Inventory Management - PowerPoint PPT Presentation

1 / 45

Title: Inventory Management

1

Inventory Management

- S. Cholette

- DS412

2

Why Carry Inventory?

- 1 Reason Need to meet anticipated demand

- To protect against stock-outs

- To smooth production requirements, de-couple

components of the production-distribution, and/or

permit operations (pipeline inventory) - To help hedge against price increases or to take

advantage of quantity discounts or order cycles - Why Study Inventory Management (IM)?

- Inventory is the largest factor in manufacturing

costs, and efficient IM has the greatest

potential for increasing profitability - Example For a typical US manufacturer 60 of

corporate income goes towards the purchase of

materials

3

Key Inventory Terms Costs!

- Holding (carrying) costs cost to carry an item

in inventory for a length of time, usually a year - Variable costs of warehousing, security,

spoilage - Critical component opportunity cost of capital

that cannot earn interest or otherwise be

invested - Ordering costs costs of ordering and receiving

inventory - Usually fixed, regardless of order size

- Shortage costs costs when demand exceeds supply

- Special ordering and expediting fees

- Lost customers and goodwill (retail) or penalties

if have inventory carrying requirement contract

(wholesale/manufacturing)

4

Requirements for Effective Inventory Management

- A system to keep track of inventory

- A reliable forecast of demand

- Knowledge of lead times

- Lead time the time interval between ordering and

receiving an order - Reasonable estimates of

- Holding costs

- Ordering costs

- Shortage costs

- (We will skip discussion of Classification

Systems)

5

Inventory Counting Systems

- Periodic System

- Physical count of items made at periodic

intervals - Perpetual Inventory System System that keeps

track of removals from inventory continuously,

thus monitoringcurrent levels of each item - Which is more useful for a business?

- What is the future of IM?

6

Economic Order Quantity Models

- Economic order quantity model (EOQ)

- Economic production model (EPQ)

- Quantity discount models will not be covered

7

Assumptions of EOQ Model

- Only one product is involved

- Annual demand requirements are known

- Demand is even throughout the year

- Can vary on a day-to-day basis, but must be

constant over time - Lead time does not vary

- Each order is received in a single delivery

- There are no quantity discounts

8

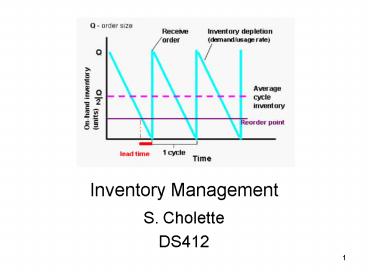

The Inventory Cycle

9

Cycle Inventory and Annual Carrying Costs

- See from the graph that the average cycle

inventory is Q/2 where Q is the order size - H represents the per-unit (annual) holding cost

- Either expressed as an absolute or percentage

of items cost (i.e. 16 or .15p where p

wholesale cost) - Can use other time periods than year. Cost per

month, season - the annual holding costs for cycle inventory are

HQ/2 - smaller Q results in lower holding costs

10

Ordering Costs

- If the annual demand D for an item, and each item

costs p, we will spend pD over the course of the

year to meet this demand, regardless of order

size - If the order size is Q, the frequency of orders

during the year is D/Q - Each order placed incurs a fixed cost, S, which

is assumed to be independent of the size of the

order - This represents the staff and resources needed to

prepare invoices, inspect shipments, etc - The annual variable order costs are pD and the

fixed order costs are (D/Q)S, with larger Q

resulting in lower ordering costs

11

Cost Minimization Goal

TC HQ/2 SD/Q pD

12

Total Cost

Total Cost Annual holding cost of cycle

stock Annual Fixed ordering cost Annual

Variable ordering cost However, Variable

ordering cost (pD) will be the same regardless

of order size (no quantity discounts), so we can

drop from the cost equation below

Where H is per-unit annual holding

cost (rate of return, etc.) D is annual

demand Q is order size S is fixed cost per

order

13

Deriving the EOQ

- Using calculus, take the derivative of the total

cost function (with respect to Q). Next set this

equal to zero to solve for Q - The total cost curve reaches its minimum where

the carrying and ordering costs are equal

d(TC)/dQ 0 at the minimal total cost.

14

EOQ Example 1

- Moes Tavern is open 52 weeks a year and buys

Duff beer by the keg for 100/keg, and he sells

2 kegs of beer a week. His costs are 20/order

and annual holding costs are 10 the cost of the

beer. - How much beer should Moe order and how often?

- What are his total order costs and inventory

holding costs?

- D 2kegs/wks(52 wks/yr) 104 annual keg demand

- H 10 of 100 10 per keg per year

- S 20 re-order fee

- Q sqrt(2SD/H) sqrt(220104/10) 20.3

kegs - So Moe should reorder 20 kegs about every 10

weeks - Assume that can only order whole kegs

- Total Order Costs S D/Q 20104/20 104

- Total Inventory Holding Costs HQ/2 1020/2

100

15

EOQ Example ExtensionEffect of Changing Holding

Costs

- Because some of Moes customers have been known

to sneak in the backroom and siphon from the

kegs, Moe has a serious problem with product

loss. Effectively, his per-keg annual holding

costs increase from 10 to 30 of the purchase

cost. - How does this change Moes optimal order quantity

and timing? - How does this change his costs?

D 2kegs/wks(52 wks/yr) 104 annual demand H

30 of 100 30 per keg per year S 20

re-order fee Q sqrt(2SD/H)

sqrt(220104/30) 11.7 kegs Moe should

reorder 12 kegs every 6 weeks For EOQ

calculations in general, round to integer values

for items that are sold in discrete units. (i.e.

cases, bags, packages)

16

Another EOQ Example

- A telecom distribution center (DC) orders their

cell phones in bulk from Asia. They buy them at

85/phone and sell them at 150, bundled with a

year-long contract - Annual holding costs are 10 of the DCs purchase

price - They are open 365 days a year. Daily demand

averages 100 phones and has a standard deviation

of 50, even on weekend days - The lead time from the manufacturer is fixed at 5

days. Every order costs 150 in shipping and

overhead fees, whether 1 or 10000 phones are

ordered - What is the economic order quantity? What is a

good way to check to make sure we did the

calculations right? - Hint There are a couple pieces of spurious

information

17

EOQ Example, Continued

- What is a good way to check to make sure we did

the EOQ calculations right? - Now assume that the manufacturers lot-size

policy is that the DC must order the phones in

multiples of 1000 - Compute the Total Holding Costs and Order Costs

for the DC with this new policy (order 1000

phones) - Are these costs higher or lower than those if the

DC can order by the EOQ?

18

Economic Production Quantity Assumptions

- Only one item is involved

- Annual demand is known

- Usage occurs continually- usage rate is constant

over time - Day-to-day fluctuations allowable

- Production rate is constant

- Lead time does not vary

- No quantity discounts

- i.e. no efficiency gains in scaling production

- Production occurs periodically- in batches or

lots - Capacity to produce a part exceeds the parts

usage (demand rate) - Assumptions of EPQ are similar to EOQ except

- Inventory is received incrementally during

production - Use a setup cost instead of an order cost

19

EPQ Inventory Cycle

- Rather than receiving inventory at once, as with

pure EOQ model, restocking occurs over time - We never reach Q in inventory, due to constant

usage - The higher the ratio of production rate usage

rate, the closer to EOQ

20

Total Inventory Costs

Total Cost Annual carrying cost

Annual setup cost Annual variable

production cost We ignore variable production

costs as these will be the same regardless of lot

size

And Imax Q(p-u)/p Where H is the (yearly)

per-unit holding cost D is the (yearly)

demand p is the (daily) production rate u is

the (daily) usage rate Q is lot size S is the

setup cost

21

Deriving the EPQ

- Using calculus, we take the derivative of the

total cost function and set the derivative

(slope) equal to zero and solve for Q - The total cost curve reaches its minimum where

the carrying and setup costs are equal - Note that if p u, then EPQ - EOQ

22

EPQ Example

A computer manufacturer builds the casing for

several different models of their laptops they

make and is open only 250 days/year, 10 hours a

day. Production of the VX-3 laptop case on an

injection molding machine is 30 units per hour.

They need to make 100 units each day they are

open. The VX-3 costs 10 to produce, and annual

holding costs are calculated to be 20 of

production costs. Changeover costs for the line

are 20. What is the optimal lot size?

23

EPQ Example, Continued

Cycle time Qopt/u 866/100 8.66 days Run

time Qopt/p 866/300 2.89 days (so the firm

isnt producing the VX-3 every 8.66 2.86 5.77

days per cycle) Inventory levels Imax

(Qopt)(p - u)/p 577.33 VX-3s Iavg Imax /2

288.67 VX-3s Annual Carrying Costs H

Imax /2 577.33 Annual Setup Costs S D/Q

20(100250)/866 (D/Q 28.9 lots/yr)

577.33 Remember that at Qopt, Annual Setup

Costs will equal Annual Carrying Costs

24

Now That We Know How Much to Order (the EOQ),

When Do We Order It?

- To complicate matters, demand usually is variable

- 2 different strategies can be used

- 1. Re-Order Point with Economic Order Quantity

(ROP-EOQ, or just ROP for short) - When? Order when stock falls to the Re-Order

Point - How Much? Q, the Economic Order Quantity

- 2. Fixed-Order-Interval (FOI)

- When? Order at a fixed point (end of week,

beginning of month, every two weeks, when the

vendor specifies you can) - How Much? Order a variable amount each period-

up to a pre-determined level, Q. - We will only cover (1) ROP in this class (yay!)

25

Factoring in Demand Uncertainty

- If demand were constant and deterministic, we

would know exactly when each replenishment needs

to arrive - If lead-times were zero, we could request

replenishment at the instant we exhaust our

inventory, and not have our Service Level suffer - Alas, in the real world we have neither

deterministic demand nor zero lead times! - We need to place orders in response to demand

that will occur while we wait for our order - We also need to worry about the possibility of

either exhausting our inventory before the next

order arrives, or over-ordering and having excess

inventory

26

Terms in ROP-EOQ Ordering

- Reorder Point (ROP)- When the quantity on hand of

an item drops to this amount, the item is

reordered - Lead Time Demand - Expected demand during the

lead time (a.k.a. pipeline demand) - Safety Stock - Stock that is held in excess of

expected demand due to a variable demand rate

and/or a variable lead time - Service Level (SL) - Probability that demand will

not exceed supply during lead time, - SL 100 Stockout Risk

27

ROP with Safety Stock

- ROP Expected demand during lead time safety

stock - The larger we make safety stock, the less likely

we are to experience a shortage - However, the greater the cost, as average annual

cost of maintaining safety stock is HIss

28

Considerations for Safety Stock

- Average demand rate and average lead time

- The higher either demand rate or lead time, the

more safety stock needed - Demand and lead time variability

- The greater the variability of either demand or

lead time, the more safety stock needed - Desired Service Level often set by policy

- The higher our service level goals, the more

safety stock needed - Cost Effectiveness

- The higher the safety stock level, the more

expensive to maintain

29

Determining ROP

- Assume that any variability in demand or lead

time (LT) can be approximated with a Normal

Distribution - Remember from statistics z (X-m) / s,

- z is the of standard deviations from mean

Probability of stockout (1.0 - 0.85 0.15)

For SL .85, z 1.04

30

m zs ?! Where Do We Get m s ? (not Mentioned

in Stevenson)

- Remember back to Forecasting(many chapters

back!) - Use an appropriate smoothing or trend estimate to

calculate m - Determine the accuracy of the forecast, get MSE

(Mean Square Error) - The square root of MSE is s (Standard Deviation)

- z is the of standard deviations from mean

(DS212). - For all Inventory Management homework and exam

questions, you will always be given m and s. We

will be talking about how to calculate z later.

31

Determining ROP, continued

- ROP Expected demand during LT safety stock

- If demand and lead time are both constant

- ROP dLT

- 2) If demand is variable, but lead time is

constant - 3) If demand is constant, but lead time is

variable - 4) If both demand and lead time are variable

Will use only situations (1) and (2) in this

class, never (3) and (4)

32

Calculating ROP Example

- The telecom DC from a previous example needs to

determine an appropriate re-order policy for

their cell phones. - They are open all the time 7days/wk. Daily

demand averages 100 units and has a standard

deviation of 50, even on weekend days - The lead time from the manufacturer is fixed at 5

days, and the order size is 1,000 units. - What should their safety stock and re-order point

be to insure a 2.3 chance of stock-out during a

replenishment cycle (i.e. a lead-time service

level of 97.7)? - Hint 1 We can use Formula (2), as we have a

fixed lead-time LT, but a variable demand - Hint 2 The table of Normal distribution

service levels on page 888 of Stevenson shows z2

for a .9772 Service level - ( i.e. 1 - P(stockout)) .9772 TLU-- Z

2)

33

Digression Pages to Bookmark

- pp 850 Appendix Table B

- Area under the Standardized Normal Curve from

- -infinity to z

- More detail and less confusing than the normal

table within the chapter (Table 11.3 on p 510) - Can use the table to find SL () given z, as well

as the reverse! - p. 519 - Table 11-4 Summary of Inventory

Formulae - Most of the formulae we use in IM can be found

here!

34

Calculating ROP Example

- The telecom DC from a previous example needs to

determine an appropriate re-order policy for

their cell phones. - They are open 7days/wk. Daily demand averages 100

units and has a standard deviation of 50, even on

weekend days - The lead time from the manufacturer is fixed at 5

days, and order size is 1,000 units. - What should their safety stock and re-order point

be to insure a 2.3 chance of stock-out during a

replenishment cycle (i.e. a lead-time service

level of 97.72)?

Steps 12 0.023 stock-out Prob. - Z 2

Step 3- calculate Safety Stock SS z sdlt

2111.8 223.6 - 224

Step 4- calculate Lead-time Demand

Lastly, Sum results from Steps 34 to get the

ReOrder Point

We order 1000 phones once we drop to 724 phones

35

ROP- Example 2 Finding the Service Level for an

Order Cycle

- We can use the ROP equation to determine what our

service level will be for a particular order

cycle given the onhand supply available (A) and

the number of days until our next order comes in. - Use A for the ROP quantity LT days

remaining - Assume it is 4 days until our next order arrives,

and demand has been greater than anticipated so

the number of phones on-hand (A) is 500. What

is the chance we will experience an out-of-stock

in this order cycle? - z (500 100 4) / (50sqrt(4)) 1

- z 1 table lookup- SL .8413 - 16 chance

of stock out - Uh,oh!- the manager has just discovered someones

swiped a case-pack (100) of phones, so A is

reduced to 400. What is the chance we will

experience an out-of-stock?

36

More Practice, HW Problems

- IM Section on one of the prior finals

- A gourmet coffee shop in downtown SF is open 200

days a year and sells an average of 75 pounds of

Kona Coffee beans a day (Demand can be assumed to

be distributed normally with a standard deviation

of 15 pounds/day). After ordering (fixed cost

16 per order), beans are always shipped from

Hawaii within exactly 4 days. Per-pound annual

holding costs for the beans are 3 - What is the economic order quantity (EOQ) for

Kona coffee beans? - What are the total annual holding costs for Kona

coffee beans? - What are the total annual fixed ordering costs

for Kona coffee beans? - Assume that management has specified that no more

than a 1 risk during stock out is acceptable.

What should our reorder point (ROP) be? - What is the safety stock needed for a 1 risk of

stock-out during lead time? - What is the annual holding cost of maintaining

the level of safety stock needed to support a 1

risk? - If management specified that a 2 risk of

stock-out during lead time would be acceptable,

would our safety stock holding costs decrease or

increase?

37

Yet More Practice HW

- IM Section of a 412 midterm The Italian Eatery

at the Student Union orders pre-made, frozen

calzones from a gourmet food distributor. They

cost 2.50 apiece and can be sold to students for

4. Fixed Order costs are 10, and orders

always take 4 days to arrive. The demand over a

term (for which the eatery is open 100 days)

averages 80 calzones/day, with a standard

deviation of 20 calzones/day. Holding costs are

10 of the Eaterys purchase price - What is the EOQ and how often do we expect to

place an order? - What is the re-order point (ROP) for calzones if

the management has specified that the chance of a

stock out during a cycle is 15.87 - We placed an order 3 days ago, and our inventory

of calzones is at 85. What is the chance we run

out of Calzones before the next order comes in? - What do we expect our total holding costs and

fixed order costs to be if we use the EOQ?

38

Yet More Practice HW

- IM Section of 412 midterm bonus part EPQ

- The Eatery has decided to make calzones

themselves. These are made periodically in large

batches, and everything not used that day is

frozen. The daily production rate, p, is 160

calzones. Assume that the holding cost, H, is

now .40/calzone per term and S, the setup cost,

is 16 per run. All other parameters remain

unchanged. - What is the EPQ, and how often do we start a

production cycle? - How many days do we run production?

39

Single Period Model

- Single period model model for ordering of

perishables and other items with limited useful

lives - No inventory carryover between periods

- Shortage cost Per-unit cost of being short-

generally is the unrealized profits ( Cs p c ) - More complex if customer goodwill is a

consideration - Excess cost difference between purchase cost and

any salvage value of items left over at the end

of a period ( Ce c - s )

40

Single Period Model

- Calculating the cost-effective Service level is

the key to determining optimal stocking level - SL Cs/ (Cs Ce)

- Where Cs shortage cost

- Ce excess cost

- Continuous stocking levels (for larger demands)

- Demand is often approximated as normal

- Optimal Order Quantity Q m z s

- Table look-up of SL provides the value of z to

use - The optimal stocking level balances shortage and

excess costs - Discrete stocking levels (for smaller demands)

- Service levels are discrete rather than

continuous - Desired service level is equaled or exceeded

41

Example Single Period Inventory Model

- A news-stand sells the city paper for 35 cents.

It costs the stand 15 cents each to purchase

them, and there is no salvage value to old

papers. Daily demand is approximately normal

with m 70 and s 20. No customer goodwill is

lost if the stand sells out. How many papers

should the stand order per day? - Cs .20

- Ce .15

- SL Cs/ (Cs Ce) .20/ (.20 .15) .5714

- Looking up z for SL .5714 on Table (p569) shows

z .18 - Therefore

- Q m z s 70 .1820 73.6 or 74 papers

42

Example Single Period Inventory Model- Discrete

- A gourmet bakery sells chocolate soufflé cakes

for 10 apiece. Each costs 3 to make. At the

end of the day leftover soufflé cakes have no

value. Past observations show that demand

follows the pattern below. No customer goodwill

is lost if the bakery sells out. - How many cakes should the bakery make per day?

Cake Demand

43

Example Single Period Inventory Model- Discrete

- First determine shortage and excess costs

- Cs 10-3 7, Ce 3 0 3

- SL Cs/ (Cs Ce) 7/ (7 3) .7

- Next determine the cumulative probabilities

- Closest to a 70 Service level (rounding up) is 3

cakes

44

Example Single PeriodInventory Model- Discrete

Modified

- One of the bakers has come up with a brownie

recipe that makes use of old soufflés 1 soufflé

cake 4 of other ingredients makes a batch that

can be sold for 6. These brownies have a long

shelf life, so expiration is not an issue. - -How does this affect our optimal daily

production of soufflé cakes? - Note that the excess cost has dropped, as we

effectively salvage 2 from the unsold soufflé

cakes - SL Cs/ (Cs Ce) 7/ (7 1) .875

- It now makes sense to make 4 cakes instead of 3

45

End of Inventory!Optional Topics

- Annual Service Levels (only for 786 students)

- Additional problems

46

Measuring Customer Service

- The ROP calculation does not reveal the expected

amount of the shortage - In the previous example, the telecom DC firm

cares most about the fraction of customers who

cannot get cel phones because they are out of

stock - To analyze this, we need to use the Standard

Normal Unit Loss Function. (Again this assumes

lead time demand can be approximated by a normal

distribution.) - E(n) E(z) sdLT

- Where E(n) expected number of units short per

order cycle - E(z) standardized units short see Table

13-3, p569 - sdLT standard deviation of lead time demand

47

Measuring Customer Service, Continued

- Customer Service is often measured on an annual

terms. one metric is the fill rate, the percent

of demand filled directly from inventory - Demand that was neither lost nor had to be

backordered - The expected number of units short per time

period (often a year) is E(N), where E(N)

E(n)D/Q - remember D/Q is orders per time period

- As E(N)/D represents annual (or another

appropriate time period) units not met by demand,

the fill rate is the complement - SLan 1 - E(N)/D

- This can also be solved as

- SLan 1- (E(z) sdLT /Q)

48

ROP Example Measuring Customer Service

- What is the Overall Service Level for the cel

phone promotion? - Given daily demand averages 100 cels and our

order size is 1000 units, we would expect to

reorder about once every 10 days - A table look-up using z 2, (i.e. SL .9772)

shows that Ez 0.008 - So the expected amount of unsatisfied demand in

each replenishment cycle is E(z) sDLT 111.8

.008 111.8 .89 - We are only about 1 cel phone short per order

cycle! - If we average .89 units of unsatisfied demand

every 11 days, then our customer fill rate (per

order cycle) is - Even though the cycle service level was only

97.7, the overall service level is much higher,

at more than 99.9!!! - Overall Service Level is what firms care about.

It answers the question of How Many Customers

did we lose?

49

ROP Example

- Say a company engages in the practice of Vendor -

Managed Inventory (VMI) and stocks MP3 players at

a small electronics store. Thus the company,

not the store, incurs the inventory holding

costs, which are 20/item - Assume daily demand (7 days/wk) is normally

distributed with mean 60, standard deviation

30 - Thanks to a computerized inventory system,

restocking can be placed at any time, and are

filled in exactly 4 days. Furthermore, order

costs are low, only 10 - What is the optimal order size, Q?

- Average cycle stock Q/2 74

- so Annual Holding Costs 2074 1480

- Expected Orders/year D/Q 148 so Ordering

costs 1480

50

ROP Example, Continued

- Assuming that we choose z 0.5 (Stock-out

possibility of 31) what is our reorder point?

What is the annual service level? - First calculate Safety Stock

- Next determine E(z)

SS z(60) 0.5(60) 30 -- ROP 240 SS

270

E0.5 .198 (per table)

Unsatisfied Demand per replenishment cycle

Ez sdlt .198 (60) 11.8 Annual Service

level 1 - Ez sdlt / Q 1 - .198(60)/148

92 (much greater than the 69 lead time service

level)

51

Example Production Cycles

- (Former HW) Stevenson 12 A consumer goods

manufacturer can produce heating elements for

hairdryers at a rate of 800/day. The hair dryers

are assembled daily, 250 days/year at a uniform

rate of 300 hairdryers/day. Because of the

disparity between usage and production rates,

elements are periodically produced in batches of

2000. - Approximately how many batches are produced

annually? - How long is our Run time? If production on a

batch begins when there is no inventory of

elements remaining, how much inventory will be

on-hand 2 days later? - What is the average inventory of elements,

assuming each production cycle begins when there

are none on-hand? - The same equipment that produces elements is

used to make another component for another

product. That job would require 4 days,

including setup time. Setup time for making the

heating elements is .5 days. Is there enough

time between heating element runs to make this

other component?

52

EOQ Example

Customers take cash out of the ATM at a rate of

2000 per day (365 days/year). The bank earns a

10 return on cash that is not stored in an ATM.

The bank has determined that it costs 30 to

replenish the cash in an ATM. For simplicity,

define 1000 (or K) to be the basic inventory

unit of cash

D 2K(365) 730 units of K per year

(730,000) H 10(1K) 100 per K per year S

30 restocking fee Q sqrt(230730/100)

20.9K Approximately one replenishment every 10

days

note if we use 1 as basic unit, get same

basic results, just with large intermediate

calculations Q sqrt(230(2000365) /.1)

sqrt(438,000,000) 20,928 OR, given that ATMs

generally only give you 20 bills, lets take one

of these bills as the defining unit So we use

100 bills/day, each bill has H2/yr Q

sqrt(230(100365)/2) sqrt(109,500) 1046 And,

of course 1046 Jacksons are worth 20,920