Hot Constructive Dividend Scenarios - PowerPoint PPT Presentation

Title:

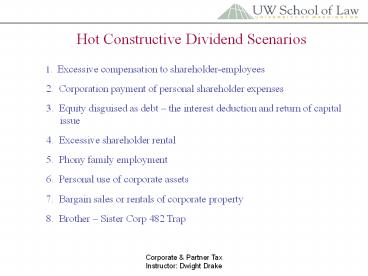

Hot Constructive Dividend Scenarios

Description:

3. Equity disguised as debt the interest deduction and return ... Waterman, TSN, Litton Industries ... show business purpose (TSN) or unrelated acts (Litton) ... – PowerPoint PPT presentation

Number of Views:68

Avg rating:3.0/5.0

Title: Hot Constructive Dividend Scenarios

1

Hot Constructive Dividend Scenarios

1. Excessive compensation to

shareholder-employees 2. Corporation payment of

personal shareholder expenses 3. Equity

disguised as debt the interest deduction and

return of capital issue 4. Excessive

shareholder rental 5. Phony family employment

6. Personal use of corporate assets 7. Bargain

sales or rentals of corporate property 8.

Brother Sister Corp 482 Trap

2

Trap Four Section 482 Rev. Rule 69-630

Bargain sale

C Corp A

C Corp B

Imputed Income

Imputed Dividend

Imputed Contribution

Common owners

3

243 Deduction Protectors

1. 246 Stock not held long enough 2.

249A - Debt financed stock ownership 3.

1059 - Extraordinary dividends 2 yr rule and

consolidated return rule 4. The Waterman

Bootstrap Acquisition

4

Problem 524

- June 1 P Corp stock trades at 15 declares

dividend 1 per share. Record date June 8.

Payment date June 12 - June 3 I Corp buys 1000 shares for 15k,

collects 1000 dividend on June 10 - June 15 I Corp sells stock for 14k

- Tax consequences to I Corp? Desire to have 243

shelter 70 of 1k dividend and have 1k STCL. But

flunk excess 45 holding period of 246(c). So, no

243 deduction. All 1k dividend taxable. - Sale date Dec 1. 246(c) not apply more than

45 days satisfied. 243 deduction of 70 allowed.

5

Problem 524

- June 1 P Corp stock trades at 15 declares

dividend 1 per share. Record date June 5.

Payment date June 10 - June 3 I Corp buys 1000 shares for 15k,

collects 1000 dividend on June 10 - June 15 I Corp sells stock for 14k

- Sale still on Dec 1, but second dividend of 1

paid on August 15 (ex date 8/5)? Per

1059(c)(3)(A), dividends with ex-dates within 85

days treated as one dividend for 10 excessive

dividend to basis rule. Here, 2k dividend over

10 of 15k basis. Effect under 1059(a) is that

basis reduced by non-taxable portion - 1400.

Hence, stock basis reduced to 13,600 (15k less

1400). Note, 243 deduction still allowed, but

creates basis reduction. When stock sold for

14k, have 400 gain.

6

Problem 524

- June 1 P Corp stock trades at 15 declares

dividend 1 per share. Record date June 5.

Payment date June 10 - June 3 I Corp buys 1000 shares for 15k,

collects 1000 dividend on June 10 - June 15 I Corp sells stock for 14k

- I Corp receives 3k dividends, but holds 25 months

before sale. 1059(a) still applies. Stock must

have been held 2 years before dividend

announcement date. Holding period after not

relevant. Hence, 243 deduction (70 - 2100)

would reduce basis to 12.9k.

7

Problem 524

- I Corp borrowed 15k to buy stock, paid 1200

interest and received 1000 dividend? What

result? No 243 dividend deduction per 246(a).

Average Indebtedness Percentage is 100, so

entire deduction lost. - What if debt 7.5k? Then Average Indebtedness

Percentage 50 under 246A. Half of 243

deduction disallowed. Deduction reduced to 35

or net 350.

8

Problem 538

Basic Facts S Corp hold X Corp stock more than

2 yrs, not part of consolidated group. Basis in

stock 150k. - X Corp pays 100k dividend to

S Corp. Plenty of EP. - B buys X Corp

stock from S for 400k. - Goal 100k

dividend sheltered 70 buy 243 capital gain on

sale reduced 100k. Will it work? Its the

Waterman, TSN, Litton Industries issue. Note, if

held stock for less than 2 yrs or consolidated

return, than basis in stock reduced by tax-free

dividend per 1059 and plan fails. Here, 1059 not

apply. Risky if cant show business purpose

(TSN) or unrelated acts (Litton). Was dividend

cash unwanted by buyer? Step Transaction/Sham

doctrines may kill under Waterman rationale.