KEYNES AND THE CLASSICS: THE ISLM, ASAD BACKGROUND - PowerPoint PPT Presentation

1 / 14

Title:

KEYNES AND THE CLASSICS: THE ISLM, ASAD BACKGROUND

Description:

Once deflation has reduced i to zero, no further increases in ... monetary expansion (or price deflation) will shift it rightwards not ... deflation ... – PowerPoint PPT presentation

Number of Views:198

Avg rating:3.0/5.0

Title: KEYNES AND THE CLASSICS: THE ISLM, ASAD BACKGROUND

1

KEYNES AND THE CLASSICS THE ISLM, AS/AD

BACKGROUND

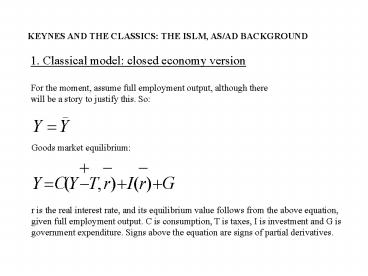

1. Classical model closed economy version For

the moment, assume full employment output,

although there will be a story to justify this.

So

Goods market equilibrium

r is the real interest rate, and its equilibrium

value follows from the above equation, given full

employment output. C is consumption, T is taxes,

I is investment and G is government expenditure.

Signs above the equation are signs of partial

derivatives.

2

Loanable funds interpretation Y C S

T subtraction from the preceding equation and

rearrangement gives us

Private savings finance investment plus

government borrowing r balances the supply and

demand for LOANABLE FUNDS.

IS

r

r0

Y

3

Money and the Classical Dichotomy

How is money to be defined? The underlying idea

is of money as a transaction medium, but in

advanced economies there is a smooth spectrum of

liquidity, from cash through checkable deposits

and so on. Ignore this problem for now. Think in

terms of Money cash Bonds (infinite

maturity) perpetuities that pay a fixed sum per

year to the holder. By definition

where i is the interest rate, x the coupon

payment, and Q the price and the ? refers to the

infinite maturity. A key feature of perpetuities

is capital risk, since i and Q are inversely

proportional (Burda/Wyplosz 4th ed, chapter 5,

box 5.2)

4

The Classical model assumes

Money supply equals money demand equals price of

output multiplied by real output divided by the

income velocity of money. Therefore with output

at its full employment level, changes in money

supply cause equiproportionate changes in P (and,

in the background, money wages, W) The nominal

rate of interest, i, in the Classical model In

steady state equilibrium, this is determined

simply as the real rate of interest plus the

inflation rate. The inflation rate depends on the

growth rate of M, since from the above equation

and assuming v constant, we have

With real output growth exogenous, this equation

determines the inflation rate

5

ISLM representation

i

LM

i0

IS

Y

How do we know that IS will conveniently

intersect LM above the x-axis? We dont! The

fundamental idea of the Classical model is that r

regulates aggregate demand, so that - subject to

the above caveat - there cannot be such a thing

as deficient aggregate demand.

6

2. Keyness critique

Essential is Keyness critique of the Classical

Theory of Interest. In Keyness model, money

demand is assumed to depend on i, so

Why? One effect is via the transactions demand

if the opportunity cost of holding money is

lower, then agents will hold more of it,

other things equal. A second effect is via what

Keynes calls the speculative demand. Recall that

Keynes is simplifying by supposing that

individuals are allocating wealth between just

two assets money and bonds, which are

capital-risky perpetuities (Keynes is, in fact,

also thinking of equities as lumped in with

bonds). Then agents may hold idle speculative

cash balances because (a) they are averse to

risk, and/or (b) they believe that Q is going to

fall, i.e. that i is going to rise

7

For (b) Keynes needed a theory of bond price

expectations. He assumed that expectations were

regressive. What this means is that there is

a normal value of Q, say Q0 to which it is

assumed that Q will tend to revert. So that when

Q is above Q0, Q is expected to fall and when Q

is below Q0, Q is expected to rise. Translated

into interest rate terms, abnormally low

interest rates go with expectations of future

interest rate rises and therefore falls in Q.

This will raise money demand as agents get rid of

assets (bonds) on which they expect to make

capital losses. The end result of this reasoning

is a non-vertical LM curve. If the speculative

demand is very important, we may end up with a

floor on the rate of interest, as illustrated in

the figure.

LM

i

Y

8

As soon as we have a non-vertical LM curve,

either because of interest dependence of the

transactions demand for money or because of the

speculative demand for money, the Classical view

that aggregate demand does not matter ceases to

hold.

IS0

LM

i

IS1

A

B

C

Y

Shown in the figure is the effect of a fall in,

say, investment spending. IS shifts left and the

equilibrium moves from A to B. In the Classical

analysis, the LM curve would have been vertical

through point A and so the demand fall would have

taken the economy to C. In that case the interest

rate is performing its Classical role of

regulating aggregate demand.

9

Interim assessment Keyness basic insight, lost

in most standard textbooks, is that in asset

markets where stocks are large in proportion to

flows, the price expectations of holders of the

stocks are going to matter. He is surely right,

and this means, as his model illustrates, that we

cannot rely on the real rate of interest to act

as an automatic regulator of aggregate demand.

Whether Keyness particular model of price

expectations is always or ever correct is quite

another matter! Still, if we view the economy as

having a long run steady state (questionable)

with a natural long run equilibrium real rate

of interest, then it would not seem completely

irrational for agents to expect the rate of

interest to move towards that natural value. So

far we have said almost nothing about wage and

price adjustments. That is the next task.

10

3. Wages and prices the Classical model, the

Neoclassical Synthesis and some deflation

dynamics.

The Classical model We can amend the classical

model so as to make full employment a result

rather than an assumption of the model. If we

assume that P (and W) fall when we are below full

employment output and rise when we are above, and

if we consider only effects of this on the LM

curve, then it is clear that the LM curve will

come to rest sitting above full employment

output, as in the figure below. This mechanism is

known as the Keynes effect.

LM0

LM1

LM2

i

IS

11

The Neoclassical Synthesis What happens if we

take Keyness model and apply the reasoning from

the preceding slide? We end up with the figures

below. The key idea is that what is known as

balanced deflation, i.e. equiproportional falls

in W and P, will restore full employment after an

adverse demand shift. We get exactly the same

interest rate fall as in the Classical model, but

by an indirect route.

Construction of AD closed economy, Keynes

effect only

Neoclassical synthesis adverse IS shift (it

shifts AD left)

LM0

IS0

IS1

LM0

LM1

i

i

a

LM1

IS

b

Y

AS

P

a

AD0

b

AD

AD1

Y

12

4. Critique of the neoclassical synthesis Two

things to consider (a) whether the model has

special cases that prevent full employment, (b)

whether the model adequately analyses the effects

of balanced deflation. (a) IS curve intersects

the x-axis to the left of full employment

IS

The unlabelled lines are LM curves as P falls

the LM curve is shifting rightwards. Once

deflation has reduced i to zero, no further

increases in output are possible. This is a

modern liquidity trap, exemplified by the case

of Japan. The AD curve is kinked, as shown.

i

P

AD

13

In a liquidity trap, monetary policy becomes

useless (given the assumptions we are currently

working with). Keynes originated this idea,

although he envisaged an interest rate floor

above zero, arising from the speculative demand

for money. If agents are sufficiently convinced

that bond prices can only fall (the rate of

interest rate can only rise), then the LM curve

will be flat and monetary expansion (or price

deflation) will shift it rightwards not

downwards.

LM2

LM0

LM1

Open market purchases of bonds by the Central

Bank will simply result in agents willingly

holding more money and fewer bonds, with no

upwards pressure on bond prices.

i

IS

Y

14

b. Effects of balanced deflation There are three

other effects to consider, apart from the Keynes

effect. The discussion here is very brief, but we

will look at some details in class. Pigou

effect When P falls M/P rises and this raises

wealth and may therefore raise consumption

expenditure. Fisher redistribution effect When

P falls, real wealth is redistributed from

debtors to creditors. It cannot be assumed that

the effects on the spending of those two groups

will cancel out. Fisher real interest rate

effect Expectations of deflation, which may be

caused by deflation itself, raise the real

interest rate for any given nominal interest

rate. There is therefore an effect on the IS

curve.