Change in Accounting Principle - PowerPoint PPT Presentation

Title:

Change in Accounting Principle

Description:

The past is the past and only future net income will be affected by the ... Example: Abercrombie and Fitch undercounted its ending inventory for 1999 by $10, ... – PowerPoint PPT presentation

Number of Views:394

Avg rating:3.0/5.0

Title: Change in Accounting Principle

1

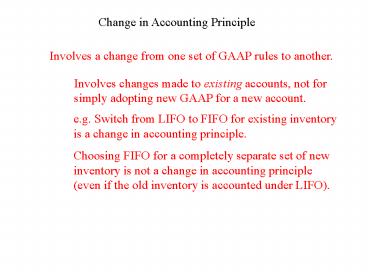

Change in Accounting Principle

Involves a change from one set of GAAP rules to

another.

Involves changes made to existing accounts, not

for simply adopting new GAAP for a new account.

e.g. Switch from LIFO to FIFO for existing

inventory is a change in accounting principle.

Choosing FIFO for a completely separate set of

new inventory is not a change in accounting

principle (even if the old inventory is accounted

under LIFO).

2

Change in Accounting Principle

Three ways to handle change in accounting

principle

Record the Cumulative Effect Go back and

collect all changes from prior years and then

report as an item, net of tax, in the income

statement. Do not restate prior years income

statements.

Record the Retroactive Effect Go back and

restate prior years income statements.

Make no adjustments at all. The past is the past

and only future net income will be affected by

the change in principle.

GAAP has generally adopted cumulative effect,

except under special circumstances.

3

Change in Accounting Principle

Special Circumstances

When a cumulative effect adjustment would result

in unreasonably dramatic changes in net income

for the current year, GAAP allows for a

retroactive adjustment.

- A change from LIFO to another method

- A change in method on long term construction

contracts

- A new company prior to an initial stock sale

(IPO)

- A change to or from full-cost method for

extractive firms.

- A FASB pronouncement requiring retroactive

adjustment

Make adjustments directly to Retained Earnings

for prior years.

4

Change in Accounting Estimates

We often have to update our estimates

- Amount of Receivables estimated not collectable

- Amount of Inventory that will be obsolete

- Assets useful lives and salvage values

- Amount of liabilities for estimated contingencies

- Amount of recoverable mineral or oil reserves

Changes in estimates happen prospectively there

are no prior period or cumulative adjustments

made.

The effects of these changes will occur in

current or future periods.

5

Change in Accounting Estimates

Example of change in estimate

Joe bought a car on Jan 1, 2000 for 24,000.

Estimated useful life on purchase date 7 years

Estimated Salvage value on purchase date 3,000

On Jan 1, 2001, he revised the useful life down

to 5 years.

Depreciation Exp. (purchase date estimates, SL)

(24,000 - 3,000) / 7 years 3,000 per year

Accumulated Depreciation as of change of estimate

date 3,000

After change of estimate, depreciate remaining

book value-salvage value over remaining useful

life

(24,000 - 3,000 - 3,000) / (5-1) years

4,500 per year

6

Change in Accounting Entity

If there is a change in accounting entity, the

new entity must restate all prior financial

statements as if they were under the new entity

status.

- Consolidating two or more companies into one

- Changing the companies covered within

consolidation - Accounting for a pooling of interests

merger/acquisition

Note this does not include simply shutting down,

creating or purchasing another business (which is

a change in real business entity).

7

Error Corrections

Error corrections for prior financial statements

are adjusted directly to the beginning balance of

Retained Earnings in the current year.

- Change from non-GAAP to GAAP

- Mathematical errors

- Changes due to poor or improper estimates

- Misuse of facts

8

Types of Errors

Counterbalancing Errors

Errors that correct themselves, or offset in the

following period.

e.g. Failing to record accrued wages

payable/wages expense.

Overstates net income in current period and

understates net income in next period (when

corrected).

Non-Counterbalancing Errors

Errors that take more than one period to correct

themselves.

e.g. Immediately expensing construction project

avoidable interest instead of capitalizing into

the asset.

Understates net income in current period and

overstates net income over depreciable life of

asset. Finally corrects when asset is fully

depreciated.

9

Types of Errors

Counterbalancing Errors

Assume we discover the error in the second, or

offsetting, period.

If the second year books are already closed, do

nothing, since the error has already reversed

itself.

If the second year books have not already closed,

make an adjustment to the Beginning value of

retained earnings.

1st Determine what effect the error had on 1st

period Retained Earnings (same as 1st

period Net Income)

2nd Create the journal entry to undo the effect

in the 2nd pd. This will restate Beginning

Retained Earnings back to its appropriate

level.

10

Types of Errors

Counterbalancing Errors

Example Beaver Stadium ticket office notices in

2001 that it had accidentally credited ticket

revenue instead of unearned ticket revenue for

160 at the end of 2000 when it received

prepayment for season tickets. 2001 books are

not closed.

1st Effect on 1st period is overstated revenue

and Retained Earnings. Therefore, 2nd

period Beginning Retained Earnings is

overstated.

2nd Create the journal entry to undo the effect

in the 2nd pd.

Retained Earnings 160 Ticket Revenue 160

11

Types of Errors

Counterbalancing Errors

Example Paterno Corp. forgot to recognize

accrued salary expense and accrued salary

liability of 200,000 at the end of 2000. The

error is discovered in 2001 before the books are

closed.

1st Effect on 1st period is understated expense

which makes Retained Earnings overstated.

Therefore, 2nd period Beginning Retained

Earnings is overstated.

2nd Create the journal entry to undo the effect

in the 2nd pd.

Retained Earnings 200,000 Salary

Expense 200,000

12

Types of Errors

Counterbalancing Errors

Example Abercrombie and Fitch undercounted its

ending inventory for 1999 by 10,000. It

discovered this error in 2000 before its books

were closed.

1st Effect on 1st period is overstated COGS

which makes Retained Earnings understated.

Therefore, 2nd period Beginning Retained

Earnings is understated.

2nd Create the journal entry to undo the effect

in the 2nd pd.

Merch. Inventory 10,000 Retained

Earnings 10,000

13

Types of Errors

Non-Counterbalancing Errors

Since these errors do not automatically correct

in the next period, an adjustment must be made

regardless of whether the books are closed.

Computing the adjustment requires more

complicated analysis and depends on whether the

books have been closed.

14

Types of Errors

Non-Counterbalancing Errors

Books not yet closed

Basically do the same adjustment as before.

Books already closed

Basically do the adjustment as before, except

back out a correction for the current year.

15

Types of Errors

Non-Counterbalancing Errors

Example Jones Corp. bought a truck for 10,000

with a 5 year useful life, no salvage value, SL

depreciation on Jan 1, 2000.

The company inadvertently recorded the 10,000 as

an expense instead of an asset on the date of

sale.

The error was discovered in 2001 and the books

were not closed for that year.

Effect of error in 2000

Truck expense overstated by 10,000 Depreciation

expense understated by 2,000 Net effect

overstated expenses (understated RE) by 8,000

Correction in 2001

Truck 10,000 Retained Earnings (Prior Pd.

Adj.) 8,000 Accum Depr. Truck 2,000

16

Types of Errors

Non-Counterbalancing Errors

Same example, yet the error was discovered in

2001 and the books were closed for that year.

The effect of error in 2000 has not changed

Truck expense overstated by 10,000 Depreciation

expense understated by 2,000 Net effect

overstated expenses (understated RE) by 8,000

However, we must now also consider the additive

effect of the error on 2001

Depreciation expense understated by another

2,000 Net effect overstated expenses

(understated RE) by only 6,000

Correction in 2001

Truck 10,000 Retained Earnings 6,000 Accum

Depr. Truck 4,000