CARRYOVER OF TAX ATTRIBUTES - PowerPoint PPT Presentation

1 / 38

Title:

CARRYOVER OF TAX ATTRIBUTES

Description:

17 brother sister corps merged; some had NOLs, and the surviving corporation ... Brother and Sister corps merge; Harry owns all the stock of each. One has an NOL. ... – PowerPoint PPT presentation

Number of Views:435

Avg rating:3.0/5.0

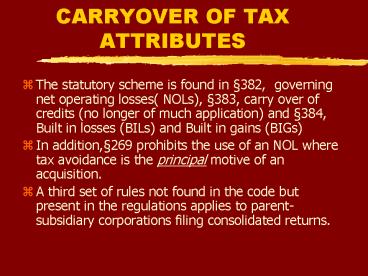

Title: CARRYOVER OF TAX ATTRIBUTES

1

CARRYOVER OF TAX ATTRIBUTES

- The statutory scheme is found in 382, governing

net operating losses( NOLs), 383, carry over of

credits (no longer of much application) and 384,

Built in losses (BILs) and Built in gains (BIGs) - In addition,269 prohibits the use of an NOL

where tax avoidance is the principal motive of an

acquisition. - A third set of rules not found in the code but

present in the regulations applies to

parent-subsidiary corporations filing

consolidated returns.

2

(No Transcript)

3

LIBSON SHOPS

- 17 brother sister corps merged some had NOLs,

and the surviving corporation reduced its post

merger income by the NOL IRS challenges that

deduction. - The court bought the IRS argument that the NOLs

can only be used against the future income of the

corporations that produced the loss. - The congressional committee reports issued when

the last revisions to 382 were enacted state

that Libson Shops has been overruled, and it has

except its theory still exists in the

consolidated return area.

4

(No Transcript)

5

STANGE COMPANY V CIR

- There was no ownership change here, but merely a

tax avoidance scheme. For that reason only 269

applies. - MGI corporation (with NOLs) and April,

brother-sister corporations, were merged each

had substantially the same stockholders. IRS

said the motive was tax avoidance, but the tax

court found some business reasons. Looks weak to

me. - Court found that tax avoidance, while present,

was not the principal motive. Other motives

included supplying capital to MGI, economy of

administration and serving as an acquisition

vehicle.

6

382 LIMITATIONS

- There are two type of changes that trigger the

limits on NOLs of 382. - Ownership changes, that is, purchases which

includes - Purchase for cash from target stockholders

- 351 contributions for stock when the new

stockholders have 80 control - Exercise of stock conversion rights, or,

- Redemptions

7

(No Transcript)

8

382 LIMITS, CONT

- The other kind of change of ownership is called

equity structure shifts. i.e.,acquisitive

reorganizations - Equity structure shifts are any one of the

following - Mergers, that is A reorganizations

- Stock for stock acquisitions, that is B

reorganizations - Assets for stock, that is C reorganizations.

- Non-divisive D reorganizations, as in Ringwalt

and Berghash, p. 757.

9

(No Transcript)

10

EXAMPLES OF THE UTILIZATION OF NOLs

- A loss corporation acquires profitable assets

and uses its losses against future income. There

is no limit on the use of the net operating

losses. - Brother and Sister corps merge Harry owns all

the stock of each. One has an NOL. Could be a

problem under 269 which requires a business

purpose for the merger. This is the fact

situation of the Stange case. - A loss corporation acquires a profitable

corporation and uses its NOL against future

income of the group no matter how organized.

There is no limit on the use of the NOL by the

Loss corporation. - A profitable corporation acquires a loss

corporation in a B reorg, and pumps profitable

assets into Loss. 382 will limit the amount of

the yearly NOL.

11

EXAMPLES CONTINUED

- A profitable corporation acquires a loss

corporation and they file a consolidated return.

The consolidated return regulations limit the use

of the NOL in much the same manner as the court

held in Libson Shops. - The change in ownership, be it a cash purchase

or a reorganization, must exceed 50 or there is

no 382 adjustment. - To make the adjustment, you simply value the loss

corporation and then multiply that value by the

IRS announced tax exempt interest rate the

result is the yearly limit on the use of the NOL.

Unused amounts carry over to future years until

the NOL expires.

12

(No Transcript)

13

PROBLEM 13-1, 2 AND 3

- 13-1 a Yes, if the sale occurs within 3 years.

b no, the sale to a third party is ignored. - 13-2 no, if it was a failed reorganization it

would be treated like a cash acquisition. - 13-3 no, Greggs interest shrinks from 100 to

40 so there has been an ownership change.

14

Ltr. Rul. 9226030 AND 200245006

- The first letter ruling not in this edition

holds that a father and son are a single person

for ownership shift status so no change occurs

when dads stock is all redeemed and son becomes

the sole shareholder. Accordingly there is no

limit on any NOL. - The second ruling announces that an ownership

shift occurs when a brother sells all his stock

to another brother. There is no family

attribution between siblings in 318. The area

is not without confusion, for if one of their

parents were alive there probably would be

attribution land the brothers would be treated as

a single person.

15

(No Transcript)

16

PROBLEM 13-5 p. 642

- Answers are as follows

- a.1. yes his interest shrinks from 100 to 10

- 2. No a peculiar rule, and seldom seen.

- 3. No there is no ownership change

- b.1. i. Yes, Jay goes from 100 to 20 Kay now

has 80 - ii. No, Jay goes from 100 to 60, Kay

has 40. - 2. i. No.

- ii. No. The form of the reorg is

immaterial.

17

(No Transcript)

18

PROBLEM 13-5 CONT

- 3. i. Yes Jay goes from 100 to 20 Kay has

80 - ii. No Jay goes from 100 to 60 Kay has

40. - 4. Jay and Kay, father and son, would be treated

as a single person and there would be no

ownership change in any of these examples. - c Gratuitous transfers are ignored, such

as gifts, inheritances and divorce awards.

19

(No Transcript)

20

PROBLEM 13-6,7 p 644

- In year 6 the limit is the total earnings,

100,000 so only that amount can be used. In

year 7, the disallowed amount is carried over, so

the total allowed in year 7 is

200,000100,000300,000 - Problem 13-7 Assume the NOL is from year 19.

- (a) 1 2 none the acquiring corporation must

use assets for 2 years. 3. 210,000, i.e. the

full allowable amount the 2 years have elapsed

since the acquisition. (b) none, in year 23, as

the NOL has expired.

21

PUBLIC GROUPS AND THE 5 RULE

- Few problems arise in this area, as virtually all

such acquisitions involve closely held

corporations. - Say a publicly held corporation has an NOL, and

merges with Loss corporation and no shareholder

has 5 or more of the stock. - Still, there will be an ownership change unless

the stockholders of the loss corporation have 50

or more of the surviving corporation. All loss

shareholders are treated as a single person.

22

(No Transcript)

23

BUILT IN GAINS LOSSES

- The amount of any built-in-gain BIG increases

the yearly net operating loss limitation when the

BIG asset is sold. - If a company acquires a loss corp with a BIG, it

cannot use the NOL against the BIG for 5 years.

Anppraisal of the assets at the time a target is

acquired is important - The amount of any BIL is allowed only up to the

value of the corporation. See also, Canaveral v

CIR, 61 TC 520 (1974) In that case a corporation

owned a yacht with a basis of 769,000 the

corporation was acquired in a B by a Canaveral,

Inc. for stock worth about 170,000. \Canaveral

later sold the yacht for 250,000 and claimed a

loss of 519,000. The tax court held that the

basis of the yacht was the value of the

Canaverals stock used to acquire the yacht

corporation. The case was decided before the

384 limits were enacted.

24

(No Transcript)

25

CONSOLITATED RETURNS

- If a parent owns a subsidiary corporation that

has an NOL, the parent could liquidate the

subsidiary tax free (332) and the loss, subject

to any 382 limits, will inure to the parent

corporation. - Another way to use the loss is to file

consolidated returns, an election available when

the parent has 80 control of the subsidiary

brothersister corporations cannot file

consolidated returns. - Each of the parent-subsidiary corporations must

elect to file consolidated returns the parents

taxable year becomes the taxable year for the

group.

26

(No Transcript)

27

CONSOLIDATED RETURNS

- Intercompany transactions, like sales, rents, and

dividends are eliminated in calculating the

income of the consolidated group. Essentially

the entire group is treated like a single

corporation. One result of consolidated returns

is a 100 dividend received deduction.

Actually, the dividends are eliminated from the

parent's income. - The parents basis in the stock of the subsidiary

will increase with the subsidiarys income, and

decrease with the subsidiarys losses. - Most eligible Parent-Subsidiary groups elect

consolidated return reporting.

28

(No Transcript)

29

CONSOLIDATED RETURNS, NOL LIMITS

- There are two kinds of limits on the use of NOLs

following the formation of a consolidated group.

These limitations are known as Consolidated

Return Change of Ownership (CRCOs) and Separate

Return Year Limitation (SRYLs). - Say a parent acquires a sub on August 1 the sub

had losses from January 1 to August 1. The parent

and subsidiary elect to file consolidated

Returns on August 1 the loss up to August 1 can

only be used against the subs income for that

year and future years, like in Libson Shops.

This is a CRCO.

30

(No Transcript)

31

SEPARATE RETURN YEAR LIMITATION (SRYL)

- A 100 controlled subsidiary corporation filed a

separate return for last year reporting a loss of

1 million. - On January 1 of this year consolidated return

filing is elected the NOL from last year is

only allowed against the subsidiarys future

income. Again this is identical to the Libson

Shops doctrine which Congress said it repealed. - These rules (CRCOs SRYLs) do not come from the

statute, but from IRS regulations concerning

consolidated return reporting that predate the

enactment of 382.

32

(No Transcript)

33

(No Transcript)

34

BERCY INDUSTRIES

- Bercy, Inc. is the target, to be acquired by

Beverly corp. Beverly forms a subsidiary and the

subsidiary merges with Bercy on April 23. The

subsidiary is the surviving corporation in the

merger it is called New Bercy. From that date

to the end of the year the subsidiary incurs a

loss on the Bercy assets, and carries the loss

back to Old Bercys pre-merger income despite a

statute to the contrary, the court allows the

carryback.

35

(No Transcript)

36

BERCY CONTINUED

- Had Old Bercy survived the merger, the loss would

have been allowed by the code i.e., it would

have been a reverse triangular merger. Perhaps

the court had this in mind when it refused to

follow the literal language of the statute. - Note the reference to disallowing a carryback in

a CERT acquisition, footnote 5, p.657. This is

Congress's response to junk bond acquisitions.

Corporate Equity Reduction Transaction CERT

means that junk bonds were used to buy out the

stockholders, like in the RJR Nabisco example I

used. The interest on those bonds cannot create

a carry back loss, but can create a carry forward

loss.

37

(No Transcript)

38

ACQUISITION OF AN S OR OTHER ENTITY

- Can a taxpayer save on his taxes by acquiring an

S corporation or a partnership with a history

of losses? Why not? - What if Larry Loser enters into matrimony with

Mary Moneybags, and he brings an NOL into the

marriage. Can Mary deduct Larrys NOL against

her post-marriage income on their joint income

tax return?