ANNOUNCEMENTS

1 / 23

Title: ANNOUNCEMENTS

1

ANNOUNCEMENTS

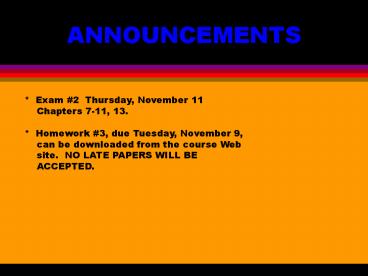

Exam 2 Thursday, November 11 Chapters

7-11, 13. Homework 3, due Tuesday, November

9, can be downloaded from the course Web

site. NO LATE PAPERS WILL BE ACCEPTED.

2

DEFINITION

A good is rival if one persons use of it

reduces another persons enjoyment of the

good. A steak dinner is rival because, when one

person consumes the steak, it cannot be eaten by

anyone else. A radio broadcast is not rival,

because many people can listen to the broadcast

without reducing the ability of others to listen.

3

DEFINITION

A good is excludable if people can be prevented

from using it once it has been produced. Cable

TV is an excludable good, because a cable hookup

is required to receive the programming. Broadcast

radio and TV are not excludable, because once

the program is broadcast, anyone with a ratio or

television receiver can tune into the program.

4

A TAXONOMY OF GOODS

Rival

Not Rival

Private Goods Natural

Monopolies

Ice-cream cones

Fire protection Excludable Clothing

Cable

TV Congested toll

roads Uncongested toll

roads Common

Resources Public Goods Not

Fish in the ocean

National defense Excludable The

environment

Knowledge Congested

nontoll roads Uncongested

nontoll roads

5

PRIVATE GOODS

Private goods are both rival and excludable. We

have seen that competitive markets efficiently

allocate resources for private goods when there

are no externalities in production or

consumption. Furthermore, when there are no

externalities, government interference with

competitive markets for private goods causes a

misallocation of resources.

6

EXTERNALITIES

When there are externalities competitive

markets do not allocate resources efficiently and

government interference can improve the

allocation of resources.

7

PUBLIC GOODS

Competitive markets also fail to allocate

resources efficiently for public goods. The

reason is that public goods are not

excludable. Once one or more persons pay for the

provision of the public good, it is freely

available for use by anyone else -- whether they

pay or not. This causes a free rider problem --

people enjoying the benefits of a public good

without helping to pay for the cost of supplying

the good.

8

PUBLIC GOODS

There are only two individuals in a community

with TVs. Their demand schedules are given at

the left, along with the TV stations supply

schedule.

Hourly

Hourly Hours of value to value

to Supply public TV Smith

Jones 1 100

60 60 2

95 55 65 3

90 50

70 4 85

45 75 5

80 40 80

6 75

35 85 7

70 30 90

8 65 25

95 9 60

20 100 10

55 15

105

9

PUBLIC GOODS

Smith pays for public TV broadcasts, while Jones

is a free rider. Smith will benefit from a hour

of TV as long as the value of the hour to him is

greater than what

Hourly

Hourly Hours of value to value

to Supply public TV Smith

Jones 1 100

60 60 2

95 55 65 3

90 50

70 4 85

45 75 5

80 40 80

6 75

35 85 7

70 30 90

8 65 25

95 9 60

20 100 10

55 15

105

10

PUBLIC GOODS

he must pay the TV station for providing it.

Smiths quantity demanded and the TV stations

quantity supplied are equal to 5 at a price of

80 per

Hourly

Hourly Hours of value to value

to Supply public TV Smith

Jones 1 100

60 60 2

95 55 65 3

90 50

70 4 85

45 75 5

80 40 80

6 75

35 85 7

70 30 90

8 65 25

95 9 60

20 100 10

55 15

105

11

PUBLIC GOODS

hour (a total cost of 80 x 5 400 to Smith).

When 5 hours are broadcast, Jones also receives

value from the broadcast without paying.

Hourly Hourly

Supply Hours of value to

value to (social public TV Smith

Jones cost) 1

100 65 60 2

95 60

65 3 90

55 70 4

85 50 75

5 80

45 80 6

75 40 85

7 70 35

90 8 65

30 95 9

60 25

100 10 55

20 105

12

PUBLIC GOODS

The total social benefit is Smiths consumer

surplus, the TV stations producer surplus, and

Jones consumer surplus.

Note that since Jones pays a zero price, the

surplus is the entire area under the demand curve.

13

PUBLIC GOODS

Consumer surplus for Smith is (105-80) x

5/262.5. Consumer surplus for Jones is 45 x 5

(70-45) x 5/2 312.5. Producer

Surplus is (80-55) x 5/2 62.5. Therefore the

total surplus is 437.5.

14

PUBLIC GOODS

Since the value of the fifth hour to Smith is

80, and the value of the fifth hour to Jones is

45, total social value of the fifth

hour is 120. However social cost is only 80, so

that the sum of consumer and producer surplus can

be

15

PUBLIC GOODS

increased by using more resources to produce

more hours of TV.

16

PUBLIC GOODS

Adding together Smiths and Jones values

for hours of public TV, total social value

exceeds total social cost up to 8 hours of TV.

Hourly Hourly

Total Supply Hours of value to

value to social (social public TV

Smith Jones value cost)

1 100 65 165

60 2 95

60 155 65 3

90 55 145

70 4 85

50 135 75 5

80 45 125 80

6 75 40

115 85 7

70 35 105 90

8 65 30

95 95 9

60 25 85 100

10 55 20

75 105

17

PUBLIC GOODS

Since public TV is not rival, both Smith and

Jones receive their full value from each of the

hours of TV. Therefore, Jones demand is added

on top of Smiths. Then the welfare maximizing

output

is 8 hours. Consumer surplus is (175-95) x

8/2320, and producer surplus is (95-55) x

8/2160. Then

18

PUBLIC GOODS

the total surplus for 8 hours is 480 compared

to 437.5 for 5 hours. Because Jones is a free

rider there are too few resources allocated

to public TV and social welfare is not maximized.

If Smith

pays her valuation of 8 hours (65) and Jones

pays his valuation of 8 hours (30), each will

benefit, and

19

PUBLIC GOODS

resources will be efficiently allocated. One way

to determine the optimal level of output of a

public good is to survey all potential consumers

to determine what value they place on the

provision of the good. Summing these values

gives the value to society which can then be

compared to social cost. Besides the enormous

problem of contacting everyone to determine

their valuation of the public good, there is a

strong likelihood that respondents

20

PUBLIC GOODS

will not be truthful about their valuation since

they know they may be charged what they report.

Since they can be a free rider, everyone has

every incentive to underreport his valuation.

In this situation there would be an

underprovision of the public good. Therefore

provision of public goods is better left to

government to provide out of tax revenues, since

the market fails to efficiently allocate

resources to the provision of public goods.

21

COMMON RESOURCES

Goods that are rival, but not excludable

are classified as common resources. Examples

are fish in ocean fisheries, the environment

(air, water, public forests), congested freeways,

and public picnic grounds on summer holidays.

Since these are not excludable, every citizen

has an incentive to exploit these resources to

the point where they obtain no additional value.

This causes overuse. Ocean fisheries may be

fished to extinction because,

22

COMMON RESOURCES

a fisherman believes that if he doesnt get the

fish, someone else will, and there will be fewer

left for him as a result. Robert Coase has

shown that the problem is that no one has, or

can exercise, any property rights on these

resources. If property rights to the common

resources were assigned, then the owner could

exclude users, making these resources rival and

excludable, i.e., making them private goods. If

there are no externalities

23

COMMON RESOURCES

associated with the resources, competitive

markets would allocate the use of these resources

efficiently. This is the idea of the Coase

Theorem. Assigned pollution rights is a form of

property rights, and a competitive market for

these rights can lead to an efficient use of the

environment when the proper amount of rights is

assigned.