736 Roadmap - PowerPoint PPT Presentation

1 / 17

Title:

736 Roadmap

Description:

(a) A receive 20k cash in liquidation and no goodwill provision. ... Since service entity, 6k under 736(a) - 3k receivables, 1k gain in goodwill, 2k premium. ... – PowerPoint PPT presentation

Number of Views:72

Avg rating:3.0/5.0

Title: 736 Roadmap

1

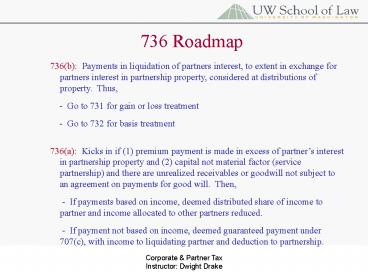

736 Roadmap

736(b) Payments in liquidation of partners

interest, to extent in exchange for partners

interest in partnership property, considered at

distributions of property. Thus, - Go

to 731 for gain or loss treatment - Go to

732 for basis treatment 736(a) Kicks in if

(1) premium payment is made in excess of

partners interest in partnership property and

(2) capital not material factor (service

partnership) and there are unrealized receivables

or goodwill not subject to an agreement on

payments for good will. Then, - If

payments based on income, deemed distributed

share of income to partner and income allocated

to other partners reduced. - If payment

not based on income, deemed guaranteed payment

under 707(c), with income to liquidating partner

and deduction to partnership.

2

731 732 via 736(b) liquidation

731 No gain or loss recognized to partner

unless - Gain to extent money distributed

exceeds partners basis in partnership interest.

- Loss recognized if only money and

unrealized receivables and inventory distributed

to extent basis in partners interest exceeds

amount of money distributed and partnerships

basis in receivables and inventory. - Any

recognized gain or loss is from sale or exchange

of partnership interest. 732(b) If property

distributed to partner in liquidation of

partnership interest, basis in property shall

equal partners interest in partnership less

money receives in distribution.

3

732 Basis Priority Allocation

First Apply partners basis in partnership

interest to inventory and unrealized receivables

equal to partnerships adjusted basis in such

items. If not enough to cover, apply decrease

first pro rata to any built-in losses and, if

more decrease still required, then apply pro rata

to remaining adjusted basis of inventory and

receivables. Second, apply remaining portion

of partners basis to other distributed assets.

- If remaining basis exceeds partnerships

basis in such assets, allocate excess first to

assets with built-in gains to extent of gains.

If still more, allocate balance per FMV of

assets. - If remaining basis less than

partnerships basis in such assets, apply

decrease first pro rata to built-in losses in

such assets to extent of losses. If still more

decrease, allocated decrease pro rata to

remaining basis in assets. Remember

Distributee partner may tack partnerships

holding period per 735(b). Partnerships

ordinary income taint sticks for ever on

receivables and 5 year on inventory. 735(a).

4

Impact on Partnership of Partners Liquidation

General Rule No gain or loss to partnership

on distributions of property to liquidate a

partners interest in partnership. 731(b)

731(a) Exception If payments made under 731(a),

partnership gets deduction if guaranteed payments

under 707(c) and allocations to other partners

reduced to extent payments deemed distribution of

income to liquidating partner. 751(b) Impact

To extent of 736(b) payments not reflect

partners proportionate share of unrealized

receivables and inventory, deemed distribution of

additional receivables and inventory to partner

followed by partners sales to partnership for

cash. Impact is ordinary income to partner and

increased basis in such assets to partnership

(result of deemed by back). Partnerships

Assets Basis No change per 734(a) unless 754

election made. If 754 election, basis in capital

or 1231 assets (1) increased by gain recognized

by distributee partner and excess of partnership

basis in distributed property over basis to

distributee under 732 and (d) decreased by loss

recognized by distributee and excess of

distributee basis over partnerships basis.

5

Problem 313-1

- Basic Facts ABC balance sheet

- A.B. FMV

A.B.

FMV - Cash 90k 90k

A Capital 85k

70k - Inventory 15k 30k

B Capital 85k 70k - Land 150k 90k

C Capital 85k

70k - Total 255k 210k

255k

210k - A receives 1/3 inventory and 60k land in

liquidation of partnership interest. No gain to

A under 731because no money in excess of basis.

No loss under 731(a)(2) to A because property

other than cash or 751 property distributed. Per

732(c) A 85k basis first allocated to inventory

(751 asset) to extent of partnerships basis (5k)

and other 80k allocated to land. Land basis

drops from 100k (2/3 of 150k) to 80k. Had 754

election been made, other partnership land basis

would be increased by lost 20k basis per

734(b)(1)(B). No gain or loss to partnership per

731(b) on inventory gain or land loss.

6

Problem 313-1

Basic Facts ABC balance sheet

A.B. FMV

A.B. FMV Cash

90k 90k A

Capital 85k 70k

Inventory 15k 30k

B Capital 85k 70k

Land 150k 90k

C Capital 85k

70k Total 255k 210k

255k

210k (b) A receives 1/3 inventory and 60k

cash in liquidation. Per 732, 5k basis allocated

to inventory (partnerships basis) and 60k

reduces basis to 20k, which is recognized as

capital loss per 731(a)(2). No gain or loss to

partnership, and no adjustment to asset basis.

If 754 election, partnerships land basis would

be reduced by 20k loss recognized by A.

7

Problem 313-1

Basic Facts ABC balance sheet

A.B. FMV

A.B. FMV Cash

90k 90k A

Capital 85k 70k

Inventory 15k 30k

B Capital 85k 70k

Land 150k 90k

C Capital 85k

70k Total 255k 210k

255k

210k c) Why 732(a)(2) loss restrictions?

Goal is to defer gain or loss through basis

adjustment. Where partners interest liquidated

and only assets distributed are 751 assets and

cash, no further deferral of loss possible.

Thus, recognized at point of liquidation.

8

Problem 313-1

Basic Facts ABC balance sheet - revised

inventory to 120k FMV

A.B. FMV

A.B. FMV Cash

90k 90k A Capital

85k 100k Inventory

15k 120k B Capital

85k 100k Land

150k 90k C

Capital 85k 100k

Total 255k 300k

255k

300k (d) A receive 60k cash and 1/3 inventory in

liquidation. A basis in inventory still 5k, 60k

reduce basis and still 20k loss to A per

731(a)(2). Same result even though gain in

partnership interest. Note, when A sell

inventory for 40k (its FMV), will have 35k

ordinary income - equal to 15k partnership

interest gain and 20k capital loss on

liquidation.

9

Problem 313- 2

- If 754 election

- Downward adjustment in partnerships other assets

only for loss on liquidation or if 732(b) applies

on liquidation. - But upward adjustment to partnerships other

assets for both operating and liquidating

distributions because 731(a)(1) and 732(a)(2) and

(b) apply to both types of distributions.

10

Problem 325

Basic Facts ABC balance sheet - Capital

material income producing factor

A.B. FMV

A.B. FMV Cash

24k 24k

A Capital 12k 18k AR

0k 9k

B Capital 12k

18k Capital Asset 9k 15k

C Capital 12k

18k Goodwill 3k 6k

Totals

36k 54k

36k 54k

(a) A receive 20k cash in liquidation and no

goodwill provision. Per 736(b), 751(b) phantom

sale applies to AR, producing 3k ordinary income

to A (1/3 of 9k). 2k premium payment 736(a)

guaranteed payment, triggering 2k ordinary income

to A and 162 deduction to partnership. Remaining

15k payment exceed 12k basis for 3k LTCG under

731(a)(1). Partnership has no gain on cash

distribution, but has 2k deduction per above.

11

Problem 325

Basic Facts ABC balance sheet - Service

partnership A.B.

FMV

A.B. FMV Cash

24k 24k A Capital

12k 18k AR

0k 9k B Capital

12k 18k Capital Asset

9k 15k C Capital

12k 18k Goodwill

3k 6k

Totals 36k

54k

36k 54k (b) A receive 20k

cash in liquidation and no goodwill provision.

Since service entity, 6k under 736(a) - 3k

receivables, 1k gain in goodwill, 2k premium.

All ordinary income to A and 6k deduction to

partnership. Balance of 14k distribution under

736(b) and exceed outside basis (12k) for 2k LTCG

per 731(a)(1).

12

Problem 325

Basic Facts ABC balance sheet - Service

partnership A.B.

FMV

A.B. FMV Cash

24k 24k A Capital

12k 18k AR

0k 9k B Capital

12k 18k Capital Asset

9k 15k C Capital

12k 18k Goodwill

3k 6k

Totals 36k

54k

36k 54k (c) A receive 20k

cash in liquidation - 10k year 1 and 1k next 10

years. Same income and deductions as (b). Issue

is timing. 14k (70) out of 20k total is 736(b)

payment 6k (30) 736(a). Thus, of first yr 10k

payment, 30 or 3k is ordinary income to A with

3k deduction to partnership, and 7k can first be

used to recover 12k basis or basis can be

allocated pro rata to all 736(b) payments. If

latter, 1k LTCG in year 1. For all 1k annual

payments, 300 736(a) ordinary income and 700

736(b).

13

Problem 325

Basic Facts ABC balance sheet - Service

partnership A.B.

FMV

A.B. FMV Cash

24k 24k A Capital

12k 18k AR

0k 9k B Capital

12k 18k Capital Asset

9k 15k C Capital

12k 18k Goodwill

3k 6k

Totals 36k

54k

36k 54k (d) Same as c) but

outside basis 16k. Still 30 of all payments

736(a) ordinary income with offsetting deduction

to partnership. 70 736(b) applied against

basis, but here 2k LTCL. Loss could be

recognized in last years of payments or pro rata

over payments. If pro rata, 1k LTCL in year 1

and 100 LTCL in each of next 10 yrs.

14

Problem 325

Basic Facts ABC balance sheet - Service

partnership A.B.

FMV

A.B. FMV Cash

24k 24k A Capital

12k 18k AR

0k 9k B Capital

12k 18k Capital Asset

9k 15k C Capital

12k 18k Goodwill

3k 6k

Totals 36k

54k

36k 54k (e) Same as c) but A

receives 10k yr 1 and 10 of profits next 10 yrs.

Profits estimated at 10k per year. Since amount

not fixed, treated as open transaction, with all

736(b) payments first, then excess 736(a). Thus,

year 1 10k applied against 12k basis, along with

yrs 2 3 1k payments. Yrs 4 5 1k payment also

736(b) representing As gain on capital asset and

each yr A has 1k LTCG under 731(a)(1). Next 6

yrs 1k payments all 736(a) - ordinary income to A

and deductible to partnership.

15

Problem 325

- Basic Facts ABC balance sheet - Service

partnership - A.B. FMV

A.B.

FMV - Cash 24k 24k

A Capital 12k

18k - AR 0k 9k

B Capital 12k

18k - Capital Asset 9k 15k

C Capital 12k 18k - Goodwill 3k 6k

- Totals 36k 54k

36k

54k - Same as (b) but 2k is received for goodwill per

agreement. Then appreciation in As goodwill

share (1k) becomes 736(b) payment, increasing

736(b) to 15k and reducing 736(a) to 5k. Thus, A

has 5k ordinary income (instead of 6k) and 3k

LTCG (instead of 2k). - A prefers this goodwill treatment because

converts 1k of ordinary income to LTCG.

16

Problem 334

- Basic Facts ABC balance sheet - Law Firm

- A.B. FMV

A.B.

FMV - Cash 60k 60k

A Capital 20k

50k - Goodwill 0k 90k

B Capital 20k 50k -

C Capital 20k

50k - Totals 60k 150k

60k

150k - B and C pay A 50k for As partnership interest.

A realizes 50k, against basis of 20k, for 30k

capital gain. B C each have 25k increase in

basis. If 754 election, partnership could

increase basis of goodwill 30k, which could be

amortized over 15 yrs per section 197. - Sale to B and C, but partnership pays 50k to A.

Deemed 25k partnership distribution to B and C,

followed by their purchase of As interest.

Purchase transaction result same as in (a).

Distribution to B C governed by 731(a)(1) and

each has 5k gain because cash exceeds basis. If

754 election, inside basis in goodwill increased

by 10k gain on distribution and 30k gain on

purchase.

17

Problem 334

- Basic Facts ABC balance sheet - Law Firm

- A.B. FMV

A.B.

FMV - Cash 60k 60k

A Capital 20k

50k - Goodwill 0k 90k

B Capital 20k 50k -

C Capital 20k

50k - Totals 60k 150k

60k

150k - Transaction 50k liquidation. If goodwill

separately stated, all payments 736(b) and A has

30k capital gain. If goodwill not stated, 20k

under 736(b) for basis recovery and 30k under

736(a) - ordinary income to A and deductible by

partnership. If goodwill separately stated and

754 election, partnership can increase goodwill

basis by 30k gain. - How avoid litigation with IRS. State intentions

in agreement regoodwill and make certain parties

file consistent positions per agreement.