FLP For Asset Protection - PowerPoint PPT Presentation

1 / 39

Title:

FLP For Asset Protection

Description:

ANNUITIES. INVESTMENTS. INVESTMENT INCOME. LIFE INSURANCE CASH VALUE. PENSIONS-PROFIT ... ANNUITIES. INVESTMENTS. INVESTMENT INCOME (Protected After April 15th of Each ... – PowerPoint PPT presentation

Number of Views:144

Avg rating:3.0/5.0

Title: FLP For Asset Protection

1

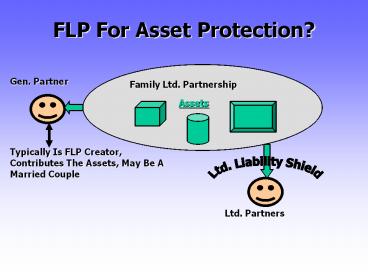

FLP For Asset Protection?

Gen. Partner

Family Ltd. Partnership

Assets

Typically Is FLP Creator, Contributes The Assets,

May Be A Married Couple

Ltd. Liability Shield

Ltd. Partners

2

FLP For Asset Protection?

Gen. Partner

Family Ltd. Partnership

Assets

Ltd. Liability Shield

Personal Legal Attack, Resulting In Judgment

Ltd. Partners

Creditor (1 Eye Monster)

3

FLP For Asset Protection?

Gen. Partner

Family Ltd. Partnership

Assets

Ltd. Liability Shield

Personal Legal Attack, Charging Order

Ltd. Partners

Lien or Garnishment On Distributions Of

Affected Partner

4

FLP For Asset Protection?

Gen. Partner

Family Ltd. Partnership

Assets

K-1

Ltd. Liability Shield

0.00, Tax Liability Hot Potato

Ltd. Partners

Creditor (1 Eye Monster)

5

FLP For Asset Protection?

Theory of the K-1 Hot Potato Effect is Enhanced

With These Results

- A Creditor w/Charging Order Cannot

- Reach Partnership Assets

- Manage The Partnership or Vote

- Control Cash Flow Or Force Distributions

- Cause Partnership Liquidation

6

FLP For Asset Protection?

Creditor, In Reality, Is Not Shut Out!

- Because The General Partner Cannot

- Make Distributions to Some Partners While

Withholding Distributions to The Partner Who Has

The Charging Order - Withhold Distributions Period, Without Legitimate

Business or Investment Purpose - Therefore, In Many Or Most Cases the Creditor

Will Be Able to Force Distributions To Accompany

The K-1. Or, All Partners Are Tied Up

Stalemate! - See The Cutting Edge Handout

7

FLP For Asset Protection?

Creditor, In Reality, Is Not Shut Out!

Even If The General Partner Could Withhold The

Creditors Distributions, While Paying Other

Partners,

- The Charging Order Partner Definitely Cannot

Receive Distributions of Income or Capital - If The FLP Forming Partners (Clients) Receive a

Charging Order, They Have No Asset Protection! - The Promoters Claims Are Not Valid

8

FLP For Asset Protection?

And, The Creditor May Very Well Pay The Taxes!

- Taxes To Pay May Be Small In Comparison to

Judgment Amount - May Be No Taxes At All, If FLP Assets Are

Primarily Capital Growth - Paying The Taxes Probably Is A Good Investment,

Ultimately Creditor Will Receive Corresponding

Capital and Growth On It - The Promoters Claims Are Not Valid

9

FLP For Asset Protection?

- Other Limitations And Issues

- General Partners Must Give Away (98?) Interests

To Protect Assets Which They Contribute To FLP - No Protection For Non-FLP Assets, For Any Partner

- California Effectively Eliminated Charging Orders

for LLCs On 1/1/2004, Allowing Membership

Interest Liquidation For Creditor (FLPs and Other

States Not Far Behind?) - And, You Have To Question Competence Of Anyone

Not At Least Recommending A Limited FLP or LLC

10

FLP For Asset Protection?

What About Legal Attacks On The Partnership?

Gen. Partner

Family Ltd. Partnership

Assets

Ltd. Liability Shield

Ltd. Partners

11

FLP For Asset Protection?

What About Legal Attacks On The Partnership?

Gen. Partner

Family Ltd. Partnership

Assets

For This Case, Charging Order Is Useless For

Partnership Assets and General Partners Non FLP

Assets. Only Ltd. Partners Are Protected.

Ltd. Liability Shield

Ltd. Partners

12

FLP For Asset Protection?

- General Problems and Issues

- To Improve Protection, Should Use Outside

Partners - Must Avoid Personal Usage, Alter Ego Problems

- FLP Must Be Run As A Business

- Court Can Sell Interest, Even Dissolve FLP

- Limit on Asset Type, All Must Have Biz Purpose

- Statutory Action Is All In the Trust Arena

- If The FLP Worked For Asset Protection, NAFEP

Would Support That. We Do Create FLPs For Proper

Usage.

13

If Not For Asset Protection,Then What Is FLP

Purpose?

Family Ltd. Partnership

Gen. Partner

Assets

- FLPs Make An Excellent Income and Estate Tax

Planning Vehicle - Very Useful For Managing Familys Income

Producing Assets

Ltd. Liability Shield

Ltd. Partners

14

FLP For Asset Protection?

- Source\Reference Material For FLPs

- ?The Cutting Edge, Published By Leimberg

Associates, Inc. www.leimbergservices.com, 60.00

- Asset Protection, By Peter Spero, Published By

Warren Gorham Lamont (WGL-RIA), Division of

Thomson Tax Accounting Company - Tools and Techniques of Estate Planning, By (Many

Authors), Published By National Underwriter Co.,

64.95, www.nationalunderwriter.com

15

Getting Rid of Myths

- This Is Not Asset Protection

Business Directed Legal Attacks

Limited Liability Co.

Personal Property Directed Legal Attacks

Ltd. Liability Shield

LLC Owner

LLC Units

Assets

16

Getting Rid of Myths

- This Is Not Asset Protection

Asset Directed Legal Attacks

Revocable Living Trust

Assets

Personal Legal Attacks

17

(No Transcript)

18

(No Transcript)

19

(No Transcript)

20

(No Transcript)

21

(No Transcript)

22

(No Transcript)

23

(No Transcript)

24

(No Transcript)

25

(No Transcript)

26

(No Transcript)

27

(No Transcript)

28

(No Transcript)

29

(No Transcript)

30

(No Transcript)

31

(No Transcript)

32

(No Transcript)

33

(No Transcript)

34

(No Transcript)

35

(No Transcript)

36

(No Transcript)

37

- Your Assets

- Without a Life Estate Trust

- Your Assets

- With a Life Estate Trust

- EARNED INCOME

- HOUSE

- (Some Protection in Some States)

- VACATION HOUSE

- AUTOMOBILES

- OFFICE BUILDING

- RENTAL PROPERTY

- CASH/SAVINGS

- EARNED INCOME

- HOUSE

- (Some State Protection Full Protection in

Trust) - VACATION HOUSE

- AUTOMOBILES

- OFFICE BUILDING

- RENTAL PROPERTY

- CASH/SAVINGS

38

- Your Assets

- Without a Life Estate Trust

- Your Assets

- With a Life Estate Trust

ANNUITIES INVESTMENTS INVESTMENT INCOME LIFE

INSURANCE CASH VALUE PENSIONS-PROFIT SHARING /

401K IRA / 403 B (Protection in Some States)

ANNUITIES INVESTMENTS INVESTMENT

INCOME (Protected After April 15th of Each Year

if Left in Trust) LIFE INSURANCE CASH

VALUE PENSIONS-PROFIT SHARING / 401K IRA /

403B (Protection in Some States)

39

Asset Protection Support Materials

- The Preceding PowerPoint Presentation w/Script

- Automated Presentation (Answers To Lifes

Financial Risks) - Answers Booklet, Paralleling Above

Presentations, Excellent Study Guide at Seminars,

Client Handout - Color, Bi-Fold Brochure, Client Handout

- Asset Protection Legal Package, For Clients

Counsel