Real World Economic Activity - PowerPoint PPT Presentation

1 / 65

Title:

Real World Economic Activity

Description:

International Finance. United States Current Account and Fiscal Balance, 1968-1992 ... International Finance. Conditions for a Devaluation to 'Work' , or not! ... – PowerPoint PPT presentation

Number of Views:149

Avg rating:3.0/5.0

Title: Real World Economic Activity

1

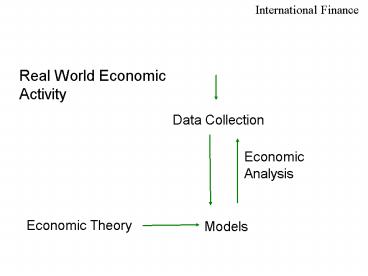

- Real World Economic Activity

Data Collection

Economic Analysis

Economic Theory

Models

2

The Quantity Theory

Equation 1

Equation 2

Equation 3

3

- Quantity Theory of Price Adjustment

2 M0

M

M0

time

t

2P0

P

P0

time

Q0

Q0

Q0

Q

time

4

- Extreme Macro Instability

5

The Purchasing Power Parity

Equation 4

Equation 5

6

- Purchasing Power Parity and Overshooting

2M0

M

M0

time

E

P,E

2P0, 2E0

P0,E0

P

time

7

Unpleasant Monetarist Arithmetic

Equation 6

8

- Unpleasant Monetarist Arithmetic

- Sargent and Wallace P vs P

Deficit

time

Bonds

Money, Bonds

Money

time

t

P

Price Level

P

time

9

The Absorption Model of the Balance of Trade

Equation 7

Equation 8

10

- United States Current Account and Fiscal Balance,

1968-1992

11

Further Implications

Equation 9

Equation 10

Equation 11

Equation 12

12

Balance of Payments

BOP Current Account Capital Account

Under fixed exchange rates only Change in

Foreign Exchange Reserves BOP

13

- Fiscal and External Balances, USA

14

Organization and Characteristics of FOREX Markets

- Spot and forward markets

- Many buyers and sellers, so no buyer or seller

dominates - Transactions are quick, buy/sell decisions have

to be made very quickly - Low transactions costs

- Open virtually 24/7.

15

Reasons to Use FOREX Markets

- Export and Import Transactions

- Triangular arbitrage in the Spot Market

- Hedging on foreign investment

- Forward speculation

- Interest arbitrage

- Engage in a speculative attack on a foreign

currency (aka hedge fund management)

16

- Demand and Supply of

- Foreign Exchange

R(,DM)

German Supply of DM

R

US Demand for DM

DM

17

- Responses to Overvaluation

- Devaluation and Fiscal Contraction

R(,DM)

German Supply of DM

R

New US Demand

R

Trade Deficit

US Demand for DM

DM

18

Conditions for a Devaluation to Work , or not!

- Marshall-Lerner conditions must hold elasticity

of foreign demand for export good and elasticity

of domestic demand for import good must sum to

value greater than unity. - Example imports are oil, exports are wheat.

Devaluation may actually make BOT worse! People

will still buy oil and just need so much wheat.

Elasticity pessimism.

19

Further conditions why devalution may not work

- Issue of contractionary devaluation imports may

be inputs in production so devaluation may cause

a fall in investment, employment, output - Harberger-Laursen-Metzler effect devaluation

worsens income, so net saving falls quickly, so

there is a savings-investment imbalance, and the

trade balance falls.

20

- Multiple Equilibria in ForEx Market

R

B

Demand

A

Supply

C

DM

21

J-Curve Dynamics

Trade Balance

Devaluation

0

time

22

Triangular Arbitrage

Equation 13

Equation 14

Equation 15

23

- Covered Interest Parity

K dollars

US investment

K(1r)

(K/R)(1r) FR

sell forward

buy spot

UK investment

K/R sterling

(K/R)(1r)

24

Covered Interest Rate Parity

Equation 16

Equation 17

Equation 18

Equation 19

Equation 20

Equation 21

25

Measuring Capital Mobility

Equation 22

Equation 23

Equation 24

Equation 25

26

Real Exchange Rate

Non-tradeables

Real Exchange Rate

NT

Tradeables

T

27

The Real Exchange Rate

Equation 26

Equation 27

Equation 28

28

- U.S. Real Exchange Rate Swings, 79-81

29

Classification of Policy Regimes

Exchange Rate Regime

Fixed

Flexible

Instrument

STRONG

WEAK

Monetary Policy

Fiscal Policy

WEAK

STRONG

30

The Mundell-Fleming Model of Fixed Exchange Rates

Equation 29

31

- Mundell - Fleming Model

- General Equilibrium

IS

r

LM

FF

E

Y

32

Endogeneity of the Money Supply

Equation 30

33

- Mundell - Fleming Model

- Effects of Monetary Expansion

r

LM

LM

FF

E

E

IS

Y

34

- Mundell - Fleming Model

- Effects of Fiscal Expansion

r

LM

LM

FF

E

IS

E

IS

Y

35

- Mundell - Fleming Model

- Effects of Devaluation

r

LM

LM

FF

E

FF

IS

Y

36

Swan Diagram Internal/External Balance

r

II

Bexternal surplus, internal inflation

EE

Aexternal deficit, internal inflation.

G-T

37

The Dornbusch Model of Flexible Exchange Rates

Equation 31

38

Dornbusch Model Basic Setup

e

DD

A

AA

p

39

Dornbusch Model Monetary Expansion with

Overshooting

e

DD

B

C

AA

AA

A

p

40

- Wicksell's Problem

Sweden

timber

Norway

fish

ultimate flows

Denmark

wheat

intermediate flows

41

- Bilateral Exchange Arrangements-Unbalanced Flows

A

B

D

C

42

- Ds Money as Medium of Exchange, Barter between A

and B

A

B

D

C

43

- As and Bs Money as Media of Exchange

A

B

D

C

44

Borrowing and Lending Strategies

Lending

Borrowing

Period 1

r1

i1

r

i

Period 2

i2

r2

Positive maturity transformation

45

The Phillips Fixed-Coefficient Model of the

Banking System

Equation 32

Equation 33

46

Internal Structure of Eurodollar Market

Borrowers

Lenders

USA

London

Europe

47

Eurodollar Market and OPEC Recycling

Borrowers

Lenders

USA

LDC Borrowers

OPEC Deposits

London

Europe

48

- Manufacturing, Resources, and Service Sector

Economy

D-m

D-r

D-s

w

w

Manufacturing employment

Resource employment

Services

R

O

O'

M

49

- Manufacturing, Resources, and Service Sector

Economy- - Direct Deindustrialization Due to Boom in

Resource Sector - M-M' Direct De-industrialization Effect

D-m

D-r

D-s

W

w

R

O

O'

M

M'

50

- Manufacturing, Resources, and Service Sector

Economy- - Indirect Deindustrialization Due to Boom in

Ensuring Service-Sector Boom - M'-M'' Indirect De-industrialization Effect

D-m

D-r

D-s

w''

w'

w

M

R

M'

M''

O

O'

51

(No Transcript)

52

(No Transcript)

53

(No Transcript)

54

Secondary Market Value

B

C

- A

Nominal Value of Debt

55

Seignorage and Dollarization Multiple Equilibria

Equation 34

Equation 35

56

Inflation Laffer Curve

?

Deficit

A

B

? (M/P)

57

- Inflationary Dynamis in a Dollarized Indexed

Economy

Oil Shock

Manufacturing

50 Import Component

50 wages

Devaluation

COLA

Price of Output

Indexed Gov't Debt

Dollarization

Monetary Growth

Fiscal Deficit

58

Figure 1Instruments of Markets

- Structure of Financial Markets

Banks

Acceptances

Time and Saving Deposits

CD's

Mortgages

Parallel loans and currency swaps

Mortgage-backed securities

Bonds

Repurchase Agreements

T'Bills

Long-term bonds

Commercial Paper

Stripped and zero coupon bonds

Heaven and hell bonds

Dual currency bonds

warrants and convertible bonds

Swapsdebt for equity

Prime and score securities

Equity

Optioned and non-optioned equity

Poisoned pills

Preferred stock

Foreign Exchange

call/put option

spot

forward

future

59

Figure 2

- Trading Structure in Financial Markets

Structured/ embedded

Over-the- counter

Exchange-traded

Convertibles

Swaps

Futures

Warrants

Options

60

Figure 3

- Nikkei-linked bond with puts

put

Investor

Issuer

coupon,premium

put

premium

Arranging bank

put

premium

Investor

61

Figure 4

- Equity derivative swap, two-sided

appreciation

Bank A

Bank B

depreciation

premium (upfront or LIBOR flow)

62

Figure 5

- Customized derivative swap

premium for call at 22,000

appreciation

Bank A

Investor

5

T-notes at 5

appreciation in Nikkei over 22,000

63

Figure 6

- Equity Derivative Swap with Embedded Options

LIBOR Prem

Bank Y

Bank X

Index apprec.

Knock-out on Nikkei

Yen/ Quanto

64

Figure 7

- Swap Credit Exposure Regulatory Approach

CEM

OEM

Credit conversion

Mark to market

Swap credit risk

Swap credit risk

Swap credit risk

Swap credit risk

65

Figure 8

- Creation of a Differential Swap

i-US

i-US

Company Y

Bank A

Bank B

US fixed

i-DM less SPR

DM fixed

i-DM

Bank C

i-DM and i-US DM and US LIBOR