Investment Bank - PowerPoint PPT Presentation

1 / 5

Title:

Investment Bank

Description:

Investment banks differ from commercial ... In recent years, however, the lines between the two types of structures have ... Wachovia. Lifestyle/Compensation ... – PowerPoint PPT presentation

Number of Views:174

Avg rating:3.0/5.0

Title: Investment Bank

1

Investment Bank

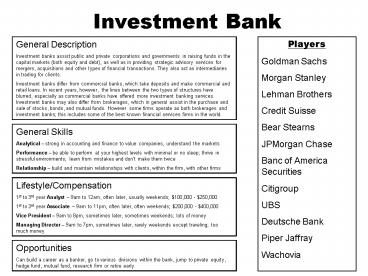

- General Description

- Investment banks assist public and private

corporations and governments in raising funds in

the capital markets (both equity and debt), as

well as in providing strategic advisory services

for mergers, acquisitions and other types of

financial transactions. They also act as

intermediaries in trading for clients. - Investment banks differ from commercial banks,

which take deposits and make commercial and

retail loans. In recent years, however, the lines

between the two types of structures have blurred,

especially as commercial banks have offered more

investment banking services. Investment banks may

also differ from brokerages, which in general

assist in the purchase and sale of stocks, bonds,

and mutual funds. However some firms operate as

both brokerages and investment banks this

includes some of the best known financial

services firms in the world.

Players Goldman Sachs Morgan Stanley Lehman

Brothers Credit Suisse Bear Stearns JPMorgan

Chase Banc of America Securities Citigroup UBS Deu

tsche Bank Piper Jaffray Wachovia

General Skills Analytical strong in accounting

and finance to value companies, understand the

markets Performance be able to perform at your

highest levels with minimal or no sleep thrive

in stressful environments learn from mistakes

and dont make them twice Relationship build

and maintain relationships with clients, within

the firm, with other firms

Lifestyle/Compensation 1st to 3rd year Analyst

9am to 12am, often later, usually weekends

100,000 - 250,000 1st to 3rd year Associate

9am to 11pm, often later, often weekends

200,000 - 400,000 Vice President 9am to 8pm,

sometimes later, sometimes weekends lots of

money Managing Director 9am to 7pm, sometimes

later, rarely weekends except traveling too much

money

Opportunities Can build a career as a banker, go

to various divisions within the bank, jump to

private equity, hedge fund, mutual fund, research

firm or retire early.

2

Hedge Fund

- General Description

- A hedge fund is a lightly regulated private

investment fund sometimes characterized by

unconventional strategies. The term hedge fund

dates back to the first such fund founded by

Alfred Winslow Jones in 1949. Jones' innovation

was to sell short some stocks while buying

others, thus some of the market risk was hedged.

While most of today's hedge funds still trade

stocks both long and short, many do not trade

stocks at all. Generally investments are

non-controlling stakes in the target company. - For U.S.-based managers and investors, hedge

funds are simply structured as limited

partnerships or limited liability companies. The

hedge fund manager is the general partner or

manager and the investors are the limited

partners or members respectively. The funds are

pooled together in the partnership or company and

the general partner or manager makes all the

investment decisions based on the strategy it

outlined in the offering documents. - The fee structures of hedge funds vary, but the

annual management fee is typically 10-25 of the

profits of the fund plus 1-2.5 of assets under

management.

Players NightWatch Capital D.E. Shaw Bridgewater

Associates Goldman Sachs Asset Management Farallon

Capital Management Caxton Associates Gotham

Capital Other Major Investment Banks

Strategies/Skills Various investing strategies

exist Multi-strategy (varied upon asset classes

such as equities, debt, derivatives), statistical

arbitrage, hedging, long/short, value,

contrarian, opportunistic, technical,

risk-averse, etc. Skills vary but generally

highly technical and quantitative.

Lifestyle/Compensation Generally one does not

start at a hedge fund but works in investment

banking, sales and trading, a related industry

for 2 years or business school before making the

jump. Expect 10-14 hours per day and rarely

weekends. Salary will be competitive to banking

with an extremely high upside. A top trader in

2005 made 750,000,000. Others lost their shirts.

Opportunities Usually those who work at a hedge

fund eventually start their own or jump to

another.

3

Private Equity

- General Description

- Private equity is a broad term that refers to any

type of equity investment in an asset in which

the equity is not freely tradable on a public

stock market. Categories of private equity

investment include leveraged buyout, venture

capital, growth capital, angel investing,

mezzanine capital and others. - Generally, private equity funds are organized as

limited partnerships which are controlled by the

private equity firm that acts as the general

partner. The fund obtains commitments from

certain qualified investors such as pension

funds, financial institutions and wealthy

individuals to invest a specified amount. These

investors become passive limited partners in the

fund partnership and at such time as the general

partner identifies an appropriate investment

opportunity, it is entitled to "call" the

required equity capital at which time each

limited partner funds a pro rata portion of its

commitment. All investment decisions are made by

the General Partner which also manages the fund's

investments (commonly referred to as the

"portfolio"). Over the life of a fund which often

extends up to ten years, the fund will typically

make between 15 and 25 separate investments with

usually no single investment exceeding 10 of the

total commitments. Most often private equity

investments are controlling positions in the

target company.

Players Blackstone Group Carlyle Group KKR Thomas

H. Lee Cerberus Capital Management Oaktree

Capital Management Sorenson Capital Major

Investment Banks

General Skills Analytical strong in accounting

and finance to value companies, understand the

markets Performance be able to perform at your

highest levels with minimal or no sleep, lots of

travel thrive in stressful environments compete

against the best in the investment

world Relationship build and maintain

relationships with clients, with banks and other

supporting firms

Lifestyle/Compensation Generally one does not

begin a career in private equity. These firms

often take top analysts from Investment Banks or

top candidates from premiere business schools.

Expect banking-like hours at top large firms and

hedge fund-like hours for smaller firms. Pay is

generally a little more than banking with higher

upside potential based on yearly performance.

Opportunities Usually those who work in private

equity eventually start their own firm or jump to

another. They may move into a hedge fund or

venture capital firm.

4

Venture Capital

- General Description

- Venture capital is capital provided by somewhat

outside investors for financing of new, growing

businesses. Venture capital investments generally

are high risk investments but offer the potential

for above average returns. A venture capitalist

(VC) is a person who makes such investments. A

venture capital fund is a pooled investment

vehicle (often a partnership) that primarily

invests the financial capital of third-party

investors in enterprises that are too risky for

the standard capital markets or bank loans.

Venture Capital can be looked at as an

early-stage private equity firm.

National Players Kleiner Perkins Caufield

Byers Greylock Partners Sequoia Capital Thomas

Weisel Partners Major Investment Banks Intel

Capital Local Players VSpring Capital UV

Partners Wasatch Venture Fund

General Skills Analytical accounting and finance

is important to value companies but due to early

stage investing and financial forecasting, they

are not as integral to the valuation process

understand the markets Relationship build and

maintain relationships with clients, investors,

banks and other supporting firms a fundamental

skill because money must be invested and the

relationships used to introduce target companies

to different groups of investors Entrepreneurial

VCs are very entrepreneurial, more so than

private equity. Many principals have grown

companies themselves and/or found seed money in

the past. Often times its investing in the RD

stage, then working bringing it to commercial

use Consulting working with the company on how

things go not only from a financial perspective

but also from a management perspective

Lifestyle/Compensation Typically not as

labor-intensive as investment banking. Expect

50-70 hours per week, similar to a mutual fund

lifestyle. Almost all dont begin their careers

in venture capital but in investment banking,

consulting or as an entrepreneur (natural fit).

An Associate is compensated by a salary and

bonus. More senior partners earn a salary plus

carry, which is a share in yearly profits which

represents the high upside potential. Venture

Capital firms dont need a lot of people so

generally have a small-firm feel.

Opportunities One can move from venture capital

to another fund, hedge fund or company management.

5

Mutual Fund

- General Description

- A mutual fund is a form of collective investment

that pools money from many investors and invests

the money in stocks, bonds, short-term money

market instruments, and/or other securities. In a

mutual fund, the fund manager trades the fund's

underlying securities, realizing capital gains or

loss, and collects the dividend or interest

income. The investment proceeds are then passed

along to the individual investors. The value of a

share of the mutual fund, known as the net asset

value (NAV), is calculated daily based on the

total value of the fund divided by the number of

shares purchased by investors. - Legally known as an "open-end company", a mutual

fund is one of three basic types of investment

companies available in the United States. Outside

of the U.S. (except Canada), mutual fund is a

generic term for various types of collective

investment.

Players Bridgeway Legg Mason Muhlenkamp T.

Rowe Vanguard Dodge Cox Marsico Fidelity PIMCO

General Skills

Lifestyle/Compensation

Opportunities