around 57 of the

total unit launches, with a majority in the

affordable segment in Sohna and the mid segment

launches in the submarkets of Southern Peripheral

Road, New Gurgaon and Dwarka Expressway. Noida

Extension continued to witness launches in

affordable segment while launches along Noida

Expressway were in the mid segment.

Project Name Developer Location Number of Units Type Area of Units (in sf)

Resortico CHD Developers Sector 34, Sohna 1,379 Apartments 1 BHK 709

Hill Town Supertech Sector 2, Sohna 1,324 Apartments 2 BHK 1,200 to 1,440 3 BHK 1,685 to 2,225 4 BHK 2,695

Ace Parkway Ace Group Sector 150, Noida 970 Apartments 2 BHK 1,310 to 1,360 3 BHK 1,750 to 2,460 4 BHK 3,220

Ophira Mangalya Group Sector 1, Greater Noida (West) 924 Apartments 2 BHK 1,025 to 1,250 3 BHK 1,455

M3M Marina M3M Sector 68, Gurgaon 760 Apartments 2 BHK 1,304 3 BHK 1,595 to 1,914

Ratan Pearls Ratan Buildtech Sector 16, Greater Noida (West) 624 Apartments 2 BHK 1,035 to 1,189 3 BHK 1,370 to 1,900

F Premiere Home Soul Yamuna Expressway 412 Apartments 2 BHK 1,490 to 1,640 3 BHK 1,779 to 1,835 4 BHK 4,008

37th Avenue Imperia Structures Sector 37C, Gurgaon 300 Apartments 1 BHK 600 2 BHK 900

Icon Godrej Properties Sector 88A, Gurgaon 200 Apartments 2 BHK 1,617 to 1,630 3 BHK 1,365 4 BHK 1,595

Estimated and as per market information

Under Construction Residential Property Update

Developers continued offering phase-wise

possession in projects across submarkets. Under-

construction projects in Noida Extension, which

were stuck in petitions challenging the land

acquisition, received a boost after the Supreme

Court quashed all petitions. Projects on Dwarka

Expressway also witnessed healthy pick-up in

construction activity after the State High

Court

vacated its stay on the construction work on the

expressway. A 2-km stretch of Dwarka Expressway

was caught in land acquisition litigation and the

court had earlier ordered a stay on construction

activity of the expressway. However, the

National Green Tribunal imposed a ban on

construction activity on several projects for

flouting pollution norms in Noida Extension.

23

Commercial Office Sector Grade A office supply in

Delhi-NCR was recorded at 2.5 msf in the second

quarter of 2015, a 20.8 increase from the

previous quarter. Commercial developments

accounted for 87.2 of this new supply followed

by IT-SEZs with a 12.8 share. The quarter

witnessed net absorption of over 1.3 msf in

Grade A developments, a 111 increase from the

previous quarter. The IT-ITeS sector had the

highest share (67), followed by healthcare (7)

and the consulting sectors (5). No

pre-commitments were noted during the quarter.

Led by a surge in supply along with high

relocations and consolidation by occupiers, the

overall vacancy in Grade A developments increased

by 0.7 percentage points and was noted at 27.8.

The weighted average Grade A rentals in Gurgaon

CBD increased by over 4.5 amidst strong demand

and limited availability. Weighted average

rentals in Noida increased by over 27.2 due to

fresh addition of premium spaces at higher

rentals.

Retail Sector Overall mall vacancy levels was

recorded at 14.5, increasing by 0.1 percentage

point over the previous quarter. The increase

was primarily due to tepid demand and exit by

several vanilla retailers in a mall in West

Delhi. The demand for space in malls was driven

mainly by retailers from food and beverage

(FB), apparel and accessories brands. Some of

these retailers include, Carls Jr., HM, W and

GAP to name a few. Low levels of churn resulted

in rental values maintaining status quo during

the second quarter of 2015, although rentals in

select prominent malls increased. Apparels, FB

and footwear brands, which continued to

strengthen their presence across various

locations, mainly drove the demand in main

street locations. Few of the brands that took up

space during the quarter include Farzi Café,

Café Coffee Day, Bear Café, Nike, W and Madame.

Outlook Considering that currently, only a few

projects are in pre-launch stage, new unit

launches are likely to decline in the next

quarter. As transaction activity is likely to

remain subdued, capital values across submarkets

in Delhi-NCR are expected to remain stable

during the next quarter. With the Delhi

government pushing for re-categorization of areas

for demarcation of circle rates, a revision is

expected soon. Several projects nearing

completion in the submarkets of Noida and

Gurgaon are expected to begin possession in the

coming quarters.

this surge in supply is likely to lead to an

increase in overall vacancy levels. Rental

values are expected to further strengthen in

Gurgaon CBD due to strong demand and limited

availability.

Nearly 3.6 msf of new mall supply is scheduled

for completion in the next quarter across Noida,

South Delhi and West Delhi, which is likely to

put pressure on rentals owing to increased

vacancy levels. During the next quarter, rentals

across most main street locations are expected

to remain stable. Prominent main street

locations such as Connaught Place and Sector 29,

Gurgaon will continue to see strong interest

from retailers especially from FB segment.

Approximately 3.8 msf of office space is

scheduled for completion during the next quarter,

primarily in Gurgaon. Despite sustained

absorption,

24

Hyderabad

Market Overview

- During the second quarter of 2015, Hyderabad

witnessed the launch of nearly 1,140 residential

units, a decline of 66 over the previous quarter

due to the absence of large township projects

that were witnessed in the previous quarter. Of

the total units launched, Madhapur, Gachibowli

in the north- western quadrant of the city

accounted for 71 share. Land availability

coupled with ease of access to prominent

business parks via the Outer Ring Road continue