Intertemporal Choice Ec 101 Prof' Camerer

1 / 49

Title:

Intertemporal Choice Ec 101 Prof' Camerer

Description:

Preferences for earlier vs later rewards. Important choices involve time ... vs expert advice & external self-control (Soc. Security) 2 ... –

Number of Views:223

Avg rating:3.0/5.0

Title: Intertemporal Choice Ec 101 Prof' Camerer

1

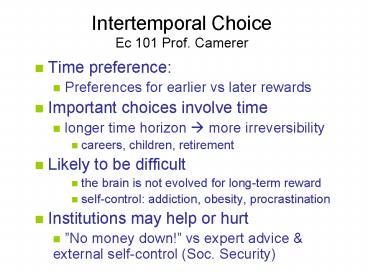

Intertemporal ChoiceEc 101 Prof. Camerer

- Time preference

- Preferences for earlier vs later rewards

- Important choices involve time

- longer time horizon ? more irreversibility

- careers, children, retirement

- Likely to be difficult

- the brain is not evolved for long-term reward

- self-control addiction, obesity,

procrastination - Institutions may help or hurt

- No money down! vs expert advice external

self-control (Soc. Security)

2

- 1 Some history of intertemporal choice

- 2 Anomalies from discounted utility theory (LFR

review) - Field tests

- 3 Projection bias

- 4 Life-cycle savings

- Mental accounting puzzles

- Calibration exercise (Angeletos et al)

- Experimental data

- 5 Research frontiers

- Practical lessons

- Sophistication vs naivete

3

1. Some history of intertemporal choice (see

Loewenstein, ch 1 L-Elster Choice Over Time)

- Adam Smith (1776)

- impartial spectator (cingulate, PFC?)

- John Rae (1834)

- Eugen von Böhm-Bawerk (1889)

- Irving Fisher (1930)

- Paul Samuelson (1937)

- Robert Strotz (1956)

- Phelps and Pollak (1968)

- ?- d used to explain discounting of self and

children (future selves) - David Laibson (1994,97) adapted PP 68

4

E.g., Fisher

- Personal determinants of time preference

- Foresight

- Risk of future

- Self-control

- Habit

- Life-expectancy

- Concern for lives of other persons

- Fashion In whatever direction the leaders of

fashion first chance to move, the crowd will

follow in mad pursuit - Was critical of econ-psych divide

- The fact that there are two schools, the

productivity school and the psychological school,

constantly crossing swords on this subject is a

scandal in economic science and a reflection on

the inadequate methods employed by these would-be

destroyers of each other

5

Discounted Utility Model

- Discount factor compresses many Fisherian forces

into one term - Now accepted as normative and descriptive

- It is completely arbitrary to assume that the

individual behaves so as to maximize an integral

of the form evisaged in DU. (Samuelson 1937) - Utility and consumption independence

- Exponential ? time consistency

6

2. Anomalies from DU (LFR)

- Measured discount factors are not constant

- Over time

- Across type of intertemporal choices

- Sign effect (gains vs. losses)

- Neural substitution of loss and delay?

- Magnitude effect (small vs. large amounts)

- Sequence effect (preference for upward-sloping

profiles) - Speedup-delay asymmetry (temporal loss-aversion).

7

Magnitude and hyperbolic effects

- 15 now is same as ___ in a month. ___ in a year.

___ in 10 years. - Thaler (1981) 20 in a month (demand 345

interest), 50 in a year (120), 100 in 10 years

(19 interest) - Show discount rates decrease over time

- Students asked

- 150 vs. x in 1 month, 1 year, 10 years

- 5000 vs x .

8

Results of class survey

160

197

500

6,000

14,000

5,100

9

Figure 1 (LFR) Increasing variation over time as

more studies are done

,

10

Figure 2 (LFR) Increasing patience with longer

horizons

,

11

Discounting is important in other domains

- Education (Duckworth, Seligman 05 Psych Sci)

Predicts 14-yr olds grades - Not the will to winthe will to practice

12

Role of attention cognition Exposure and

distractions very powerful (Walter Mischel et

al)

- Delay-of-gratification in children (ring bell

when they cant wait any longer for better snack) - Fun thoughts, covering snacks enhances

patienceexcept if they are thinking about the

snacks! (see Fig 6.1) - Thoughts about arousing features versus

cognitive re-appraisal creates impatience

13

Field test Front-loaded buyouts for soldiers

(Warner-Pleeter AER 01)

- After the Gulf War in the early 1990s the

military enticed soldiers into retirement - Choose between a lump sum payment (on the order

of 20K) and an annuity (worth around 40K in PV

_at_ r10) - Officers 50 took lump sum

- Enlisted 90 took lump sum

14

- Officers

- enlisted

15

- Can estimate discount rates from large n55,000

sample (enlisted results) - Male .01

- Black .035

- College -.048

- Test scores high (-.016), medium (-.01)

- Size of lump sum (-.059/10k) (largest fx)

16

Vietnam exp (w/ Tomomi Tanaka, Quang Nguyen)

17

General model estimation

- Benhabib, Bisin, Schotter (04)

- T1 exponential xexp(-rt)

- T2 hyperbolic x/(1rt)

- Graph for T1,2,5 (r.13)

- BBS est. T (2.62,4.14), r (6.37, 33.64)

- Vietnam villages T5.19, r13, a.88

- ROSCA participants have higher a (.15), lower r

(-.04) - Can also add fixed cost (-b) and variable cost (a

multiplier) - Highly variable estimates

18

Projection bias (Loewenstein, Read, Rabin )

- Overestimate duration of state-dependence

- is estimated utility in s from

state s - a0 rational

- Examples

- Shopping while hungry

- Childbirth Lamaze versus epidural painkiller

during labor - Cannibalism

- Interpersonal Difficult to imagine what people

will do in different emotional states...(looting,

lynchmobs, corporate scandals, crimes of passion,

heroic acts...) - Wilson-Gilbert affective forecasting mistakes

(fail to appreciate emotional immune system)

19

Empirics Catalog sales for winter clothes items

- Winter-item catalog sales (Conlin, ODonoghue,

Vogelsang AER in press) - 2.4 million observations 95-99. One 1 day to

process, 3-7 days to ship - Theory predicts returns will depend on

temperature on return day R -

- on temperature on order day O - intuition lower temp(O) ? surprised at high

temp(R) and then return - temp(O)

- temp (R)

20

4. Lifecycle savings

- Golden eggs and hyperbolic discounting

- Hyperbolics are tempted

- Illiquid assets provide commitment

- Two-thirds of US wealth illiquid (real estate)

- Not counting human capital

- Access to credit reduces commitment

- Explain decline in savings rate 1980s?

21

Borrowing Boom in bankruptcies

22

Borrowing Credit card facts

- Average debt outstanding by income quintile (IQ)

- Rates (APR, red) have

- fallen as interest rates fall (blue). Blue is

spread

23

Mental accounting and MPC (Thaler-Shefrin 1988)

24

Angeletos et al calibration

- Model features

- Quasi-hyperbolic sophisticated preferences

- uncertain future labor income

- liquidity constraint

- allow to borrow on credit cards - limit

- hyperbolic discounting implications

- labor income autocorrelated shocks

- hold liquid and illiquid assets

- Calibration strategy

- Fix some parameters, simulate behavior, compare

properties with data

25

Figure 3 Shapes of discount functions

,

26

Figure 4 - from Angeletos et al

,

27

Figure 5 - from Angeletos et al

,

28

Figure 6 - from Angeletos et al

,

29

Figure 7 - from Angeletos et al

,

30

Table 1 - from Angeletos et al

,

31

Table 2 - from Angeletos et al

,

32

Habit formation Spending

- The hedonic treadmill

33

Habit formation Spending

- The hedonic treadmill

34

Optimal saving and investing Do sufficiently

rational agents optimize?

35

Economics Nobel laureates reflect (from LA Times)

36

Beverage delivery apparatus

37

5. Research frontiers Sophistication vs naivete

- Are hyperbolics sophisticated? or naïve?

- Sophisticated hyperbolics will prefer

pre-commitment - IRS refunds

- Deadlines (Blockbuster vs Netflix)

- Ulysses and the sirens

- Arrest me list on riverboat casinos

- Wertenbroch

- Smaller package sizes of vices than virtues

- Cigarettes by the pack, gym contracts

(Malmendier-Della Vigna AER 06, 19/visit vs 10

visit fee) - Q Will markets work? Or does government have

special legal power to enforce these contracts?

(e.g. Army AWOL)

38

Sophisticates seek self-control (from periodic

food stamp checks, Ohls 92 Shapiro, 03 JPubEc)

39

Factoid

40

80 of respondents have negative discount rates!

voluntary forced saving (Shapiro JPubEc 03

cf. Ashraf et al QJE in press)

41

Frontiers Practical value of behavioral

econSave More Tomorrow (Benartzi-Thaler JPE 04)

- Exploit power of inertia and desire to avoid a

nominal decrease in pay - Commit 1/3 of future raise to 401(k)

42

Swedish privatization c 2000 (Cronqvist-Thaler

AER 04)

- Driven by desire for investor autonomy

- 456 funds, could advertise set fees

- Information (fees, performance, risk) in book

form - Big ad campaign Investors encouraged to choose

their own fund (57 of young did) - What happened?

43

Swedish privatization (Cronqvist-Thaler AER 04)

- Autonomous investors

- home biased

- high fees

- Poor performance

- 03 92 of young choose default

44

Neural evidence (McClure et al Sci

04)u(x0,x1,)/ ß (1/ß)u(x0) du(x1)

d2u(x2) Impulsive ß ?

long-term planning d ?

45

Problem Measured d system is all stimulus

activityuse difficulty to separate d (bottom

left), d more active in late decisions with

immediacybut is it d or complexity?

46

Other aspects of time in econ

- Other models and phenomena

- Habit formation (common in macro)

- Visceral influence (emotion-cognition)

- Temptation preferences (Gul-Pesendorfer 01

Emetrica) - w?w,t?t iff U(S)maxx?Su(x)v(x) maxy ? S

v(y) - Anxiety/savoring/memory as consumption

(Caplin-Leahy e.g. wedding planning) - Multiple selves/dual process models

47

Types of anticipation preferences

- Reference-dependent preferences (K-Rabin 04)

- Belief about choice changes reference point

- Endowment effects/auction fever

- Explains experience effects (experienced traders

expect to lose objects, doesnt enter endowment/

f1) - Emotions and self-regulation

- E.g. depression. Focusses attention on bad

outcomes, causes further depression - Intimidating decisions

- f1 may increase stress about future choices

- health care, marriage, job market, etc.

- Better to pretend future choicestatus quo

- Q When are these effects economically large?

- Avoid the doctor? late cancer diagnosis

- Supply side determination of endowment effects

(marketing)

48

Three interesting patterns

- Self-fulfilling beliefs

- u2(dz,z)gtu2(dz,z) u2(dz,z)gt u2(dz,z)

- prefer z if you expect(ed) z, z if you

expect(ed) z - Cognitive dissonance, encoding bias

- If I could change the way/I live my life today/I

wouldnt change/a single thing Lisa Stansfield - Undermines learning from mistakes

- Time inconsistency

- Self 2 prefers z given beliefs

u2(f1,z)gtu2(f1,z) - but self 1 preferred to believe and pick z

u1(x,dz,z)gtu1(x,dz,z) - Problem Beliefs occur after self 1 picks

- Informational preferences

- Resolution-loving Likes to know actual period 2

choice ahead of time - Information-neutral Doesnt care about knowing

choice ahead of time (go with the flow) - Information-loving Prefers more information to

less (convex utility in f1) - Disappointment-averse (prefers correct to

incorrect guesses) - u1(x,dz,z)u1(x,dz,z)gt u1(x,dz,z)u1(x,d

- Surprising fact If none of above hold, then

personal equilibrium iff u maxs E(u1(z1,z2)

I.e. only way beliefs can matter is through these

three

49

Koszegi, Utility from anticipation and personal

equilibrium

- Framework Two selves, 1 and 2

- Choices z1,z2 , belief about z2 is f1

- u1(z1,f1,z2)

- anticipation function F(z1,d2)f1 (d2 is period

2 decision problem) - personal equilibrium

- each self optimizes

- F(z1,d2)s2(z1,F(z1,d2),d2) anticipate s2(.)

choice - Beliefs are both a source of utility and

constraint - Timeline

- Choose from z1 X d2.

- Choose f1 from F.

- Choose z2